Crude, Copper, & Credit Crushed As Stocks ‘Dead-Bat-Bounce’ (Again)

Another day, another ‘dead-bat-bounce’ on absolutely nothing…

Makes you wonder eh?

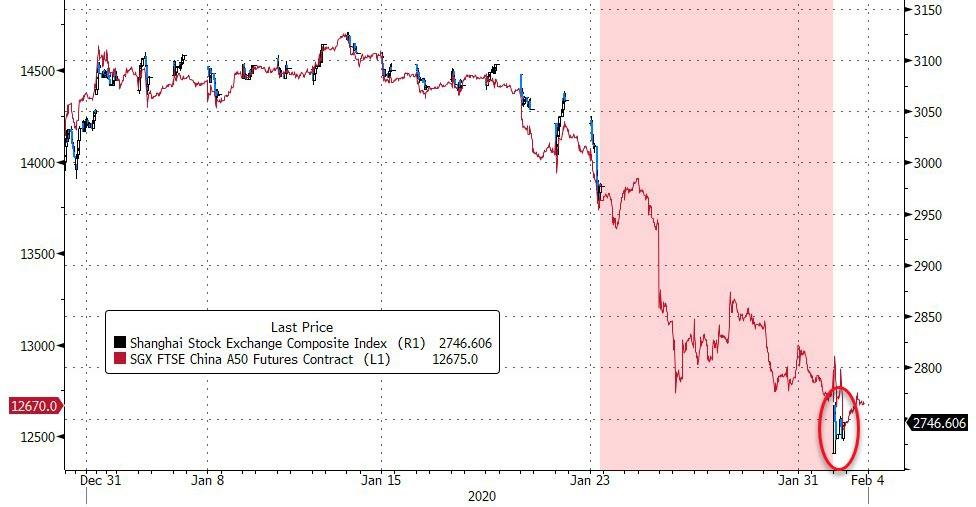

China’s cash markets reopened and collapsed as expected…

Source: Bloomberg

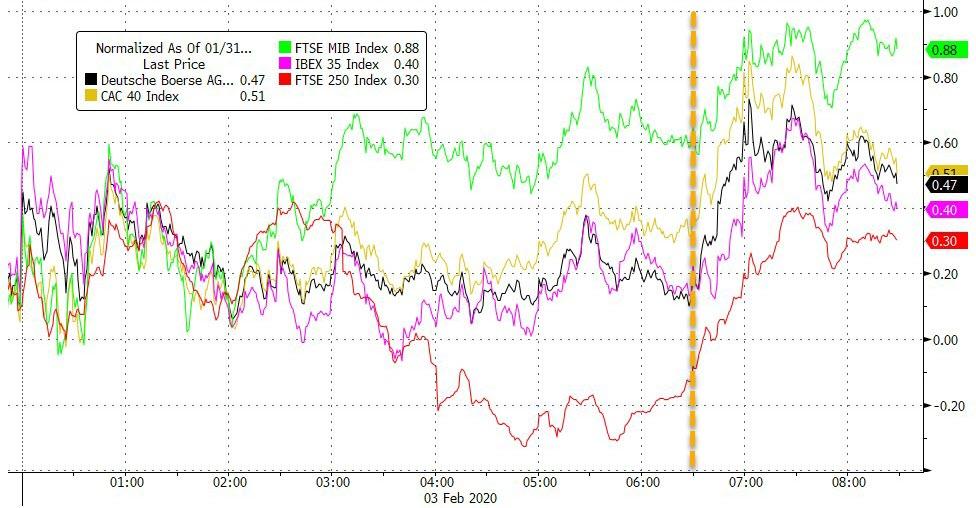

European markets were all higher, thanks to a lurch upwards at the US open…

Source: Bloomberg

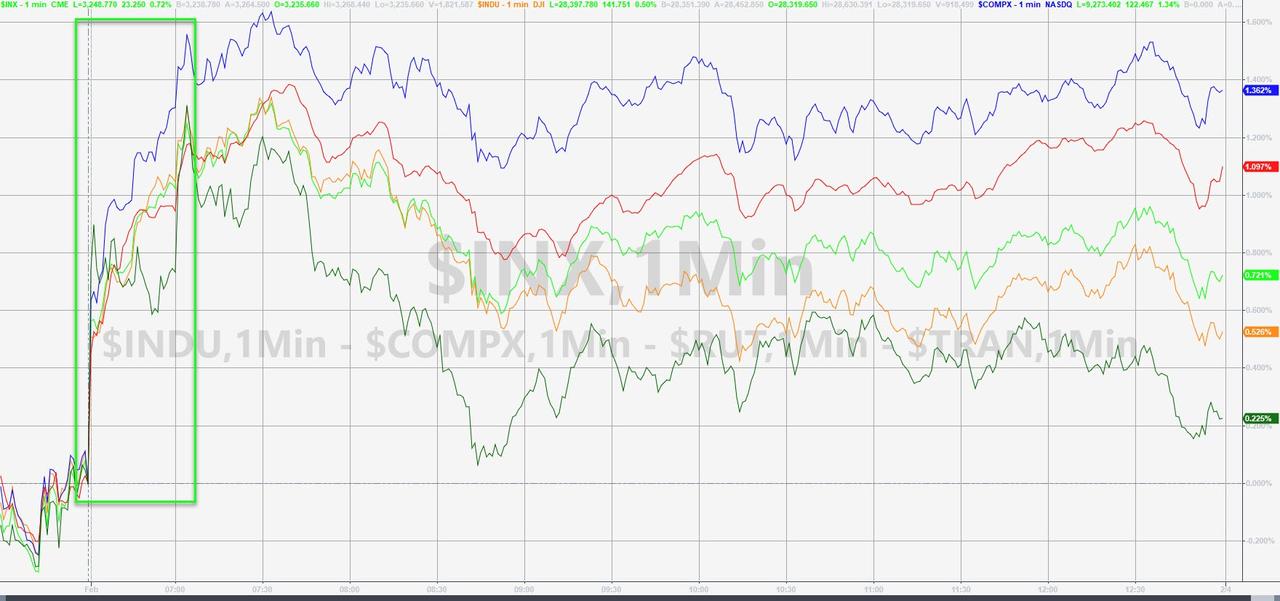

US markets ramped overnight, ramped more at the open, dipped on CDC headlines, then rebounded after Europe closed…

Big short-squeeze at the open today…

Source: Bloomberg

S&P futs were glued around the 3254 level – the gamma flip…

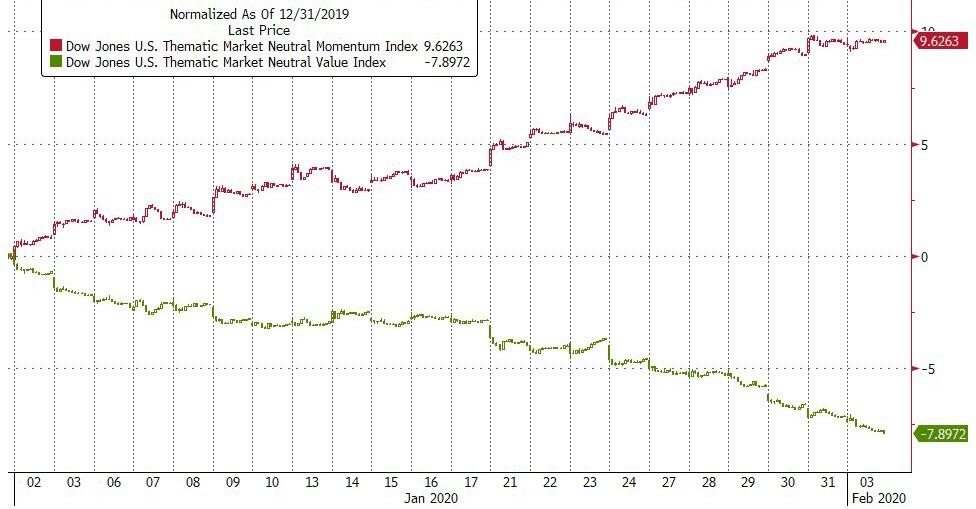

Momentum and Value continue to diverge year-to-date – rather stunningly serially…

Source: Bloomberg

TSLA went full-retard…surging over 20% today!…

…and up 80% YTD…

Source: Bloomberg

Credit markets refused to play along with the equity bounce today…

Source: Bloomberg

Treasury yields tumbled intraday after rising overnight…

Source: Bloomberg

With 30Y back below 2.00%…

Source: Bloomberg

The yield curve briefly uninverted but pushed back into inversion as the US day session wore on…

Source: Bloomberg

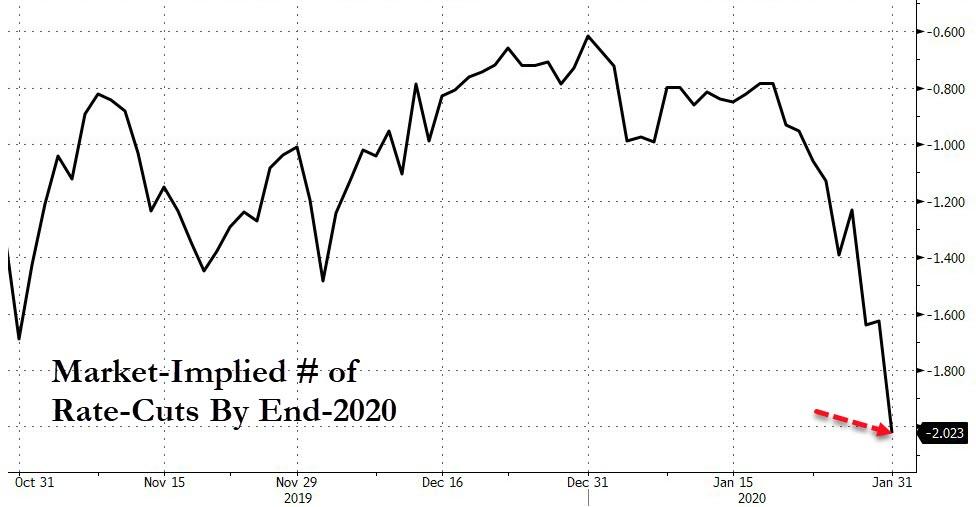

And at the short-end, the market is now pricing in at least 2 rate cuts in 2020… (there is now a 75% chance of a rate-cut in June, up from 8% on 1/20)

Source: Bloomberg

It took less than 2 days for the bond market to nullify the Fed’s “we’re firmly on hold” message this week. Now a 90% chance of a 2020 cut.

— Jeffrey Gundlach (@TruthGundlach) January 31, 2020

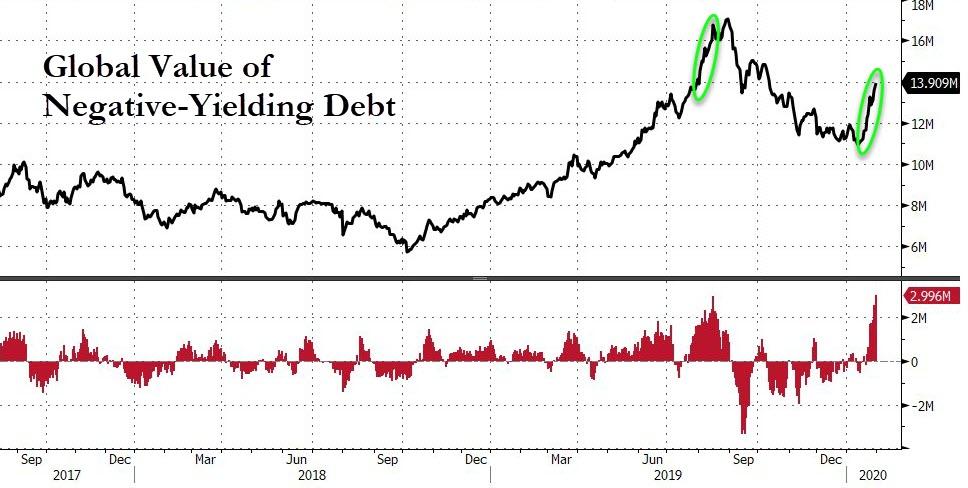

Negative-yielding debt has soared $3 trillion in the last 12 days…

Source: Bloomberg

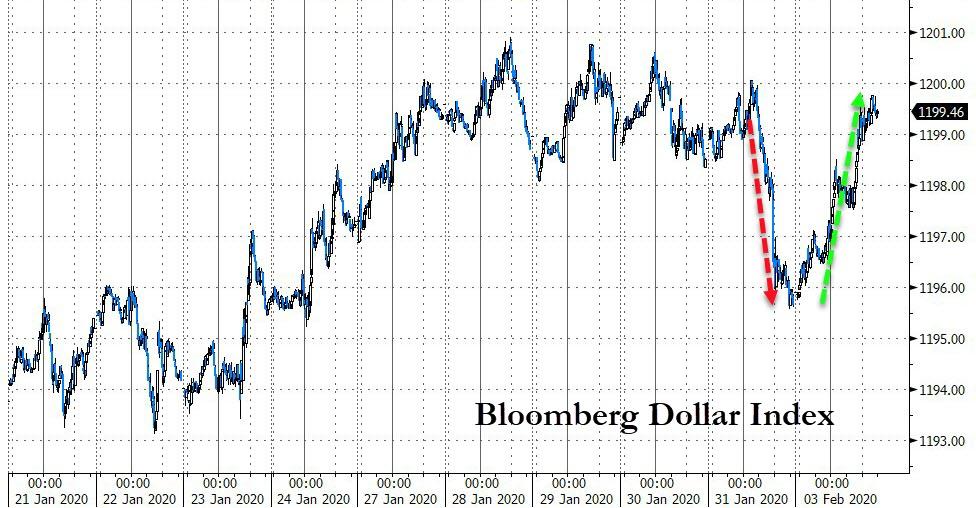

The Dollar soared back, reversing all of Friday’s losses today…

Source: Bloomberg

Yuan tumbled…

Source: Bloomberg

Huge roundtrip in Cable today…

Source: Bloomberg

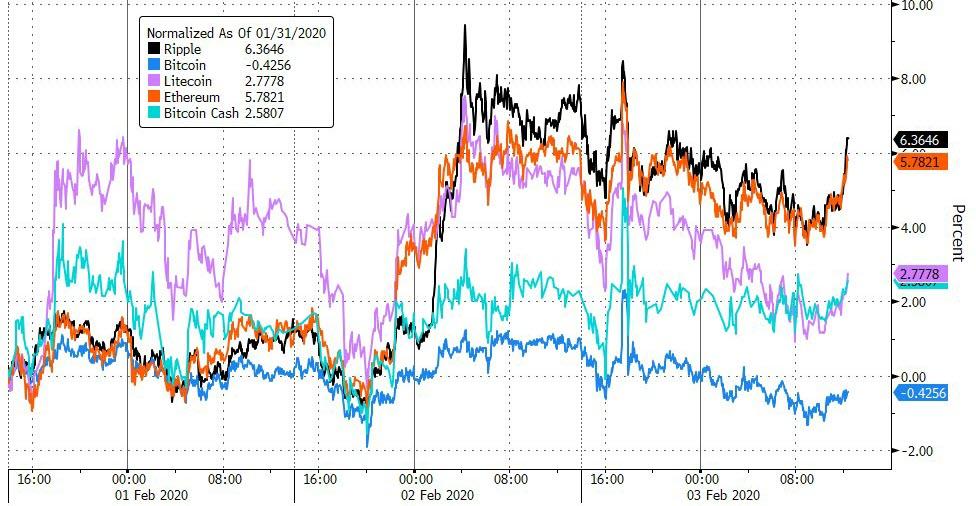

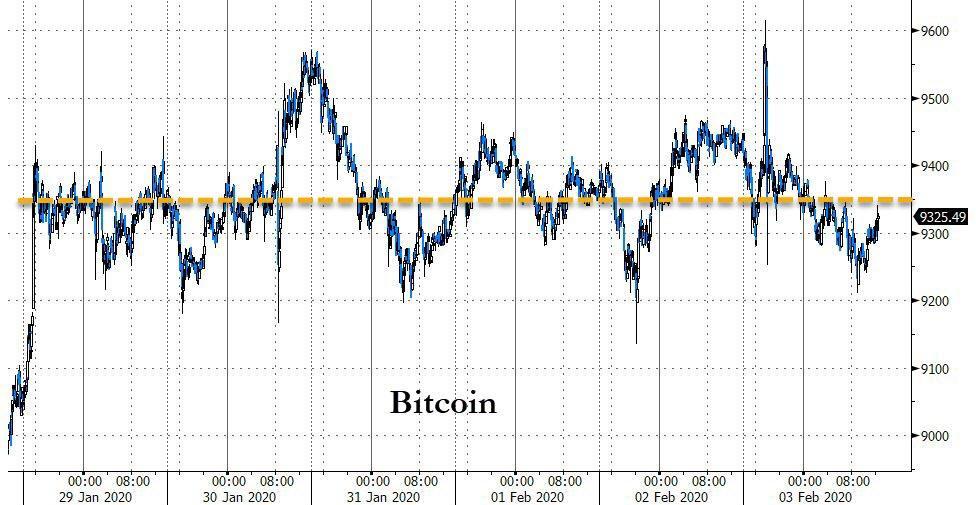

Cryptos are broadly higher since Friday, but Bitcoin is the laggard…

Source: Bloomberg

Bitcoin has been hovering around $9200-$9400 for a week…

Source: Bloomberg

Commodities were all lower today as the dollar jumped with oil worst…

Source: Bloomberg

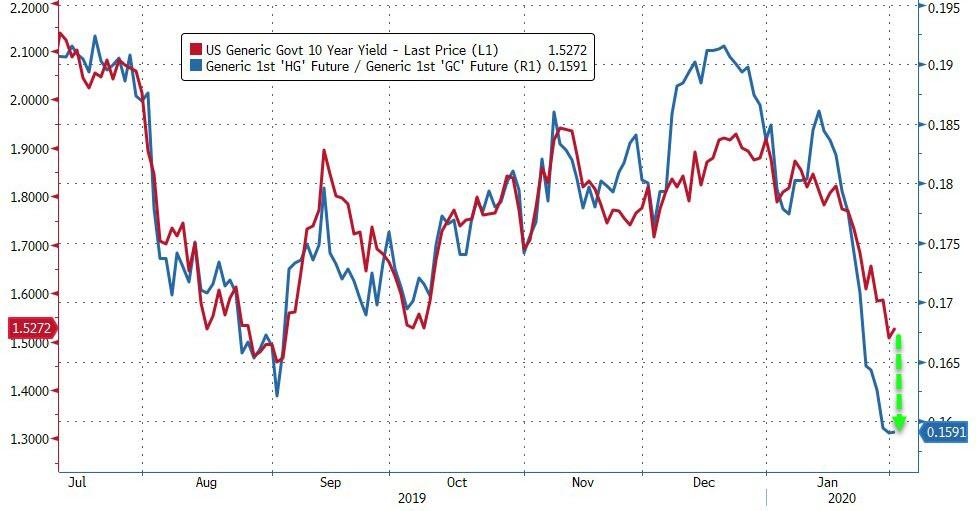

Copper’s collapse relative to gold signal a dramatic decline in yields is due…

Source: Bloomberg

WTI Crude fell below $50 for the first time since Jan 2019…

Source: Bloomberg

Finally, we wonder if the market is fearsome of the coronavirus, Fed balance sheet deflation, or Sanders surging into the lead?

Source: Bloomberg

So to sum up – copper, crude, credit, rates, the yield curve, and the yuan are all down today… but US equities are higher.

Tyler Durden

Mon, 02/03/2020 – 16:01

via ZeroHedge News https://ift.tt/37XMvIX Tyler Durden