Key Events This Week: Never A Dull Moment

While the world will be focusing on every development out of China which is struggling to contain the fallout from the coronavirus pandemic which has now infected nearly 17,500 people across the globe, in terms of newsflow DB’s Jim Reid writes that this week the highlight could be today’s first US democratic primary in Iowa – the first of four this month. There’ll also be a number of data releases, including PMIs from around the world (today and Wednesday), before the US jobs report comes out on Friday, now without a lockup and forcing traders and analysts to scramble to decipher what the BLS has reproted. Earnings season will also continue to be in full flow.

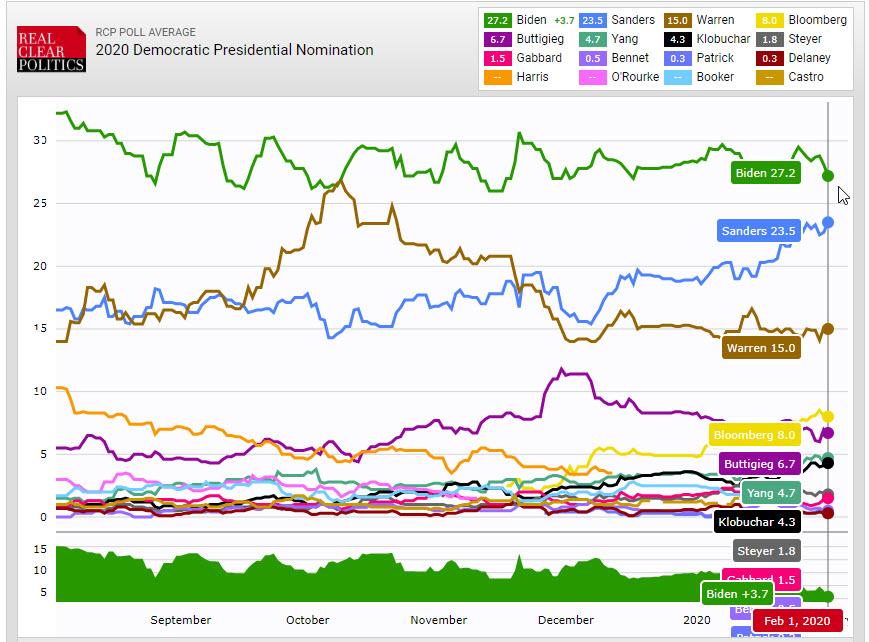

While Iowa only makes up about 1% of nationwide delegates, we will start to see some sign as to momentum of the various candidates. Technically there will also be Republican primaries, but these are widely considered a foregone conclusion in favor of President Trump. In terms of what to expect, the national polling average from RealClearPolitics shows former Vice President Joe Biden still in the lead at the moment, with 27.2%, followed by Senator Bernie Sanders on 23.5% and Senator Elizabeth Warren on 15.0%.

However, in Iowa, the polling average shows Sanders in the lead, with 24.7%, and Biden in second on 21.0%. Furthermore, both former Mayor Pete Buttigieg (16.3%) and Warren (15.2%) are around the crucial 15% mark that is important when it comes to accumulating the delegates required to win the nomination.

In terms of what will happen, the race remains competitive, with FiveThirtyEight’s model at time of writing giving Sanders a 40% chance of winning the most votes in Iowa, followed by Biden on 34%, with Buttigieg on 18% and Warren on a 16% chance. It’s true that often the winner of the Iowa caucuses don’t actually go on to be the nominee – indeed on the Republican side the winners in 2008, 2012 and 2016 all lost out to someone else. Nevertheless, it’s the first indicator of real votes we have, and very important in terms of momentum for each of the candidates, as it’s only 8 days later that the next primary takes place in New Hampshire, and between the two votes there’ll be another TV debate between the candidates on the Friday.

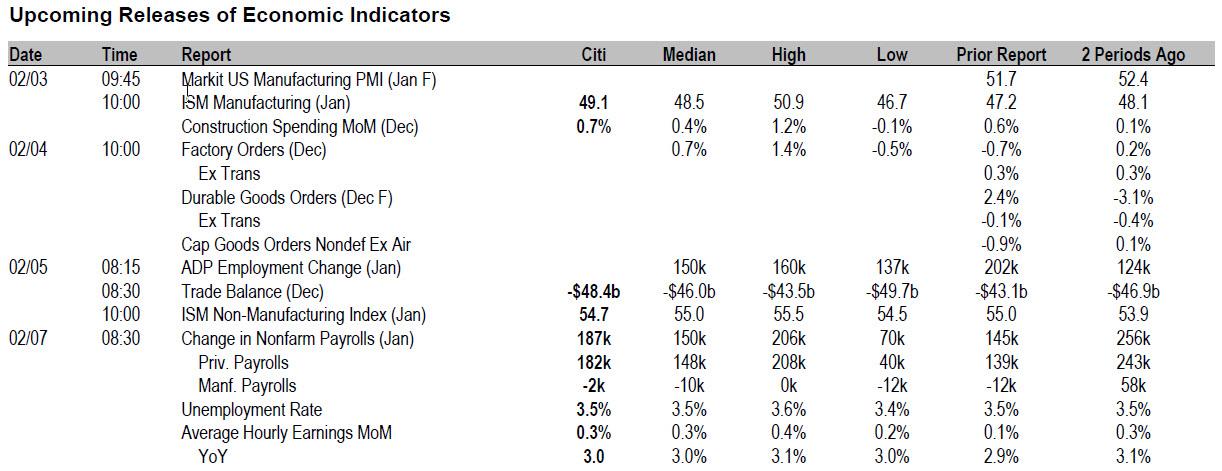

The week ahead also has a number of data highlights, with the main ones likely to be the release of manufacturing (today), services and composite (Wednesday) PMIs from around the world. We have already had the preliminary PMIs from a number of countries, so those countries such as Italy where we haven’t had the preliminary numbers will take on added interest. Also of note will be the ISM manufacturing and nonmanufacturing indices from the US, out today and Wednesday respectively. Back in December, the ISM manufacturing reading fell to 47.2, its lowest level since June 2009, though the consensus is expecting an uptick for January to 48.4, so that’s one to keep an eye out for.

On Friday, we’ll also get the US jobs report for January, the first one that will be subject to the new lockup rules meaning it is unclear if wire services will have any prepared data at the time the report comes out. The current consensus expectation is for a +160k increase in nonfarm payrolls in January, up from the +145k increase in December, with the unemployment rate remaining at 3.5%, and average hourly earnings growth ticking up a tenth to +3.0% year-on-year. Other key data out this week will come with the Euro Area’s retail sales for December on Wednesday, while in Germany, there’ll be the release of December’s factory orders on Thursday and industrial production on Friday.

Also earnings season continues this week, with another raft of companies reporting. Looking at things so far, of the 225 S&P 500 companies that have reported, 74.4% have reported a positive surprise on earnings and 64.1% have reported a positive surprise on sales. Looking to the week ahead, today sees Alphabet report. Then tomorrow we’ll hear from Walt Disney, BP and Sony. On Wednesday, there’s Merck, Novo Nordisk, GlaxoSmithKline, Siemens, Qualcomm, BNP Paribas and General Motors. Thursday sees reports from L’Oréal, Bristol-Myers Squibb, Philip Morris International, Total, Sanofi, Enel, Nordea Bank, UniCredit, Société Générale, Twitter and Toyota. And finally on Friday, we’ll hear from AbbVie.

Finally on US politics, tomorrow sees President Trump give his State of the Union address to Congress.

Below is a day by day summary of key events, courtesy of Deutsche Bank:

Monday

- Data: January Manufacturing PMIs from Indonesia, South Korea, Japan, China, India, Russia, turkey, Italy, France, Germany, South Africa, Euro Area, UK, Brazil, Canada and US, China December industrial profits, Japan January vehicle sales, US December construction spending, January ISM manufacturing

- Central Banks: Fed’s Bostic speaks

- Earnings: Alphabet

- Politics: Iowa caucuses held in the US

Tuesday

- Data: UK January construction PMI, Euro Area December PPI, Italy preliminary January CPI, US December factory orders, final December durable goods orders, non-military capital goods orders excluding aircraft

- Central Banks: Reserve Bank of Australia decision

- Earnings: Walt Disney, BP, Sony

- Politics: President Trump delivers State of the Union address to Congress

Wednesday

- Data: January services and composite PMIs from Japan, China, India, Russia, Italy, France, Germany, Euro Area, UK, Brazil and US, Euro Area December retail sales, US weekly MBA mortgage applications, January ADP employment change, ISM non-manufacturing index, December trade balance, Canada December international merchandise trade

- Central Banks: Brazil central bank decision, BoJ’s Wakatabe, ECB’s de Guindos, Bank of Canada’s Wilkins and Fed’s Brainard speak

- Earnings: Merck, Novo Nordisk, GlaxoSmithKline, Siemens, Qualcomm, BNP Paribas, General Motors

Thursday

- Data: Germany December factory orders, January construction PMI, US preliminary Q4 unit labour costs, nonfarm productivity, weekly initial jobless claims, Japan December labour cash earnings, household spending

- Central Banks: Reserve Bank of India decision, ECB publishes Economic Bulletin, BoJ’s Masai, ECB’s Lagarde and Villeroy and Fed’s Kaplan speak

- Earnings: L’Oréal, Bristol-Myers Squibb, Philip Morris International, Total, Sanofi, Enel, Nordea Bank, UniCredit, Société Générale, Twitter, Toyota

Friday

- Data: China January trade balance, Japan preliminary December leading index, Germany December trade balance, industrial production, France December industrial production, manufacturing production, trade balance, Italy December retail sales, US January change in nonfarm payrolls, unemployment rate, labour force participation rate, average hourly earnings, final December wholesale inventories, December consumer credit, Canada January net change in employment, unemployment rate, participation rate

- Central Banks: Russian monetary policy decision, Fed’s Quarles speaks (00:15 UK time), Fed releases semi-annual monetary policy report to Congress

- Earnings: AbbVie

- Politics: US Democratic primary TV debate

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Monday, the ISM non-manufacturing index on Wednesday, and the employment report on Friday. There are a few speaking engagements from Fed officials this week.

Monday, February 3

- 10:00 AM ISM manufacturing index, January (GS 48.3, consensus 48.5, last 47.2): Our manufacturing survey tracker rose by 2.1pt to 52.5 in December, following firmer regional manufacturing surveys on net. However, we note that late-month surveys like the ISM could be affected by the outbreak of the coronavirus. Additionally, we do not expect improvement among firms exposed to the commercial aircraft supply chain, as Boeing halted production of the 737 MAX in the month. Taken together, we expect the ISM manufacturing index to rise 0.5pt to 48.3 (from its upward revised level of 47.8).

- 10:00 AM Construction spending, December (GS +0.7%, consensus +0.5%, last +0.6%): We estimate a 0.7% increase in construction spending in December, with scope for increases in both private and public construction spending.

- 02:00 PM Senior Loan Officer Opinion Survey (Q4) likely released

- 04:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on big data and machine learning at a conference in California. Audience Q&A is expected.

- 5:00 PM Lightweight motor vehicle sales, January (GS 16.7m, consensus 16.8m, last 16.7m)

Tuesday, February 4

- 10:00 AM Factory Orders, December (GS +1.5%, consensus +1.2%, last -0.7%); Durable goods orders, December final (last +2.4%); Durable goods orders ex-transportation, December final (last -0.1%); Core capital goods orders, December final (last -0.9%); Core capital goods shipments, December final (last -0.4%): We estimate factory orders increased 1.5% in December following a 0.7% decline in November. Durable goods orders rose in the December advance report, driven by a large increase in defense orders.

Wednesday, February 5

- 08:15 AM ADP employment report, January (GS +175k, consensus +158k, last +202k): We expect a 175k gain in ADP payroll employment, reflecting the impact of lower jobless claims and other ADP model inputs. While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 08:30 AM Trade balance, December (GS -$48.1bn, consensus -$47.8bn, last -$43.1bn): We estimate the trade deficit increased by $5.0bn in December, reflecting a rebound in the goods trade deficit.

- 10:00 AM ISM non-manufacturing index, January (GS 54.9, consensus 55.1, last 54.9): Our non-manufacturing survey tracker edged down by 0.1pt to 54.1 in January, following mixed regional service sector surveys. We expect the ISM non-manufacturing index to remain unchanged at 54.9 in the January report.

- 04:10 PM Fed Governor Brainard (FOMC voter) speaks: Federal Reserve Governor Lael Brainard will speak on payment system innovation.

Thursday, February 6

- 8:30 AM Nonfarm productivity (qoq saar), Q4 preliminary (GS +1.6%, consensus +1.5%, last -0.2%); Unit labor costs, Q4 preliminary (GS +1.6%, consensus +1.2%, last +2.5%): We estimate non-farm productivity growth rebounded to +1.6% in Q4 qoq saar (+1.8% yoy), above the trend achieved during this expansion. This reflects steady business output growth in Q4 and only a modest increase in hours worked. We expect Q4 unit labor costs—compensation per hour divided by output per hour—to decelerate to +1.6% qoq ar (+2.5% yoy).

- 08:30 AM Initial jobless claims, week ended February 1 (GS 215k, consensus 215k, last 216k); Continuing jobless claims, week ended January 25 (consensus 1,710k, last 1,703k): We estimate jobless claims ticked down 1k to 215k in the week that ended February 1. We expect a persistent winter seasonal bias to continue to exert upward pressure on the continuing claims measure through February.

- 09:15 AM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will speak on the economic outlook at an event in Dallas.

- 07:15 PM Fed Vice Chair for Supervision Quarles (FOMC voter) speaks: Federal Reserve Vice Chair for Supervision Randal Quarles will give a speech on the economic and monetary policy outlook.

Friday, February 7

- 08:30 AM Nonfarm payroll employment, January (GS +190k, consensus +160k, last +145k); Private payroll employment, January (GS +185k, consensus +150k, last +139k); Average hourly earnings (mom), January (GS +0.2%, consensus +0.3%, last +0.2%); Average hourly earnings (yoy), January (GS +3.0%, consensus +3.1%, last +3.1%); Unemployment rate, January (GS 3.5%, consensus 3.5%, last 3.5%): We estimate nonfarm payrolls increased 190k in January. While employment surveys on net were little changed in the month, initial jobless claims declined further, and an unseasonably dry survey week in the Northeast and Ohio Valley is set to boost weather-sensitive categories. We also note that January job growth tends to accelerate in tight labor markets, as labor supply constraints may lead firms to implement fewer end-of-year layoffs. We do not expect a significant impact from Census employment in this week’s report. We estimate an unchanged unemployment rate at 3.5%, as we believe the increase in continuing claims over the last two months reflects technical distortions related to residual seasonality—and in any event, the uptrend tentatively retraced in the first three weeks of 2020. We estimate average hourly earnings increased 0.2% month-over-month and 3.0% year-over-year, reflecting neutral calendar effects and continued upward wage pressures.

- 11:00 AM Federal Reserve Board Releases Monetary Policy Report to Congress

Source: Deutsche Bank, Goldman

Tyler Durden

Mon, 02/03/2020 – 09:35

via ZeroHedge News https://ift.tt/390cI9Z Tyler Durden