Oil Bear Market Sends Tanker Rates Plunging, Hopes For Global Rebound Fade

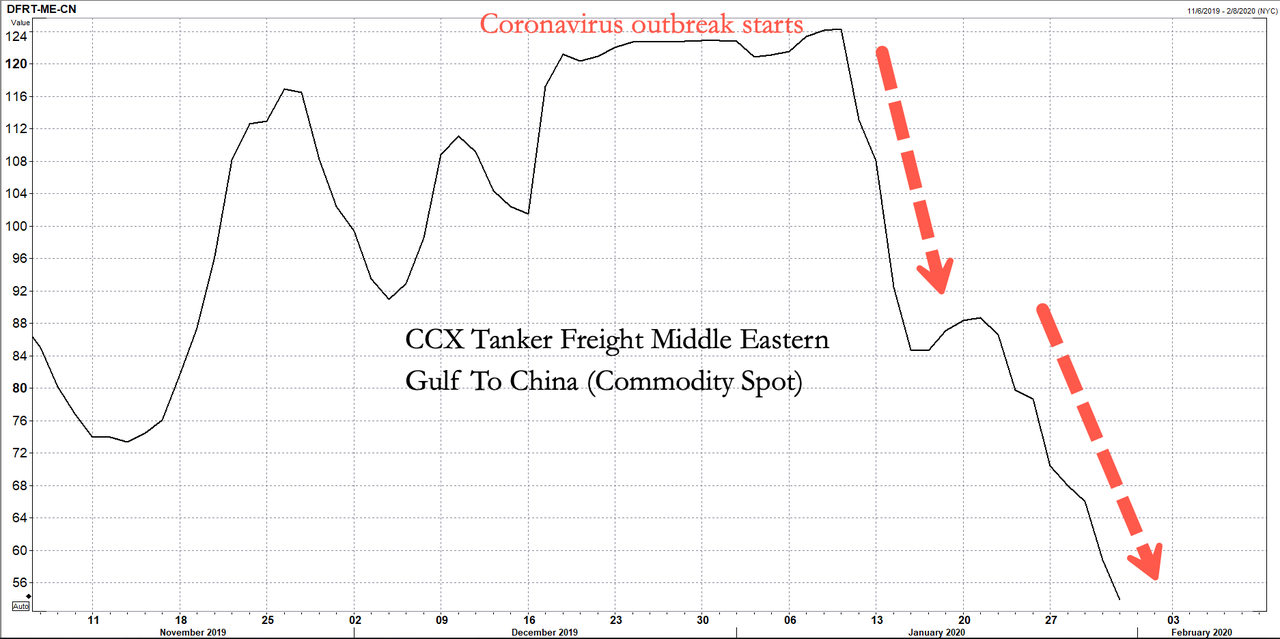

The coronavirus outbreak has sent Chinese oil demand, energy prices, and tanker freight rates plunging in the last three weeks.

With more than a dozen cities locked down, 50 million people or more quarantined, and large manufacturing hubs shuttered, oil demand in China has collapsed by nearly three million barrels per day, or 20% of total consumption, as a result of the creeping economic paralysis unleashed by the coronavirus epidemic. The drop is said to be the most massive demand shock the oil market has suffered since the global financial crisis of 2008 to 2009.

China surpassed the U.S. as the world’s largest oil importer back in 2016, so any changes in consumption have a profound impact on the global energy market. That’s why Brent tumbled into a bear market Sunday night, plunging over 22% since its January 8 peak.

And is accelerating lower this morning with WTI back below $50 for the first time since Jan 2019

The shock also has sent freight rates for very large crude carriers (VLCC) on Mideast Gulf and U.S. Gulf to Asia routes to their lowest since mid-September, shipbrokers told Reuters.

“The market had gone back to what it was before the COSCO sanctions came in,” said one shipbroker referring to U.S. sanctions on the state-owned Chinese shipping firm.

The plunge in freight rates wasn’t limited to just tankers. We’ve noted that the Baltic Exchange’s main sea freight index continues to plunge as the virus outbreak shuts down about two-thirds of China’s economy, leading to an economic shock that is starting to vibrate across the world, seen mostly in commodity prices, shipping rates, bond markets, widening credit spreads, and global equity prices at the moment.

Baltic Dry Index seems to have caught the Corona Virus as well. pic.twitter.com/uD07vTJ99Q

— Mileura Capital (@mileura1) February 3, 2020

Former Morgan Stanley Asia chairman Stephen Roach said last week that China’s economy going offline is a notable shock that is occurring at the same time the global economy continues to decelerate, which could tilt the world into recession.

“With the world economy operating dangerously close to stall speed, the confluence of ever-present shocks and a sharply diminished trade cushion raises serious questions about financial markets’ increasingly optimistic view of global economic prospects,” Roach said via his op-ed in Project Syndicate.

OPEC, on Monday, said coronavirus had caused a consumption decline that will hit global oil demand and called for an emergency effort with other countries to stabilize the price.

Iranian Oil Minister Bijan Zanganeh said Iran would agree to oil production cuts to stabilize prices in an upcoming meeting.

“The oil market is under pressure, and prices have dropped to under $60 a barrel, and efforts must be made to balance it,” Zanganeh said.

And judging by the bear market in energy prices because of collapsing consumption in China as their economy has ground to a halt, this all suggests the global economy is headed for further deceleration, rather than a massive economic rebound.

Tyler Durden

Mon, 02/03/2020 – 12:30

via ZeroHedge News https://ift.tt/2GP42Hx Tyler Durden