Trader Warns “Cutting Global Rates Doesn’t Cure Sick People”

Authored by Richard Breslow via Bloomberg,

On days like today, it’s easy to fall into one of two camps.

You can either look at every move that risk makes and declare it horribly important. Portending something lasting, momentous and dispositive. And demanding to know why someone isn’t doing something to propel stocks higher. Bounces are taken as a blow struck for justice and the wholesome functioning of asset markets as they are meant to be experienced. Sell-offs are seen as unfair.

Or you can be taken as a scold for suggesting that traders, and commentators, get a grip.

This is a moment when we should accept that the calming financial measures taken by the authorities in China were wholly appropriate for their markets and everyone else should stand down.They are trying to do what they think they need to do to prevent panic in their markets and have the ability, and willingness, to do more if it isn’t enough. But that doesn’t mean every other central bank must proactively adjust policy lest their stock markets gets antsy. I wish more people would talk about whether enough is being done to eradicate the illness and what might help rather than what can be done to keep traders mollified. As an aside, traders should take comfort from measures such as travel restrictions rather than think this incites panic as some have suggested.

On Friday, Fed Vice Chairman Richard Clarida, while acknowledging that the virus scare is a wild card for the economic outlook, reiterated that the U.S. economy “is in a good place.” And the current interest-rate stance can keep things “humming.” This morning, ECB Vice President Luis de Guidnos said that the euro area economy’s risks are tilted less to the downside and that the bank believes that economic activity should start to accelerate in the second or third quarter of the year. It’s doubtful they just said these things to cheerlead.

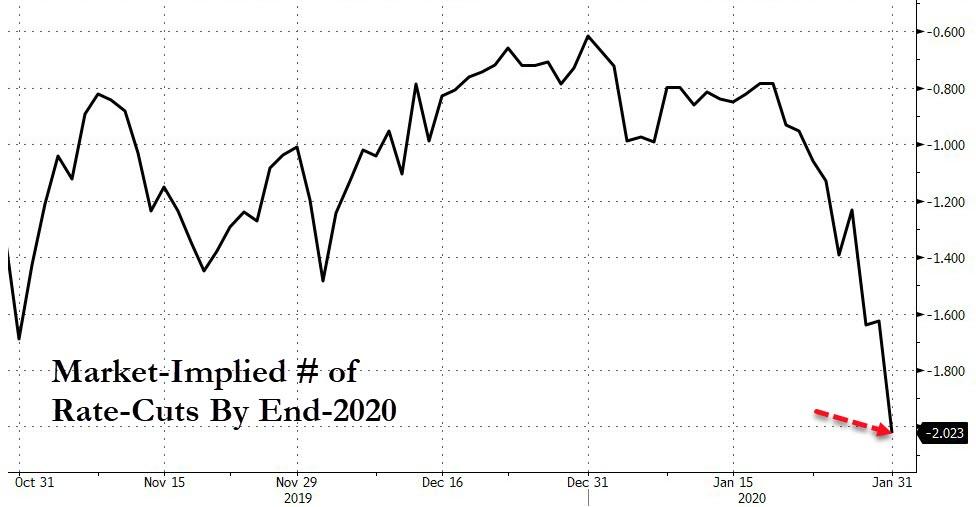

And I’m sure we all take comfort that they both made clear that their institutions are monitoring the situation. Who would expect anything less. Don’t they always do that? But expecting, let alone demanding, a monetary policy response at this point is ridiculous. If S&P 500 futures open near where they are trading this morning, the index will be up small year-to-date. Not as good a start as some had hoped, but hardly a disaster.

A look at the monthly charts shows an equity market that has been moving up impulsively. Some sort of correction could hardly come as a surprise, no matter what the news. But as futures bounced overnight, right from the get-go mind you, my inbox read like catastrophe has been, narrowly, averted. And, laughably, that traders had somehow decided that the negative price action in China’s markets wouldn’t have lasting spillover elsewhere. With the subtext being, however, as long as rate cuts remain a possibility.

China is said to be reviewing its economic growth targets and may downgrade its forecast of 2020 growth. They won’t do that today, as it’s usually something officially set in March. It makes logical sense, in any case, that they give themselves a chance to evaluate the fall-out. That’s an approach traders might consider themselves. We can’t all be experts on disease control and containment.

Last Friday, the Bloomberg Dollar Spot Index had a bit of a washout. Today, it’s bid and has risen right into its resistance zone 1,198 to 1,200. It’s worth watching.

Ten-year Treasury yields got close to the meaningful 1.50% level. It was big in October and will be so now. A lot of people are looking to fade the move down here. It’s a level that is very much in play. Very hard not to nibble. Equally hard to give away your protection.

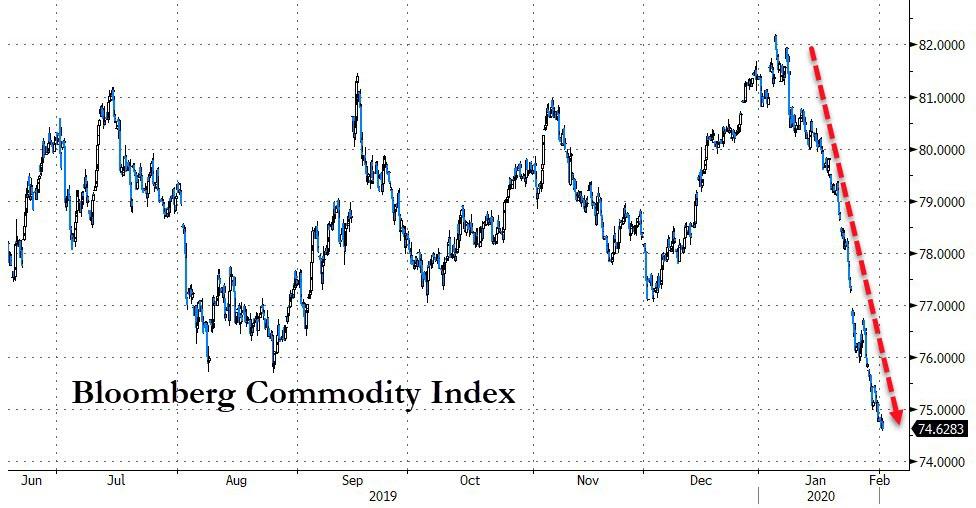

But perhaps the most important market to watch for guidance will be commodities.

The Bloomberg Commodity Index looks awful.

Whether it bounces or continues on its way may be the best indicator of where we make the next move from here in everything else.

Tyler Durden

Mon, 02/03/2020 – 10:40

via ZeroHedge News https://ift.tt/2Sd1ZSS Tyler Durden