An Unexpected Catalyst Emerges To Push Stocks To Fresh All Time Highs

Over the past month, as stocks soared to all time highs (as they are on the verge of doing again today), we discussed on several occasions that virtually all investors classes – from retail investors, to institutions, to systematic quants, CTAs and Risk Parity funds and virtually everyone else – had gone “all in” stocks lulled by the dovish encouragement of the Fed. For those unfamiliar, we suggest reading the following articles:

- Institutions, Retail And Algos Are Now All-In, Just As Buybacks Tumble

- Never Before Seen Market Complacency, As Everyone Goes Even More “All In”

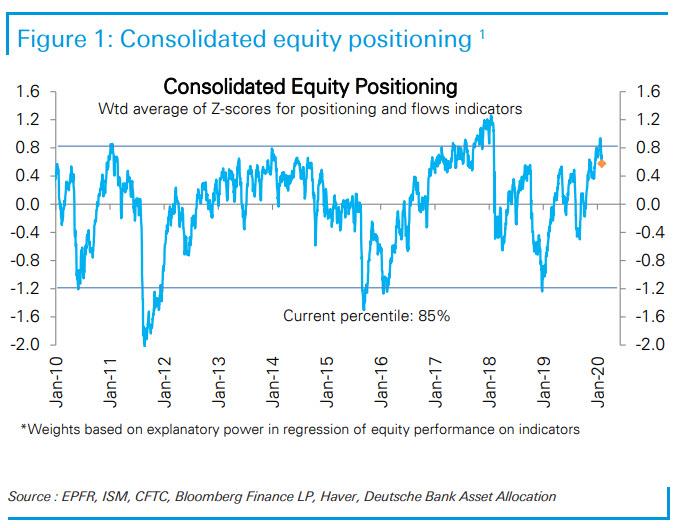

And while the coronavirus epidemic black bat black swan sparked a modest equity selloff just as everyone was all-in, it barely dented euphoric investor sentiment (mostly thanks to a surge in put option buys in recent weeks, i.e., “crash protection”, which provided a healthy buffer to any selloff) and which remains an almost unprecedented 85% in the bullish category, and just shy of decade highs, as the latest Consolidated Equity Positioning index from Deutsche Bank shows.

This also validates the violent surge higher in stocks following several days of “hope” that the coronavirus pandemic is either contained (despite US experts claiming otherwise) or a drug/vaccine is now in the works (it isn’t, as Bloomberg writes in “Why Reports of Drugs for Coronavirus Are Premature“), as investors now deploy a barbell strategy that, on one hand, a worst-case scenario will only prompt central banks to unleash even more aggressive monetary stimulus, while a best case scenario will merely result in the world reverting back to its previous growth trendline.

So while we wait for either scenario to play out, with both the Fed and PBOC lurking in the shadows ready to inject tens of billions in liquidity the moment there is even a modest market hiccup, a new “catalyst” has emerged that could push stocks even higher, all else equal.

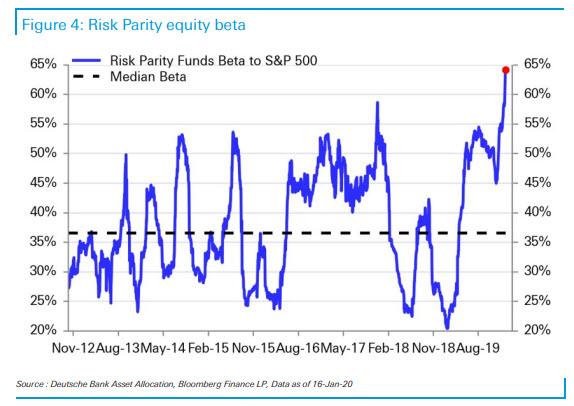

As readers may recall, two weeks ago we highlighted the latest risk-parity positioning extrapolation from Deutsche Bank, according to which the best performance investor class in recent years had an unprecedented beta to stocks of roughly 65%, the highest on record, meaning that risk parity levered exposure to stocks had never been greater.

It also meant that – at least in our opinion – it was virtually impossible for risk parity funds to be sources of demand for stocks going forward. After all, they already had record exposure to stocks as measured by their beta.

It turns out that we may have been wrong.

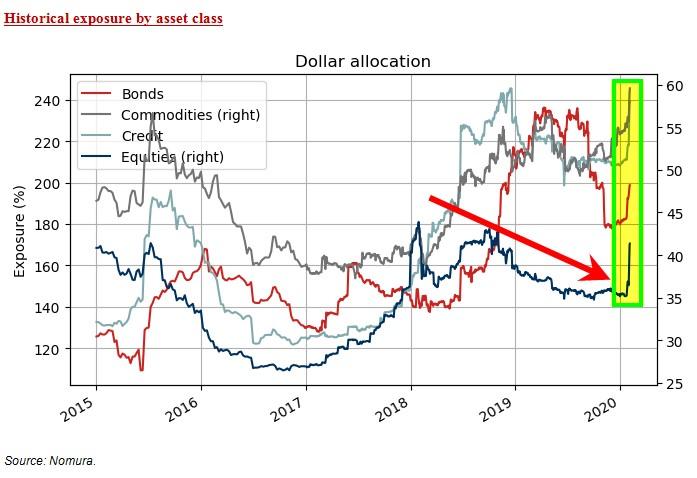

According to Nomura we can add a new, and decidedly bullish, market positioning dynamic which is already impacting the systematic “Vol Control”/Risk Parity community and their deployment of leverage across multiple asset exposures and their Dollar allocation—particularly within equities.

As the Bank’s cross-asset strategist Charlie McElligott writes, over the past few days and certainly as of today, we have seen the infamous Feb 5th 2018 VIXtermination “vol event” – which in minute destroyed the universe of retail-darling inverse VIX ETF – drop-OUT of the 2-Year lookback window time-series utilized by the Nomura QIS Risk Parity model, which in the period since Feb 2018 has, according to McElligott, “dictated a slow-moving, mechanical de-leveraging across our estimated Risk Parity “gross” allocations, particularly in the Equities space.”

As of today, this event is no longer a consideration for the systematic community.

This means that as this enormous cross-asset “Vol Shock” event has largely rolled-out of the lockback sample, going forward there will be the opposite move effectively taking place: a slow-moving “gross-up” as trailing realized vols drop and signal re-leveraging, from Equities to rates to credit to commodities.

In fact, since risk-parity is effectively long everything with various amounts of leverage, one can argue that this is the most bullish thing possible for stocks!

This dynamic can be seen visually in the chart below:

This means that despite already having a record exposure to stocks, risk-parity funds will lever up even more and purchase tens of billions in more equities, simply because an event that took place a long time ago, is now 2 years and 1 day in the past, and this does not impact the buying programs’ vol targeting signals.

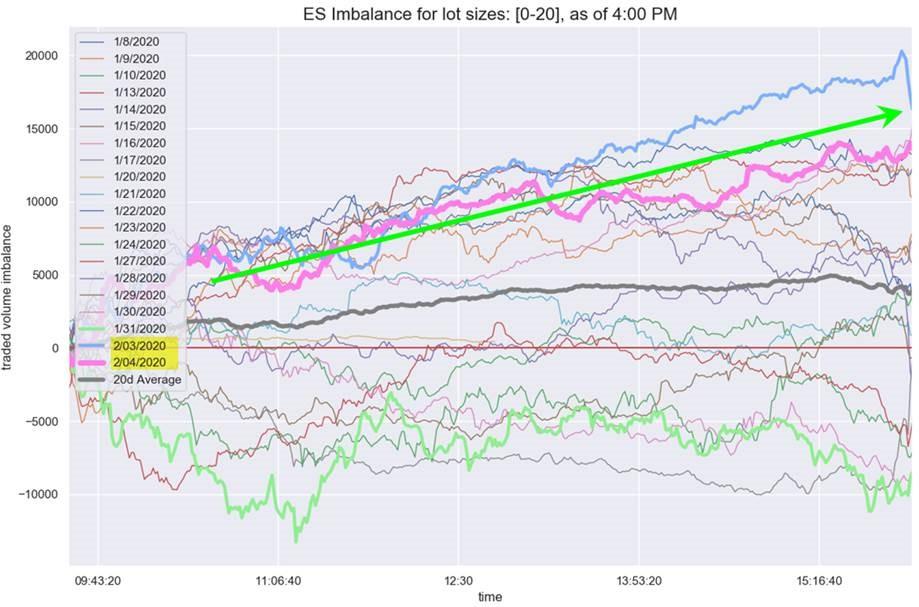

It is this releveraging dynamic that, Nomura believes, might be picking-up in its “intraday trade imbalance” estimate analysis over the past 2 sessions in S&P futures, as small lots of 0-20 contracts — which it views as a “systematic” fund proxy flow — have seen outlier “bid only” demand over the course of the US trading day.

To this, all we can add is that those outlier lots may have merely been an artifact of the Tesla meltup, which as of this morning appears to finally be over with the stock tumbling the most on record. However, with Tesla plunging and stocks soaring, it may well be that McElligott is right, and the echoes of the Feb 5, 2018 VIX crash are now being heard, and may serve to push stocks to new all time highs.

Tyler Durden

Wed, 02/05/2020 – 14:10

via ZeroHedge News https://ift.tt/372VwiF Tyler Durden