As Rich Dump To The Poor, Tesla Daytrading Millennials Dream Of Untold Riches

If you have found yourself recently wondering what stage of this record-long, Fed-induced bull market we are in, here is the answer: the “dump to the masses” stage. Indeed, we are in that delightful time where the hype surrounding the stock market, as evidenced by such totally normal moves as cash furnace Tesla doubling in just a few days, has hit a fever pitch. And this, as Goldman points out, is always the time when the “smart money” dumps their equities to the unsuspecting and excitable, yet horribly uninformed, retail crowd.

The evidence has been trickling in every day.

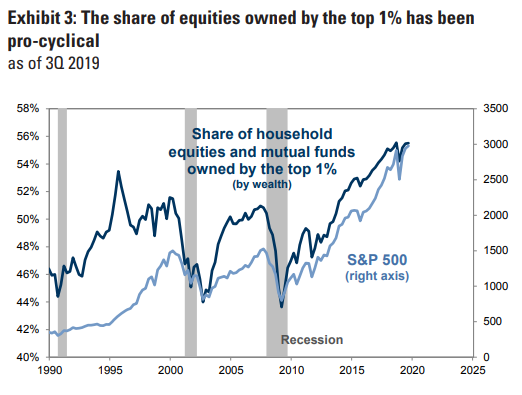

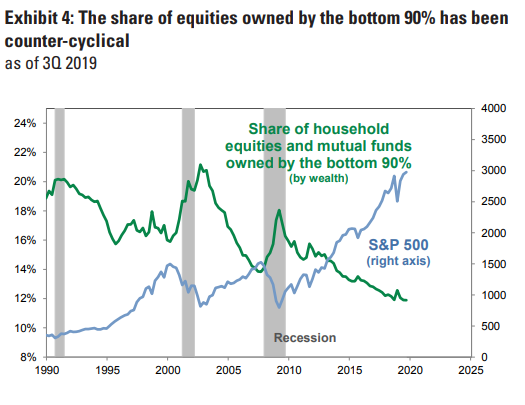

For instance, recently released data from the Federal Reserve Board shows us a couple of trends that are worth keeping an eye on. The two following charts indicate that as recessions begin, the top 1% begins to sell their holdings, while the bottom 90% continues to try and “buy the dip”.

The first chart shows the top 1% dumping as the market falls entering recession. Of late, we can see that selling has happened in spurts by the top 1%:

For the bottom 90% it’s just the opposite: the vast majority of unsophisticated retail investor start to chase momentum at the worst possible time, as they buy stocks en masse just as a recession begins, which in turn craters the market. In the Goldman chart below, we can see that the share of equities owned by the 90% jumps just as recession begin.

In laymens terms, the rich dump their stock to the poor just before the market crashes.

The technical term is “distribution.”

And when it comes to other signs of both recession and “dumping to the bottom 90%” as of late, there’s plenty.

Despite the stock market rallying to new heights, sectors like automotive have been mired in recession for the better part of the last 18 months globally. Recent housing data also suggests that we could be on our way to recession in 2020, as we have pointed out. We also pointed out recently that 9 states were heading to recession over the course of just six months – numbers that we haven’t seen since the 2008 financial crisis.

There also remains the existential threat of the coronavirus, whose economic damage won’t be knownfor weeks. It has, however, put a damper on the newly signed U.S./China trade deal, paralyzing the country of China just days after that volatility was putting downward pressure on the market (if you can even call it that).

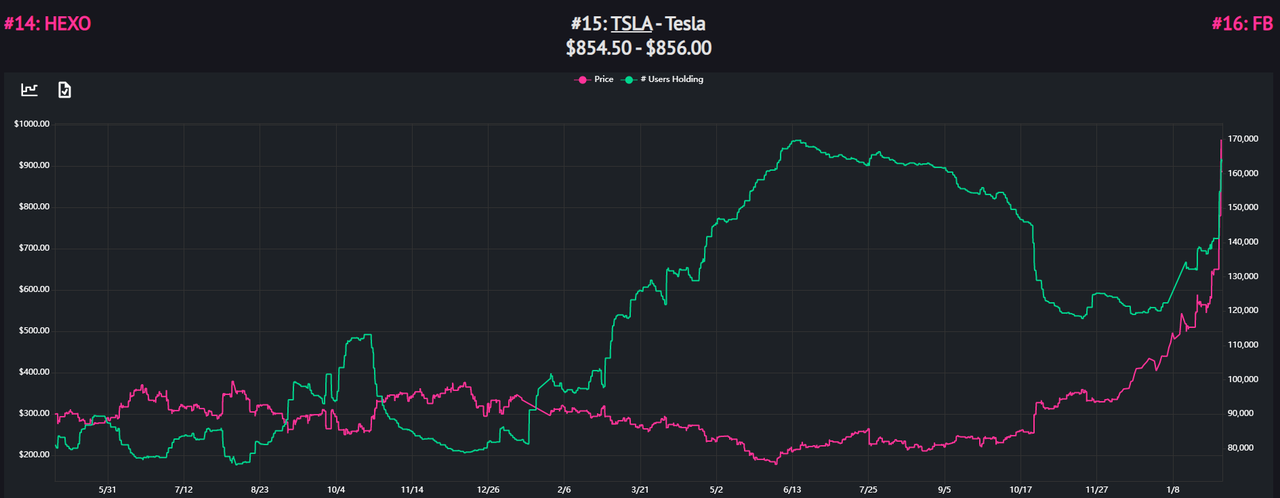

Going back to Tesla again, it was posted on Robintrack , a site that monitors the buying and selling habits of Robinhood users, that 21,000 new users on Robinhood have bought Tesla stock since the beginning of February during the stock’s wild ascent. Of course, Robinhood users – whose frontrun orderflow has made the CEOs of some of the most notorious HFT companies in the world unbelievably rich – are about as “retail” as it gets.

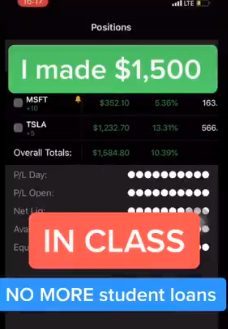

Case in point: the following video posted on T`witter, shows a young girl claiming she “paid off her student loans” by trading stocks while in class. The video then shows her, in class, on Thinkorswim, trading. She also shows a photo of her P/L, where its clear that she owns both Microsoft and (of course) Tesla.

“This is how to make money in school as a college student,” the millennial daytrader cheerfully says, before directing people to open a TD account and download Thinkorswim (perhaps she is an influencer?) Alas, we have a feeling this video will soon be followed up of her crying into a Starbucks frappuccino, just as soon as Tesla flash crashes and has a circuit breaker halt lower.

We’ll keep an eye out for it. Until then, we hope to have answered the question “what stage of the cycle is this”

what stage of the cycle is this @awealthofcs @michaelbatnick pic.twitter.com/rBrGyLZhKM

— LVD (@LVDTrades) February 4, 2020

Tyler Durden

Wed, 02/05/2020 – 13:30

via ZeroHedge News https://ift.tt/2udYUtQ Tyler Durden