Peloton Plummets After Cutting Revenue Guidance

Any retail investors who had just gotten long Tesla in the past 24 hours, had a terrible day following the biggest one day drop in the EV-automaker’s history. Yet if those same investors were consoling themselves that their momo long in the company that popularized stationary bikes with an ipad superglued at the front yelling at the rider for motivation, i.e., Peloton, would offset their P&L losses, were in for a shock after the company reported a stellar quarter, where every metric beat expectations only to see the stock plunge as much as 16% after hours, wiping out all the year’s gains after the company guided to slightly weaker Q4 revenue.

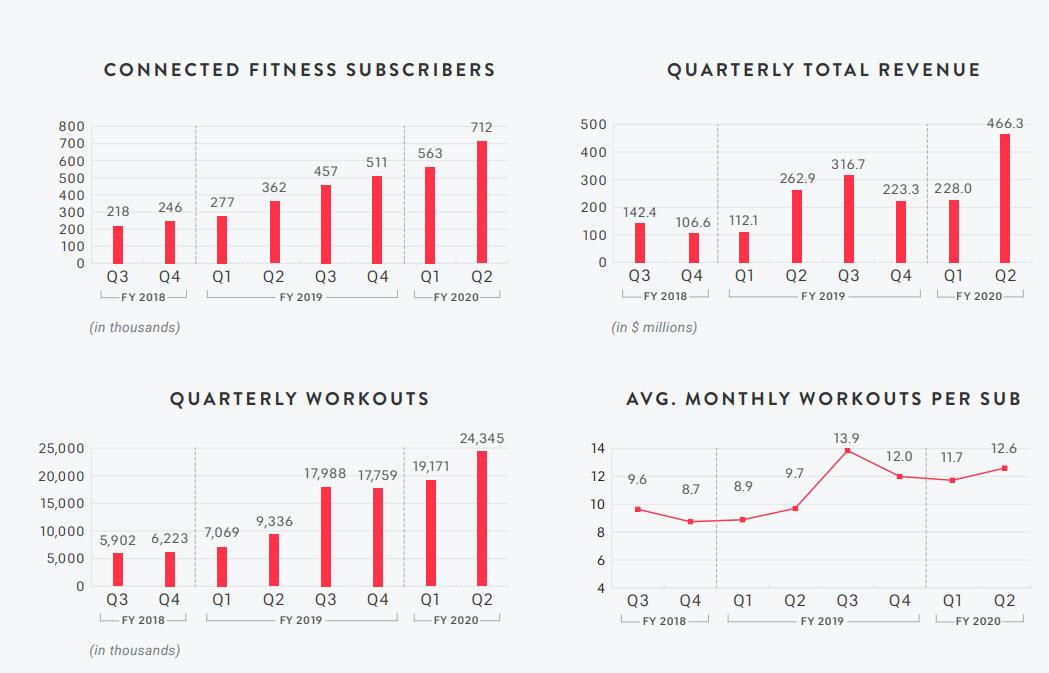

Here are the company’s Q2 results, as well as Q3 and full-year guidance:

- Q2 sales $466.3MM, beating estimates of $423.65m

- Q2 loss per share 20c, beating adj EPS est. loss 34c

- Q2 adj. EBITDA loss $28.4 million, beating estimated loss $65.9m

The additional metrics were also solid:

- Connected fitness subscribers 712,005; beating est. 686.84K

- Subscription revenue $77.1MM; beating est. $68.75MM

Looking ahead, however, a problem emerged as the company now sees Q4 revenue of $470MM to $480MM, the top end of the range badly missing the estimate $494.2MM. The company also guided to Q4 EBITDA loss $25m to loss $35m, roughly in line with the consensus EBITDA loss $31.75m. Additionally, Peloton also sees 3Q Connected fitness subscribers 843K to 848K, 85% growth at midpoint.

Surprisingly, for the full year, Peloton actually guided higher, and now sees FY2020 revenue of $1.53b to $1.55b, after seeing $1.45BN to $1.50BN in November, both above the est. $1.49b. Full year 2020 adj. Ebitda loss was also trimmed to $95m-$115m, after initially seeing a loss of $150m to $170m, also in line with the estimate loss $158m.

Not even the modest improvement in full year sub expectations, as PTON now sees FY20 Connected fitness subscribers of 920,000 to 930,000, up 81% at the midpoint, and up from the previous November guidance of 885,000 to 895,000 was enough to appears the company which appears was priced to perfection, and the one disappointing revenue guidance was enough to send the stock plunging…

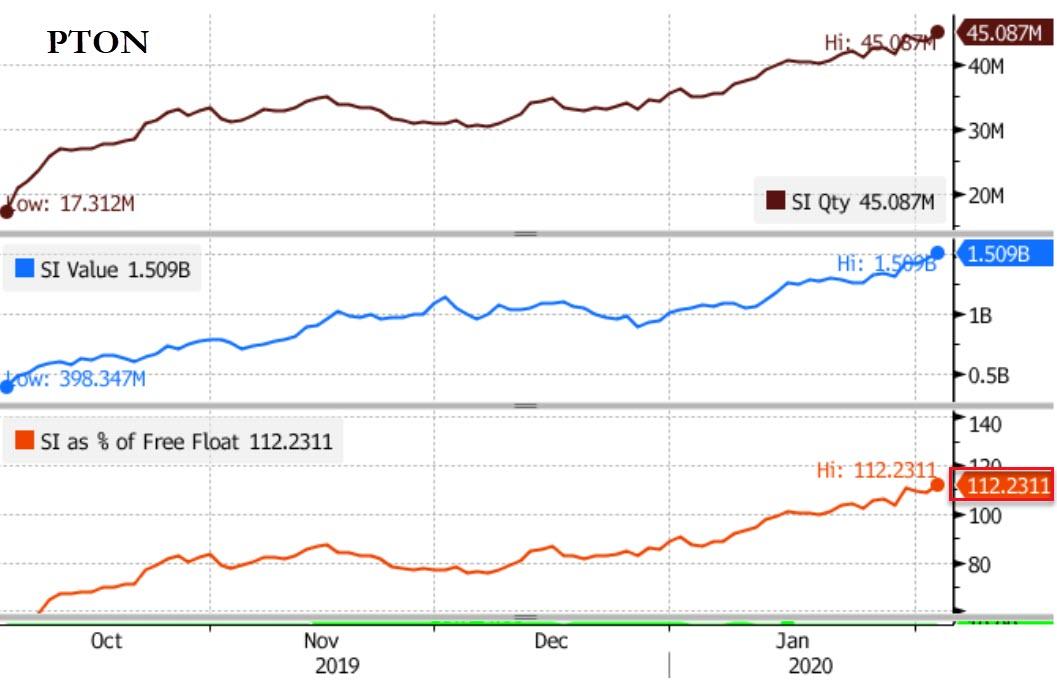

… much to the delight of shorts. And speaking of Peloton shorts, a bizarre observation emerges, because the company with a 40 million float, and 43.2 million total shares outstanding, somehow has a total short interest of 45 million, or 112% of the float!

As Bloomberg notes, “short interest of more than 100% of the float is unusual, but has precedent.” According to IHS Markit’s Sam Pierson, “the reason is that when shares are sold short, the purchaser of the shares is free to lend them to another short seller. The current estimate of short interest from IHS Markit is based on international reported borrowing of shares. It stands in contrast to data from financial analytics firm S3 Partners, which shows Peloton short interest at 86% of float.”

In other words, someone was very aggressive in rehypothecating their already lent out shares, a rather risky proposal should the stock ever spike on unexpected positive news.

To be sure, if and when an unexpected upside catalyst emerges, this unprecedented short interest could well make Peloton into the next Tesla/Volkswagen. Until then, and certainly today, the shorts will have the (interim) laugh.

Tyler Durden

Wed, 02/05/2020 – 16:23

via ZeroHedge News https://ift.tt/381LUWR Tyler Durden