Record Surge In Global Virus Cases Sparks Panic-Bid For Stocks To All-Time Highs

What better catalyst is there for buying US equities with both hands and feet that the Director-General of The World Health Organization – who has been down-playing the pandemic for days – admitting that the last 24 hours saw the biggest surge in coronavirus cases worldwide since the crisis began? And as far as rumors of a vaccine, how long will that take?

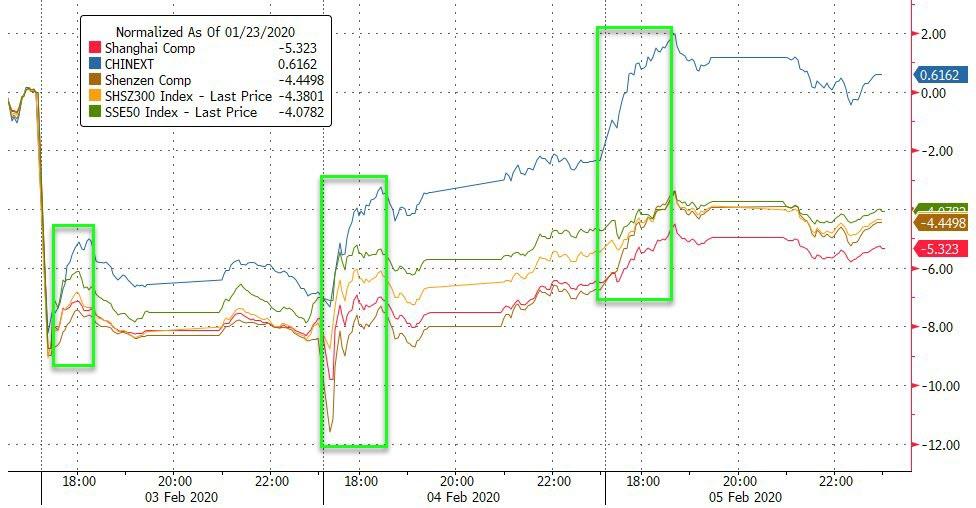

China did not supply liquidity last night, but momentum was still with the small cap tech stocks in ChiNext…

Source: Bloomberg

European markets all bounced higher once again today…

Source: Bloomberg

And as Industrials, Trannies, and Small Caps roared higher in the US, Nasdaq lagged (everything saw quite an ugly close)…

Futures show the surge on the vaccine and the complete ignorance of WHO comments…

Dow gapped through 29,000 and never looked back (IBM, UNH, and BA accounted for half of the index gains alone)

And the S&P 500 almost perfectly top-ticked the record high from January (after testing the spike lows from the Iran missile strike)…

The last 3 days have been the biggest short-squeeze since September’s melt-up (and melt back down)…

Source: Bloomberg

what stage of the cycle is this @awealthofcs @michaelbatnick pic.twitter.com/rBrGyLZhKM

— LVD (@LVDTrades) February 4, 2020

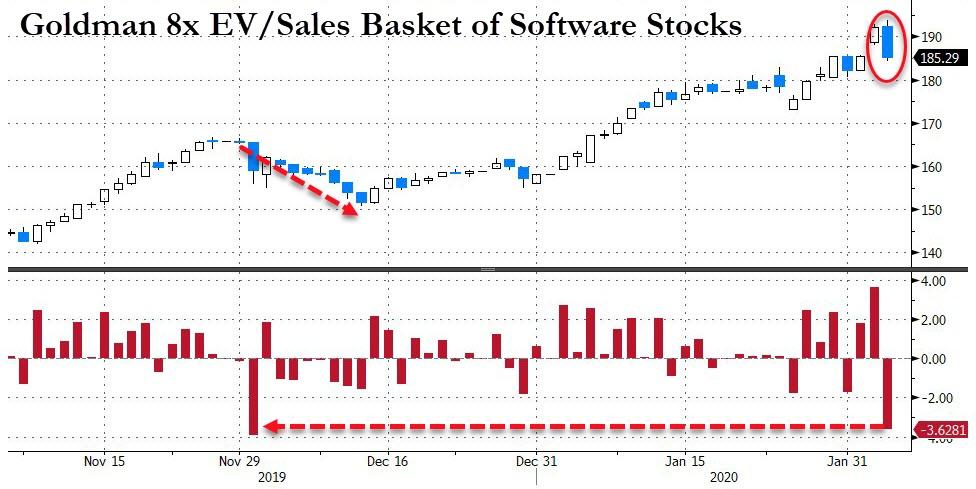

As high-growth, super-expensive software stocks plunged today by the most in 2 months…

Source: Bloomberg

The GS 8X EV / SALES software basket is a basket of US growth software stocks that carry the highest EV/S multiples in the group.

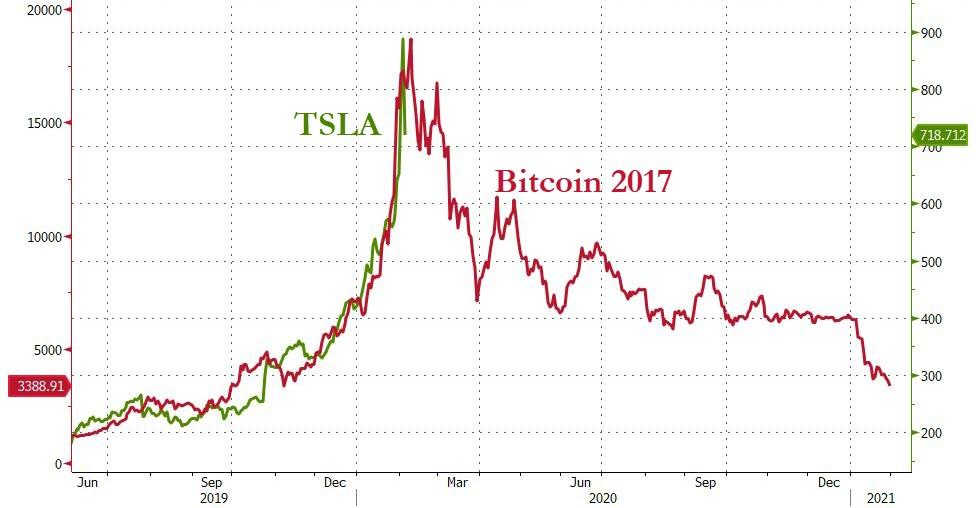

And then there’s TSLA!! Which suffered its biggest one-day drop ever…

Following Bitcoin’s 2017 trajectory rather too well…

Cyclicals are almost back to pre-virus levels…

Source: Bloomberg

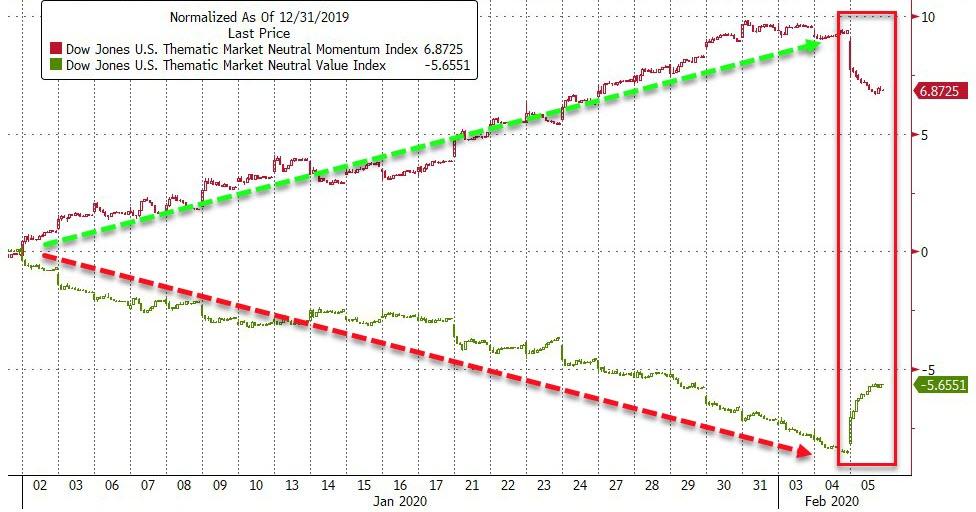

Big regime change today as Momo tumbled (cough TSLA cough)…that is the biggest drop in momentum in 2 months

Source: Bloomberg

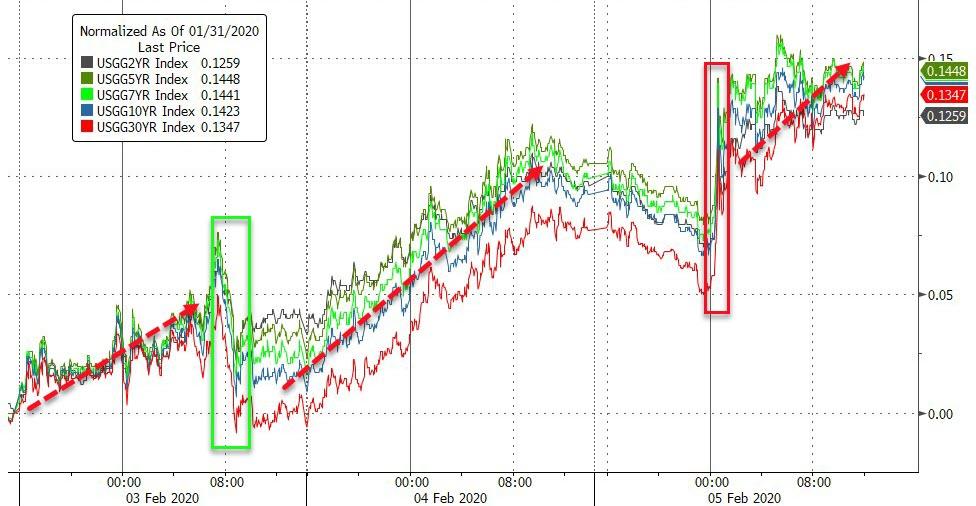

Treasury yields extended their rise (but note the jump in yields occurred on the vaccine headlines at 3amET not the ADP or ISM data)…

Source: Bloomberg

30Y Yields rose to fill the gap from the major virus drop…

Source: Bloomberg

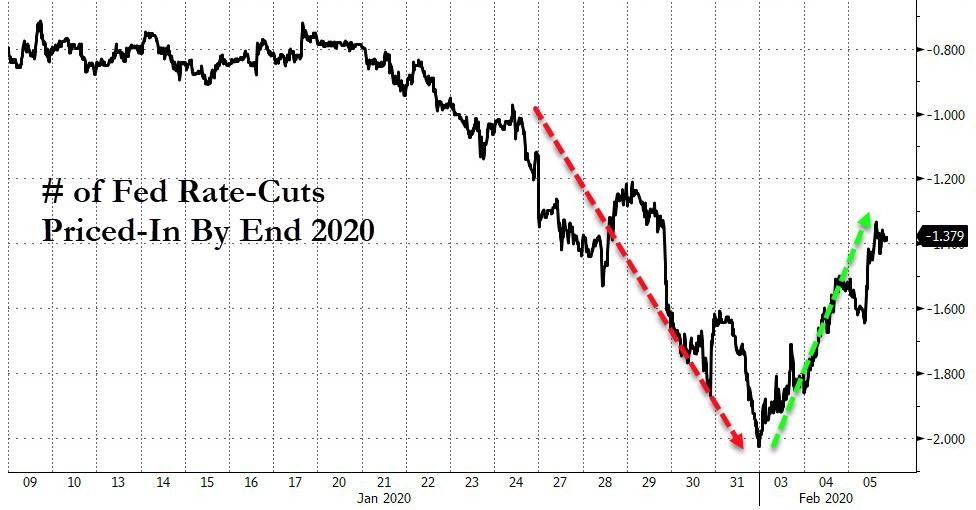

Notably the market has un-priced its demands for Fed easing as stocks soared back to record highs…

Source: Bloomberg

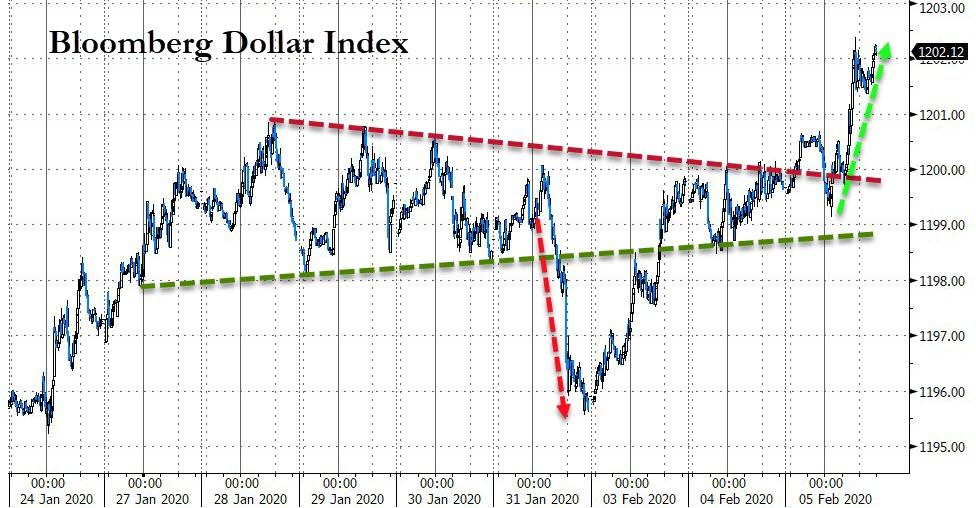

The Dollar Index broke out to the upside of its recent range today…

Source: Bloomberg

Hitting 2-month highs and breaking above all its major moving averages…

Source: Bloomberg

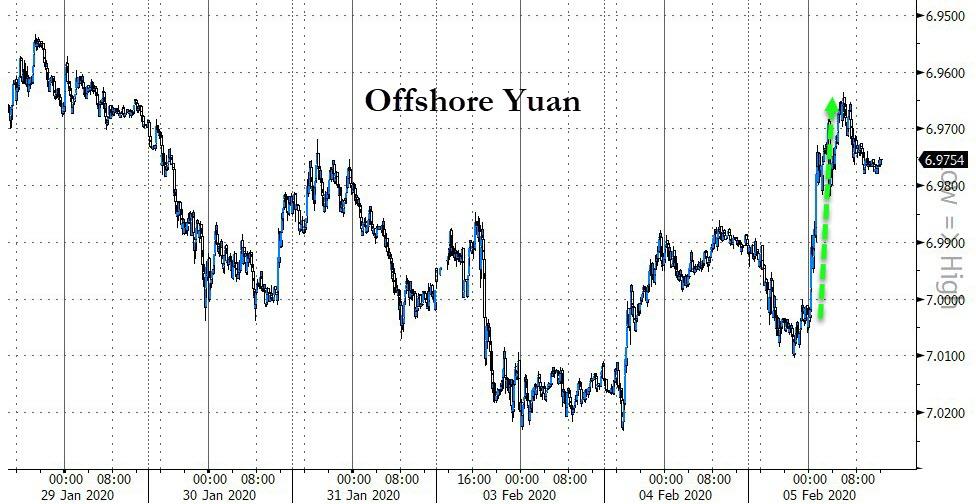

Yuan jumped on the vaccine headlines…

Source: Bloomberg

Bitcoin surged today, nearing $9800 intraday…

Source: Bloomberg

PMs drifted lower today as the dollar gained but copper and crude rallied on vaccine hopes…

Source: Bloomberg

WTI was higher for only the 2nd time in 12 sessions on a surprise gasoline draw and chatter from OPEC+ of more cuts (but we note oil went out weak)…

Source: Bloomberg

Finally, some context for everything else in the world’s reaction to the Wuhan coronavirus… and stocks…

Source: Bloomberg

And maybe, just maybe, the fact that Bernie never won the Iowa caucus, which lowered his odds of a nomination (despite still leading by a mile at the bookies) may have buoyed the market (and Bloomberg just overtook Biden!)…

Source: Bloomberg

Tyler Durden

Wed, 02/05/2020 – 16:00

via ZeroHedge News https://ift.tt/31vzaW4 Tyler Durden