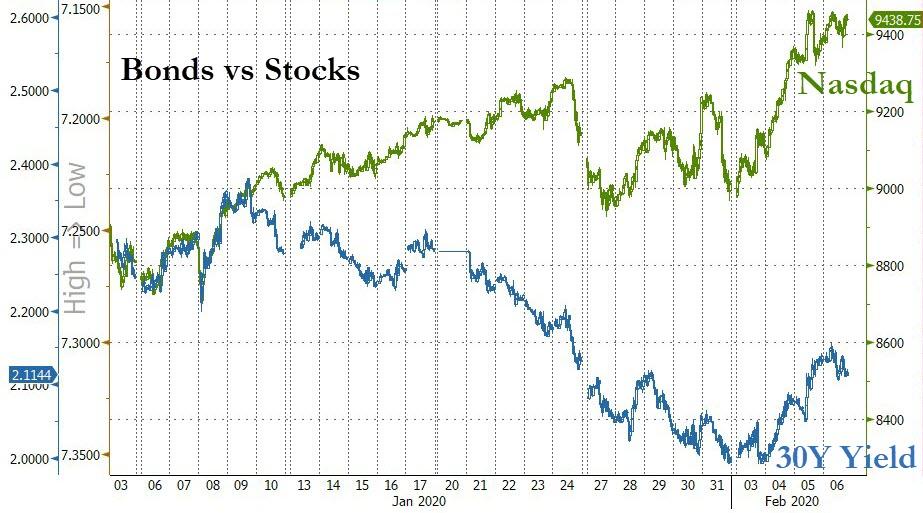

Stock And Bond Investors Are Looking At Identical Virus Headlines And Both Concluding: “Great Reason To Buy”

To say that the market response to the Chinese coronavirus pandemic has been bizarre, with both stocks and bonds ramping higher (even with perennial permabull JPMorgan now saying it’s time to ease out of stocks), is an understatement. What is more bizarre is that both equity and bond investors are looking at the exact same headlines, and both sets of investors deciding these are catalysts to buy. How does one explain this divergence? How else: as BMO’s rates strategists Ian Lyngen and Jon Hill summarize it in just 5 words, it’s all thanks to the “galvanizing of the Powell Put.”

Below we present the key excerpt from BMO’s morning note which explains everything those who still don’t understand that the only driving force behind the market, and the global economy which is about to see a sharp contraction in Q1 which has somehow pushed stocks to all time highs, is the Fed.

In an environment plagued by so many unknowns related to 2019nCov, the divergence between the response of equities and bonds is notable – albeit not as atypical as it might once have been. Treasuries have benefited from an underlying bullishness due, in part, to the reality that if the situation deteriorates further, there is ample safe-haven demand on the sidelines to drive 10-year yields quickly back to the bottom of the range and beyond. The implied ‘insurance’ aspect of USTs is once again at play here.

The inability of rates to retrace even half of January’s rally conflicts with stocks, where record highs are again the norm rather than the exception. In pondering this divergence, it’s worth highlighting that there is no asymmetry of information related to the most significant risk factor thus far in 2020 (i.e. the coronavirus).

Said differently, investors in stocks and bonds are simultaneously looking at identical headlines on quarantines, contagion stats, and mortality rates, concluding ‘Ah! That’s a great reason to buy.” This isn’t likely to go unchecked indefinitely, however for the time being the trends will be defended.

The political impact on domestic equities is greater than the implications for Treasuries; the lack of clarity regarding who will emerge as the Democratic front-runner has bolstered Trump’s reelection prospects (thereby inspiring stock investors). Let us not forget the classic ‘bad news is good news’ dynamic which suggests 1) lower rates are good for equity valuations and 2) should the situation devolve far enough, the Fed will have to respond.

Their conclusion: “Alas, the galvanizing of the Powell Put.” Alas, indeed, because at some point there will be tears. Until then, however, it’s a market made for millennials making millions daytrading Tesla.

Tyler Durden

Thu, 02/06/2020 – 13:50

via ZeroHedge News https://ift.tt/31tUuLu Tyler Durden