Uber Jumps After Beating Expectations, Despite $8.5 Billion Full Year Loss

Having plunged to an all time low after reporting its dismal Q3 earnings which included a massive loss and yet another consecutive quarter of negative EBITDA, Uber managed to stage an impressive recovery in the past three months alongside the rest of the tech sector, rising from $26 to $37. As a result investors were eagerly anticipating the car hailer’s Q4 earnings to see if the rebound was justified.

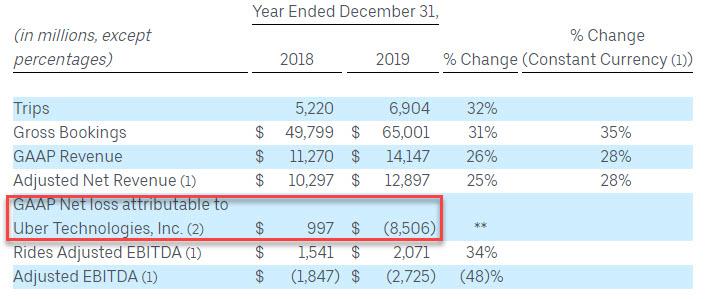

With that in mind, moments ago Uber reported earnings that beat across the board even as active users actually trailed expectations modestly (111MM vs 113.4MM), and despite CEO Khosrowshani saying that the era of growth at all costs is “over”, Uber lost a record $8.5 billion for the full year 2019.

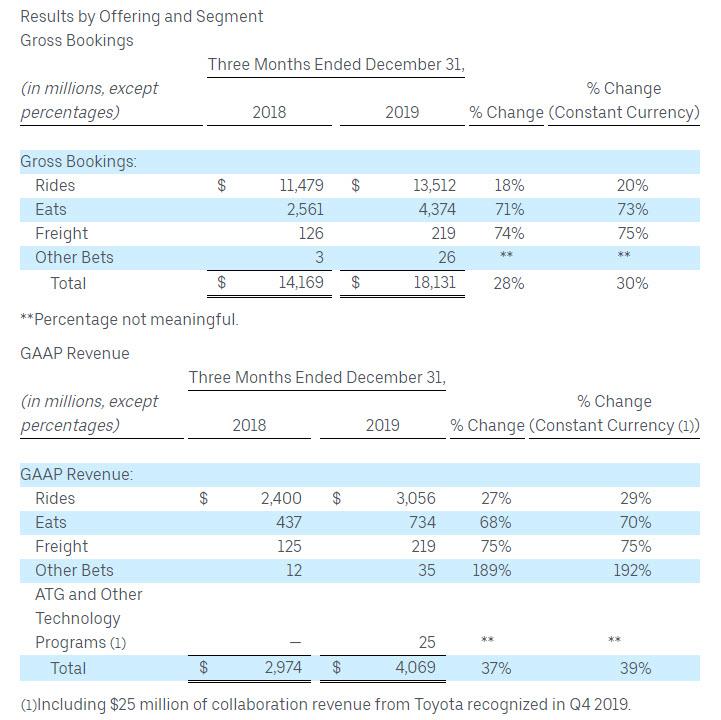

- Gross bookings $18.13 billion, beating the estimate $18.03 billion

- Total ridesharing bookings $13.51 billion, beating the estimate $13.50 billion

- Uber Eats bookings $4.37 billion, beating the estimate $4.21 billion

- GAAP Revenue $4.069 billion, beating the estimate of $4.06BN

- Adjusted net revenue $3.73 billion beating the estimate $3.70 billion

- Adjusted loss per share 64c, beating the estimate loss/share 65c

Of course, all of that has to be considered against the flipside, namely that the $1.1BN net loss in Q4 meant that the company lost a whopping $8.5 billion for the full year, propelled by $4.6 billion in stock based compensation in 2019 following the company’s IPO.

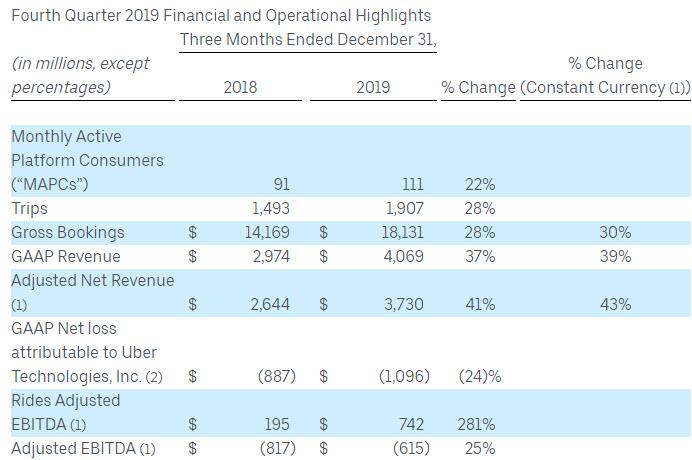

The company also reported that Q4 monthly active platform consumers 111 million, up 22% Y/Y but missing the estimate of 113.4 million. Also concerning is that even as revenues increased 27%, the Net Loss went in the other direction, and increased by 24% to $1.1 billion, which however was also just better than the $1.15 billion expected.

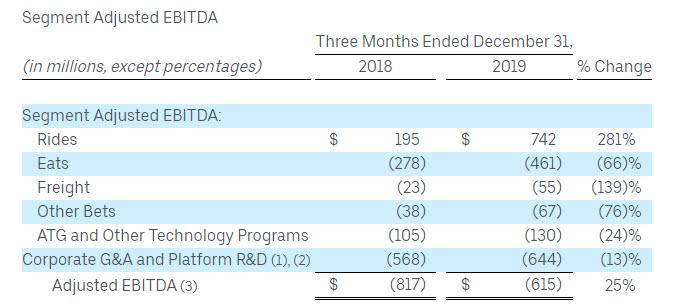

In short, the top and bottom line beat across, with adjusted EBITDA loss $615 million also coming in modestly above the expected loss of $712.9 million, and 25% stronger than the $817MM EBITDA a year ago.

The not so good news: Uber’s self-driving car program (as well as other research projects) saw losses grow to $130 million in the fourth quarter, up 24% from a year before, which may explain why we hear less about the program these days (if not at Tesla). As Bloomberg notes, Uber was likely “trying to cut costs amid skepticism that self-driving cars will revolutionize the company’s business model. But adjusted losses are growing in that category, as they are in eats, freight and other bets. The rides business is driving margin improvement.”

Commenting on the results, Uber CEO Dara Khosrowshani said that the company is now on the path to profitability in 2021:

“2019 was a transformational year for Uber and I’m gratified by our progress, steadily delivering against the commitments we’ve made to our shareholders on our path to profitability. We recognize that the era of growth at all costs is over. In a world where investors increasingly demand not just growth, but profitable growth, we are well-positioned to win through continuous innovation, excellent execution, and the unrivaled scale of our global platform.”

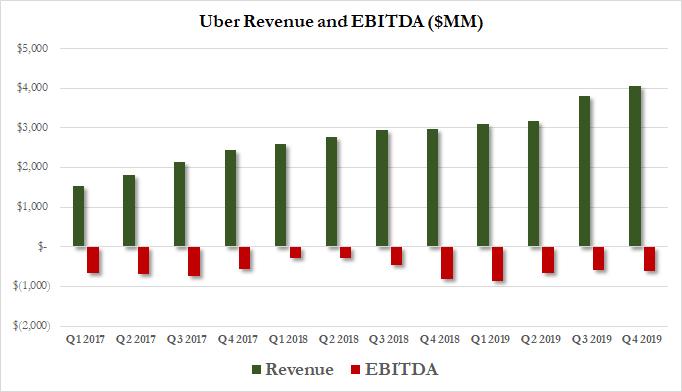

However, the biggest concern is that despite the sizable improvement in revenue, the company’s adjusted Ebitda loss of $615 million was still staggering, and while it was a modest improvement quarterly, the company has never reported a positive EBITDA quarter in its history yet.

Said otherwise, Uber is forced to continue to provide subsidies to its drivers, which means that even as revenue grows and the company burns cash to capture market share, losses refuse to turn to profits, as shown in the chart below which demonstrates just how sticky negative EBITDA has become. In short, the business refuses to scale, and with Lyft growing with every quarter, it is debatable if and when the company will ever achieve profitability.

The chart above also explains why CEO Dara said that “We recognize that the era of growth at all costs is over.” So does that mean that the company will now retrench until its generates positive EBITDA as backlash against the idiotic WeWork model grows? We will find out in the coming quarters, when the company has vowed it will turn profitable. Good luck.

Following earnings, the stock initially dipped, then rebounded and is now taking out the highs.

Tyler Durden

Thu, 02/06/2020 – 16:39

via ZeroHedge News https://ift.tt/2tB0LbL Tyler Durden