Ford’s Lending Arm Does The Dirty Work For Parent Company, Generating More Profit Now Than Ever

At a time when the global automotive market is mired in deep recession – and things likely aren’t going to be getting any better, with China in the midst of an epidemic – Ford’s lending arm is acting as the profit backbone for the company, generating more profit now than it ever has for the company.

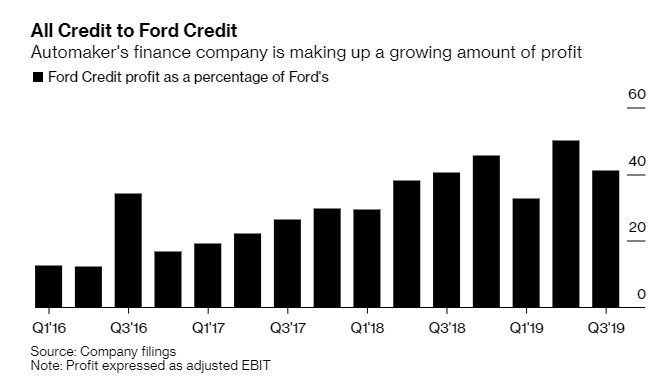

Amid an epic loss, and the resignation of the company’s president, Ford credit now generates a remarkable half of the automaker’s profit, according to Bloomberg, which is up from 15% to 20% in the past. The company’s credit arm makes loans to dealers stocking vehicles and then the consumers who buy them. Ford is relying on its financing unit to help it fund “multi-billion outlays on electric and self-driving cars” now.

The parent corporation, however, is dealing with $11 billion in charges from a restructuring that “could take years”.

Lawrence Orlowski, an analyst at S&P Global Ratings said of Ford’s credit arm: “It’s like the ballast that keeps the ship steady. It’s a balancing act.”

The amount of vehicles that Ford has been selling has been on the decline for the last three years and the company is losing money in China.

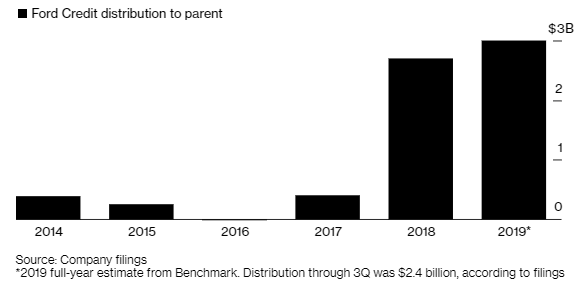

But the company would be “far worse off” without its Ford Motor Credit unit, which is paying for the company’s capex by borrowing in the debt markets and paying a dividend back to the parent company. Expectations are for the credit arm to contribute nearly $3 billion annually to Ford over the next 2 years. In 2017, that contribution was just $400 million.

The company’s credit arm borrowed about $10 billion in the U.S. investment grade bond market over the last 12 months. Meanwhile, it has been over 3 years since Ford itself has issued bonds. Moody’s downgraded Ford to junk in September and S&P cut its rating on the company to its lowest investment grade rating in October. Another downgrade from S&P could remove Ford out of some major indices, which has weighed on the minds of investors for the better part of the last year.

All eyes are on the credit division now, especially, as the global automotive market continues to falter. Ford is going to be rolling out a new line of SUVs and redesigning its F-150 as part of its recent restructuring, as well.

Analysts are wary of both cost risk and execution risk.

David Whiston, an equity strategist with Morningstar said: “It’s quite clear Ford is not where it should be, but the finance arm is a bright spot. Obviously you want the whole company operating at full power, which you don’t have right now.”

Ford credit is also responsible for protecting the parent company’s dividend. The $2.4 billion it paid back to its parent in 2019 may be “unsustainable” in the future, analysts say, because Ford’s dividend consumers a much greater percentage of its cash flow than peers.

In fact, Bloomberg notes how further important the credit arm would become/is during a recession:

In a recession, Ford Credit’s role becomes even more important. It doesn’t play much in the subprime market, so the ratio of its losses to total customer bills outstanding stayed below 2% during the Great Recession, a low level. Its repossession rate never got higher than 3.2%.

Those strong metrics allowed Ford’s captive finance unit to generate a dividend for the parent even in 2009, when U.S. auto sales slumped to a 27-year low.

Tim Stone, Ford’s chief financial officer, said during a November interview: “With a healthy portfolio, a captive balance sheet in an economic downturn actually starts generating and kicking off a bunch of cash flow. We take a very thoughtful approach to that business.”

Ford Credit has sent $28 billion over the last two decades to Ford.

Tyler Durden

Sun, 02/09/2020 – 22:30

via ZeroHedge News https://ift.tt/2uoara3 Tyler Durden