Garbage-In, Garbage-Out – Uncertainty Goes Viral As Baltic Dry Crashes Near All-Time Low

Authored by Peter Tchir via Academy Securities,

Uncertainty

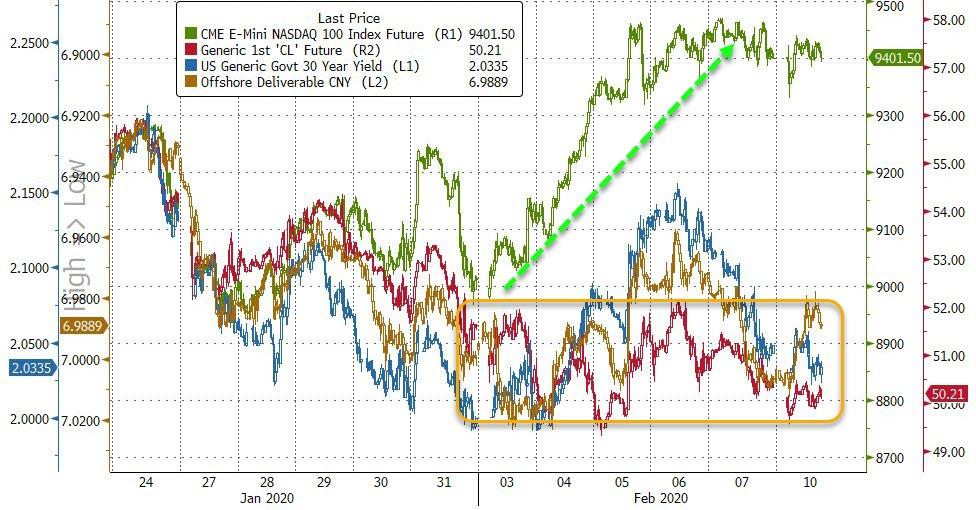

Let’s revisit the chart from Friday’s T-Report where we examine stocks, bonds, and oil.

Oil Didn’t Buy into the Bounce

At the start of the week, stocks retraced all of their coronavirus losses, but treasuries only retraced a portion and commodities in general (oil specifically), barely budged.

With high levels of uncertainty and stocks near all time highs, the risk/reward seems skewed in favor of being prudent. There is nothing to stop stocks from making new, even greater highs but as the official death toll of the coronavirus surpasses SARS and much of China is in lockdown while the virus continues to spread globally, it is difficult to be risk-on at the moment.

On a subjective basis, it seems like Wall Street was fixated on coronavirus long before it gained mainstream attention, which might mean we haven’t started to see retail’s reaction to increasing media coverage of coronavirus.

Garbage In, Garbage Out – The Problem with Existing Data

Garbage In, Garbage Out (or GIGO) is an important concept that warns against taking too seriously the results of any calculation or thesis based on low quality data.

As of Sunday morning, the Johns Hopkins dashboard that I’ve been using states that there have been 37,592 confirmed cases with 814 deaths and 2,920 recoveries.

It is tempting to use this data as being highly accurate. 37,592 confirmed cases seems pretty accurate, as opposed to giving a range of 35,000 to 40,000 but do they really have such precise information? I suspect that the “precision” of the counts implies a much higher degree of certainty around the numbers than there actually is. Rather than trying to work with the data today, I’ll highlight what I think the biggest risks are to using this data.

Some simple questions that I don’t think are being answered (or I haven’t found where to look)

Confirmed cases

o Any estimate of how many might be infected and have not yet been tested?

o Any good estimate of ‘suspected’ cases? Or at least those who have been tested and are awaiting results?

o How is it attributed to a specific country? By citizenship? Where they were when discovered? Where they likely caught it?

o I see lots of estimates of R0, a measure of the rate of infection that is critical to modelling, but given the quality of data we have, it seems like at worst a wild guess and at best something that has been fitted to what is potentially low-quality data.

Deaths and Recoveries

o Deaths have been very steady around 2% of confirmed cases, but we don’t know much about who is dying or when they are dying relative to becoming a confirmed case. It is similar for recoveries. What might be much more helpful is some sort of cohort or detailed analysis of age and time they were confirmed (though this may be biased early on, maybe only severe cases tried to find out what was wrong and now everyone is trying to find out).

o While it is highly encouraging that recoveries are now outpacing deaths at almost 8% versus just over 2%, that still leaves 90% of confirmed cases sick.

o I see lots of estimates of the mortality rate, another measure critical to modelling the risk the virus poses. Many seem to be using 2% or so, which fits the current data, but seems extremely optimistic on the outcome of the remaining cases (I hope they are right as it would save a huge number of lives).

How much of China is in quarantine and how long will it last?

o While this seems like it should be a simple question, the answer is not obvious to me. It seems like quarantine or further Lunar New Year extensions are case specific and I have no idea what sources of information are trustworthy and what could be fake news (domestically, I have a decent understanding of the biases of various sources and can try to adjust it, but not on this information flow). Making it more difficult, some seemingly “alternative sites” (a polite way of saying fake news) do seem to have had stories days before traditional, larger, global media had published similar stories. In this case, I think quarantine and travel bans are evolving quickly which is the reason it is difficult to get a precise number, but that still makes it difficult to estimate the impact.

o On the Bloomberg terminal, I pulled up NI China (stories on China) and picked Bloomberg only as a source (to limit the number of repeat stories). The most recent 10 headlines included EL AL suspending Hong Kong flights, Mattel closing 2 factories in Asia and one in Canada, Foxconn says plant restart hinges on China’ guidance, and J. Crew closing Hong Kong stores. The fact that these stories mostly related to Hong Kong seems to indicate we are far from done with seeing risk to supply chains and the global economy diminish.

The cruise ship quarantined in Japan.

There are now over 70 reported cases of coronavirus on this cruise ship alone. Is what seems like a high rate of infection a sign that it is more infectious than we realize or is the nature of quarantine in such a situation the problem? Even with precautions being taken, I’d want off that ship, yet it is understandable why Japan wants the quarantine to run its course since so little is really known about the spread or the incubation period. Of all the stories out there this weekend, this one makes me the most nervous as it would indicate the ease of which this is transmitted might be higher than expected (the argument against that is the nature of the quarantine/life on a contained vessel). Ultimately, it scares me in that it could give credence to those arguing the measures taken already indicate a more severe problem is occurring than the data we’ve received so far. Probably alarmist, but…

I am hopeful that the ‘good’ data is accurate, but I’m not sure we can rely too heavily on the data that we have, as its quality across the globe could be influenced by many factors. Some would argue that we have to use the data we have, but that is precisely why we have to be cautious of making decisions based on potentially low quality data, because garbage in, garbage out is real and leads to bad decisions.

Tourism and Travel

According to Nielson, overseas travel spending by Chinese tourists reached $261 billion in 2016 – ranking first worldwide. That was an increase of 4.5% over 2015. This report does include trips to Hong Kong and Macao as foreign travel (which is debatable) but the top 10 destinations include Hong Kong, Japan, Macao, Thailand, South Korea, the U.S., Singapore, Taiwan, Australia and France.

China outbound travel has been growing at a rapid rate. In 2003, when SARS hit, China GDP was about 4% of the global total – since then it has climbed to 16%. My understanding is that the percentage of global tourism is even greater than their share of global GDP now.

Thwarting the ability of the nation with the largest outbound tourist spending to travel is likely to have a significant impact on the global economy and it will be orders of magnitude greater than what it was in 2003.

It is too early to tell how long travel bans will be in place. If the spread is contained could travel restrictions be lifted early? Possibly, but for now I think that this is an underestimated issue for the global economy to deal with.

Supply Chains

There is no shortage of stories about potential supply chain disruption.

I am sure that China will make every effort to support their most critical global customers. China is extremely commercial and will do what it can to ensure they don’t lose their place as a global leader in production. Having said that, it is unclear even with that intention, what can be done given the quarantines and domestic travel restrictions. Away from the massive global companies they supply, there could be serious risk to small and medium sized companies that are more susceptible to supply shocks.

Again, worth remembering that during SARS, which resulted in fewer deaths, China was 75% less important to the global economy than they are today.

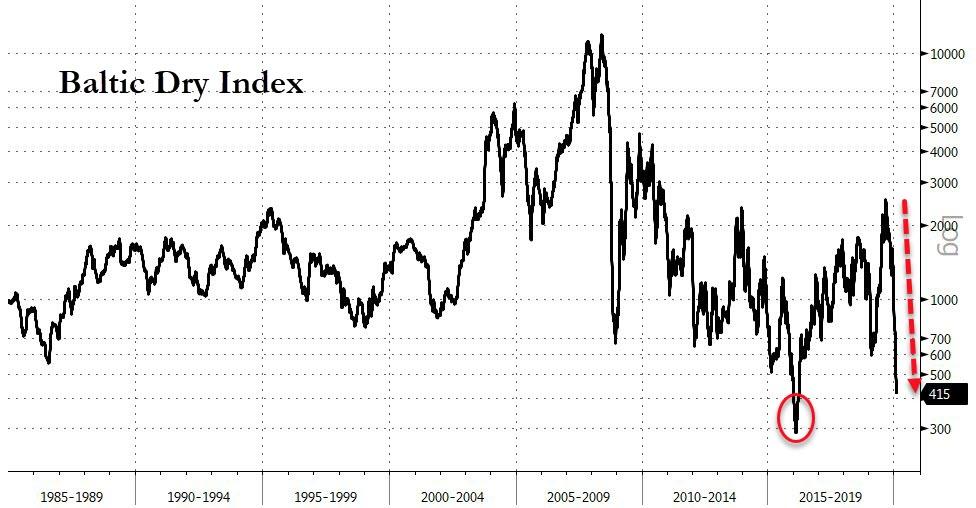

I am not generally a big fan of the Baltic Dry Index (I have a great story on how it was created and how little respect some of the creators have for it), but as Shakespeare said, the devil can cite Scripture for his purpose, so let’s run with it.

Baltic Dry Index Nears Record Low

It has declined over 83% since it peaked in early September. While I don’t think it is a particularly useful measure, it does tell us something and you will certainly see this widely circulated by the doomers in the coming days (if you haven’t seen it already).

Stay positioned for more “risk off” and stay safe!

Tyler Durden

Mon, 02/10/2020 – 11:19

via ZeroHedge News https://ift.tt/31EAFBh Tyler Durden