Saxo: Watch Global Logistics Shares For Virus Supply-Chain Signals

Authored by Peter Garnry, head of Equity Strategy, Saxo Bank,

Summary

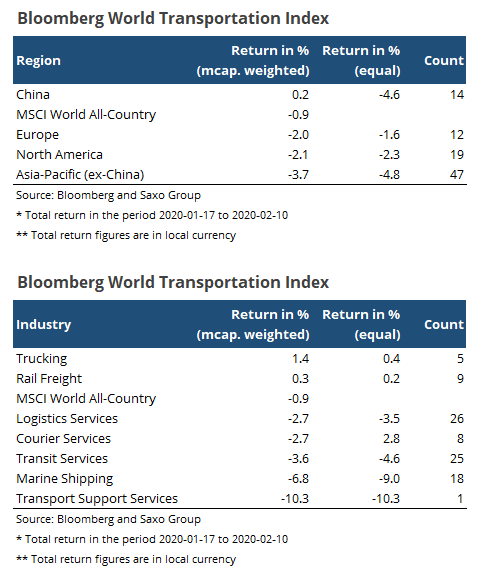

Logistics stocks have underperformed the global equity market since 17 January 2020 but overall the declines have not been severe enough to be called an all-out warning. Drilling deeper we observe the most stress among logistics stocks in China and Asia-Pacific (ex. China) and among industries we observe the worst declines in the marine shipping and transit services industries.

* * *

The coronavirus in China has still not peaked and mixed reports are coming out of China in relation to when production can be resumed in some regions of the country. Equities in general have been calm on the coronavirus outbreak with the real impact showing up in commodities such as crude oil which tells a tale of the world’s factory grinding to a halt. Within equities the epicenter is in the logistics industry group which was down 5% last Monday compared to the official start date of the coronavirus’ impact on financial markets. However, news flow was on balance positive last week pulling back equities as investors were betting on the coronavirus being contained fast enough to leave little impact on the economy.

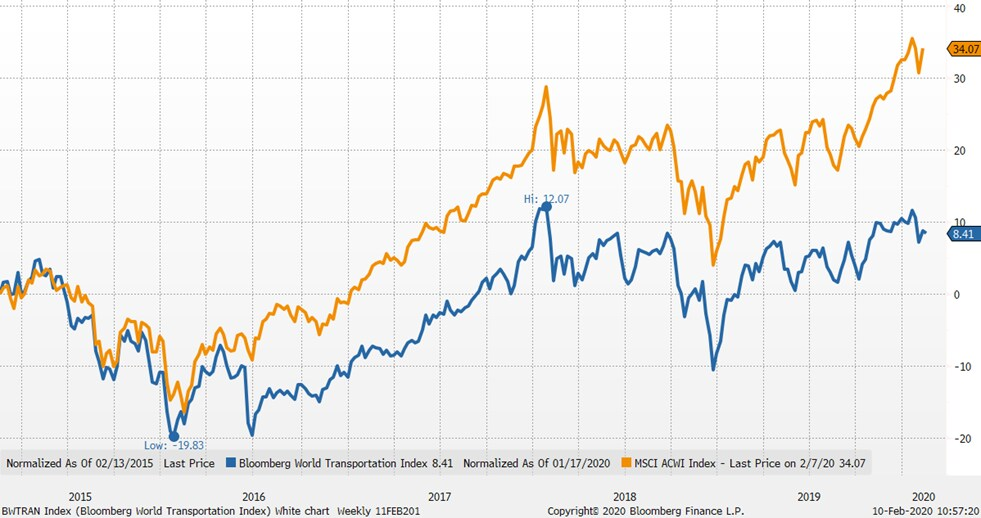

We take a more cautious view and believe the coronavirus could get much worse globally. As of this morning the Bloomberg World Transportation Index is down 3% from the close on 17 January 2020 which means that investors have not really discounted any meaningful disruption yet from the outbreak.

Underneath the index value the data tells more stories about where the impact really is. Across regions it’s clear that Asia-Pacific and China (a few of the larger names are pulling the weighted return into positive) are the two regions that are suffering the most which is not a surprise.

When we look at industries we observe that marine shipping and transit services (basically passenger transport by rail) are hit the hardest.

So the global supply chain has seen a materially decline in activity also supported by the 83% drop in the Baltic Dry Index since August 2019.

[ZH: And The Capesize Freight Index is negative! Shippers are paying you to be able to ship your gear]

While shipping and transit services are flashing some signs of warning here the declines are not catastrophic but we recommend investors to watch these industries for guidance. The overall market cap weighted equity indices are broadly reflecting technology companies which are not living in the same physical world as manufacturing companies.

It’s worth noting that the transportation sector has not been an attractive investment over a five year period delivering less than 9% return while the global equity market has delivered 34%.

In our technology-driven society our equity markets are no longer reflecting the underlying manufacturing economy but more a services and software economy.

Tyler Durden

Mon, 02/10/2020 – 14:23

via ZeroHedge News https://ift.tt/2tP8RO4 Tyler Durden