US Household Debt Soars Most Since Crisis In Q4 Amid Explosion In New Mortgage Originations

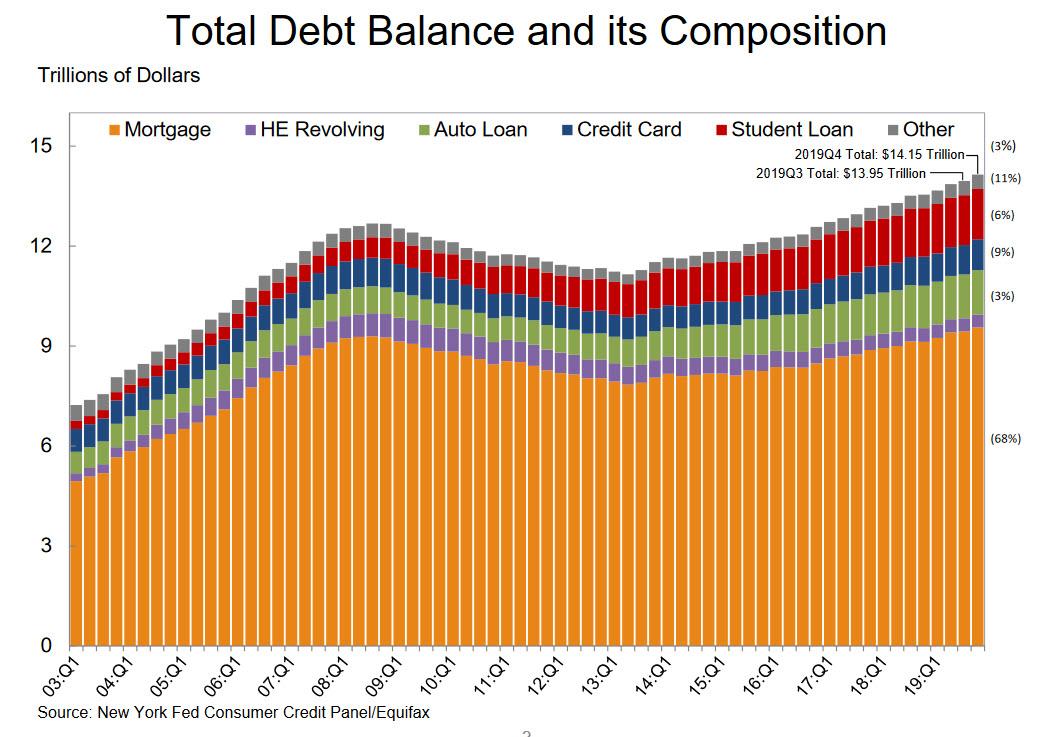

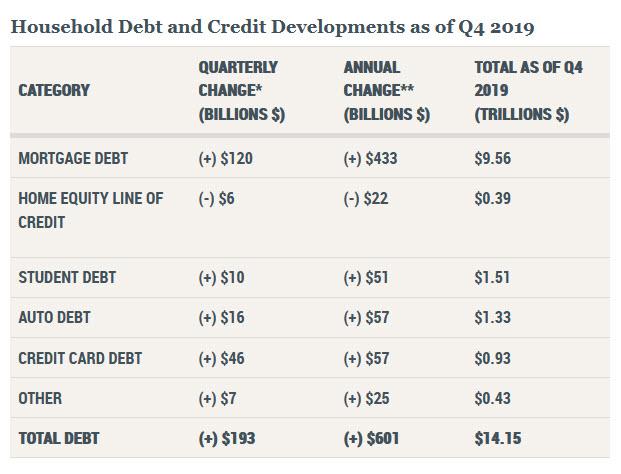

Today the NY Fed published its latest quarterly consumer credit report which found that aggregate household debt increased 1.4%, or by $193 billion in the fourth quarter 2019, its 22nd consecutive increase, for the first time ever surpassing $14 trillion ($14.15 trillion to be exact) some $601 billion higher than a year ago. This was the single biggest monthly increase in household debt since before the financial crisis.

Household debt balances have been steadily rising for the past five years and in aggregate are now $1.5 trillion higher than the previous peak of $12.68 trillion reached in Q3, 2008. Overall household debt is now 26.8% above the Q2 2013 trough.

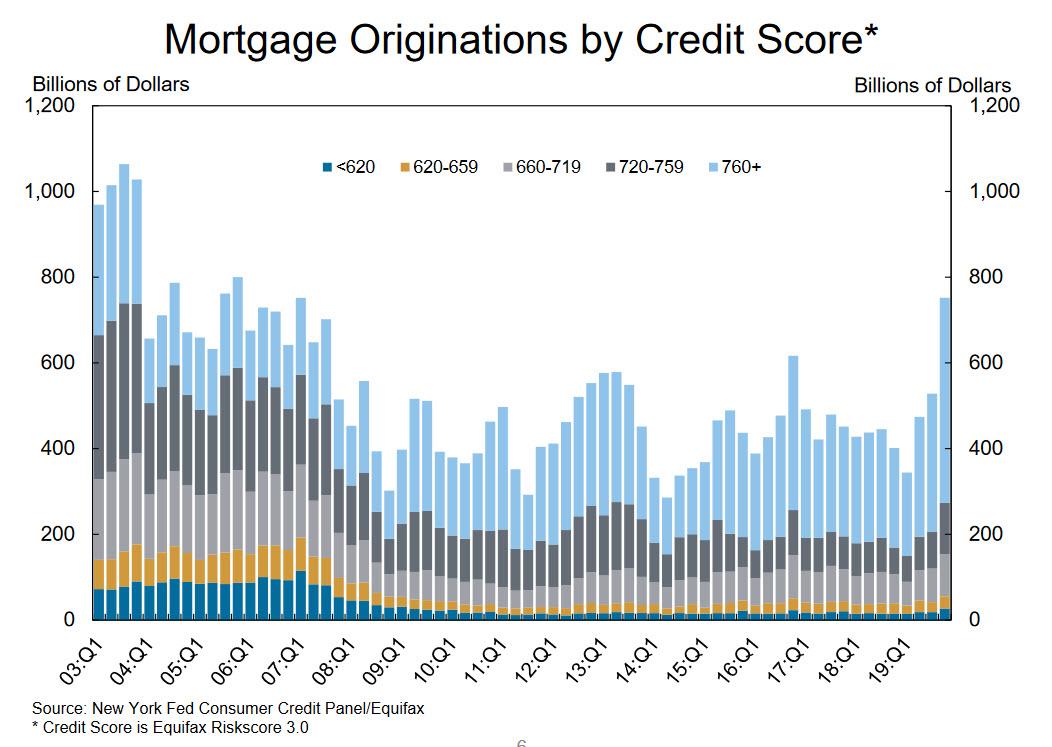

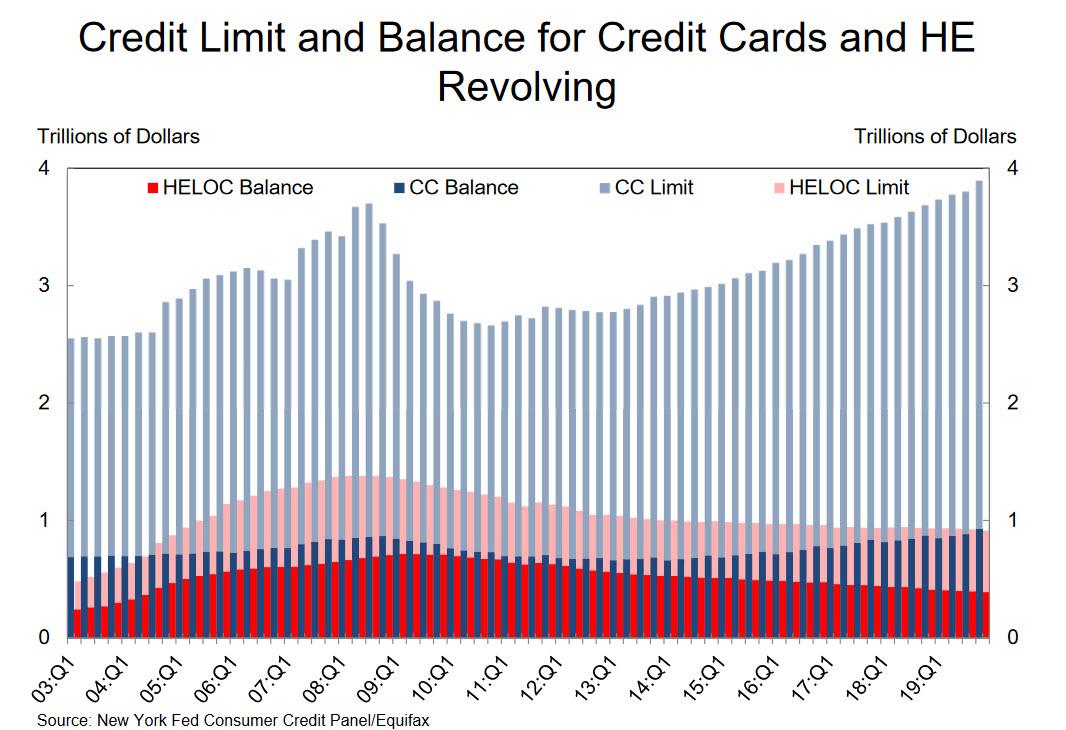

The surge in consumer debt was led by mortgage debt which rose by $120BN in Q4, to $9.56 trillion, while balances on home equity lines of credit saw a $6 billion decline, bringing the outstanding balance to $390 billion and continuing the 10 year downward trend. The dramatic increase in new mortgage debt took place as the rate on a 30-year mortgage fell by about 100 basis points over the past year, adding to home purchasers’ buying power.

“Mortgage originations, including refinances, increased significantly in the final quarter of 2019, with auto loan originations also remaining at the brisk pace seen throughout the year,” said Wilbert Van Der Klaauw, senior vice president at the New York Fed. “The data also show that transitions into delinquency among credit card borrowers have steadily risen since 2016, notably among younger borrowers.”

Mortgage originations jumped to the highest volume seen since Q4 2005, rising to $752 billion in the fourth quarter from $528 billion in Q3 2019, due to a large increase in refinance activities. Among newly originating mortgage borrowers, the median credit score stood at 770, a 5-point increase from the Q3 2019, reflecting higher share of refinances.

And with interest rates near record low, only about 1.0% of current mortgage balances became 30 or more days delinquent in the fourth quarter, near the lowest level observed in the data history. At the same time, just 71,000 individuals had a new foreclosure notation added to their credit reports between October 1 and December31, as foreclosures remained historically low.

Non-housing balances increased by $79 billion in the fourth quarter, with increases across the board, including $16 billion in auto loans, $46 billion in credit card balances, and $10 billion in student loans.

- Outstanding student debt stood at $1.51 trillion in the fourth quarter of 2019, an increase of $10 billion from Q3 2019.

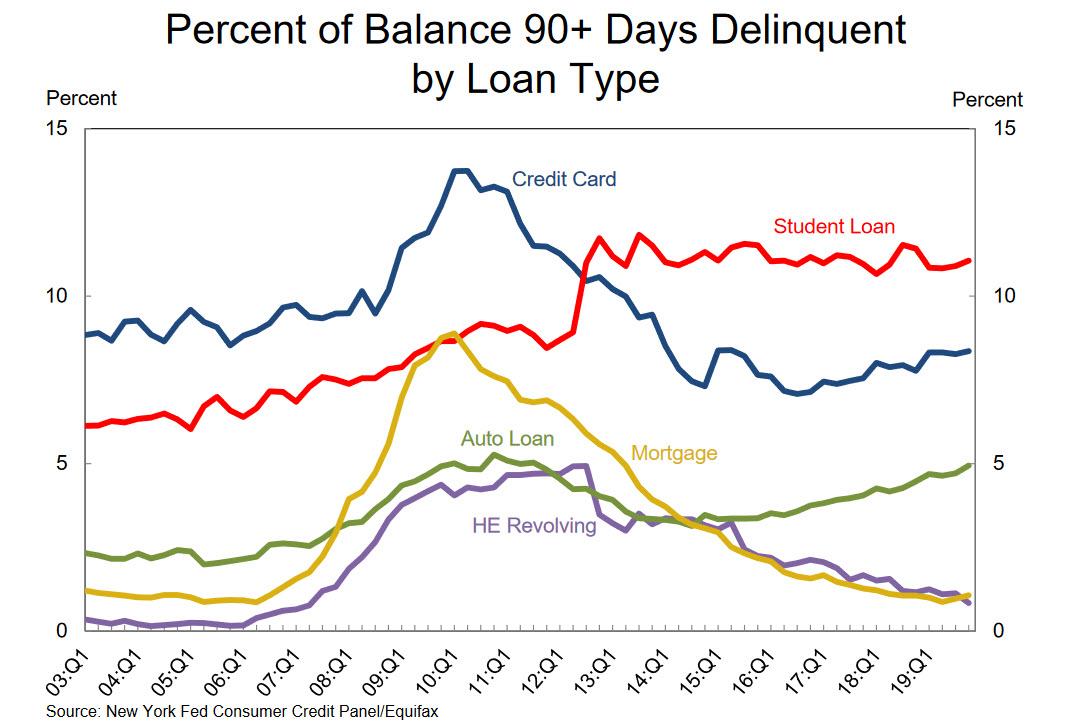

- 11.1% of aggregate student debt was 90+ days delinquent or in default in Q4 2019. The transition rate into 90+ day delinquency among student loans was 9.2%.

- Auto loan balances stood at $1.33 trillion in Q4 2019, an increase of $16 billion from the previous quarter. The transition rate into serious (90+ days) delinquency among auto loans rose to 2.36% in the fourth quarter from 2.34% in Q3 2019.

The large increase in credit card balances reflects, in part, a shifting of balances across debt types as portfolios have shifted by among lender.

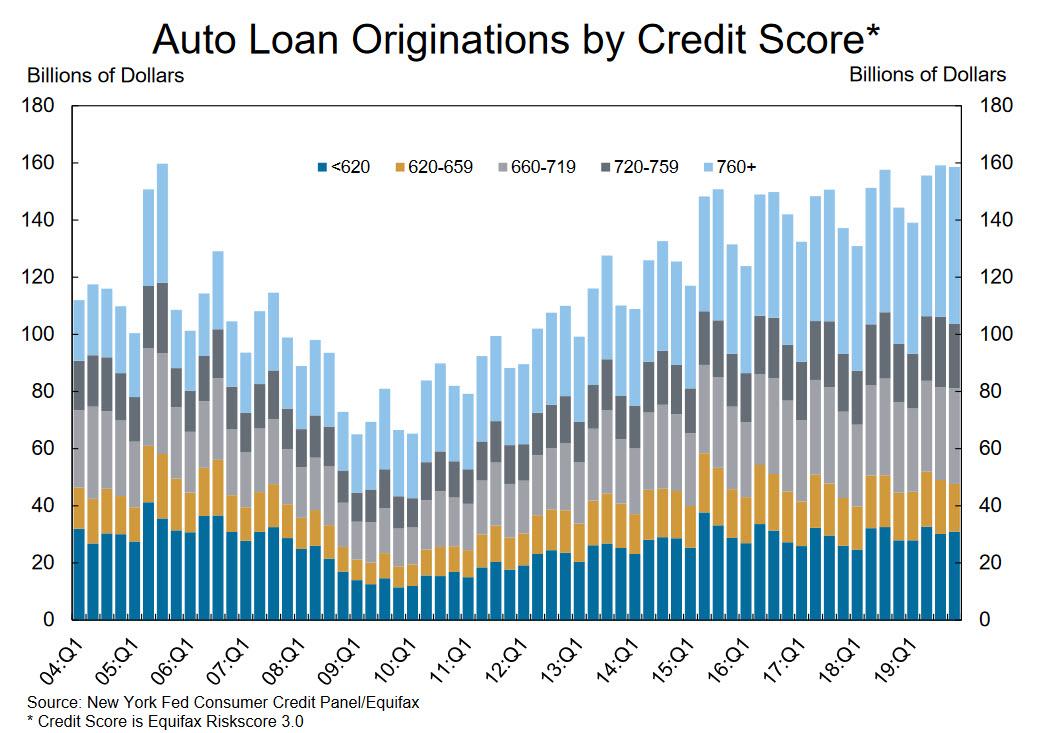

Auto loan originations, which include both newly opened loans and leases, at $159 billion, were about flat with the previous quarter’s high level. Auto debt, which has risen for 35 consecutive quarters, increased $16 billion from the previous quarter. Almost 5% of auto loans are 90 days of more delinquent. This is the highest percentage since the third quarter of 2011.

After several years of easing standards, auto loans saw tightening in underwriting standards, with a 4 point increase in the median originating credit score. The volume of subprime auto originations was $31 billion, a level on par with the last several years.

Aggregate credit limits on credit cards also increased, by $96 billion, and continuing a 10-year upward trend.

And yet despite near all time low rates, there was one especially troubling trend: credit card delinquencies rose to 8.36% an 18-month high, while auto loan delinquencies approached all time highs.

NY Fed economists said in a blog post that credit cards have again surpassed student loans as the most common form of initial credit history among young borrowers, following several years after the crisis when student loans were higher.

“The data also show that transitions into delinquency among credit card borrowers have steadily risen since 2016, notably among younger borrowers,” Wilbert Van Der Klaauw, senior vice president at the New York Fed, said in a statement.

And speaking of student loans, the total amount of debt stood at $1.51 trillion in the fourth quarter, up by $10 billion from 2019 Q3, with more than 11% of aggregate student debt 90+ days delinquent or in default in 2019 Q4. Far more troubling, about half of student loans are currently in deferment, in grace periods or in forbearance and therefore temporarily not in the repayment cycle. Once these loans enter that cycle, delinquency rates are projected to be roughly twice as high, according to the Fed report, but for now everyone is pretending that the US does not have a student loan crisis.

Tyler Durden

Tue, 02/11/2020 – 18:25

via ZeroHedge News https://ift.tt/37jFTDq Tyler Durden