The Empty Suit In The Eccles Building

Authored by Sven Henrich via NorthmanTrader.com,

After getting a public twitter scolding from President Trump for letting the Dow reverse into red yesterday Jay Powell was not about to let the same mistake happen twice and came fully prepared ready to jawbone today.

Is the presumption ridiculous? What isn’t ridiculous these days?

A president watching every tick on the $DJIA and grading the Fed Chair on it?

When Jerome Powell started his testimony today, the Dow was up 125, & heading higher. As he spoke it drifted steadily downward, as usual, and is now at -15. Germany & other countries get paid to borrow money. We are more prime, but Fed Rate is too high, Dollar tough on exports.

— Donald J. Trump (@realDonaldTrump) February 11, 2020

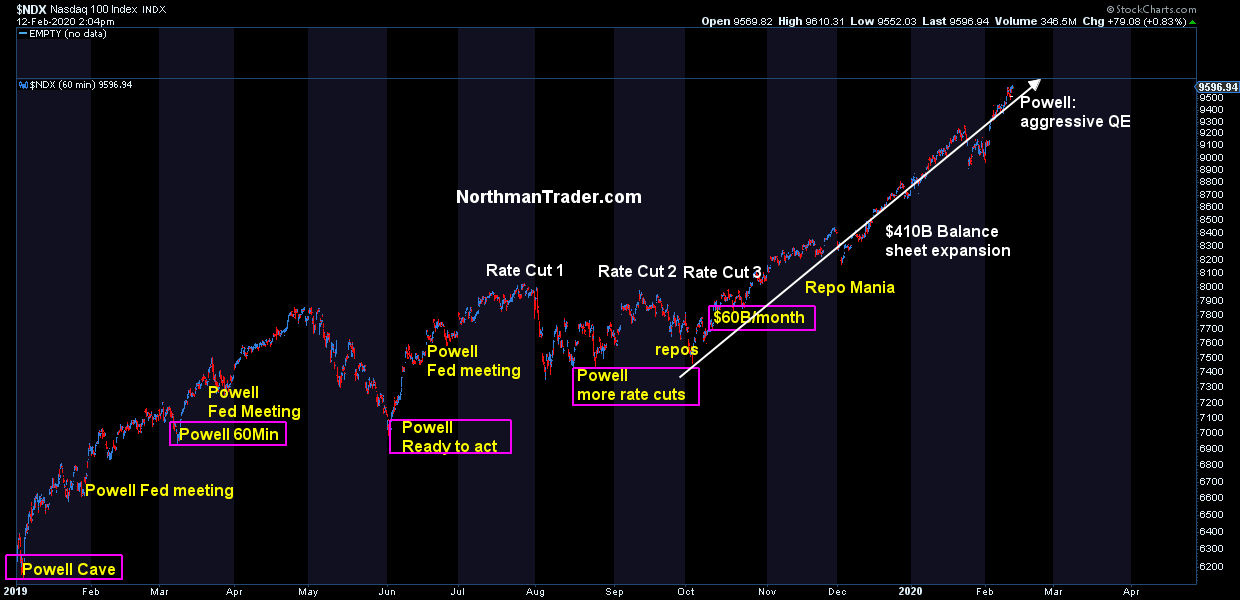

Or a Fed Chair whose renewed easy money policies have propelled stocks sky high using the opportunity to jawbone markets higher by promising even more easy money:

The times we live in. pic.twitter.com/L3Sgmf7Iwp

— Sven Henrich (@NorthmanTrader) February 12, 2020

Yes this is the moment in time JayPowell assured markets to save them if there’s any trouble ever:

“Federal Reserve Chairman Jerome Powell said Wednesday the central bank would fight the next economic downturn by buying large amounts of government debt to drive down long-term interest rates, a strategy that has been dubbed quantitative easing, or QE.

In testimony before the Senate Banking Committee, Powell said the Fed had two recession-fighting tools; buying government bonds, known as QE, and communicating clearly with markets about interest-rate policy, routinely considered as “forward guidance.”

“We will use those tools — I believe we will use them aggressively should the need arise to do so,” Powell said.”

QE and jawboning. Swell. What exactly have they been doing this past year?

While ECB president Lagarde admitted yesterday that loose monetary policies are stoking asset prices higher, the very assets owned by the top 1%, Powell goes on to say how great it all is:

Powell: “it’s been a particularly good time to be at the top of the income spectrum”.

*the parties are awesome pic.twitter.com/eCfwdvIMRa

— Sven Henrich (@NorthmanTrader) February 12, 2020

Chumming it up at the Jeff Bezos party the other week he ought to know what a good time it is to be at the top of the income spectrum. After all he is there himself.

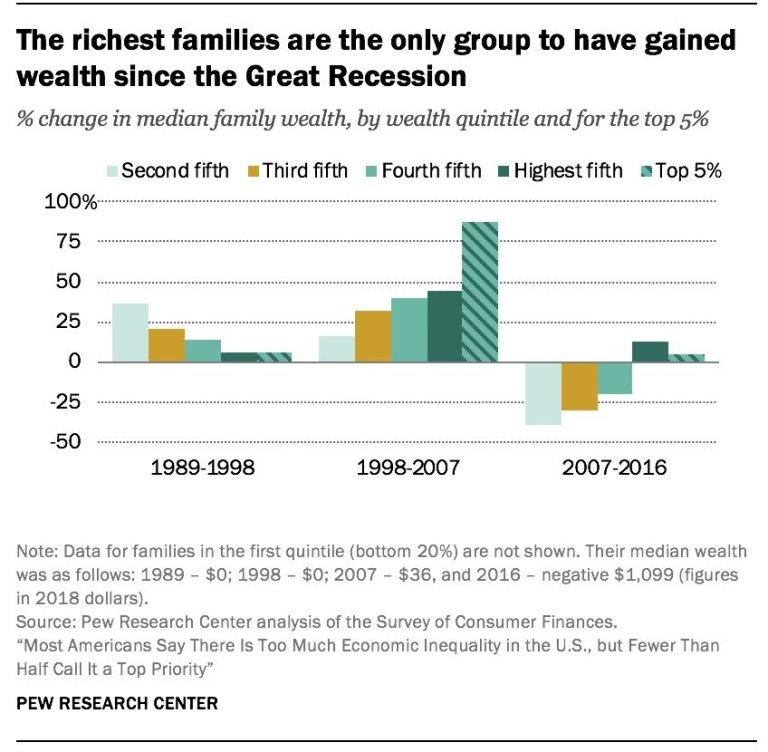

Problem is of course all these loose monetary policies have done exactly nothing for the the rest of the population since the financial crisis:

And so the solution is to do more at the first sign of trouble.

The audacity of the claim is of course pretending that this is not exactly what they have been doing ever since markets plummeted 20% in Q4 of 2018. Jawbone and QE and repo. Powell, like his processors before him has shown to be beholden to markets, to appease them, to make sure they don’t get disappointed. Another easy money shill. At the first sign of market trouble he ran scared and flipped and flopped and now he will never make the mistake of policy tightening again. He is a perma dove now, he will always ease and use “forward guidance” (jawboning) to keep markets from dropping too far.

After all that’s exactly what he has been doing since 2019:

Central bankers still pretend to deny that repo has no impact on asset prices when participant behavior clearly has shown that this is exactly what’s happening.

There is an easy way to refute the claim of course, but the Fed won’t dare:

Stop repo completely for a week.

Just try it.

Start tomorrow.

Watch what happens. https://t.co/mzALQlvMPN— Sven Henrich (@NorthmanTrader) February 12, 2020

And so here we are in 2020, with the highest market valuations in history on many measures and all they’re talking about is more QE and jawboning.

11 years after the financial crisis there is no path to balance sheet normalization, there is no path for rate hikes, there is only the path of more intervention to disproportionally benefit the same people that have benefited for the past 11 years.

Permanent intervention. That’s their answer. That’s intellectual bankruptcy and exposes central bank policy to be an empty suit.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Wed, 02/12/2020 – 18:25

via ZeroHedge News https://ift.tt/2ULHiAd Tyler Durden