What Rebound? Eurozone Industrial Production Collapses In December

On Wednesday morning, all hope for a recovery in Europe was abandoned when industrial production numbers missed estimates in December.

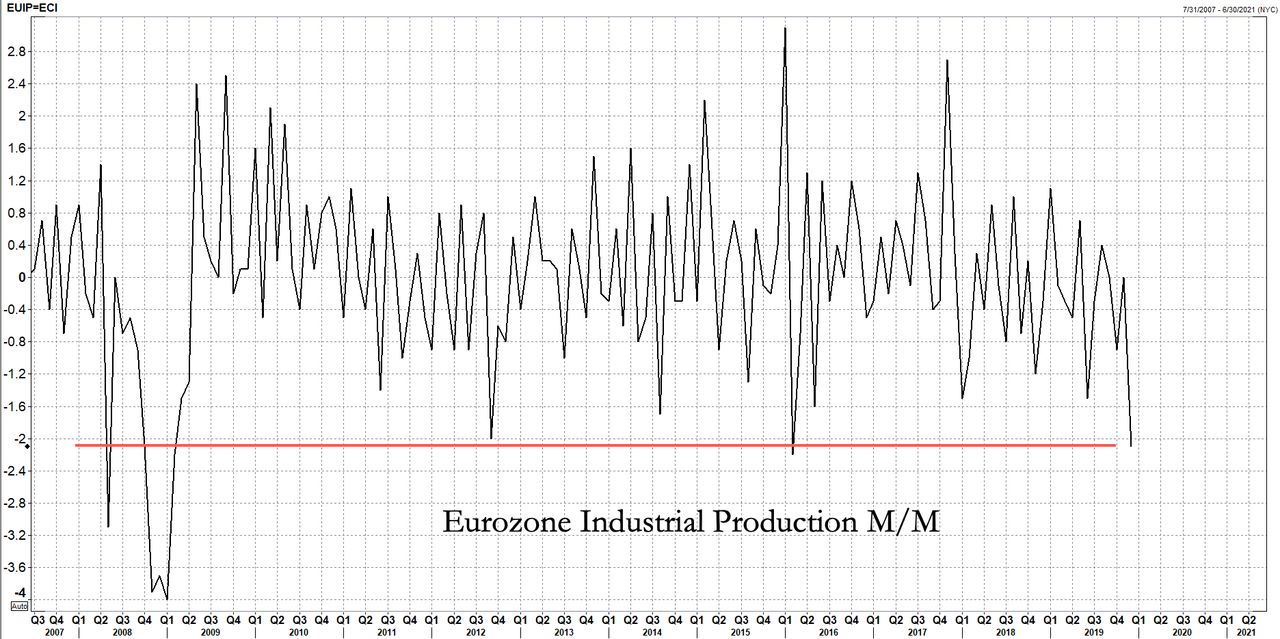

Industrial production fell -2.1% in December on an M/M basis, according to Eurostat, confirming our suspicions that Germany was “suck in a recession,” with limited signs of an economic rebound.

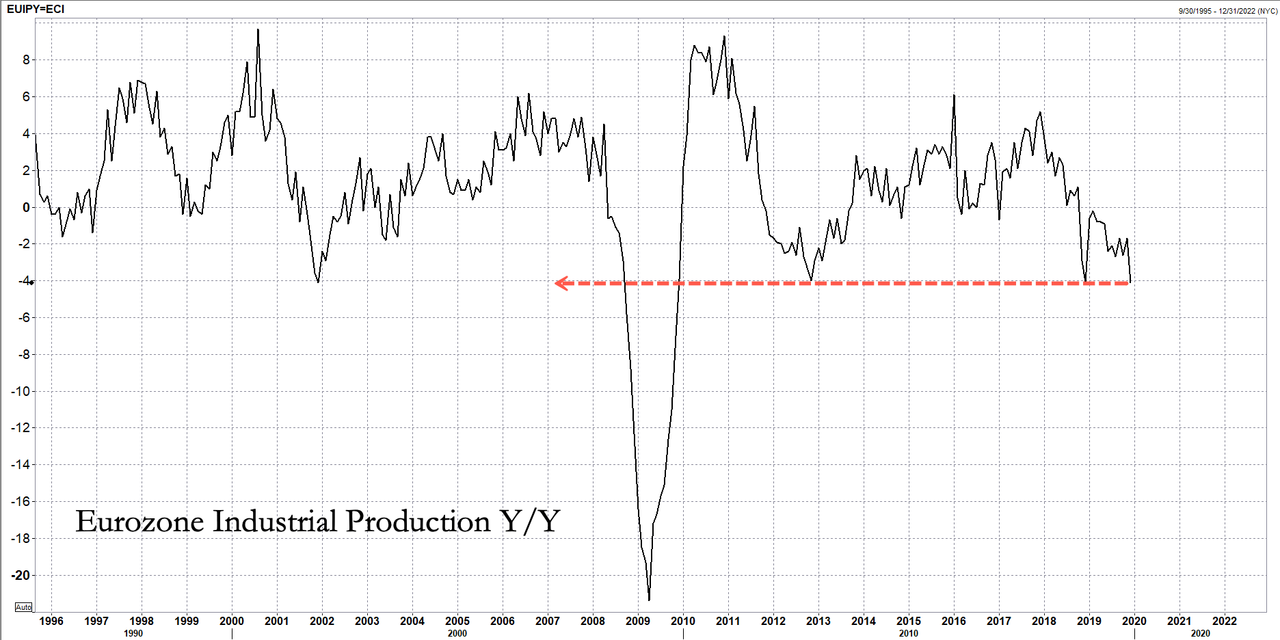

Eurozone industrial production plunged -4.1% in December on a Y/Y basis, now printing at its weakest level since 2012.

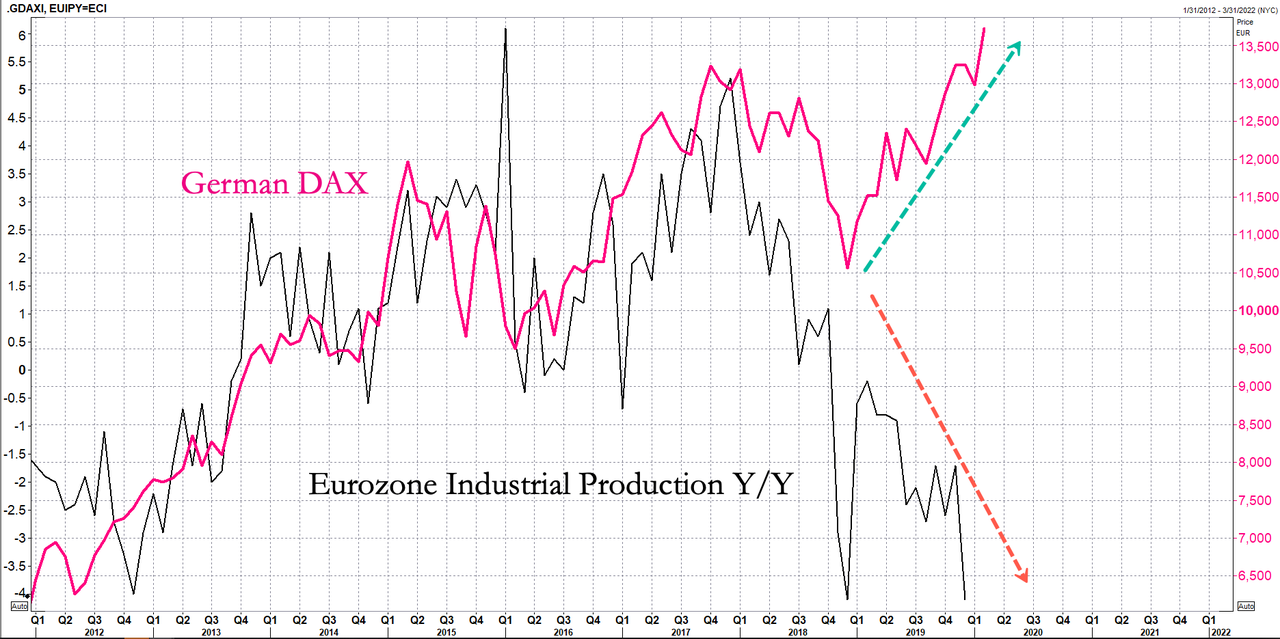

The disappointing news came as investors have been buying European equities hand over fist, essentially frontrunning an industrial recovery, that at this point, could be another example where central banks are forcing risk-taking at a time when many should be playing defensive names.

Though sentiment has improved in the region in the last several months because the European Central Bank (ECB) continues its unprecedented money printing to keep the stock market party alive.

However, no matter how much money the ECB throws at stocks and corporate bonds, industrial production remains in a severe slump, now two-years-old, with no rebound in sight.

Economists have spent the last several weeks revising down their forecasts for Eurozone economic growth in 1Q as the coronavirus shock in China could produce an even more significant downturn in Europe.

“European car manufacturers, in particular, are already warning of potential shortages of components due to factory shutdowns in China,” said Jessica Hinds, an economist at Capital Economics. “So even if the virus is soon brought under control, eurozone industry is likely to remain in recession in at least the early part of this year.”

The longer China’s economy remains offline, the larger the shock will be in Europe and elsewhere.

“The longer it takes for production to resume, the higher the risks,” said Jörg Krämer, chief economist at Commerzbank in Frankfurt.

Automobiles are Germany’s largest export. The industrial slump could produce a negative print for 4Q19 GDP.

The challenges of the imploding automobile industry in Germany have spread across the Continent. Suppliers in other countries were also affected by the industrial slowdown.

“For most countries, Germany is the most important trading partner,” said Carsten Brzeski, chief economist at ING Germany. “If it starts to slow down, other countries will feel it.”

One of the most significant threats to Europe’s economy is part shortages from China. This could effectively cause major production lines in Germany and across the Continent to shut down.

Also, Daimler sold 700,000 Mercedes-Benz cars in China last year, twice as many as it sold in the US. If two-thirds of China’s economy remains frozen, and more than 400 million people are in quarantine, this could severely damage car sales.

Europe’s industrial production downturn continued to accelerate in late 2019, but now, it could crash because of the virus shock seen in China.

What could possible go wrong for German stocks?

Tyler Durden

Wed, 02/12/2020 – 08:40

via ZeroHedge News https://ift.tt/39nqvHI Tyler Durden