World Stocks Storm To Record High As Traders “Believe All Will Be OK With The Coronavirus Situation”

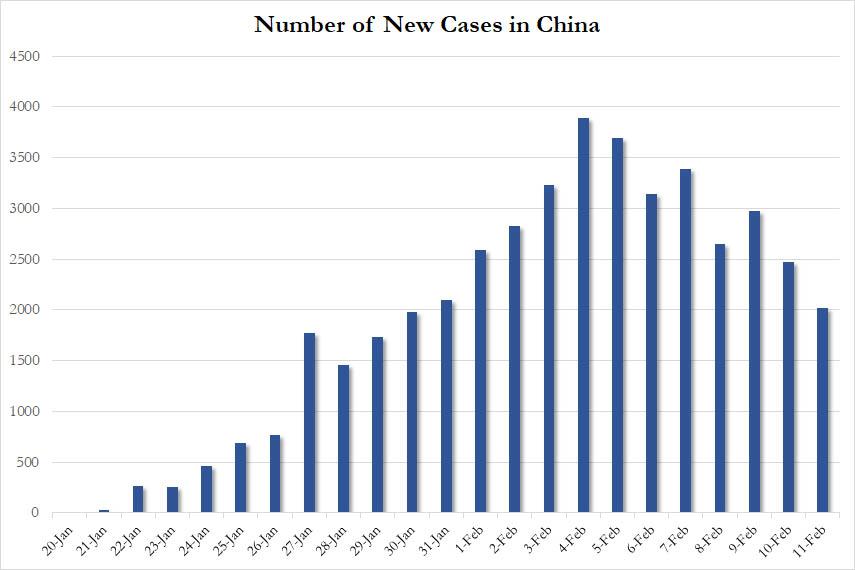

Another drop in the number of new coronavirus cases and Powell’s cheerful view of the economy (with the backstop of more easing should the coronavirus epidemic turn out worse than expected) boosted global stocks for a third day on Wednesday and sparked a 2% rally in oil prices, on hopes the epidemic’s effects would be contained.

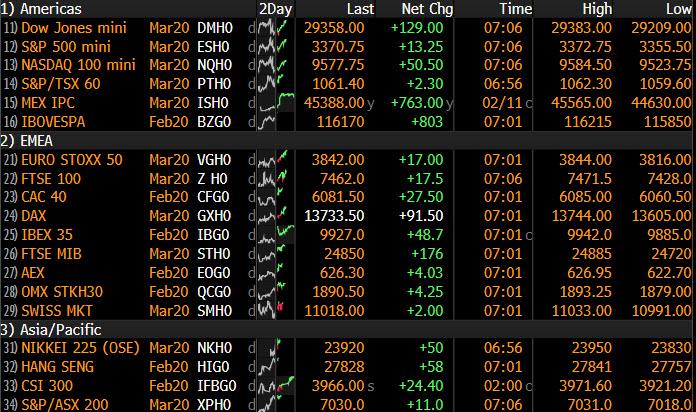

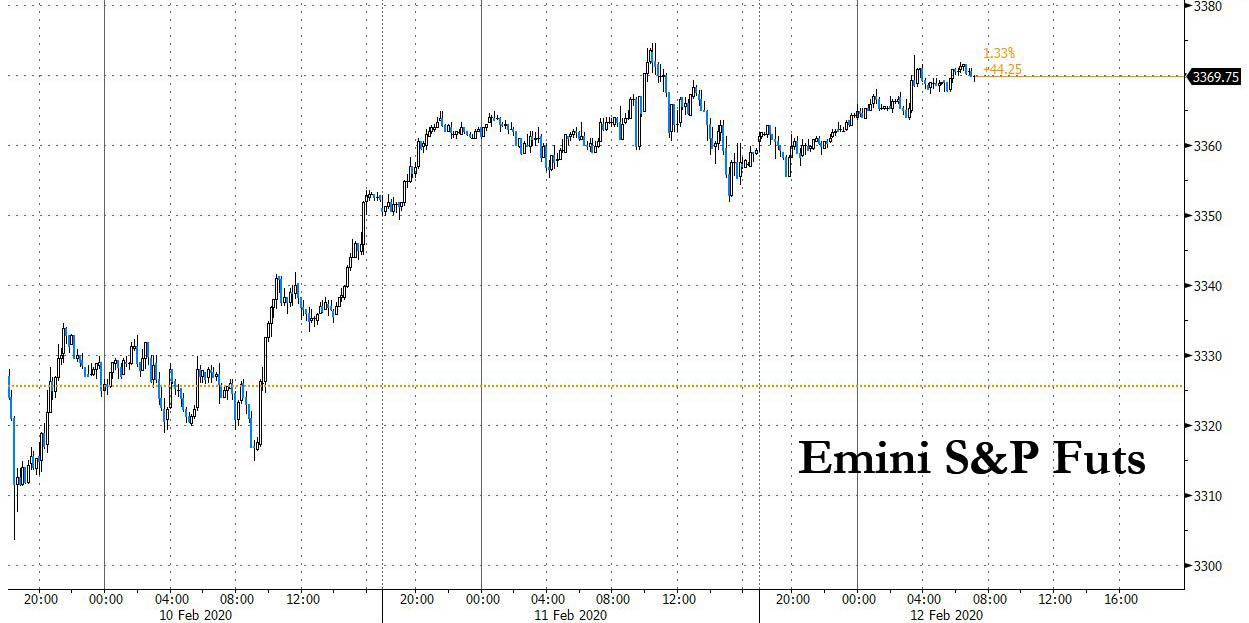

S&P futures indicated Wall Street would extend gains from Tuesday, when the S&P 500 and Nasdaq posted record closing highs, gaining overnight along with European stocks on Wednesday…

… after China reported its lowest number of new coronavirus cases since late January, lending weight to a prediction from its senior medical adviser that the outbreak might be over by April.

The drop encouraged investors to get back into equities at the expense of safe-haven assets such as bonds, gold and the Japanese yen which benefited as the virus death toll mounted. Riskier, higher-yielding bonds also rallied, with yields on 10-year Greek governments bonds slipping under 1% for the first time ever .

“If you look at the share indexes and other risky assets it seems like people now believe all will be okay with the coronavirus situation,” said Francois Savary, chief investment officer at Swiss wealth manager Prime Partners.

MSCI’s global equity index rose 0.2% to stand just off Tuesday’s record highs. The pan-European Stoxx 600 index rose to a record as automobile stocks — which depend on exports to China — jumped 1.2%. Carmakers and miners led the advance in Europe even as data showed a deep slump in euro-area industrial output at the end of last year.

Earlier in the session, Asian stocks gained, led by communications and technology stocks. The MSCI Asia Pacific Index advanced for a second day. Markets in the region were mixed, with Taiwan’s Taiex Index and Hong Kong’s Hang Seng Index rising and Indonesia’s Jakarta Stock Price Index falling. Chinese shares rose almost 1% and the offshore-traded yuan reached two-week highs after the death toll from the coronavirus reached 1,115. President Xi Jinping vowed that China would meet its economic goals while winning the battle against the deadly pandemic.

Despite the clear return of market euphoria, many analysts still caution against complacency over the economic fallout. Some Chinese firms have reported job cuts caused by damage to manufacturing supply chains. Savary at Prime Partners agreed, noting the dollar is near four-month highs, 10-year U.S. yields are some 30 basis points below early-January levels and demand for Swiss francs is high.

“Investors are not completely convinced the coronavirus is under control … they are trying to hedge their equity bets by taking exposure to safe-havens at the same time,” he said.

In short, we are back to the good news is good, bad news is better regime that defined much of the past decade.

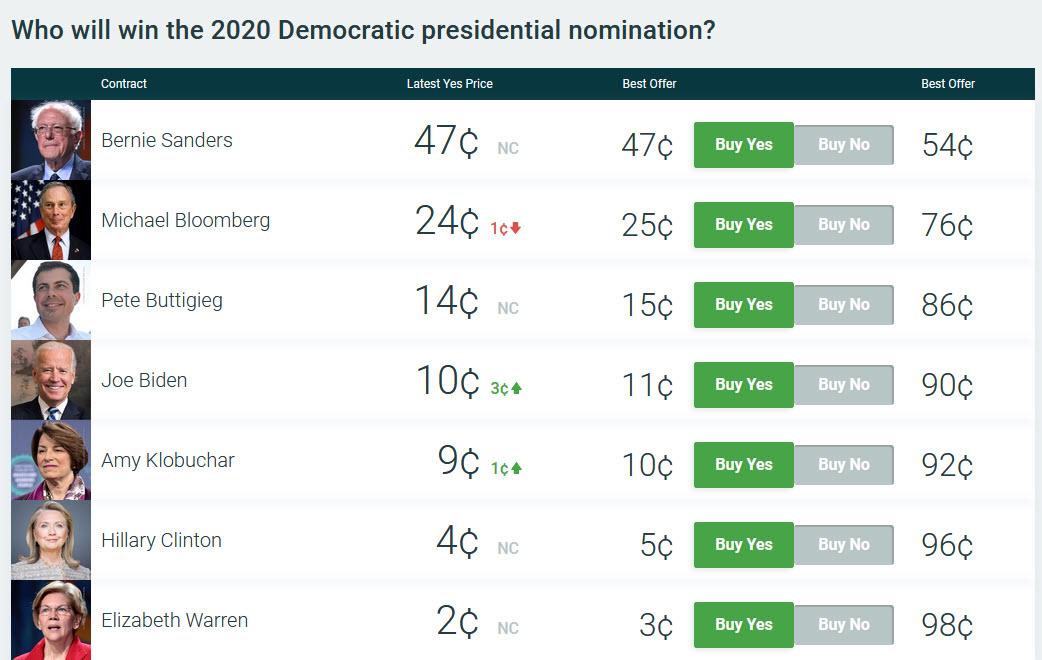

Markets also got a boost from signs President Donald Trump might be re-elected in November, since centrist candidates for the Democratic nomination appear to be struggling and Biden’s candidacy is now in tatters after his disastrous performance in New Hampshire where we didn’t win a single delegate.

“Trump had a great start into the U.S. election season. After the early end of the impeachment trial in the Senate and the Iowa caucus chaos for the Democrats, betting markets suggest that Trump has a 58% probability of winning re-election on 3 November,” Berenberg said.

Summarizing the New Hampshire primary results this morning, after 86% of the precincts reported, Sanders has been declared the winner with 25.8% of the vote, followed by Buttigieg in second with 24.4%, and then Klobuchar at 19.7%. Both Warren and Former Vice President Biden finished in a distant 4th and 5th at 9.3% and 8.4% respectively. In terms of the narrative and expectations, Klobuchar significantly outperformed her polls following a strong debate performance last Friday, with exit polls showing that roughly 50% of NH voters deciding in the last 3 days. Buttigieg also seems to have outperformed in a second straight state. Klobuchar’s outperformance may have come at the other Moderate’s expense – keeping Buttigieg from beating Sanders overall and keeping Biden under the 15% threshold to win proportional delegates. The Moderate wing of the primary continues to outperform the Left wing – Biden/Buttigieg/Klobuchar with 52.5 % and Sanders/Warren with 35.1% respectively – but it is not clear whether voters will jump between those groups. Biden left NH early in the day to start campaigning in South Carolina, indicating that the disappointing results in the first two states will not stop his primary campaign. It seems that we will not have the traditional winnowing seen after Iowa and New Hampshire, with all five major candidates moving on to Nevada and South Carolina. The field will likely only finally clear once over a third of delegates are awarded after Super Tuesday, but even then Former New York City Mayor Mike Bloomberg has already been campaigning in those delegate-rich states.

In geopolitics, the US Army is planning to set up a new military command post to cooperate with European allies in countering potential threats from Russia. The US said it was prepared to sign a deal with the Taliban that would see the withdrawal of US troops and the start of peace talks between the insurgents and the Afghan government, although a deal would only proceed if the Taliban adhere to a pledge to reduce violence over a 7-day period. Elsewhere, Turkish President Erdogan will do whatever is necessary; includes air and ground means – Erdogan accuses Russian forces of a massacre in Idlib – Erdogan and Russian President Putin discussed the situation via a phone call. Erdogan adds that Turkey will hopefully see inflation below 8.5% year-end target, trend of falling interest rates will continue.

In rates, yields on Treasuries and German Bunds rose around 2 basis points, the former rising to 1.62%; ten-year U.S. yields are now 12 bps off the four-and-a-half-month lows reached in late January. Yields rose on Tuesday after Fed Chair Jerome Powell said the U.S. economy was “resilient”. Powell also said he was monitoring the coronavirus, because it could lead to disruptions that affect the global economy.

In FX, the dollar was steady while currencies such as the Thai baht and Korean won, reliant on Chinese tourism and trade, gained 0.3% to 0.5%, as the yen slipped 0.3% to a three-week low against the dollar. The day’s big currency mover was the New Zealand dollar, which rose more than 1% against the greenback after the Reserve Bank of New Zealand kept rates unchanged and indicated it would remain on hold barring an outsized impact from the coronavirus outbreak. Traders pared odds for an RBNZ rate cut by May to around 30% from almost 50% before the decision; the Aussie advanced with the kiwi. Sweden’s krona shrugged off a downward revision of the Riksbank’s inflation forecast as the central bank kept its rate path intact, signaling a repo rate at zero in the coming years. The pound rose and gilts slid as money markets trimmed bets on BOE easing.

In commodities, oil rallied back above $50 a barrel as investors waited to see whether Russia would accept an OPEC+ plan for production cuts to cope with demand destruction from the coronavirus.

Looking at the day ahead, we’ll hear from Fed Chair Powell once again as he appears before the Senate Banking Committee, while there’ll also be remarks from Philadelphia Fed President Harker and the ECB’s Chief Economist Lane. Data releases to look out for include the MBA’s weekly mortgage applications and the monthly budget statement for January.

Market Snapshot

- S&P 500 futures up 0.3% to 3,367.50

- STOXX Europe 600 up 0.3% to 429.84

- MXAP up 0.5% to 170.72

- MXAPJ up 0.8% to 555.01

- Nikkei up 0.7% to 23,861.21

- Topix down 0.04% to 1,718.92

- Hang Seng Index up 0.9% to 27,823.66

- Shanghai Composite up 0.9% to 2,926.90

- Sensex up 0.9% to 41,584.82

- Australia S&P/ASX 200 up 0.5% to 7,088.20

- Kospi up 0.7% to 2,238.38

- German 10Y yield rose 2.0 bps to -0.371%

- Euro down 0.03% to $1.0913

- Italian 10Y yield rose 1.6 bps to 0.802%

- Spanish 10Y yield rose 4.8 bps to 0.316%

- Brent futures up 1.8% to $55.00/bbl

- Gold spot little changed at $1,566.82

- U.S. Dollar Index little changed at 98.73

Top Overnight News from Bloomberg

- The coronavirus outbreak in China could become a negative shock to global economic growth in the short term, ECB Governing Council member Gabriel Makhlouf says

- A deep slump in euro-area industrial output at the end of last year highlights the scale of the challenge the sector will face in 2020. The 2.1% drop — the steepest in almost four years — will raise doubts about a meaningful rebound in momentum

- Some of the world’s major bond funds are rekindling their love for Chinese government debt, as an unexpected rally in recent weeks took the 10-year yield to the lowest level since late 2016

- President Recep Tayyip Erdogan vowed to strike Syria should there be any new aggression against Turkish soldiers deployed across the border, escalating threats against Damascus after winning rare support from the U.S.

- Fidelity International is increasing long positions in U.S. and Australian sovereign bonds while reducing exposure to credit in some sectors amid the widening fallout from the coronavirus

- The promise of yields when many bonds pay holders close to nothing is driving a boom in sales of hybrid securities which combine elements of both debt and equities. 3.7 billion euros worth of hybrid bonds have been issued since the start of the year in Europe. This marks the fastest pace of issuance since at least 2014, based on data compiled by Bloomberg

- New Zealand’s central bank left interest rates unchanged and signaled it won’t need to cut them further unless the coronavirus outbreak has a bigger-than-expected impact on economic growth

- Bernie Sanders won the New Hampshire primary Tuesday. With 84% of the precincts reporting, Sanders had 25.9% of the vote and Buttigieg had 24.4%. Klobuchar was third with 19.7%, according to the Associated Press, which called the race. Elizabeth Warren finished fourth with 9.4%, while longtime front runner Joe Biden had 8.4%

- President Xi Jinping vowed China would meet its economic goals while winning the battle against the deadly coronavirus that has claimed 1,115 lives. Japan found 39 new cases of the coronavirus aboard a cruise ship, bringing the total number of cases from the vessel to 174

- Preliminary genetic sequence data indicating the presence of a SARS-like virus in central China was known about two weeks before key information was publicly released, scientists said

- All four U.S. government prosecutors who backed a long prison stay for Trump ally Roger Stone resigned from the case, a stunning rebuke to the Justice Department after it cut his recommended sentence by more than half

- Oil edged back above $50 a barrel as investors waited to see whether Russia would accept an OPEC+ plan for production cuts to cope with demand destruction from the coronavirus.

Asian equity markets were mostly higher but with gains initially limited as coronavirus fears lingered and following the lack of conviction on Wall St. where US stocks notched fresh record highs at the open before gradually fading the moves throughout the day. ASX 200 (+0.5%) traded positively with the biggest movers driven by earnings releases including the largest of the Big 4 banks CBA, resulting in outperformance in the top-weighted financials sector, while Nikkei 225 (+0.7%) was also lifted as it played catch up on return from holiday and with SoftBank sitting on double-digit percentage gains following the federal court approval of the merger between its unit Sprint with T-Mobile. Elsewhere, Hang Seng (+0.9%) and Shanghai Comp. (+0.9%) were kept afloat but with the mainland initially indecisive after the PBoC refrained from liquidity operations for a neutral daily position and as participants contemplated over the ongoing outbreak in which the number of cases and death toll continued to mount albeit at a slower pace with the additional number of cases at 2015 which is the lowest since January 30th. Finally, 10yr JGBs were lower amid the gains in Japanese stocks and following the mixed results at the 10yr inflation-indexed auction, while pressure was also seen in New Zealand bonds in the aftermath of the less dovish statement from the RBNZ.

Top Asian News

- Top Indian Iron Ore Miner Targets 50% Output Jump Next Year

- China Life Group Said to Seek Hong Kong Listing Via Unit

- Erdogan Escalates Threats Against Assad Loyalists in Idlib

- Rewards Outweigh Risks for Assad in Drive to Retake Idlib

European equities are mostly higher [Eurostoxx 50 +0.6%] following on from a similar APAC session, which saw Japanese markets return from yesterday’s holiday and close with firm gains. Bourses are largely in the green with the exception of the SMI (-0.2%), led lower by heavyweights Roche (-0.7%), Nestle (-0.6%) and Novartis (-0.3%) – which together account for ~55% of SMI – as sectors reflect risk appetite (healthcare, consumer staples lag and utilities lag). In terms of individual movers – dismal earnings see ABN AMRO (-7.0%) at the foot of the pan-European index after net income and dividend printed sub-par, with interest income falling and impairments rising. On the flip side, Heineken (+6.2%) stands as a top Stoxx 600 gainer following their earnings in which net profit and consolidated beer volume topped estimates, leading to the best performance in over a decade. Kering (+2.2%) shares also benefit from their numbers after metrics beat estimates across the board including the much-watched Gucci Q4 comparable sales growth. Kering also noted that the uncertainties in China do not call into question the Co’s fundamentals in the luxury industry. Thus, European luxury stocks receive tailwinds: Swatch (+1.5%), Richemont (+1%) and LVMH (+0.6%) all trade higher in tandem.

Top European News

- ECB’s Makhlouf Sees Risk of Negative Growth Shock on Coronavirus

- Euro-Area Industrial Output Slumps Most in Almost Four Years

- U.K. to Regulate Internet in Crackdown on Social Media Firms

- Google Claims EU Crackdown Is a Threat to Internet Innovation

- Riksbank Clings On to Zero Despite Cutting Inflation Outlook

In FX, the Kiwi is flying and leaving G10 rivals far behind on the back of another shift from the RBNZ towards ending its easing cycle. Nzd/Usd has rebounded sharply following February’s policy guidance tweaks and updated OCR projections that signal no change for the foreseeable future compared to 10 bp easing previously. In fact, the rate path is now pointing to a 1.10% benchmark price by mid-2021 vs 0.9% out to March next year last time, and the only caveat appears to be severe economic contagion from China’s virus. Nzd/Usd is now eyeing resistance ahead of 0.6500 from sub-0.6400 lows and the Aud/Nzd cross has snapped back towards 1.0400 following transitory forays just above 1.0500 of late. However, the Aussie is also outpacing its US peer that is largely consolidating after failing to extend its winning run when the DXY hit a brick wall inches before 99.000, as Aud/Usd probes firmer ground on the 0.6700 handle with some independent impetus from improved Westpac consumer confidence overnight.

- GBP/CHF/CAD/EUR – All benefiting from the aforementioned flagging Greenback, albeit to varying degrees, with Cable also capitalising on Tuesday’s UK GDP data rather than any dovish BoE nuances and extending recovery gains beyond 1.2980 towards 1.3000 and the 10 DMA that falls just shy of the big figure (1.2997). Meanwhile, Eur/Gbp is hovering a few pips above 0.8400 as the single currency remains leggy around 1.0900 against the Buck after yet another Eurozone data miss via pan IP and Eur/Usd runs into headwinds at 1.0925. Note also, heavy option expiry interest between the round number and 1.0910 in 1.6 bn may be capping the headline pair ahead of the NY cut. Elsewhere, the Franc is still straddling 0.9750, but trending bullishly vs the Euro around a 1.0650 axis that prefaces multi-year peaks or troughs for the cross, while the Loonie is gleaning more underlying support from oil’s revival to hold above 1.3300 against its NA neighbour.

- SCANDI – In contrast to the RBNZ, nothing new at all emanated from the Riksbank’s latest policy meeting as the repo trajectory matched December’s (flat) profile and accompanying statement underlined the likelihood that zero percent will prevail until the end of the forecast horizon. Nevertheless, Eur/Sek has drifted down towards 10.5000 as none of the regular Board dissenters entered reservations and Governor Ingves reiterated the on hold message in the ensuing press conference. However, Eur/Nok has fallen further on the crude price rebound noted above to test bids/support in front of 10.0500.

- EM – Ongoing recovery gains across the region and the Rand only partially hampered by another SA data miss (retail sales), but no respite for the Lira as Turkish President Erdogan ramps up his verbal threats to repel attacks by Syrian Government sources to prevent the Try maintaining an attempt to regain 6.0000+ status.

In commodities, WTI and Brent front-month futures continue their upward trajectories with the contracts piggy-backing the broad risk appetite across the market, amid the slowing rate of COVID-19 cases/deaths coupled with reports of positive therapies and resumptions in Chinese operations. WTI Mar’20 futures reside north of USD 50.50/bbl with prices eyeing USD 51.00/bbl ahead of potential resistance at the USD 51.50/bbl mark, which coincides with the 7th Feb high. Brent Apr’20 futures came across mild resistance in early EU trade at USD 55.38/bbl (7th Feb high) ahead of further potential resistance around USD 55.55/bbl (6th Feb high). On the OPEC front, a definite OPEC+ meeting date remains in question, with desks noting that the longer we wait, the more likely that the meeting will take place in March as opposed to late-February. Russian Energy Minister Novak will today be meeting with domestic oil companies to discuss Moscow’s stance on deeper/prolonged output reductions. Elsewhere, yesterday’s APIs, which showed a larger-than-forecast build (+6mln vs. Exp. +3mln), did little to provide sustained pressure in prices as sentiment underpins the benchmarks – participants will be on the lookout to see if the weekly DoE numbers align with those of the API. Yesterday also saw the release of the EIA STEO ahead of today’s OPEC monthly oil report. The STEO cut 2020 oil demand growth by 310k BPD, downgraded US crude output forecasts and noted the uncertainty surrounding the virus outbreak, again little sustained reaction. Next up, OPEC’s monthly report will garner interest as this is the report that will encapsulate coronavirus forecasts as well as OPEC output since the December meeting. In terms of metals, spot gold trades lacklustre on either side of the 21 DMA (USD ~1566/oz), in-fitting with the current risk appetite. Copper prices remain supported by the risk tone but within yesterday’s ranges awaiting the next catalyst. Finally, Dalian iron ore futures hit three-week highs as coronavirus cases/deaths slowed and following a 22.4% YY drop in Vale’s Q4 iron ore production.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 5.0%

- 2pm: Monthly Budget Statement, est. $10.0b deficit, prior $8.68b

DB’s Jim Reid concludes the overnight wrap

We’re jumping straight to the New Hampshire primary results this morning where, after 86% of the precincts reported, Sanders has been declared the winner with 25.8% of the vote, followed by Buttigieg in second with 24.4%, and then Klobuchar at 19.7%. Both Warren and Former Vice President Biden finished in a distant 4th and 5th at 9.3% and 8.4% respectively. In terms of the narrative and expectations, Klobuchar significantly outperformed her polls following a strong debate performance last Friday, with exit polls showing that roughly 50% of NH voters deciding in the last 3 days. Buttigieg also seems to have outperformed in a second straight state. Klobuchar’s outperformance may have come at the other Moderate’s expense – keeping Buttigieg from beating Sanders overall and keeping Biden under the 15% threshold to win proportional delegates. The Moderate wing of the primary continues to outperform the Left wing – Biden/Buttigieg/Klobuchar with 52.5 % and Sanders/Warren with 35.1% respectively – but it is not clear whether voters will jump between those groups. Biden left NH early in the day to start campaigning in South Carolina, indicating that the disappointing results in the first two states will not stop his primary campaign. It seems that we will not have the traditional winnowing seen after Iowa and New Hampshire, with all five major candidates moving on to Nevada and South Carolina. The field will likely only finally clear once over a third of delegates are awarded after Super Tuesday, but even then Former New York City Mayor Mike Bloomberg has already been campaigning in those delegate-rich states.

Prior to those results, the S&P 500 (+0.17%) and NASDAQ (+0.11%) posted another round of new record highs yesterday however it wasn’t without a bit of a pullback into the close. Indeed, the gloss was taken off after the Federal Trade Commission issued orders to Google, Apple, Facebook, Amazon and Microsoft to turn over a decade’s worth of information on past small acquisitions. That could provide insights into antitrust issues and the Commission noted could lead to enforcement action. Microsoft (-2.26%) and Facebook (-2.76%) were the biggest movers post the news.

Nevertheless, the moves yesterday still mean both indices have climbed on six out of the last seven sessions for cumulative gains of +4.07% and +5.33%% respectively. For the NASDAQ, the last time we had a better seven-day performance was October 2014. In credit US HY spreads were also 14bps tighter with the other micro story yesterday being the big rally across the Sprint complex following the announcement that T-Mobile had won court approval for its $26.5bn merger with the wireless company. For what it’s worth, Sprint is currently the second biggest issuer in the US HY index with around $20bn of bonds with the 2028 bonds as an example up around 18pts yesterday post the news.

As for bonds markets, they were comparatively less eventful with 10y Treasuries +3.1bps higher yesterday with a fairly muted reaction to the slew of Fedspeak – more on that shortly. The main measures of the yield curves were also little changed while in commodities it was a better day for oil with Brent and WTI pulling back from their one-year lows the previous day, up +1.39% and +0.75% (while being up a similar amount this morning and copper was up +1.27%.

A quick refresh of our screens shows that Asian markets are higher this morning too with the Nikkei (+0.54%), Hang Seng (+0.86%), Shanghai Comp (+0.39%) and Kospi (+0.61%) all advancing. In FX the big mover has been the New Zealand dollar which is up +0.84% after the RBNZ left rates on hold and forecasts showed no further rate cuts in this year. As for the latest on the coronavirus, the death toll in China now stands at 1,113 with confirmed cases at 44,653. Japan also found 39 new cases of the virus on the quarantined cruise ship bringing the total tally on-board to 174. Meanwhile, in an encouraging sign that the virus outbreak might be plateauing in China – Hubei province reported 1,638 additional cases overnight, the lowest daily level this month.

To be fair, there wasn’t a huge amount of news to report yesterday away from the New Hampshire results with central bankers providing most of the material. Fed Chair Powell was the main highlight as he testified before the House Financial Services Committee. In his opening statement, he referenced the coronavirus, saying that “we are closely monitoring the emergence of the coronavirus, which could lead to disruptions in China that spill over to the rest of the global economy.” However, in response to questions, he said that it was too early to say about the effects on the US. In his opening statement, Powell also said that “Putting the federal budget on a sustainable path when the economy is strong would help ensure that policymakers have the space to use fiscal policy to assist in stabilizing the economy during a downturn. A more sustainable federal budget could also support the economy’s growth over the long term.” You can read our piece last week (link here) on the latest huge increase in long-term debt projections from the CBO.

A number of Powell’s colleagues also spoke yesterday. Quarles supported the Fed’s continued purchasing of Treasury bills, while reiterating that it was important for the central bank’s balance sheet to shrink following a recession. Bullard addressed concerns with Coronavirus, saying that “previous viral outbreaks suggests that the effects on U.S. interest rates can be tangible and last until the outbreak is clearly contained. He explicitly pointed to the effects on the 10-year Treasury yield of other viral outbreaks, such as SARS, swine flu, avian flu, and Ebola. Bullard has been amongst the most dovish committee members – he was ahead of the curve last year in pushing for a shift to cutting rates – so it is notable that he is not pushing for a cut yet due to the virus. Kashkari also spoke later in the day on the need to possibly adjust monetary policy if the virus hits the country in scale, though he expressed uncertainty in its ability to contain it.

On the other side of the Atlantic, ECB President Lagarde was speaking before the European Parliament yesterday, where she said that “monetary policy cannot, and should not, be the only game in town. The longer our accommodative measures remain in place, the greater the risk that side effects will become more pronounced.” She also called for “a more complete EMU”, with banking union, capital markets union and a central stabilisation function to defend against shocks.

Away from all that and in terms of the data, the number of job openings in the US fell to a 2-year low of 6.423m in December (vs. 6.925m expected), which marked the first annual decline in the number of job openings since 2009. That said, the quits rate remained at 2.3% for the 4th consecutive month, while hirings rose for a second month running to 5.907m. Separately, data from the UK out yesterday showed GDP in Q4 was unchanged from the previous quarter, in line with expectations, while the monthly reading for December showed the economy grew by +0.3% (vs. +0.2% expected).

Staying on the UK, Brussels fired a warning shot ahead of the upcoming trade negotiations yesterday, with European Commission President Ursula von der Leyen saying that the “unique ambition in terms of access to the Single Market”, with a zero tariffs and zero quotas for trade in goods, would “require corresponding guarantees on fair competition and the protection of social, environmental and consumer standards.” So, the EU are sticking to the line that the level playing field is required for a trading relationship like this, even though Prime Minister Johnson explicitly said last week that there was “no need for a free trade agreement to involve accepting EU rules on competition policy, subsidies, social protection, the environment, or anything similar”. There was also some news on financial services, with chief negotiator Michal Barnier saying that “Certain people in the UK should not kid themselves about this: there will not be general, ongoing open-ended equivalence in financial services”.

To the day ahead, where we’ll hear from Fed Chair Powell once again as he appears before the Senate Banking Committee, while there’ll also be remarks from Philadelphia Fed President Harker and the ECB’s Chief Economist Lane. Data releases to look out for include the Euro Area’s industrial production for December, and from the US there’s the MBA’s weekly mortgage applications and the monthly budget statement for January. Finally, the Riksbank will be announcing their latest interest rate decision.

Tyler Durden

Wed, 02/12/2020 – 07:49

via ZeroHedge News https://ift.tt/2SlKrFt Tyler Durden