7 Charts To Love On Valentine’s Day

Authored by Bilal Hafeez via MacroHive.com,

It’s easy to paint gloomy pictures of the world whether looking at market valuations, climate change or health scares. However, not all is lost, there are some things to appreciate. So I thought given it is Valentine’s Day, I’d find seven charts to love:

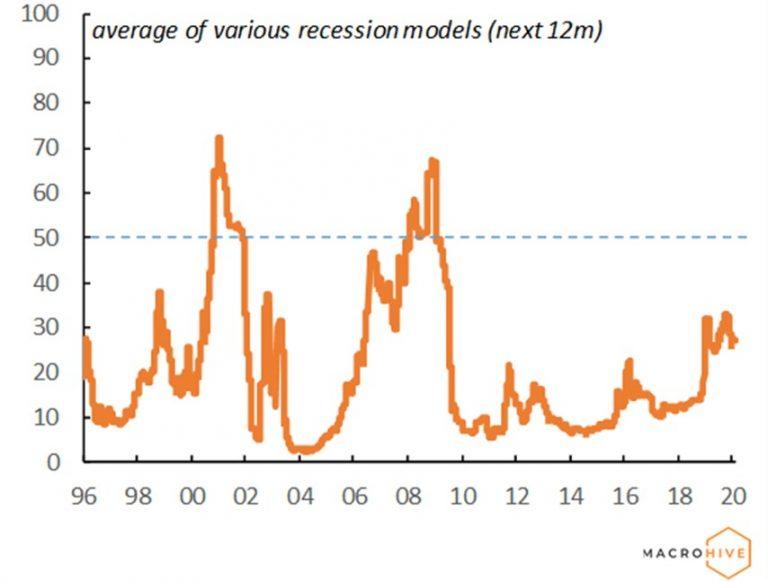

(1) Odds of US Recession This Year Are Low

When the US yield curve inverted last year, there was a panic amongst investors about an imminent US recession. And while recession odds did rise, they haven’t further increased since then (Chart 1). Most models have the odds at around 25%-30%, and if anything they seem to be edging lower. Moreover, they remain comfortably below the 50% threshold seen before the last few recessions.

Chart 1: US Recession Probabilities Starting to Subside

Source: Macro Hive, Bloomberg

(2) US Equities May Not Be At Valuation Extremes

Many are concerned about US equity valuations. Even with contracting earnings last year, they continued to rally. In the past, we have used the “Warren Buffet valuation” indicator, which compares US stocks to US GDP, as a signal of how expensive US stocks are. However, given that many US companies, especially the larger tech ones, are global in nature, it would perhaps make more sense to compare US stocks to world GDP. When we do that, valuations no longer look as extreme as they did in the early 2000s or indeed in the 1960s (Chart 2).

Chart 2: Modified Warren Buffet Valuation Indicator: S&P 500 to World GDP

Source: Macro Hive, IMF, OECD, Bloomberg

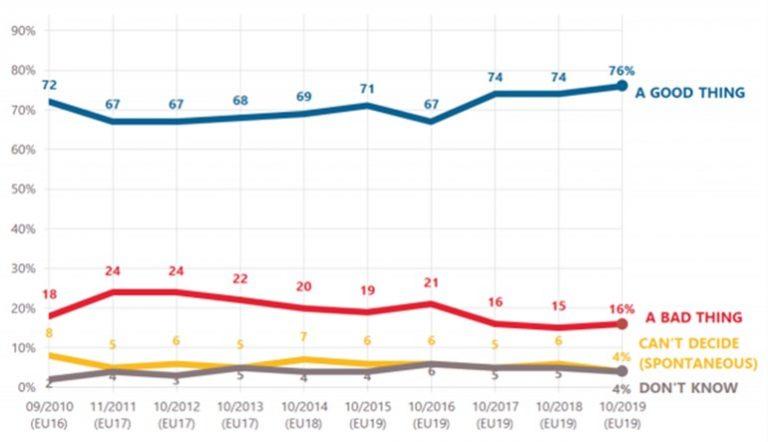

(3) Many Euro Haters, But Not in Europe

It’s easy to criticise the EU and especially the euro. How can a single currency survive without a single fiscal policy. Yet for all of its faults, the most recent surveys of Europeans find that they have record support for the currency (Chart 3).

Chart 3: Having the Euro is a Good or Bad Thing for the EU (% – EURO AREA)

Source: European Commission

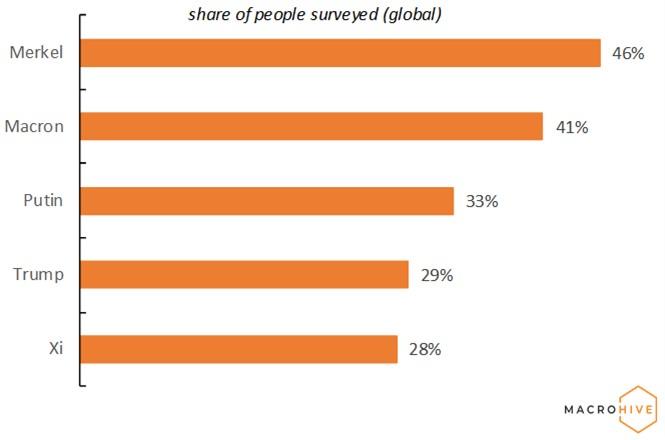

(4) Everyone Loves Merkel

Another positive about Europe is that the world seems to like its leaders. A recent survey of people around the world found that Germany’s Merkel and France’s Macron were viewed as the most trusted leaders to do the right thing for the world. Unfortunately, President Trump did not fare so well, with Putin beating him to third place (Chart 4).

Chart 4: Confidence in World Leaders to do the Right Thing

Source: Macro Hive, Pew

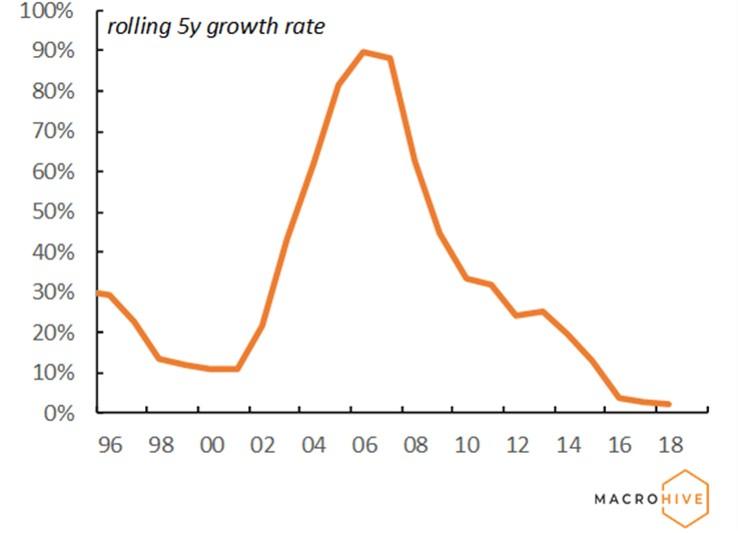

(5) China has Dramatically Slowed its CO2 Emissions

The rise of China has come with a rise in its polluting potential. However, there is some good news, after a surge in CO2 emissions in the 2000s, the growth in emissions has slowed sharply in recent years. Hopefully, the growth rate will soon turn negative.

Chart 5: China’s Growth in CO2 Emissions is Slowing

Source: Macro Hive, BP

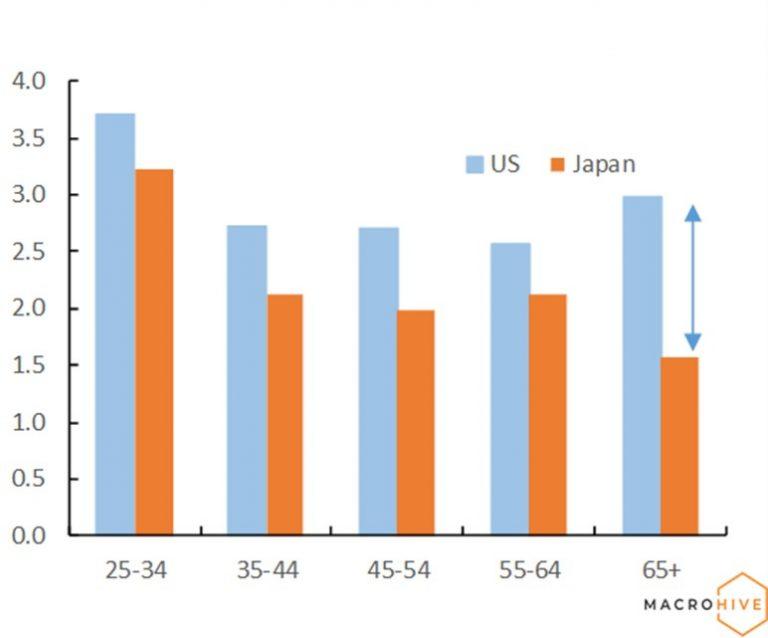

(6) Japan’s Elderly Like to Work

A country with a shrinking and ageing population needs all the help it can get to maintain its supply of workers. Thankfully, the elderly are stepping up. The unemployment rate amongst the 65+ demographic is the lowest amongst all age groups within Japan. And also it is noticeably lower than other countries like the US (Chart 6).

Chart 6: Japan’s Elderly Like to Work

Source: Macro Hive, Bloomberg

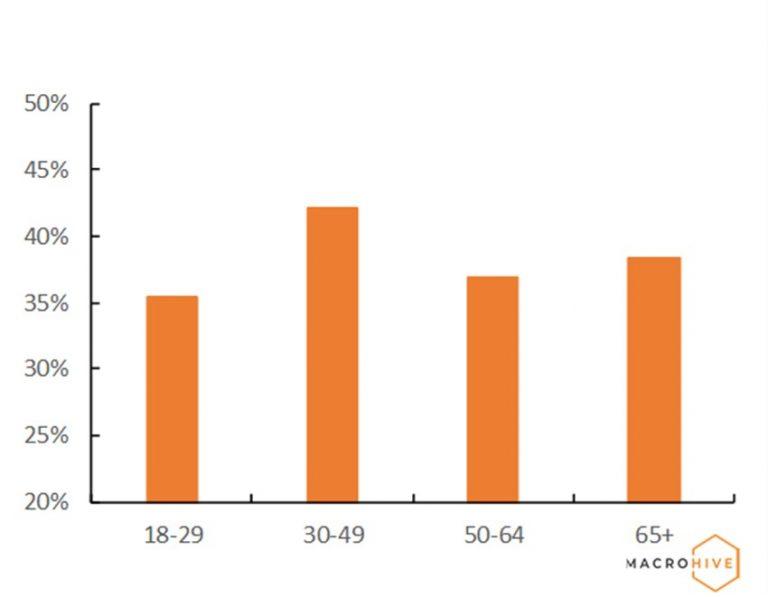

(7) Online Dating Leads to Marriage

I couldn’t resist on Valentine’s Day to sneak in something on relationships. Somewhat surprisingly recent surveys have found that a significant proportion of online daters do find love on platforms. It gives some hope for humanity that dating apps aren’t as bad as they may first appear.

Chart 7: Share of Online US Daters Who Find Long-term Partner or Marriage on Platform

Source: Macro Hive, Pew

* * *

Bilal Hafeez is the CEO and Editor of Macro Hive. He spent over twenty years doing research at big banks – JPMorgan, Deutsche Bank, and Nomura, where he had various “Global Head” roles and did FX, rates and cross-markets research.

Tyler Durden

Fri, 02/14/2020 – 21:05

via ZeroHedge News https://ift.tt/2US7IjR Tyler Durden