Buzzkill: Many Public Marijuana Companies Have Just Several Months Worth Of Cash Left

While the idea of marijuana companies has certainly been a hot topic in the public market space – especially since Tilray’s epic short squeeze in late 2018 – companies in the sector have been silently burning through their war chests of cash, leaving many just months away from being completely out of cash altogether.

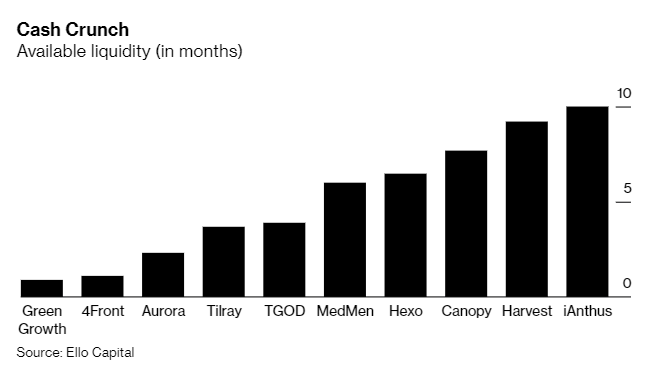

Large Canadian pot producers have a median of just 6.5 months of cash left, according to Bloomberg. This compares to 14.4 months for most U.S. multi-state operators. For operators in both countries, the clock is ticking for them to raise capital and likely cut costs.

Names like Aurora Cannabis are going to have to address the problem sooner, rather than later. The company has the worst cash position of Canadian producers with just 2.3 months of liquidity remaining. Tilray isn’t far behind, with just 3.7 months of liquidity.

Aurora announced this week that it was going to be cutting 500 jobs as part of a major cost cutting effort. It also announced that its CEO would be stepping down. Regardless of the changes internally, the reality of the situation is that the company is still going to be in dire need of cash soon.

Another option for cannabis companies that don’t want to go to the market and raise cash is to merge or find a partner in the future. Investors may be more likely to deploy capital to marijuana names under better circumstances than traditional equity raises or bond issues. And there has undoubtedly been an appetite for mergers and acquisitions in the space, with names like Altria taking a $1.8 billion stake in Cronos Group in 2019.

Hershel Gerson, chief executive officer of Ello Capital, said: “I think people are looking for quality management teams that can effectuate a turnaround and have experience operating in a tighter environment than some of these early C-level teams.”

“There’s a switch going on related to the management teams that is potentially going to benefit the industry going forward,” he concluded.

The clock is officially ticking and we’ll check back in several months to see just how beneficial these changes really are…

Tyler Durden

Sun, 02/16/2020 – 22:30

via ZeroHedge News https://ift.tt/37xaQ7m Tyler Durden