“It’s Winter-Time For Capital Flow” – Outbreak Sparks Collapse In Chinese Tech Venture Funding

Hundreds of startups in China failed in 2019 as macroeconomic headwinds flourished. But now, the Covid-19 outbreak in the country crippled the already deteriorating venture capital industry, as funding freezes last month, according to Bloomberg, citing a new report from London-based consultancy Preqin.

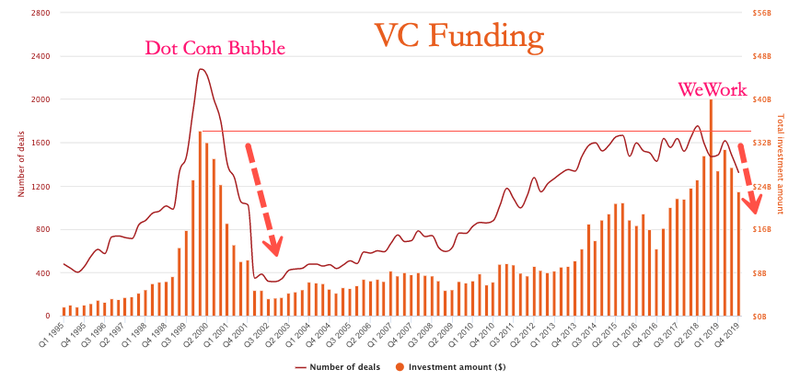

Tech companies in China faced a “capital winter” last year, where funding shortages increased as the global economy continued to decelerate. The implosion of WeWork in Sept 2019, as it attempted to IPO and subsequently ran out of cash, sent jitters through the global startup industry.

Startups in China, just like the ones in the U.S., had trouble last year supporting their lofty valuations, driven sky-high after global central banks printed an obscene amount of money, which allowed speculators to bet in greater size in these companies. With macroeconomic headwinds mounting, and the global IPO market faltering last year, it was a sign that investors were turning to the exits, out of trash unicorns, and into cash or defensive plays, such as value companies, or ones that had stable cash flows.

By the time 2020 turned the corner, the Covid-19 outbreak in China delivered a deadly blow to startups.

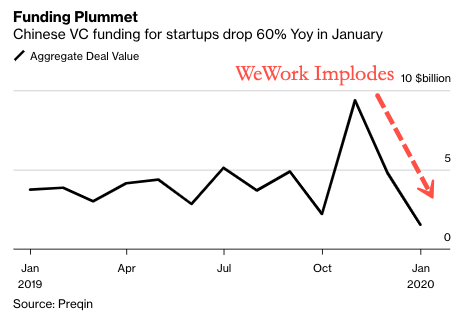

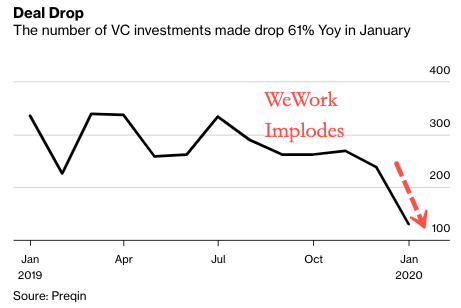

Preqin estimates that venture capital firms slashed investments in money-losing startups by 60% in January from a year ago. This means all the startups with negative cash flows and high burn rates, who are currently not operating at the moment because two-thirds of China’s economy is halted for virus containment purposes, could undergo a severe cash crunch in the near term.

Without proper funding, there could be a surge of companies that could start failing, driving up non-preforming loans for banks, and lead to the next big financial crisis.

Neil Shen, the founding partner of Sequoia Capital China, told Bloomberg that “we will fully stand by to provide help and support to the companies we backed in any way possible,” which he outlined some firms could undergo a cash crunch because the economy is shutdown.

Ee Fai Kam, head of Preqin Asian operations, said the setback in the venture capital industry is “coming on the back of a bruising 2019 when trade and tech tensions with the U.S. caused investors to exercise an abundance of caution.”

The bust of the global venture capital industry was likely accelerated by the blowup of WeWork last Sept.

Last fall, a month or so after WeWork’s IPO attempt ended in disaster, which resulted in a valuation collapse and was bailed out by its largest investor, SoftBank; top U.S. venture capitalists called an emergency meeting of startups in Oct to discuss the evolving and downshifting industry.

C.B. Insights and PWC noted last month that venture capital-backed companies in the U.S. raised $23 billion in 4Q19, down 42.5% over the prior year.

Wang Jun, chief financial officer for Chinese fresh produce delivery firm Missfresh, warned that early 2020 would be a challenging time for startups to obtain liquidity. Jun said, “It’s winter time for capital flow,” he added that “companies need to produce blood on their own to become cash-positive.”

To sum up, the venture capital industry across the world is headed for a possible bust cycle. An exogenous shock, like the trade war or a virus outbreak, is crippling startups from China to the U.S. The funding taps for these companies are shutting off; this is evident on both sides of the world as investors plow into defensive assets.

Tyler Durden

Sun, 02/16/2020 – 21:30

via ZeroHedge News https://ift.tt/2SxStuP Tyler Durden