Wall Street Sets Up Scapegoat For Next Market Crash: ‘Free Trades’ Enticing Retail To Panic-Buy Stocks

Bloomberg’s narrative this morning of why stocks have been racing higher isn’t because central banks are pushing global yields into negative territory thus providing lift for growth stocks, or the dozens of rate cuts in the last year, or the Federal Reserve’s ‘Not QE’ leading to an abundance of liquidity, or record stock buybacks, but as the mainstream financial press states: “Small investors are back. In a big way.”

So apparently broke American consumers with insurmountable debts, including auto loans, credit card debt, and student loans, along with virtually no savings, are responsible for the recent rip roar in Tesla, Virgin Galactic, and Apple.

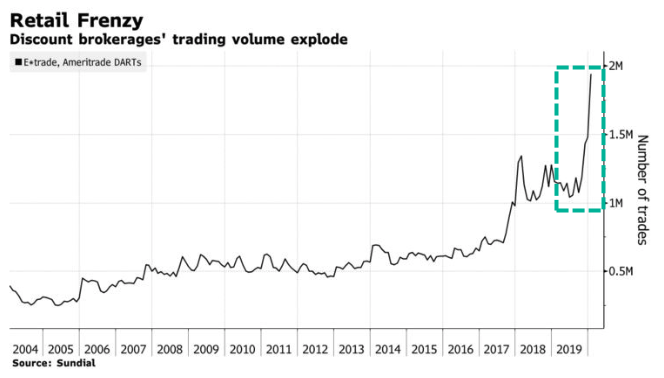

Sure… But let’s hear out what Bloomberg has to say. They mention since Ameritrade Holding Corp. offered free trading in October, trading volume from mom and pop brokerage accounts soared.

Ameritrade wasn’t the only one canceling trading fees, and this was seen industry-wide, an attempt by Wall Street to sucker in retail into a spectacular blow-off top that, as we explained above, has been produced by the Federal Reserve.

“When you take a bull market and juice it with zero commission trading, we can expect it to generate interest among retail accounts. That, it did,” said Jason Goepfert, president of Sundial. “Retail traders have become manic.”

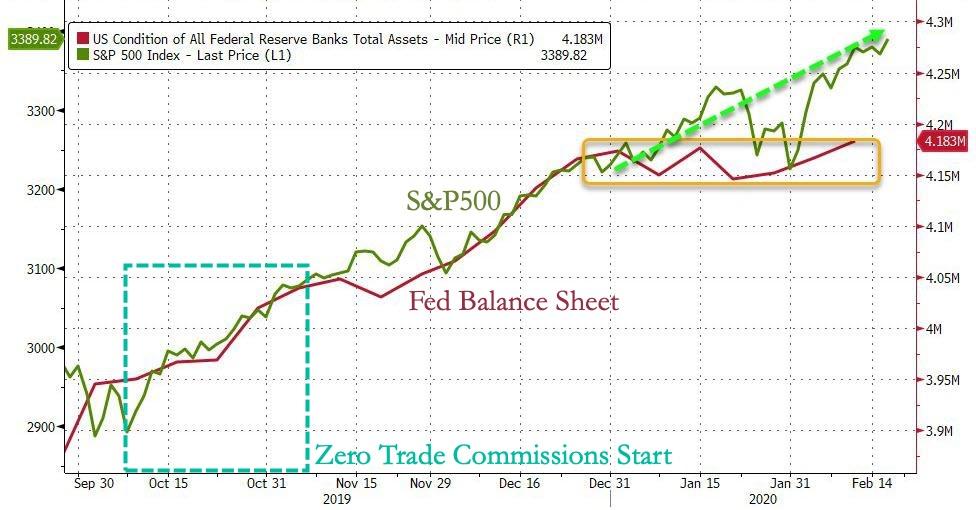

Since the start of October, when E*Trade, TD Ameritrade, Charles Schwab slashed trading fees to zero, the S&P500 has soared 13%, and the Nasdaq 100 jumped 24%.

Bloomberg fails to mention, and why would they, that rapid growth in the Fed’s balance sheet exploded during the same time. So the perfect narrative to cover up the Fed’s massive money printing to lift stocks, we mentioned here: “One Bank Finally Explains How The Fed’s Balance Sheet Expansion Pushes Stocks Higher” – is to blame retail speculation for the next blow-off top in the stock market.

Enticed by President Trump’s stock market pumping tweets and soaring stock prices, Matt Hermansen, 23, who is a blue-collar worker employed at a concrete company in Oakland, California, said zero trading fees had made him an avid trader.

“I’ll invest smaller amounts. Before I never really invested anything less than $1,000, $500 minimum,” he told Bloomberg in a phone interview. “Now, if I have enough to buy an extra share, I’ll do it. I’ll do like $300.”

TD Ameritrade’s interim president and CEO Steve Boyle said there were 38 days where the number of trades topped 1 million in 4Q, up from 23 days in all of 2019.

It’s “a new world in discount brokerage where price no longer clouds the comparison for trades,” Boyle said last month. TD’s monthly volume had already risen 40% from a year ago, averaging 1.4 million trades per day.

Randy Frederick, a vice president of trading and derivatives at Charles Schwab, said increased trading by retail accounts represents confidence in the bull market.

“It’s partially driven by free commissions, but I don’t think it’s just that, because not everyone is offering free commissions,” Frederick said. “The fact that we have been in a bull market for a long time, people are just optimistic. Things are going up and they continue to go up.”

But again, there are no mentions of the Fed-induced rally – just more white-collar Wall Street execs indicating that it’s retail driving the bull market – not balance sheet expansion and stock buybacks.

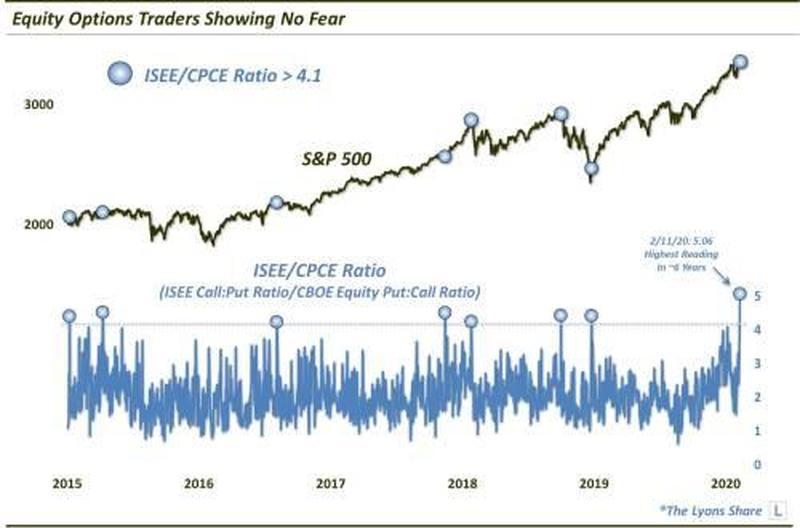

And hiding at the bottom of the Bloomberg article, a quote via Peter Cecchini, chief global market strategist at Cantor Fitzgerald LP, who says retail investors flooding the market is “creating flashbacks to the internet frenzy in the late 1990s.”

“There’s sometimes no fundamental reason for it. It just is based on perception — a perception based on narratives that run only an inch deep,” he said in note. “Let’s see how much longer it persists. This kind of activity often unwinds much faster than the wind up.”

The chart below illustrates the irrational exubernace in retail traders, betting on a one way market. Though this trend never ends well.

And it’s the aggressive money printing via the Fed, which is the missing link and why many on Wall Street can’t comprehend the latest melt-up in stocks. Nevertheless, the narrative of retail fueling the stock market has already begun, so when the bubble does pop, the Fed and Wall Street can scapegoat retail traders. Funny how things work.

Tyler Durden

Fri, 02/21/2020 – 19:45

via ZeroHedge News https://ift.tt/32i1BXM Tyler Durden