China Mobile Phone Sales Crash Most On Record

China’s mobile phone industry cratered in January as shipments plunged by more than a third, according to a new report from China Academy of Information and Communications Technology (CAICT).

China shuttered dozens of cities, closed major manufacturing hubs, shutdown retail stores, and placed more than 700 million people in lockdown for virus containment purposes, creating one of the most massive demand shock the country has ever seen, resulting in the bust of the mobile phone industry in January.

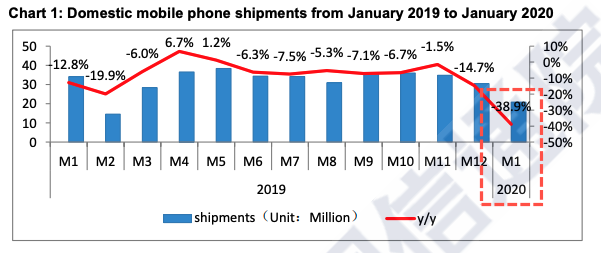

CAICT reported domestic mobile phone shipments were around 20.8 million units, down 38.9% year-over-year.

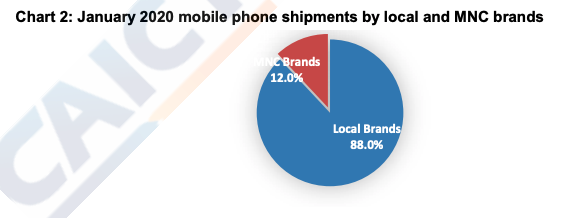

The report noted mobile phone shipments by local brands reached about 18.3 million units, down 42.9% year-over-year, which accounted for 88% of the domestic mobile phone shipments.

It also noted, smartphone shipments were 20.4 million units for the month, down 36.6% year-over-year, which accounted for nearly 98% of all domestic mobile phone shipments in the month.

We’ve cited several estimates in the last several weeks that made it entirely clear that China’s economic paralysis would lead to a full meltdown of its tech industries.

The first hint was Qualcomm earlier this month, warned the virus outbreak would disrupt the mobile and smartphone industry.

On a quarterly view, research firm Canalys suggested China’s smartphone sales could plunge upwards of 50% for 1Q, as retail phone stores and production of semiconductors/smartphones remain closed.

“Vendors’ planned product launches will be canceled or delayed, given that large public events are not allowed in China,” Canalys said.

“It will take time for vendors to change their product launch roadmaps in China, which is likely to dampen 5G shipments.”

International Data Corporation (IDC) estimated that shipments over the quarter could tumble by 30%.

TrendForce Corp. said Apple could see a 10% decline in iPhone sales in 1Q, from 45.5 million to about 41 million units.

TrendForce slashed its 1Q global smartphone production forecast by 12% Y/Y, due to factory closings across Greater China. It warned global smartphone production in 1Q would be around 275 million units, a 5-year low in production.

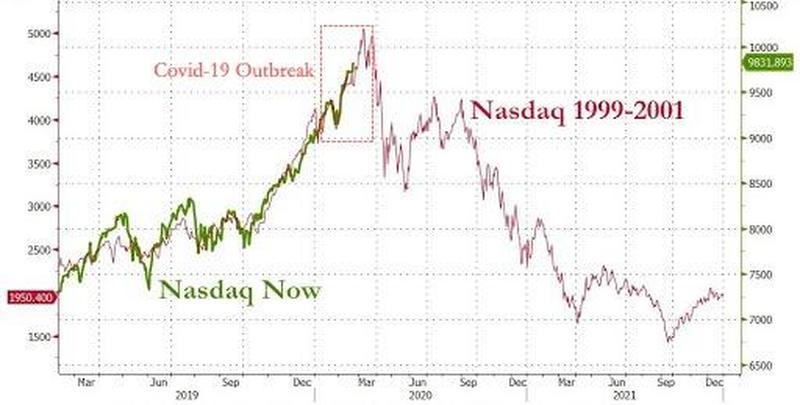

The risks are now skewed to the downside for China and the global mobile phone industry, suggesting demand and supply shocks will compound into massive disruptions through 2Q. This all suggests the global technology bubble, seen in the Nasdaq, is about to pop.

* * *

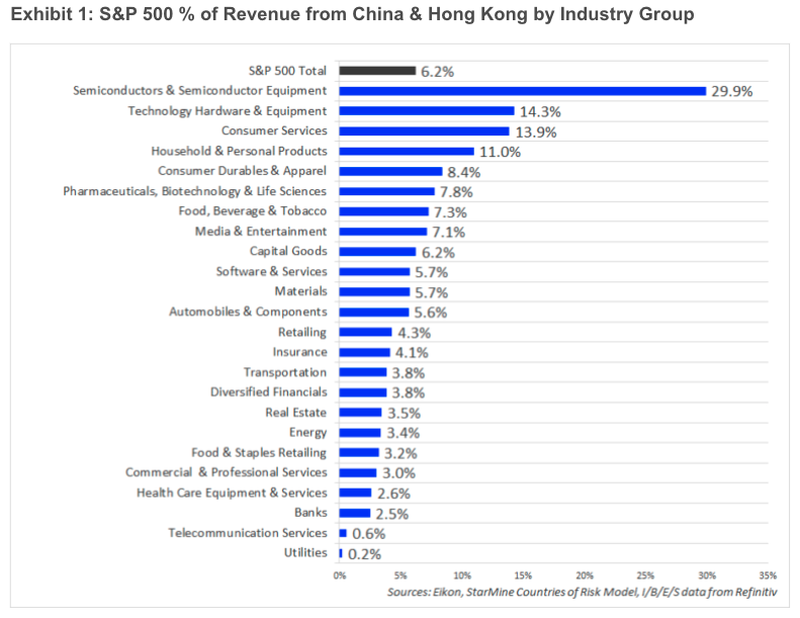

As we’ve outlined, S&P500 semiconductors and semiconductor equipment industry groups have 30% of revenue exposure to China and Hong Kong, thus being the most exposed to a collapsing China and or global phone industry thanks to the virus crisis.

Tyler Durden

Mon, 02/24/2020 – 15:20

via ZeroHedge News https://ift.tt/32l0neq Tyler Durden