Markets Scramble To Stage “Turnaround Tuesday” But Bad News Keeps Coming

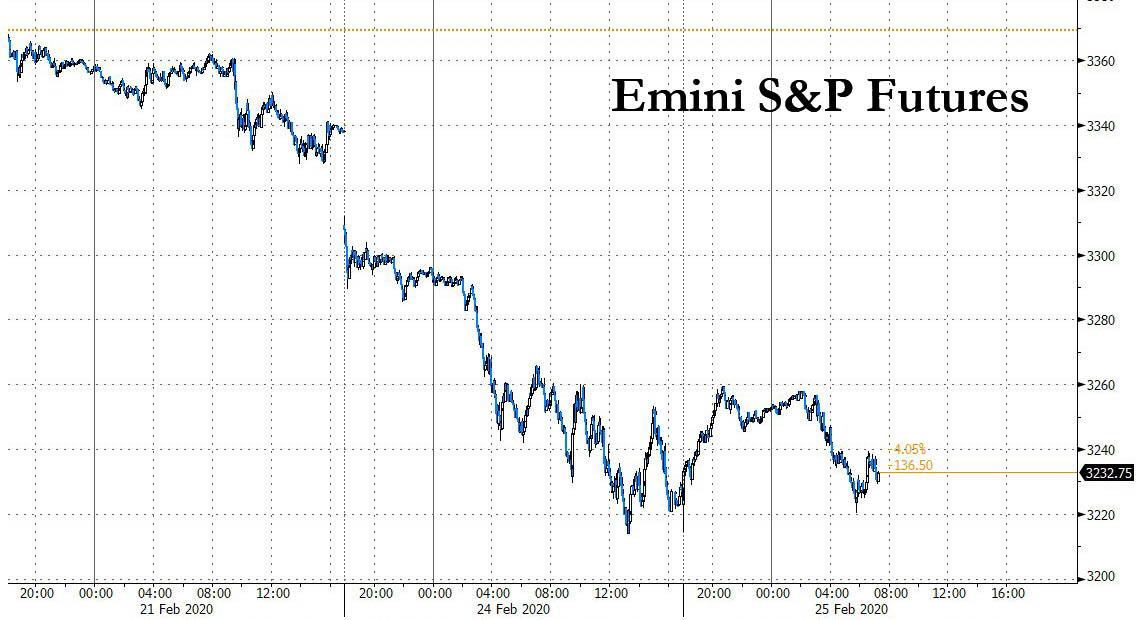

After the Monday Market Mayhem which saw the Dow drop more than 1,000 points, the VIX surge more than 8 points to close above 25 – its biggest jump since the February 2018 VIXtermination event – and prompted a panicked respond from both Trump and Kudlow urging Americans to ‘buy the dip‘, S&P futures jumped in early trading, rising as much as 40 points to 3,260 higher even after Shanghai Composite fell as much as 1.7% and China’s Nasdaq ChiNext tumbled as much as 4.1%.

Some dealers cited a WSJ report on a possible vaccine as helping sentiment, though human tests of the drug are not due until the end of April and results not until July or August. Whatever the cause, E-Mini futures for the S&P 500 bounced 0.7% to pare some of the steep 3.35% loss the cash index suffered overnight. However the initial dip buying euphoria did not last as even more cases were repoted, now in Spain and Austria, and futures faded most gains as fresh concerns about an out of control pandemic hit risk assets.

As a result, US index futures surrendered some of their early advances as a tentative risk-on mood weakened on news that reported cases of infections and deaths continued climbing outside of China and countries including the U.S. issued travel warnings. Home Depot shares climbed after an earnings beat, buoying futures on the Dow Jones Industrial Average.

MSCI’s All Country World index was down 0.16%, paring some earlier losses when Asian markets were trading. The index suffered its biggest daily drop in two years on Monday.

“There is no question financial markets are coming round to the realization that this particular crisis is likely to have a slightly longer shelf life than many thought was the case a couple of weeks ago,” said CMC Markets strategist Michael Hewson. “For now, there appears little prospect that financial markets look likely to settle down in the short term, which means investors will have to get used to an extended period of uncertainty and volatility.”

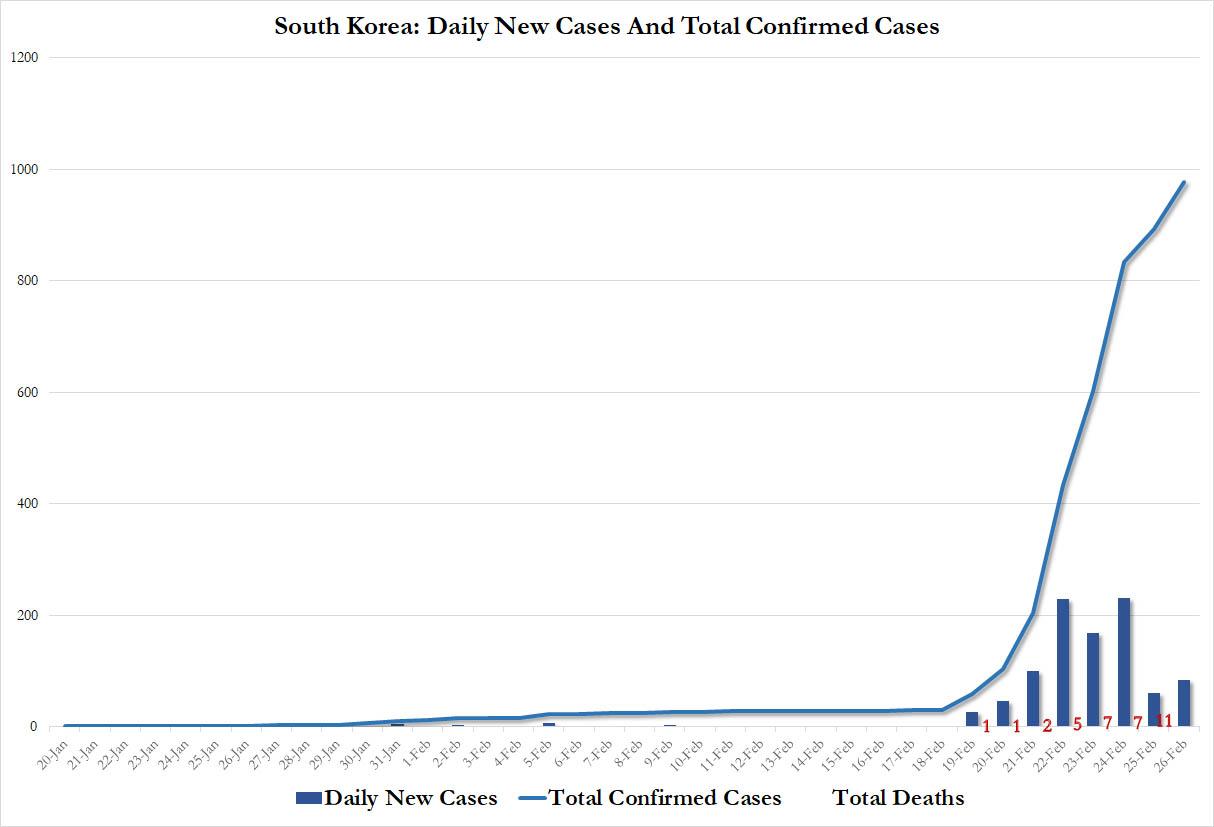

The number of confirmed coronavirus infections worldwide has risen to more than 80,000, with attention focusing on South Korea which has become the worst-affected country after China. Overnight South Korea reported a total of 977 cases, up 84 on the day, with a 11th coronavirus-related death reported. Furthermore, South Korea said it would implement containment policy in its 4th largest city, Daegu,. Separate reports noted that South Korea is to draft a supplementary budget as soon as possible; with President Moon saying declaring Daegu as a “special disaster zone” is not enough and vows full budget support.

While global markets stabilized on Tuesday after the previous day’s sharp selloff, Europe’s Stoxx 600 index slumped from an early recovery, down as much as 1.1%, after falling more than 3% on Monday, with stocks in Italy the hardest hit, down as much as 0.9%, extending losses this week to 6%. London’s FTSE 100 fell 0.8% to its lowest level since October. Declines in carmakers, banks and utilities dragged the Stoxx Europe 600 index lower.

Germany reported even more bad news, announcing that exports shrank in Q4, even before the coronavirus pandemic which held back German economic activity in the fourth quarter of last year, confirming that Europe’s largest economy was stagnating even before the coronavirus outbreak began. The Federal Statistics Office said exports fell by 0.2% in the fourth quarter from the third, which meant that net trade took off 0.6 percentage points from gross domestic product growth. The trade outlook remains clouded as the coronavirus epidemic is adding another risk, Ifo President Clemens Fuest said. The Ifo index for export expectations fell in February, with car companies among the most pessimistic, Fuest added.

European and U.S. stocks have suffered their biggest loses since mid-2016 amid fears the coronavirus may be morphing into a pandemic that could cripple global supply chains and wreak far greater economic damage than first thought. The risks are such that bond markets are starting to bet central banks will have to ride to the rescue with new stimulus.

Earlier in the session, Asian stocks fell for a fourth day, led by the industrials and health-care sectors, as nations sought to keep the coronavirus spread contained. Markets in the region were mixed, with South Korea’s Kospi index and Singapore’s Straits Times Index rising, while Japan’s Topix and Australia’s S&P/ASX 200 fell. Trading volume for MSCI Asia Pacific Index members was 45% above the monthly average for this time of the day. The Topix sank 3% after reopening following a holiday, and the Shanghai Composite Index posted its first back-to-back losses since before the Lunar New Year holiday.

Erratic market moves suggest investors remain on edge over the economic impact of the virus. The World Health Organization has held off from declaring a global pandemic even as cases surged in South Korea, Italy and Japan. Some traders may be taking encouragement from news about the development of treatments, even if experts warn it would take time to build stocks of medicines. Japan’s health minister said the country plans to recommendFujifilm Holdings Corp.’s Avigan drug to treat the virus.

In rates, the yield on 10-year Treasuries swung around, after nearing record lows earlier in the session, dropping below 1.35%, before trading roughly flat, which still was down almost 20 bps in just three sessions and paying less than overnight rates. Yields are rapidly approaching the all-time low of 1.321% hit in July 2016. European bonds were mixed, with core yields falling. Benchmark JGB yield falls 4bps to lowest since November. Aussie bonds erase opening gains to trade near unchanged.

The sharp drop in yields, combined with the fact the Fed has far more room to cut interest rates than its peers, kept the U.S. dollar restrained after a run of strong gains.

“Besides a tapering in the geographical spread of the coronavirus or unexpected improvements in key short-term macro indicators, the circuit breaker for these market moves is starting to move towards the U.S. central bank,” Danske Bank said in a note to clients.

In FX, the Japanese yen headed for its biggest three-day gain since October, as concerns over the spread of the coronavirus in South Korea strengthened haven demand. Japan’s currency erased losses after Korean Air said it’s working with health authorities to prevent a spread of the virus after a crew member fell sick. Earlier, South Korea reported 84 new infections for a total tally of 977, making it the country with most cases outside of China. USD/JPY rose 0.2% to 110.47, after earlier reaching as high as 111.04. “Overnight, the JPY was clearly a safe-haven bet as the focus has shifted from China to Europe,” said Stephen Innes, market strategist at AxiCorp Ltd. “JPY loses its haven appeal when the exogenous shock comes from China but not from global risk aversion. With virus fear spreading in Europe, the JPY should, in theory, also benefit from the squeeze on its funding shorts.”

In commodities, gold ran into profit-taking after hitting a seven-year peak overnight, and was last down 0.9% at $1,645.57 an ounce. Oil steadied after shedding nearly 4% on Monday. U.S. crude was up 0.2% at $51.55, while Brent crude firmed 0.4% to $56.51.

Conference Board consumer confidence is due. Home Depot, Salesforce.com and American Tower are among scheduled earnings

Market Snapshot

- S&P 500 futures up 0.2% to 3,234.00

- STOXX Europe 600 down 0.3% to 410.50

- MXAP down 1% to 162.62

- MXAPJ up 0.1% to 532.02

- Nikkei down 3.3% to 22,605.41

- Topix down 3.3% to 1,618.26

- Hang Seng Index up 0.3% to 26,893.23

- Shanghai Composite down 0.6% to 3,013.05

- Sensex down 0.3% to 40,250.32

- Australia S&P/ASX 200 down 1.6% to 6,866.60

- Kospi up 1.2% to 2,103.61

- German 10Y yield fell 1.5 bps to -0.496%

- Euro up 0.04% to $1.0858

- Brent Futures down 0.1% to $56.24/bbl

- Italian 10Y yield rose 5.6 bps to 0.802%

- Spanish 10Y yield rose 1.1 bps to 0.22%

- Brent Futures little changed at $56.31/bbl

- Gold spot down 0.4% to $1,653.24

- U.S. Dollar Index down 0.2% to 99.18

Top Overnight News from Bloomberg

- Iran reported a total of 15 deaths from the coronavirus, the most fatalities outside China. Italy, the outbreak’s epicenter in Europe, said infections in the Lombardy region rose to 206 from 172. The country might seek flexibility on some budget targets

- Congress is expected to grill U.S. officials this week on the Chinese coronavirus outbreak that the Trump administration has so far kept from taking hold on American soil, even as the spread of the disease to South Korea, Italy and elsewhere rattles markets

- German companies cut spending for a third quarter at the end of last year, leaving the economy struggling and vulnerable even before the coronavirus outbreak created a fresh threat for global growth

- A moderate in Angela Merkel’s mold became the clear front-runner to replace her after a vocal conservative contender backed his bid to lead the Christian Democratic Union. Armin Laschet, 58, the premier of North Rhine- Westphalia, won the support of Health Minister Jens Spahn, 39, a move that would likely ease pressure on the German leader to step down early.

- Traders are ratcheting up their bets on the Bank of Japan cutting rates this year, even as the slide in the yen eases pressure on the export-heavy economy

- The biggest U.S. stock- and bond-trading firms are expanding their lead over smaller competitors, partly by grabbing market share from struggling European banks

- Moderna said it has released the first batch of mRNA-1273, the company’s vaccine against the novel coronavirus, for human use. Fujifilm Holdings Corp. rose as much as 8.8% following Japanese Health Minister Katsunobu Kato’s comments over the weekend on the country’s plans to recommend its Avigan drug to treat coronavirus

- The spread of the coronavirus outbreak to regions from Italy to Iran sparked concerns about a pandemic, with the number of cases worldwide topping 80,000. South Korea reported another 60 cases, bringing its total number of infections to 893. China’s death toll rose to 2,663, an increase of 71

- The Cboe Volatility Index surged to its highest in more than a year Monday as renewed fears about the coronavirus outbreak battered risk assets. The VIX rose 8 points to close above 25 — its biggest jump since the February 2018 “Volmageddon” meltdown

- Regaining political independence and freedom from the EU’s legal system will take priority over securing a trade deal by the Dec. 31 deadline, Prime Minister Boris Johnson’s spokesman, James Slack, told reporters on Monday.

- Oil held its biggest loss in almost seven weeks as investors attempted to gauge the economic consequences of the fast-spreading coronavirus and whether it would become a global pandemic

Asian equities traded mixed with the overall risk tone seemingly improved compared to yesterday’s global stock rout. US indices closed with sharp losses on Monday over fears regarding the number of growing coronavirus cases outside of China, causing the S&P and Dow to wipe out their YTD gains, with the latter closing lower by over 1000 points. However, US equity futures have experienced a modest relief rally since the open as the contracts retraced some of their recent losses. Nonetheless, ASX 200 (-1.6%) remained subdued, albeit off lows, as mining and banking names still bore the brunt of the prior session’s decline in base metals and yields. Nikkei 225 (-3.4%) opened with losses of ~4.5% as the benchmark played catch-up to the recent events after its extended weekend, including a firmer JPY. The Japanese index later clambered off lows amid the abating risk aversion, and with Fujifilm Holdings’ shares soaring almost 9% at the open on Japan’s plans to recommend its Avigan drug, produced by a Fujifilm unit, as a coronavirus treatment. That being said, Japanese automakers experienced firm losses on the outbreak’s implications on sales and supply chains; (Nissan -3.9%, Toyota -3.0%, and Mitsubishi -3.4%). Elsewhere, KOSPI (+1.2%) stood as the outperformer after the index consolidated from the prior session’s hefty losses before being bolstered by a declining rate of COVID-19 cases in the country. Furthermore, reports stated that South Korea is to draft a supplementary budget as soon as possible, whilst the government is also taking containment measures in Daegu and North Gyeongsang provinces to prevent further spreading. Over in China, the Hang Seng (+0.3%) and Shanghai Comp (-0.6%) traded mixed, with the former balancing gains in tech and pharma against losses in financials and oil giants. Meanwhile, Mainland lagged amid a lack of fresh China stimulus and with the PBoC also skipping open market operations for a sixth consecutive day.

Top Asian News

- Hong Kong Exports Slid Most in Decade in January Ahead of Virus

- Economic Discontent Brews in Malaysia Amid Power Struggle

- Temasek’s Fullerton Said to Weigh Indian Shadow Bank Stake Sale

- Banks Shunning Coal Financing Bodes Badly for New Plants in Asia

The attempted recovery for European equities from yesterday’s sharp sell-off ran out of steam in early trade with investors unwilling to buy up stocks amidst a backdrop of the increasing coronavirus case count across the globe. Despite prospective aid packages from various global powers, focus remains on the mounting case count as the virus continues to spread throughout Italy, the death toll rises in South Korea and Iran, whilst other nations report their first diagnosis’ of COVD-19. In a note published earlier today, Nomura Quants highlights that although it would be unwise to try and reach conclusions based on a single day’s change in sentiment (yesterday), investors are likely reacting to the increasing prospect that the COVID-19 outbreak could lead to a global economic collapse, compared to the initial belief that it would likely only lead to a momentary depressive impact. As such, European bourses are enduring another session of losses (Eurostoxx 50 -1.0%), albeit to a less extent than yesterday. That said, momentum to the downside for European equities has been accelerating with the DAX Mar’20 future taking out yesterday’s low (12961) and the Feb low (12958) to briefly breach a key double-bottom/fib level at 12880.5. Sectoral performance is negative with not too much in the way of specific underperformance. In terms of stock specifics, Prudential (+1.6%) shares have been supported by Third Point disclosing a 5% stake in the Co. and urging them to sperate its Asian and US businesses, whilst Anglo American (+0.4%) shares have been underpinned by recommendations from shareholder advisory groups ISS and Glass Lewis that Sirius shareholders accept the Anglo’s proposed takeover. To the downside, auto/autoparts makers continue to remain out of favour (Continental -2.9%, Michelin -2.3%, Renault -1.8%), whilst Novartis (-3.4%) shares have been weighed on by concerns over the safety of one of its eye drugs and AB Inbev (-2.9%) are enduring losses in the wake of a broker downgrade at HSBC. Furthermore, Philips (-2.9%) shares are lower after the company warned coronavirus is expected to have a negative impact on Q1 performance (albeit it is too early to quantify at this stage), whilst COVID-19 also forced Mastercard (-4.4% pre-market) to cut Q1 guidance and United Airlines (-3.3% pre-market) withdrew all previously issued 2020 guidance.

Top European News

- Merkel Ally Becomes Front-Runner, Easing Pressure on Chancellor

- Stuck in Traffic? Spare a Thought for Europe’s Capital of Chaos

- German Firms Cut Investment for Third Quarter as Growth Stalled

- Sell-Off’s Silver Lining Is That Italian Bonds Are Now a Bargain

In FX, heightened hard Brexit prospects heading into trade talks between the UK and EU, Sterling has recouped more lost ground vs the Euro and Dollar to sit on top of the G10 table ahead of the CBI’s Distributive trades survey and Brussels unveiling its mandate for the impending negotiations. The Pound’s revival looks partly technical and perhaps as a bi-product of cross positioning, as Cable held above 1.2900 before breaching the 100 DMA (circa 1.2955) and is now testing the 21 DMA (1.2988) that stands in the way of 1.3000, while Eur/Gbp has pulled back from 0.8400+ towards 0.8350. Similarly, the Yen has regained momentum after containing declines against the Buck to 111.00 or thereabouts, and with more depth in the market following the return of Japanese participants from Monday’s Emperor’s Birthday holiday. However, the main catalyst is another downturn in sentiment amidst a growing number of confirmed COVID-19 cases and fatalities stretching further across the globe, with Usd/Jpy inching closer to yesterday’s safe-haven lows and stops said to be sitting down to 110.25.

- CHF – Also firmer vs the Greenback and back above 0.9800, while Eur/Chf is eying 1.0600 again on the back of renewed risk aversion and with the Franc largely unfazed by a marginal decline in Swiss payrolls. Meanwhile, GOLD looks a bit more stable after suffering a rather sharp and abrupt fall almost as sudden and large as its spike to almost Usd1690/oz amidst the aforementioned deteriorating risk tone.

- NZD/EUR/AUD/CAD – The Kiwi has retreated from 0.6350+ levels against its US counterpart and near 1.4000 vs the Aussie to prop up the major ranks even though the latter has lost grip of the 0.6600 handle against the Usd and potentially has more to lose from China’s nCoV outbreak and fallout. Elsewhere, the Euro has also handed back gains vs the Buck after failing to sustain 1.0850+ territory and the Loonie is pivoting 1.3300 again as crude prices slip ahead of API inventories. All this helping to keep the DXY afloat within a 98.120-392 range.

- SCANDI/EM – Somewhat conflicting commentary from the Riksbank for the Sek to digest, as Floden continues to discount soft inflation, but Jansson sounding more concerned especially given the coronavirus and perhaps almost intimating that a reservation should have been entered again. Elsewhere, it’s back to general depreciation, albeit off the troughs seen at the height of aversion on Monday, as the Mxn awaits GDP and IGAE at noon, while the Brl gets current account data 30 minutes later.

In commodities, the crude complex is relatively flat at present, but has fallen significantly from its session highs of circa USD 52/bbl and USD 56.40/bbl respectively for WTI and Brent as there was a brief reprieve in the downside during APAC hours given yesterday’s sell-off; but this reprieve was not enough to flip overall sentiment as markets are firmly back into a risk-off/ FTQ state. Newsflow specifically for the crude complex has been relatively light, with the only specific flow thus far being Libyan oil production at 122.4k BPD which is down marginally from the prior 123.5k BPD, whilst IEA Director Birol warned the body may need to lower its oil demand growth forecast, with the oil demand growth estimate at its lowest in the Prev. 10-years. Looking ahead, the crude complexes fortunes today are likely to remain firmly affixed to the corona-driven demand side; unless we get a statement from Russia on their stance to the recommended OPEC cuts, but so far nothing new. Additionally, we get the weekly API inventory report which previously saw a build of 4.2mln for headline crude. Turning to metals where spot gold experienced a similar reprieve overnight and early EU hours where prices dropped as low as USD 1634/oz, but has turned around in-line with overall sentiment. Having printed a session high of USD 1663.91/oz at present, which is some way off yesterday’s USD 1689.29/oz peak. Elsewhere, base metals remain under pressure, but did experience some mild relief overnight as the sell-off’s momentum dissipated.

US Event Calendar

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.41%, prior 0.48%

- 9am: S&P CoreLogic CS 20-City YoY NSA, est. 2.8%, prior 2.55%

- 9am: House Price Purchase Index QoQ, prior 1.1%

- 9am: FHFA House Price Index MoM, est. 0.4%, prior 0.2%

- 9am: S&P CoreLogic CS 20-City NSA Index, prior 218.7

- 10am: Conf. Board Consumer Confidence, est. 132.1, prior 131.6; Expectations, prior 102.5; Present Situation, prior 175.3

- 10am: Richmond Fed Manufact. Index, est. 10, prior 20

DB’s Jim Reid concludes the overnight wrap

Today we are going to have a follow up call at 3pm London time with Dr. Michael Edelstein, an expert epidemiologist we did a call with a few weeks ago. You can see how to sign up by viewing this link here. A few of us had a pre-call with Dr Edelstein yesterday and I would urge you to dial in if you can. My interpretation of the conversation is that the COVID-19 virus from a medical standpoint looks like flu plus or perhaps flu plus plus but that trying to contain the disease now it’s spread notably outside China is likely to cause a lot of economic disruption.

The contagiousness is similar to flu (maybe a touch worse) but with the mortality rate anywhere between 2 and 20 times as high. Flu has a mortality rate of c.0.2% with COVID-19 cited at anywhere between 0.4 and 4. This is a wide bid offer but with our expert thinking it should be in the c.0.5-1% range. He thinks the often quoted 2.5-3% mortality rate might be overstated due to a likely understatement of cases as many people in China with relatively mild symptoms may not have been tested. New information since his first call with us is that we now know people are contagious before they show symptoms. This makes containment very difficult. As such the reports over the weekend of the surge in cases in Italy are a potential game changer. It now is unlikely that Italy will be the only sizeable European outbreak. Given the nature of the way governments will balance the risk/rewards, this could easily lead to widespread travel restrictions and lock downs. Anyway the call will have lots of great colour from an expert.

Interestingly China is certainly returning back to work, with our real-time shipping data now showing activity at levels where you’d expect them to be at this time of the year. The risks are that this will lead to a second round pick up in cases but at some point the risk/reward has to be managed by countries between the health risks and economic impact. Europe is currently at a very different point of this mini cycle than China. So the risks are that shutdowns are to come in Europe as cases increase. Beyond that we should look out for any signs that cases in the US start to surface. That would be very serious for markets in the short-term.

To illustrate how important the next few days are, a reminder that on Friday Italy had only 3 confirmed cases. The latest number from yesterday is that they have 229 cases and 7 deaths. All updates today will be very closely watched. Meanwhile Korean cases have gone up from 30 last Monday to 893 (+60 from yesterday) this morning with a Korean Air cabin crew member also being confirmed as being infected. Afghanistan, Kuwait, Bahrain and Iraq all reported their first cases of the virus yesterday with Iran reporting 61 confirmed cases (it only had 1 confirmed case as of last Wednesday) and 12 deaths. So the fact that this is spreading outside of China is the real problem for growth and financial markets in the short-term.

Before we look at the latest news in Asia the most impressive stat of the tumultuous last 24 hours of trading is that intra-day 10yr US Treasury yields dipped below their all time closing low yesterday. We have data going back to the birth of the nation in the 1790s and US government borrowing costs (including proxies in the early years) have never been lower.

The latest in Asia this morning is that the US CDC has now issued a warning asking Americans to avoid all non-essential travel to South Korea. The level 3 warning, the CDC’s highest, matches that it had previously placed on China. Earlier, the CDC issued lower-level alerts for Italy, Iran and Japan, telling travelers to take extra care and consider postponing non-essential travel. Also, as concerns over the virus impact linger, Hong Kong has now extended the closures of school until the end of Easter. Elsewhere, in China there are now 77,658 confirmed cases and deaths stand at 2,663 (+71 from yesterday). Japan also reported the death of a 4th passenger from the quarantined ship which has been the source of about 700 infections.

The fallout from the virus is now becoming more visible at the micro level with Singapore’s Temasek Holdings saying overnight that it will implement a company-wide wage freeze and ask senior management to take bonus cuts and voluntary pay reductions starting in April. About 26% of Temasek’s holdings were in China as of March 2019. Meanwhile, United Airlines dropped its profit forecast for 2020, citing the financial impact of the coronavirus outbreak. Singapore Airlines also said overnight that it will make more temporary adjustments to flights across its network due to weak demand. They will result in a -7.1% reduction in scheduled capacity from February to the end of May. Separately, Mastercard Inc. lowered its three-week-old forecast for quarterly revenue growth with the company knocking 2 to 3pp off the prediction.

The major risk off from yesterday is showing some small signs of easing this morning with the Kospi (+0.88%) up, the Hang Seng (-0.11%) flattish while the Shanghai Comp (-1.58%) is down. The Nikkei (-3.15%) is leading declines as it reopens post a holiday. Elsewhere, futures on the S&P 500 are up +0.79% while yields on 10y USTs are also up +2.7bps. Crude oil prices are up c. +0.40% this morning while gold prices are down -0.33%. As for data, South Korea’s February consumer confidence plunged to 96.9 in the biggest drop since June 2015.

This follows on what can only be described as a rout for markets yesterday with the S&P 500 down -3.35% in its worst day since August. It also closed back in negative YTD territory. Over in Europe the STOXX 600 was down -3.79% in its worst day since the two days – Friday and Monday – following Brexit Referendum vote in June 2016. This is the first time that we’ve had 3 consecutive daily falls for the S&P 500 since early December, which shows just how calm things have been over the last couple of months. Volatility returned with a vengeance yesterday however, with the VIX index up nearly 8pts to c.25 and to its highest level since December 2018. Unsurprisingly some of the biggest falls for equity markets were seen in Europe, where the STOXX 600 also erased its year-to-date gains for the year (alongside most equity markets), and both the DAX (-4.01%) and the FTSE MIB (-5.43%) saw their biggest daily moves lower since the day after the Brexit referendum. Italian assets in particular suffered, with the spread of Italian 10-year BTPs over bunds rising by 10.7bps to 145bps, their highest level in a month.

Fixed income provided a number of additional headlines. As already commented above 10yr Treasuries fell below their all time closing low before ending just above it at 1.371% (-10.1bps on the day). The 30yr yield plunged to a fresh record low, down -8.0bps to 1.83%. Aside from Italy where yields spiked higher, it was much the same picture in Europe, with 10yr bund yields down -5.0bps at their lowest level since October, while the 30yr yield fell -4.5bps to close just above negative territory, but earlier traded below for the first time since October as well. Over in credit, the iTraxx Crossover index rose +23.8bps, its biggest single-day rise since March 2018.

Thanks to the coronavirus, markets have ratcheted up the chances of rate cuts from central banks over the coming months, with the next Fed cut now fully priced in by the June meeting. This has been brought forward by around a month from Friday. Looking at Bloomberg’s financial conditions index for the US, monetary easing might be increasingly called for, as yesterday saw the single biggest tightening of financial conditions since August. Over in Europe meanwhile, inflation expectations continued to decline, with five-year forward five-year inflation swaps down -1.1bps at 1.18%, their lowest level since late November, and down from 1.349% in mid-January. The all time low was 1.115% in October of last year.

Other havens surged, with gold up +0.97% to a 7-year high of $1659/oz, while silver also rose +0.79% to $18.63. Gold was up as much as +2.7% midday until there was a sharp pullback in the US afternoon that was caused by some unsourced speculation on potential central bank selling. It was the reverse picture for oil though, with heightened fears over global economic demand sending Brent crude down -3.76% to $56.30/bbl. Haven currencies strengthened too, with the Japanese Yen the top performing G10 currency yesterday, up +0.80% against the US Dollar.

Onto other matters, and attention tonight will turn to the latest Democratic primary debate in South Carolina ahead of the state’s primary vote on Saturday. At the debate in Nevada last week, former NYC Mayor Bloomberg came under sustained attack from the other candidates, but it was Bernie Sanders who won the caucus there and now finds himself as the undisputed frontrunner, having won the popular vote in the first 3/3 contests. The interesting question for tonight therefore will be whether the more centrist/moderate candidates train their fire on Sanders to try and stop his momentum or continue their attacks on each other in order to emerge as the main moderate alternative. The state is super important for former Vice President Biden, who goes in with a narrow 3-point poll lead according to the RealClearPolitics average, as victory there would establish him as the main contender against Sanders, and provide all-important momentum ahead of Super Tuesday in a week’s time. If Sanders managed to come on top though, his momentum going into Super Tuesday, when 14 states plus American Samoa will be voting, could become almost unstoppable.

Sticking with political developments, in Germany the CDU announced yesterday that they would be bringing forward the process to select a new leader to replace Annegret Kramp-Karrenbauer, holding a special conference on April 25 to choose her successor. This will be a key event to watch out for after Easter, one that will help set the direction of travel in German politics. Meanwhile in the UK, Prime Minister Johnson’s spokesman said that the government would be publishing its negotiating mandate for the upcoming EU trade talks on Thursday, before they publish the mandate for the US trade talks the following week.

Amidst the market rout, the German Ifo survey was unexpectedly positive, with the business climate indicator rising to 96.1 (vs. 95.3 expected), while both the expectations (93.4 vs. 92.1 expected) and the current assessment figures (98.9 vs. 98.6 expected) also beat consensus estimates. That said, given the developments over the weekend with the surge in the number of European cases, the question will be whether this can be maintained moving into March. In the US, the Dallas Fed’s manufacturing index rose to a 5-month high of 1.2 in February (vs. 0.0 expected), though the Chicago Fed’s national activity index came in at -0.25, below expectations for a -0.18 reading.

To the day ahead now, where the data highlights include the final reading of Germany’s GDP in Q4, the INSEE’s French business confidence indicator for February, while from the US we’ll get the Conference Board’s consumer confidence indicator for February, along with the Richmond Fed’s manufacturing index for February and the FHFA’s house price index for December. From central banks, we’ll hear from the ECB’s Hernandez de Cos and Fed Vice Chair Clarida, and tonight there’ll be the aforementioned Democratic debate taking place.

Tyler Durden

Tue, 02/25/2020 – 08:10

via ZeroHedge News https://ift.tt/390qvgW Tyler Durden