Nomura: Investors Are Finally Considering A “Previously Unthinkable Scenario”

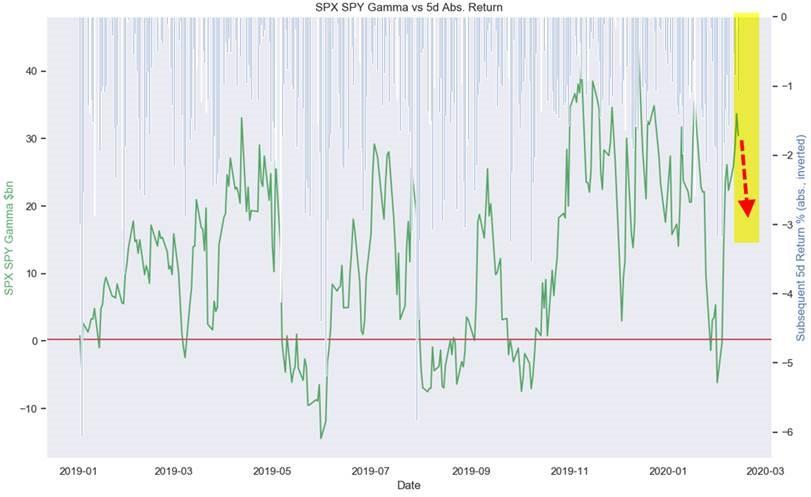

When discussing the potential catalysts for yesterday’s furious market selloff, we pointed out the sharp dropoff in dealer gamma following Friday’s op-ex which opened a “trapdoor” lower in stocks now that the gamma buffer was gone…

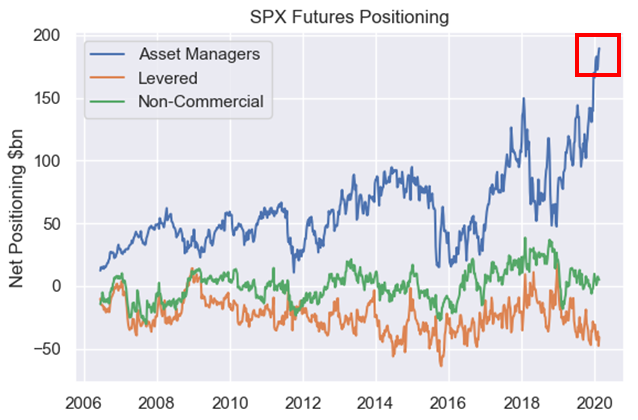

… coupled with the likely liquidation among asset managers whose SPX futures positioning had reached an all time high, 100%ile heading into this weeks puke.

However, relying on CTA model estimates from Charlie McElligott, we said that it was unlikely that systematic (i.e. quant) investors had joined in the selloff, primarily because many of their forced-selling trigger levels were far below yesterday’s S&P spot level. That said, we may well be witnessing the first wave of systematic liquidation today with Morgan Stanley anticipating some $60BN in forced liquidations today as a result of the continued selloff, a number which may rise substantially if the selloff isn’t halted, and if vol continues to rise.

Picking up on this theme, Nomura’s other quant, Maasanari Takada writes overnight the it is unlikely that algorithmic investors (trend-following algos such as CTAs and risk-parity funds) are the main culprits behind the selloff. Instead, the Nomura quant believes that the algos were “forced to adjust their positions by a drop in share prices and rise in bond prices running counter to recent short-term trends.”

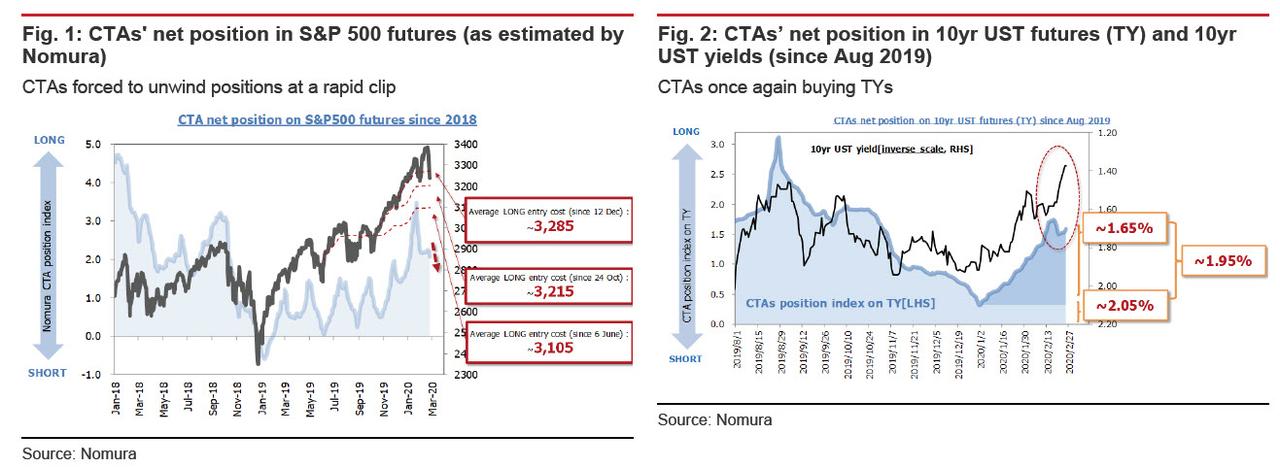

Looking first at CTAs, Takada writes that pressured by the global risk-off flow, the S&P 500 suddenly broke below 3,285 (the average cost of CTAs’ net buying of futures since December 2019). If it falls below the next inflection point of 3,215, CTAs would likely step up their loss-cutting. Meanwhile CTAs have been net buyers of UST futures (TY), accumulating long positions at a rapid clip. While CTAs showed early signs of unwinding these long TY positions in the latter half of last week, they switched to following the market in buying when 10yr UST yields broke out of their recent range, falling below 1.50%. In both cases, prices of these futures are shifting in ways that cannot be explained by the typical behavior of trend followers.

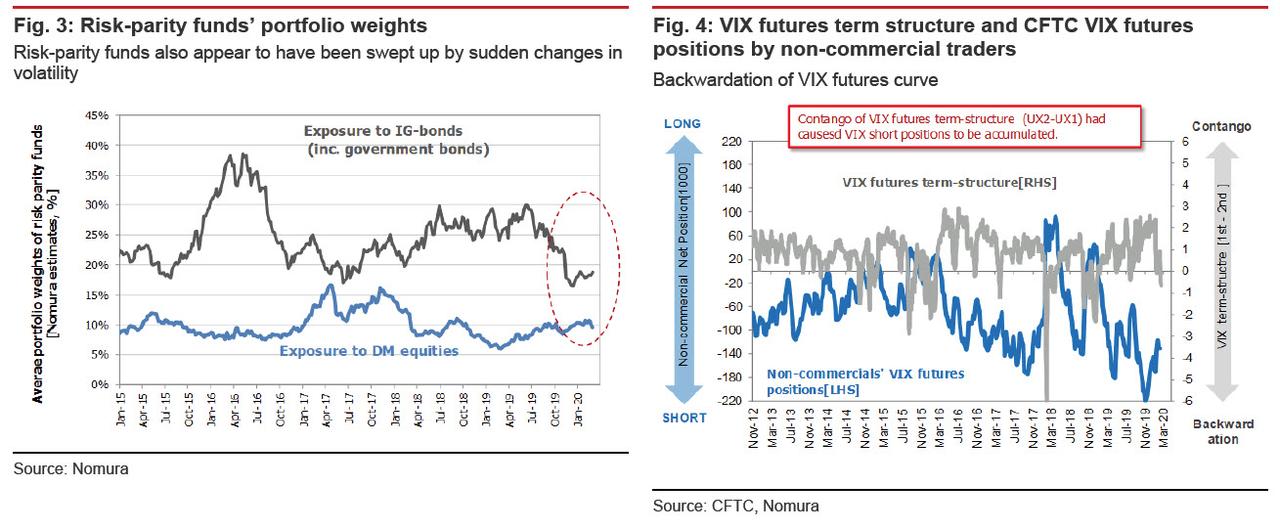

The same can be said for the volatility-driven trend-followers. Risk-parity funds, for example, also seem to have begun to partially rebalance their portfolios, shifting from selling stocks to buying investment-grade bonds in response to the sharp rise in equity volatility. Unlike in the lead-up to the VIX shock in February 2018, however, they do not seem to have built up excessive equity exposure. We surmise that backwardation in the VIX futures term structure led to mechanistic buying back of VIX futures. In both cases these seem to have stopped at mere passive position adjustments, and it does not appear that a series of systematic trades actively caused the equity selloff on their own.

While these mechanistic trades likely ended up accentuating the drop in share prices and the rise in bond prices, the main trigger seems to have been human decisions and nontechnical factors.

So if not quant-driven selling then what prompted Monday’s dramatic liquidation?

To Nomura, the most straightforward interpretation of these changes in speculative supply and demand is that “investors probably stepped up their moves to factor in irregular deterioration in fundamentals.” One such “fundamental”, which investors long ignored, is the growing risk from the COVID-19 outbreak, which had been thought likely to have only a momentary depressive effect on the economy, and which could in fact trigger a global economic collapse.

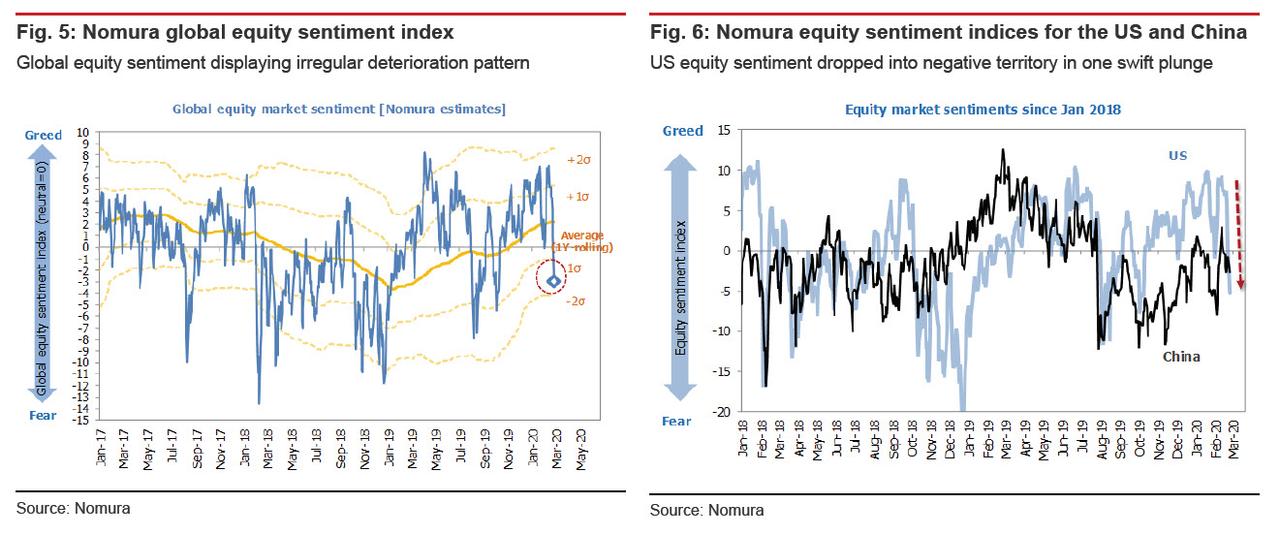

As a result, Nomura ominously points out that “a wide range of investors are now factoring in a previously unthinkable scenario” which becomes apparent when observing the “unusual deterioration pattern” in the bank’s global equity sentiment index, shown below.

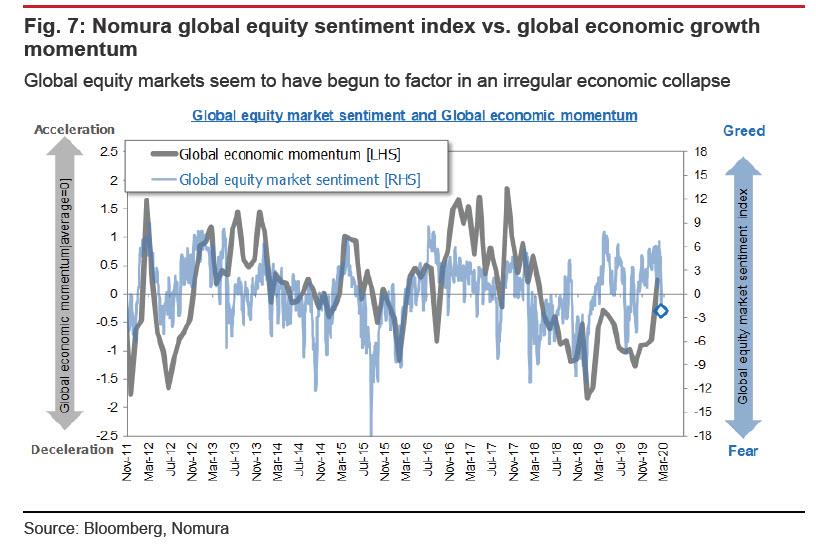

While extrapolating the dramatic one-day change into the future may be unwise, Takada writes that equity sentiment does tend to be predictive of economic trends. The recovery in equity sentiment since autumn 2019 has tended to be in lockstep with shifts in global economic sentiment (as synthetically measured using sentiment indicators from major countries, converted to a z-score). As he concludes, “if sentiment stagnates below zero, this would seem to indicate that markets have begun to factor in a slowdown in economic momentum.”

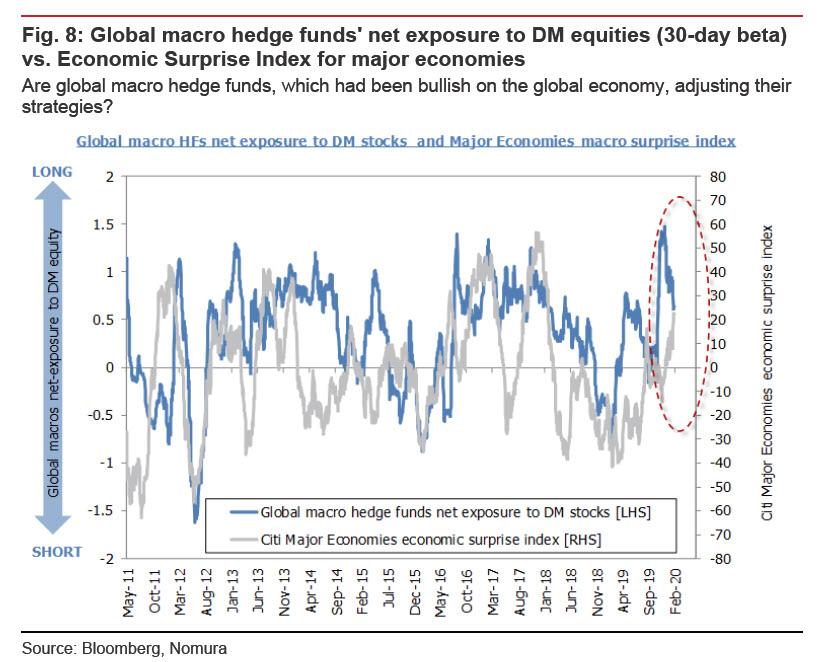

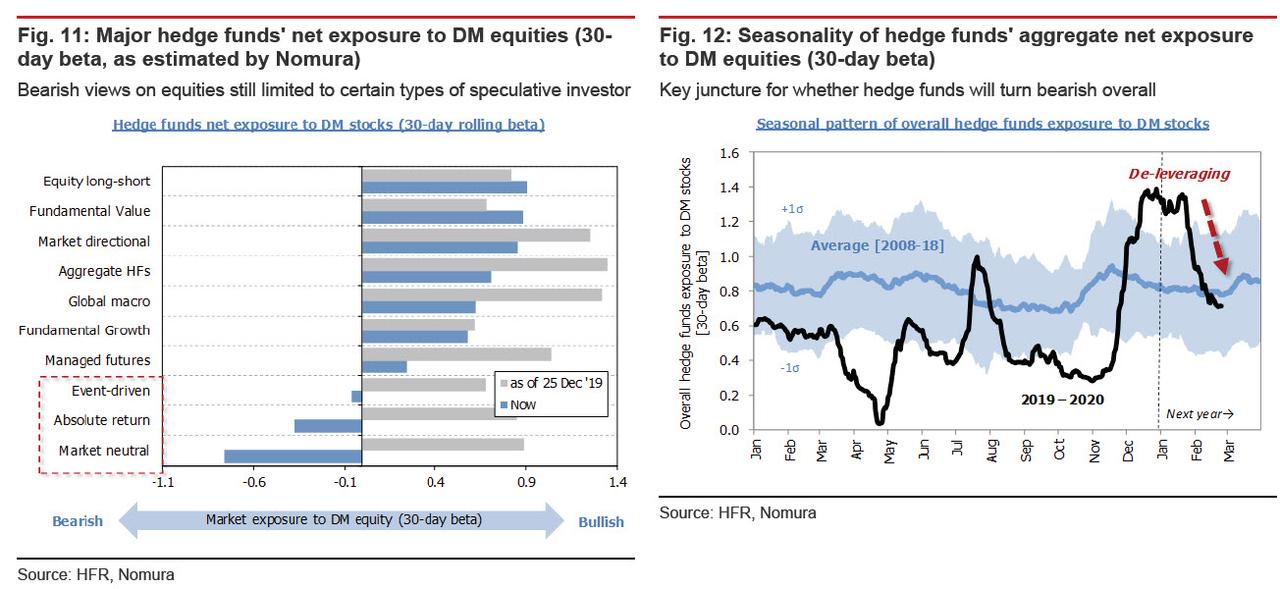

As further evidence of a violent deterioration in sentiment, Nomura also sees evidence that global macro hedge funds, which have heretofore been working under a somewhat bullish top-down scenario, have been selling equities. As if tracking the improvement in DM macro surprise indices, global macro hedge funds had been accumulating long equity positions, but they now look to have found it necessary to adjust their positions in light of the risk of an unexpected economic downturn triggered by the COVID-19 outbreak.

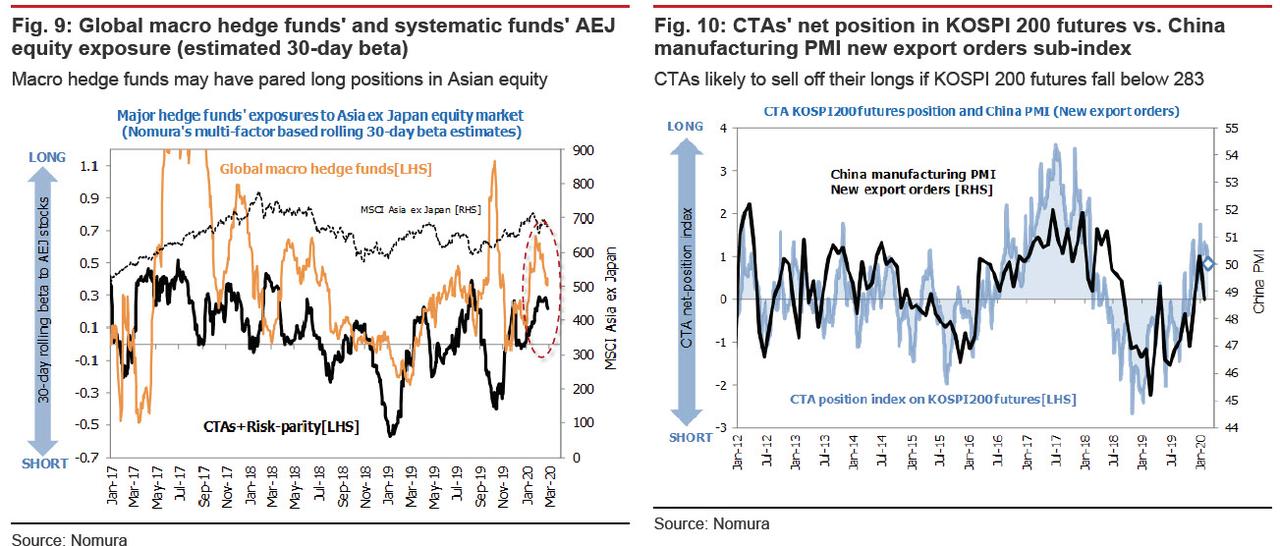

Noting that this unwinding of long equity positions by global macro hedge funds is also noticeable in Asia ex-Japan (AEJ) equities, Nomura cautions that CTAs may have been obliged to follow this selloff by global macro hedge funds by liquidating their own long positions. This can be clearly seen in South Korea’s KOSPI 200 futures market. As of yesterday (24 February), CTAs had rapidly closed out 35% of their long positions from the recent peak (9 February). As their existing long positions (net buying since November 2019) break even with KOSPI 200 futures around 283, a break below this would likely add impetus to CTAs’ exits.

Takada is especially focused on what long/short funds – who have been the most bullish of the major players to date – do next, and whether they will again push back against these headwinds to once again buy on weakness. Of note, long/short funds have consistently bought on dips throughout the selloff since January, building up their equity exposure globally. If even the long/short funds were to shift toward cautious stances, Takada concludes that there is risk that this bearish contagion could infect the entire hedge fund population.

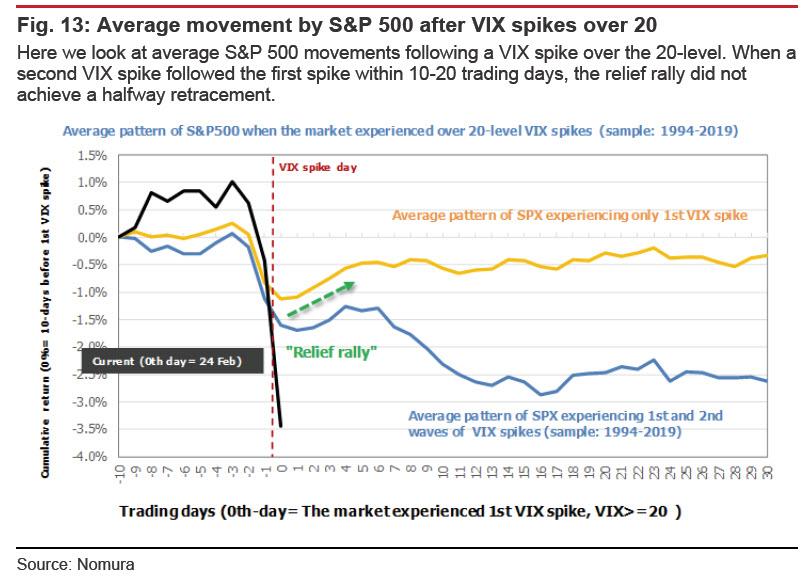

In conclusion, Nomura also takes a look at the technical situation, where it evaluates whether the S&P 500 can achieve a retracement of half its recent plunge during the relief rally that is expected to take place in the next three to four days.

Judging from past patterns of activity, advance omens of a second vol-up wave tend to manifest in (1) weakness in the relief rally, and (2) a conspicuous sellback flow around 6-7 trading days after the initial vol-up wave (here we define a “second wave” as VIX above 20 within 10-20 days after the initial vol-up). This time, even if a relief rally associated with a retracement of around half takes shape, some speculative investors would likely be inclined to undertake sellbacks if uncertainty regarding COIVD-19-related risk remains unresolved.

Tyler Durden

Tue, 02/25/2020 – 12:50

via ZeroHedge News https://ift.tt/2HTyReH Tyler Durden