Peter Schiff: The Real Safe-Haven Money Is Going Into Gold

Stock markets have crashed this week with the Dow Jones Industrial Average down over 3000 points from its highs, entering a formal correction (-10.4%).

As stocks dropped, the bond market was red-hot. Prices soared and yields dipped to record lows. Bonds are considered a safe-haven, but in his latest podcast, Peter said US Treasuries aren’t a safe-space.

When it’s all said and done, the only safe-haven left standing will be gold.

Coronavirus fear was the immediate catalyst for the sell-off as the virus spread outside China, but Peter noted that US stock markets were already vulnerable before the virus outbreak.

Remember, we’re talking about the US stock market that’s at bubble territory, nosebleed valuations, long in the tooth, the longest bull market in US history that has been fueled by the most monetary and reckless fiscal policy in US history. But this is a bubble in search of a pin. So, maybe the coronavirus is going to be the pin. But if we had a healthy market, if we had a healthy economy, it wouldn’t matter about the coronavirus. It’s because the economy is sick. That’s the problem, not the people who are infected with this virus.”

Peter said it looks like the coronavirus is going to have a bigger effect on the global economy than he originally thought. But there is a lot to worry about even if we didn’t have the coronavirus.

So now, when you have this too – you have another straw on a camel’s back that is ready to just implode at any moment because he’s already barely able to support all the straws that are already up there. I mean, hey, why not sell? Why not lighten up in the stock market?”

While people were selling in the stock market, they were buying in the bond market. The yield on the 10-year Treasury was pushed all the way down to 1.377% — a record low. The 30-year US Treasury yield is also at record lows. Peter talked about the bubble in the bond market in his previous podcast and he reiterated his point in this one.

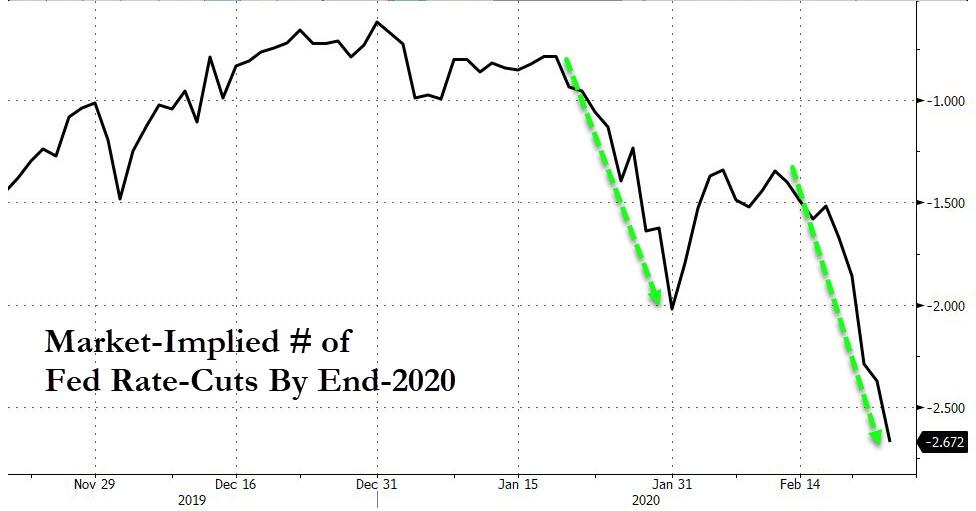

This is the biggest bubble of them all. And what is fueling this bubble, the reason that so many speculators are piling in the US treasuries is because they assume the Fed is going to cut rates. And they’re right. The Fed is going to cut rates.”

In fact, markets are now pricing in at least two Federal Reserve rate cuts before the end of the year.

But investors are ignoring the specter of inflation. Inflation is the enemy of the bond investor. These people are piling into 30-year Treasuries and accepting a nominal yield of 1.8% in front of what’s going to be a massive surge of inflation.

The dumb money is piling into Treasuries because they think they’re doing something safe when they’re actually doing something extremely risky and probably extremely foolish if the music stops playing and they still hold those Treasuries.”

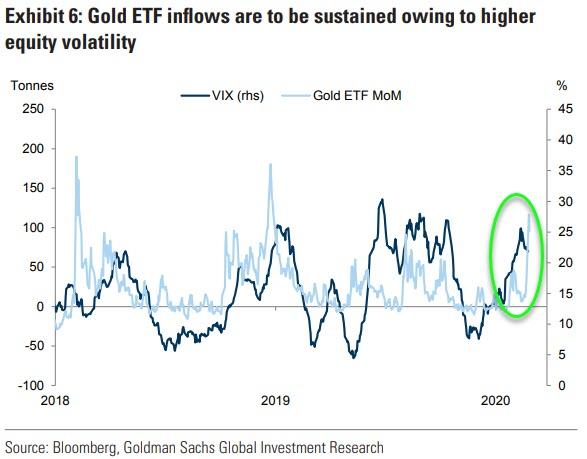

The real safe-haven money is going into gold.

Gold closed yesterday just above $1660 mark before some profit-taking overnight. During the day on Monday, the yellow metal surged as high as $1,690. But gold stocks continued to lag and there was some selling early in the day even as physical gold was rallying. Peter said this is another indication that this is an “unloved bull market.”

Nobody is looking for a reason to buy. Everybody wants to sell. People don’t believe this gold rally. We keep on making new high, after new high, after new high, yet nobody wants to come on and recommend gold or recommend these gold stocks.”

Peter said he watched CNBC throughout the day Monday and gold was barely even mentioned. But gold is exactly what you want to hold when inflation is hot and the stock market is crashing. It is a true safe-haven and his historically preserved wealth.

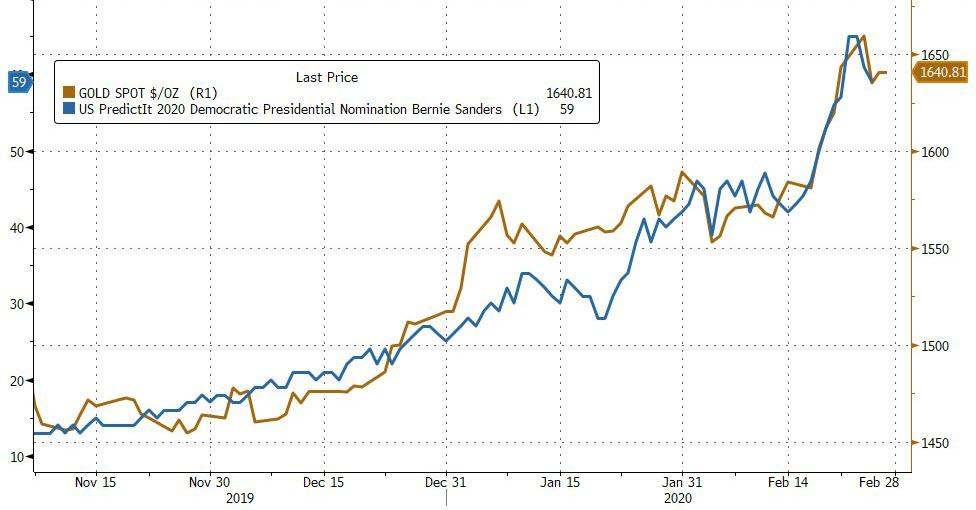

During this podcast, Peter also talked about Warren Buffet and the possibility of a Bernie Sanders presidency…

Coincidence or not?

Tyler Durden

Thu, 02/27/2020 – 15:00

via ZeroHedge News https://ift.tt/2VwzZg7 Tyler Durden