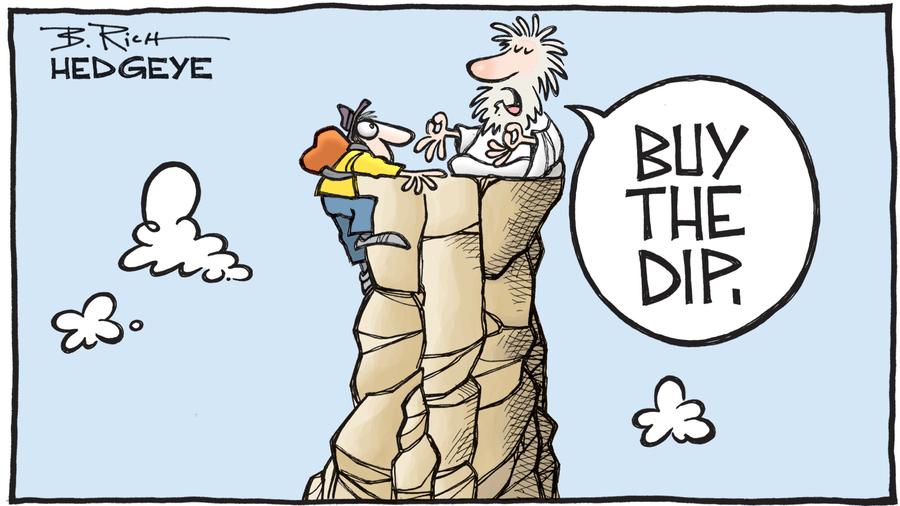

Rabobank: “So, It Was Right Not To ‘Buy The Dip’?”

Authored by Michael Every via Rabobank,

So it was right not to “buy the dip”.

Virus cases continue to escalate almost everywhere that already had them, despite government lockdowns, and nobody and nowhere is proving immune. Iran’s Vice-President is infected and their ambassador to the Vatican has just died from it; now the Pope is feeling ill, if not necessarily with COVID-19.

Nigeria has its first case, which could mean havoc for that economy with its lack of healthcare facilities. New Zealand has an Iran-linked case. Lithuania has a case. The Netherlands has its first case. Germany and Spain are seeing more and more cases, and Italy is up to 528 with 17 deaths. Even in South Korea, being held up as a benchmark of how a developed economy with full data transparency and rapid, wide virus testing can respond, the number of new cases continues to rise. It’s also worth noting that while China is seeing fewer new cases—apparently–it is also seeing dozens of deaths each day (now 2,788 with 44 just added). That makes COVID-19 look more and more deadly as the epidemic data move around. The WHO helpfully stress that this “could get out of control” but still isn’t a global pandemic…so closing down global travel is not a solution.

In hindsight, and not being the head of a World Health Organisation, might I ask if perhaps having done so a month ago might have done the trick?

But too late.

We now also see panic and confusion in parts of the US: dozens have now tested positive in California, with reports of potential virus patients being treated by staff without protective suits, while in Hawaii there has been panic buying reported. The new “Virus Czar” Mike Pence has also just appointed some very old faces, Treasury Secretary Mnuchin and Economic Advisor Larry “airtight” Kudlow, to help him out: because of their vast professional experience in epidemiology and virus science, obviously. As we see ever-increasing virus circles, does that ever-decreasing pool of White House talent inspire confidence? Not so much, despite President Trump’s confident assertion that he is doing an “incredible” job.

After all, even his Austin Powers Mojo (baby) of the stock market is voting with its feet. Stocks slumped once again yesterday, with the S&P -4.4% to mark another awful day in a terrible week, and the Dow down the same and a whole baseball cap lower at 25,767. Moreover, futures point to another large decline when the markets reopen today: the Nikkei was down -4.2% at time of writing, for example, with most of Asia deeply in the red. We are now past a mere 10% technical correction and seem to be heading for a bear market, which is only logical when one considers the global backdrop. Indeed, the worst week for equities since 2008 surely beckons. Do you want to be long going into the weekend, even at these lower prices, when any number of worrying headlines may potentially hit the screens?

At the same time, the 10-year US Treasury is now trading at 1.24%, a fresh record low. Let nobody say again that the US yield curve does not have predictive power: it clearly told us a killer virus pandemic was imminent. The market is now expecting Fed rate action as soon as next month. However, we have recently seen the Bank of Korea hold its ground on rates despite the far greater local crisis occurring there; and the ECB’s Lagarde came out to say she didn’t see any immediate need to act. (Europe being behind the curve is more of a dog bites man story, however; plus, the ECB has little left it can usefully do anyway.) Yet the US is an economy where that stock-market Mojo (baby) really seems to matter more than little things like wages – or so you would say looking at the collective policy actions taken by US authorities for decades. As such, the Fed must indeed be a good bet to start slashing rates *to no practical effect on the virus* soon.

Underlining that negative economic scenario globally, in South Korea Hyundai is shuttering a plant in Ulsan: first there was a problem with Chinese inputs for Korean firms, and now the problems are local; in Japan, Tokyo Disneyland is closing; and in Hong Kong, a dog has been found to have a weak form of the virus, raising another potential channel of infection ahead if confirmed. Meanwhile, China is still trying to get back to business as usual and estimates say it is back at 60-70%. The problem remains how to do that without the virus erupting again – and all the more so now the rest of the world seems to be infected.

In terms of currencies, EUR is somehow still looking strong vs. USD, which is surely a technical correction and not a vote of confidence. Recall that in the virus background the UK and the EU are about to go over the trade cliff together based on their stated negotiated positions: the EU for years asked the UK what kind of deal they wanted and the UK would not commit; now the UK has said “Canada” and the EU has said “Sorry, we are out of Canadas.” This risks a WTO “Australia” as the only option left on the menu. But back to FX. China is still trying to send out a signal that all really is well with CNY at 7.01. However, AUD is at 0.6522, which screams the opposite in a market that is not used for virtue signalling. Meanwhile, JPY is under 109 even as nobody is going to school or Disneyland.

While all of this is happening nobody is really talking about the US-China Cold War, which COVID-19 is likely to freeze even further; or that 33 Turkish soldiers have just been killed in Syria in one day at the hands of Syrian (read Russian) forces. As we have already noted this week, this virus pandemic is an accelerant to the pre-existing global conditions we had of populism, deglobalization, concern for national security over economic “efficiency” (read corporate profits), and rawer real politik; with co-morbidity factors like that, it is likely to prove highly damaging to the health of the “global liberal order”, which is surely close to being moved to the ICU (if there are any beds available).

After all, the US is talking about forcing firms to produce masks and anti-virus clothing in the US via the sweeping Defence Production Act of 1950, i.e., dating back to the Korean War. The UK has only 15 specialist beds available for patients in the deepest need of respiratory assistance: you think that will do? Ex-Chancellor Sajid Javid can stomp Thatcherite-ly in Parliament all he wants about fiscal prudence and debt, but the tide–and the virus–is flowing in the opposite direction.

Happy Friday – and stay healthy!

Tyler Durden

Fri, 02/28/2020 – 08:47

via ZeroHedge News https://ift.tt/2I1hNTW Tyler Durden