The Entire Treasury Yield Curve Is ‘Inverted’

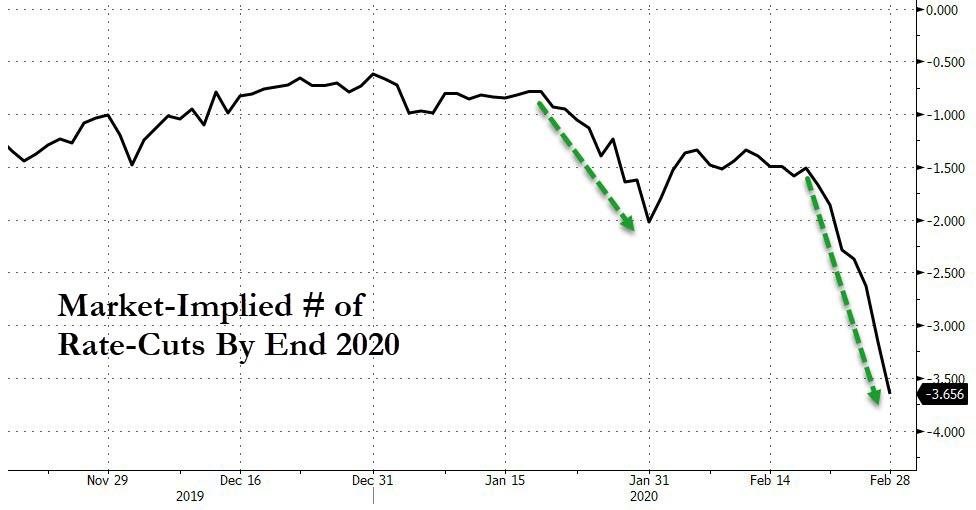

The market is now demanding almost 4 rate-cuts this year – a stunning example of the desperation for monetary policy mavens to save the world through easy money… and maintain the ‘buy the dip’ strategy that a generation of money managers has become conditioned to.

Source: Bloomberg

As former Dallas Fed’s Fisher noted yesterday:

“Does The Fed really want to have a put every time the market gets nervous? …Coming off all-time highs, does it make sense for The Fed to bail the markets out every single time… creating a trap?”

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, anbd even 2007-2009.. and have only seen a one-way street… of course they’re nervous.“

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?“

“the market is getting ahead of itself, because the market is dependent on Fed largesse… and we made it that way…

…but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

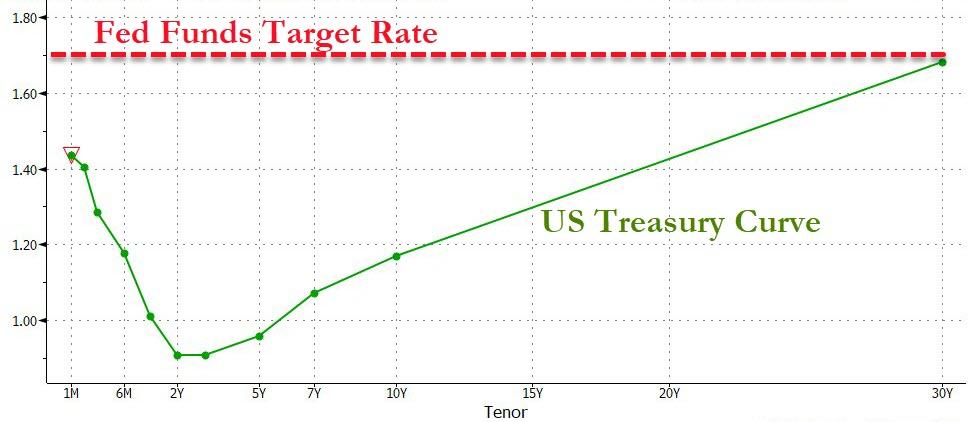

But the expectations have driven Treasury yields drastically lower…

Source: Bloomberg

With the entire curve now below the Fed Funds target rate…

Source: Bloomberg

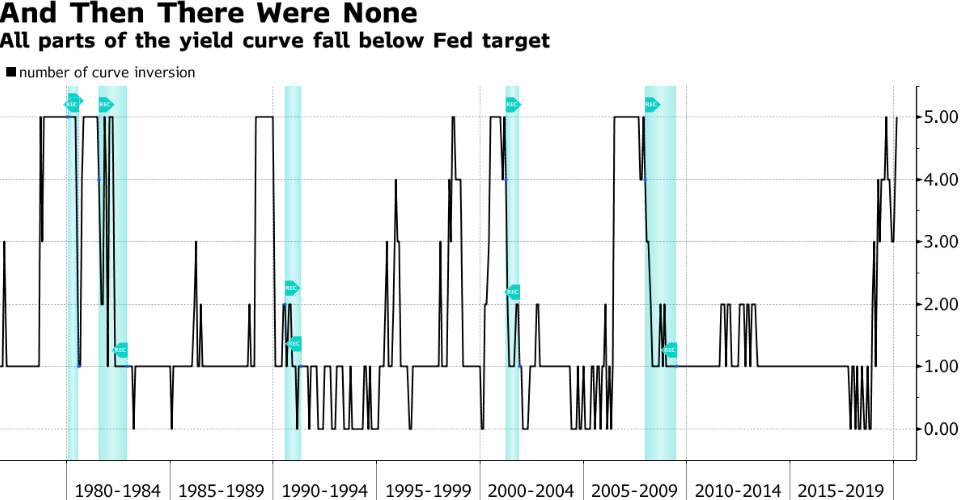

And we know “it’s different this time” but every other time this has happened, a recession was imminent…

Source: Bloomberg

“probably nothing…”

Tyler Durden

Fri, 02/28/2020 – 11:40

via ZeroHedge News https://ift.tt/2wQVCxj Tyler Durden