While Everyone Waits For Powell, Here’s What Wall Street Thinks Will Happen Next

On Friday morning, with stocks resuming their historic plunge, we said that across Wall Street, there was just one question: “Will The Fed Activate A Coordinated Central Bank Bailout On Sunday.” And indeed, just a few hours later, the Fed Chair did in fact publish an unscheduled statement in an attempy to calm crashing markets:

The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.

Unfortunately for the bulls who got steamrolled by last week’s record drop from a record high, this statement wasn’t sufficient to assure them that the Fed would indeed do “whatever it takes” to stem the bleeding. Commenting on Powell’s attempt to ease nerves, JPMorgan’s chief economist Michael Feroli said that the “statement took a page of out Greenspan’s playbook in responding to Black Monday, reminding markets that the Fed is on the job and ready to respond. This may have been particularly necessary since Fed rhetoric this week sounded somewhat unresponsive to the changing situation. Unlike Black Monday, however, the economic fundamentals may truly be changing” according to Feroli, which is ironic because just last week JPM’s head quant, Marko Kolanovic, tripled down on his bullish view of the market. Perhaps he was too concerned as being seen as wrong, than accounting for the “changing economic fundamentals”?

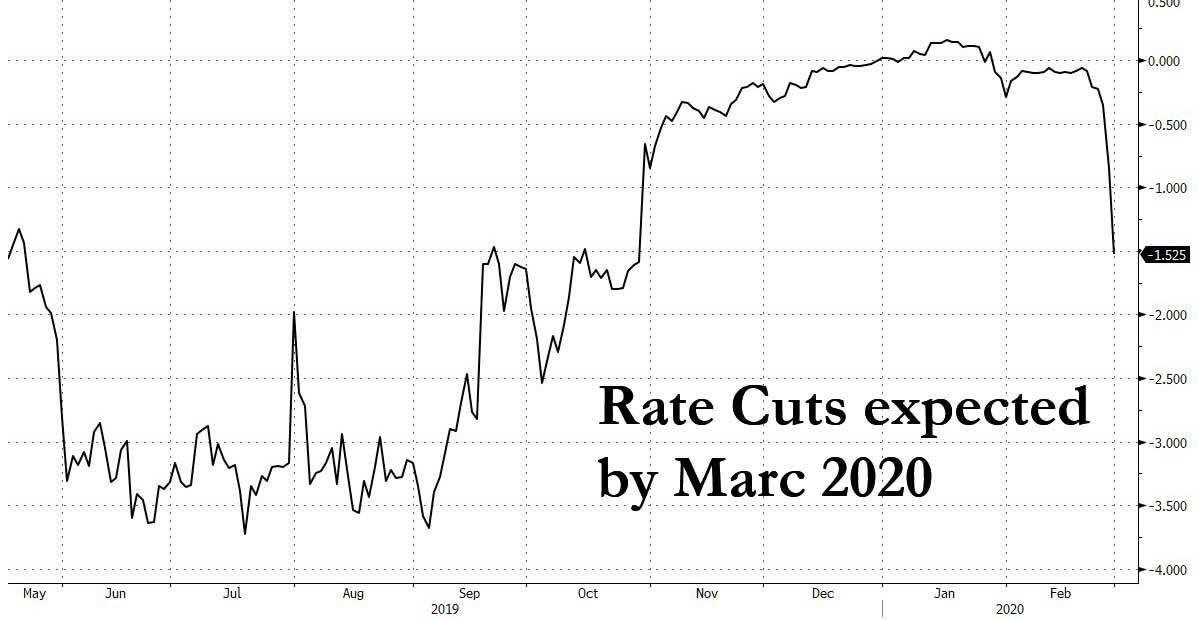

For this reason, Feroli said that “the tool most likely to be considered is the overnight interest rate target, not the discount window or some other liquidity tool”, which makes sense – the market is now pricing in more than 1.5 rate cuts on or before March 18…

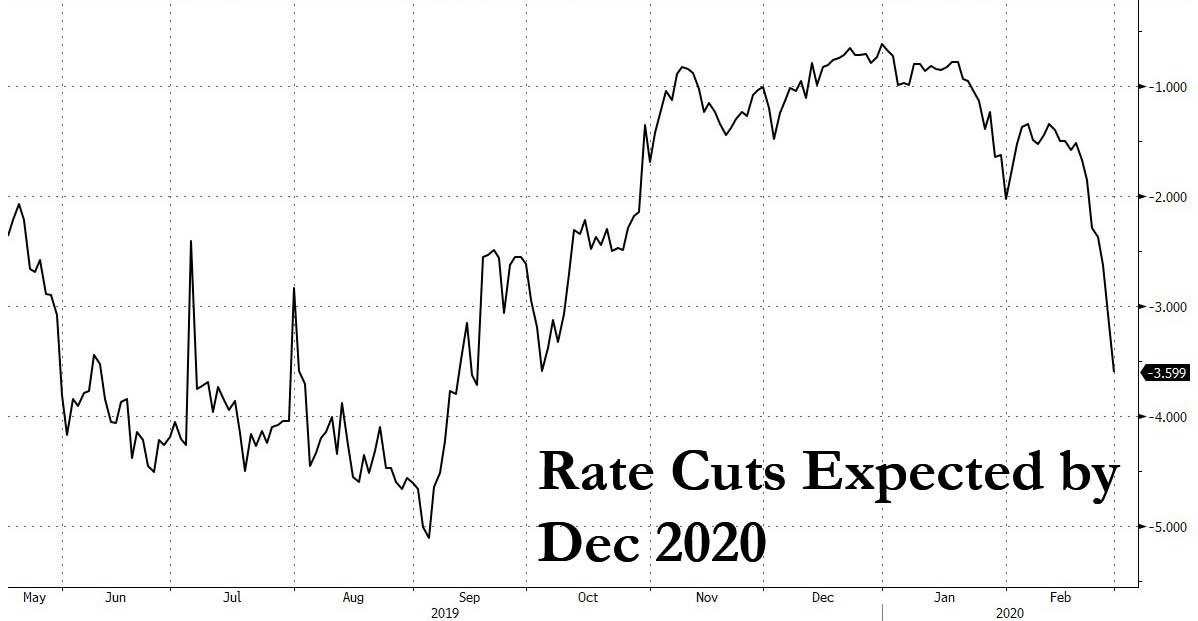

… and one could come as soon as this evening. Incidentally the market is also pricing in almost 4 – or 3.6 to be exact – rate cuts by year end, which would send the fed funds rate just above 0.0%, and a second Trump administration may start off with the first ever negative interest rates in US history.

But here JPM had some bad news: the bank said it suspects “the Fed is minded to avoid going inter-meeting, if they can get away with it.” Instead, Friday’s statement by Powell implicitly acknowledges that current policy may no longer be appropriate and that a cut may be the central scenario (Tealbook alternative B) at the March meeting.

As such, Feroli concludes by comically noting that his long-standing call for a cut at the June meeting, which had looked quite dovish just a few weeks ago, “is now looking sadistically hawkish relative to market pricing.”

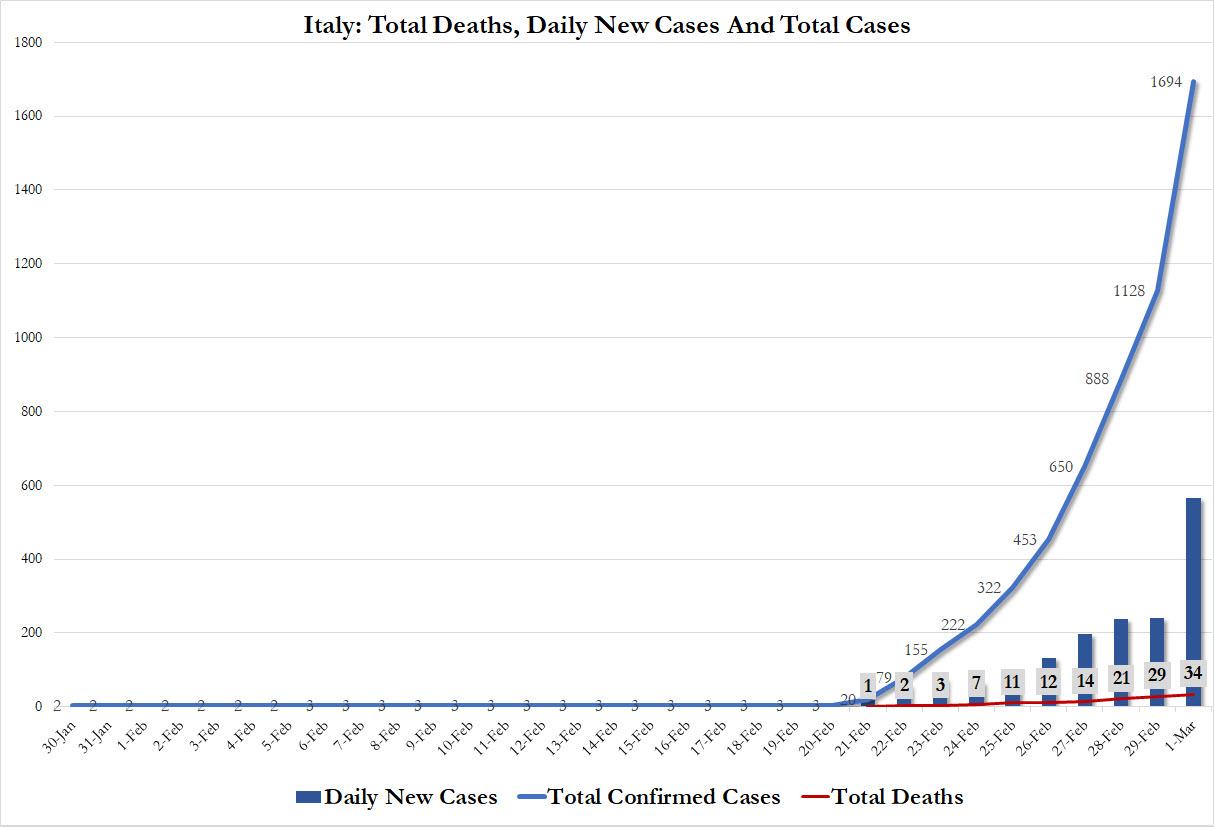

Of course, with events moving fast and furious now, the pandemic situation as of Sunday is far worse than where it was just on Friday morning, as the drumbeat of viral, so to speak, bad has only gotten more feverish: the US had its first coronavirus related death and admitted it may have a potential cluster of new cases in Washington State, Italy reported a 50% surge in new coronavirus cases…

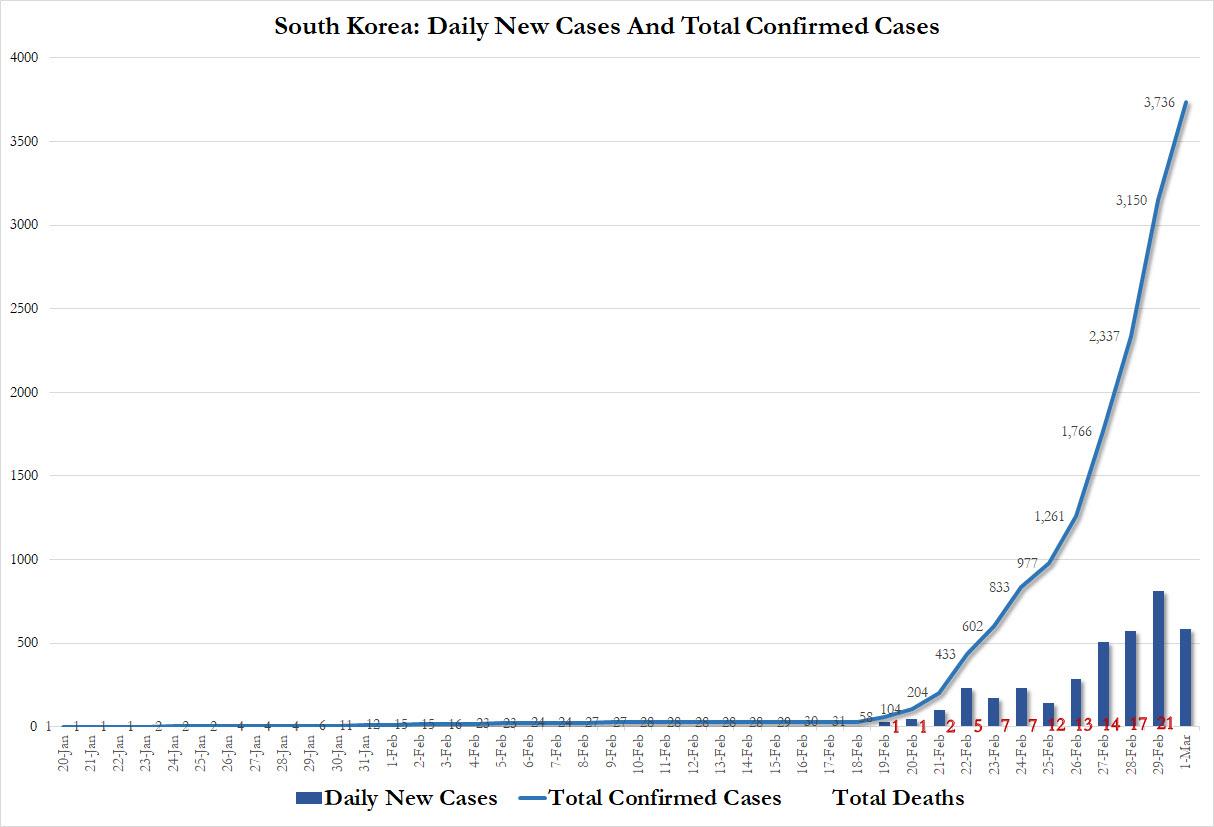

… South Korea also had a surge in new cases…

… and the U.S. and Japan issued “do-not-travel” warnings for affected regions of Italy and South Korea after the U.S., Australia and Thailand reported their first fatalities.

Even before the latest news, the market was already in freefall – despite a furious last minute short squeeze on Friday ahead of a possible Powell statement – with global stock plunging the most since the 2008 financial crisis last week, while commodities tumbled on concern the spread of the coronavirus will tip the global economy into a recession, crippling both commodity supply and demand. In the Treasury market, both 10- and 30-year yields fell last week to record lows.

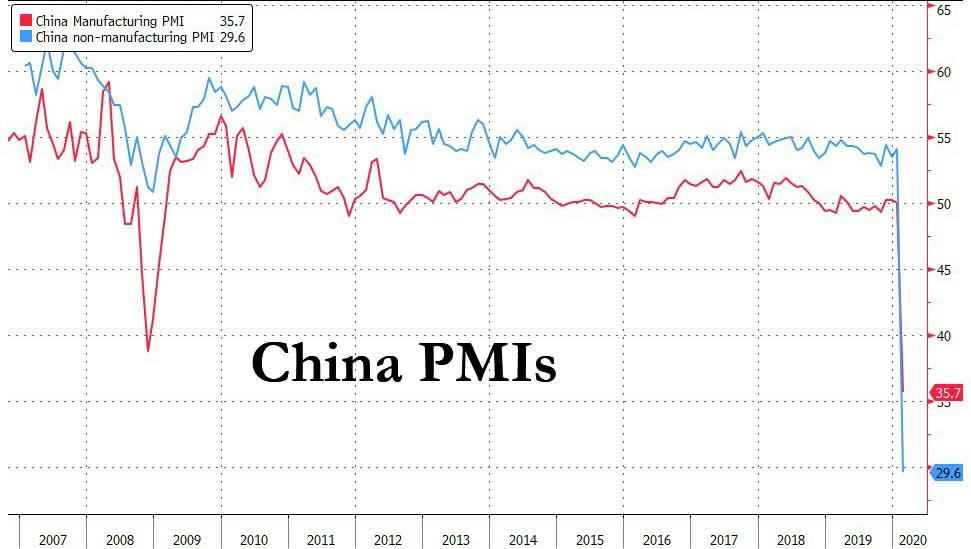

Adding insult to injury, China’s February manufacturing purchasing managers’ index plunged to 35.7 in February from 50 the previous month, much lower than the consensus estimates. The non-manufacturing gauge also fell to 29.6, its lowest ever. Both were far below 50, which denotes not just contraction but potentially recession.

Therefore it is hardly a surprise that virtually every trader is refreshing the federalreserve.gov website every few seconds ahead of what is seen as an inevitable intervention by the Fed, which has always stepped in when there was a sharp market drop in the past 11 years – why would it not do so now?

Sure, one can argue that nothing the Fed can do will actually have a positive impact on what is essentially a rapidly spreading diseases. After all just what will the Fed’s rate cuts do – it’s not like the central bank will print viral antibodies. And yet, the Fed has to do something.

This is the argument made by BMO’s rate strategist Ian Lyngen who over the weekend writes that “The Fed has been boxed into a corner and now effectively must act to prevent financial conditions from tightening even further – this much is obvious even to us. The second-order uncertainty is whether Powell’s put is a quarter-point or a half-point; and, of course, the timing thereof. It goes without saying that the Fed would rather not be pressed into monetary policy service by the market, and if it must, it would be better to do it on the Committee’s terms. This would imply a quarter-point ‘post-preemptive’ ease on the 18th. At this stage however, with the S&P down 15.8% from the peaks and the Dow off 16.5%, such a restrained effort would risk being considered insufficient.”

This, as Lyngen correctly notes, “quickly becomes a self-fulfilling paradox – the easier monetary conditions are, the more investors will require from Powell to remain in risk assets.” Critically, the viral pandemic has now become a test of the Fed’s commitment to using financial conditions as the transparency-inspired decision making policy tool. One thing is certain: there is little chance the Committee reverts to the traditional metrics of domestic growth and inflation expectations; after all, as Bmo concludes, “using those inputs not only would a rate-cut not be on the table for March, but we also wouldn’t have seen the 2019 ‘fine-tuning’ effort which resulted in 75 bp of net easing. Alas, we digress.“

So with the Fed unable to do nothing, consensus is that it will do something. The only questions are what and when?

“There is a sense the Fed will be there for markets, but a lot of that was already priced-in on Friday,” said Steven Englander, Standard Chartered Bank’s head of North America Macro Strategy. Ironically, any sharp easing by the Fed would only result in even lower rates, which could lead to even more selling especially among bank stocks, as yields now indicate a recession is virtually inevitable.

“I can see rates continuing to fall in the near term as there is no sign of a cure or vaccine,” said TD Securities chief rates strategist Priya Misra. “Even though the mortality is lower than SARS, the magnitude and geographical spread of affected people is massive. Add to that travel restrictions and fear.”

And so, with everyone hitting F5 on the Fed’s website, here is a summary of what some of the more notable Wall Street strategists are saying as we countdown the minutes to tonight’s futures reopening which – if the Fed has failed to chime in by then – could be absolutely devastating.

Jason Daw, head of emerging markets strategy at Societe Generale SA in Singapore, wrote in a note:

- “Markets might be partially soothed by Powell’s statement that the Fed will act, but unlike other growth or liquidity induced market sell-offs, monetary policy could be ill-equipped to deal with Covid-19”

- “Whether the market rout last week develops into a full-blown crisis is an open question (Covid-19 news flow will be critical). But the tail risk event everyone was worried about is possibly here in the form of large negative growth shock and it’s time to be prepared and dust off the crisis playbook”

- “If risk assets come under continued pressure, CNY might outperform others, but ultimately there is no safe-haven EM currency in a negative growth shock”

Mansoor Mohi-uddin, a Singapore-based senior strategist at NatWest Markets:

- “Risk assets will weaken Monday morning in Asia because China’s PMI data was worse than the consensus expected. If the U.S. ISM survey later in the day also falls back below 50, signaling the coronavirus was already affecting U.S. corporate sentiment in February, then financial market expectations for Fed easing before March’s FOMC meeting will increase further”

- “Central banks will wait to see what the Fed does first before using their own limited ammunition”

- “The market will focus more on the rapid spread of the coronavirus while Super Tuesday will be seen as a secondary U.S. risk”

Stephen Innes, the Bangkok-based chief market strategist at Axicorp:

- “The fallout from the China PMI means we are starting the recovery process from a weaker level than thought. The shift from a more Asia-centric to global perspective means a more protracted economic downturn is also negative”

- “Risk-free assets are getting scarce and people will view the best option to stay in cash.”

- “The PBOC response should help, given the dreadful PMI. I expect much more policy front-running, with RRR cut and guidance for a 15-basis-point cut in the OMO rate.”

- “Powell was unusually dovish on Friday and I expect a stream of Fed speak to confirm this pivot before Friday’s blackout period”

- “The week will start horrible, but may improve on central-bank pivots, with a coordinated G-20 fiscal pump not out of the question”

Patricia Ribeiro, a New York-based senior portfolio manager at American Century Investments:

- “It’s a short-term impact or challenge for the portfolio. The second half of 2020 should get better” as countries respond quickly to contain the outbreak

- “The earnings-per-share numbers are still pretty high. You’re going to see a very significant slowdown in the first half of the year and then that will bounce in the second half”

- “Rates are already low and that’s positive for emerging markets. It’s beneficial for consumption in all of these countries. For me, it’s less about rates coming down more in the U.S.; it’s more about not going up any time soon. If rates were to stay or be around where they are now, it’s definitely a positive”

Richard Segal, a senior analyst at Manulife Investment Management in London:

- “Markets will open down a lot, but more likely because of the virus spreading in the U.S. The Chinese PMI was bad but I don’t think worse than expected. Super Tuesday in the U.S. is also a preoccupation”

- “Until last week, investors were apprehensive about the virus and mainly worried about the impact on the Chinese economy given its status as the locomotive of global growth. However, the mood darkened a lot on Monday when it began to spread more widely in Italy and Korea. This led many to sell at any price and ask questions later”

- “The mood shifted from hoping it could be controlled and contained to expecting the worst. Mainly though, markets are searching for a new base”

Divye Arora, a portfolio manager at Daman Investments in Dubai:

- “Given the increasing spread of virus in the West, we expect global equity markets to remain under pressure. However, the pace of decline would be much lower versus last week as markets seem to have priced in a significant amount of uncertainty in the form of lower consumer demand, travel and supply chain disruptions”

- “We also expect some institutional investors to start buying the dip on expectation of fiscal and monetary stimulus, virus spread being more contained in the West versus China due to the timely response from the respective health authorities and declining supply-chain disruptions in China. Overall people will continue to diversify into safe-haven assets such as U.S. treasuries, gold and the U.S. dollar”

Edward Bell, a commodity analyst at Emirates NBD in Dubai:

- “The virus has just begun to become rooted in other markets such as Italy and, while the economic hit may not be as sharp as in China’s case, it will nevertheless be significantly negative”

- “The fixation for oil markets this week will be the OPEC meeting taking place on March 5, followed by a meeting with partners outside the bloc the next day”

- Despite the collapse in prices, speculative net longs in both Brent and WTI rose last week as investors may have expected crude prices to have hit a bottom

- “As many of these new long inflows will have burned by the price decline last week we may see another round of selling pressure in the coming days if doubts grow about how committed OPEC+ is to limiting production”

Han Tan, a Kuala Lumpur-based market analyst at FXTM:

- “Equities are set to continue hogging the limelight over the immediate term. Although a lot of the coronavirus-related pessimism has been discounted over recent sessions, investors will be wondering if the correction may eventually give way to a bear market, though perhaps not at the same ferocious pace that we saw last week”

- “With China reporting its lowest ever manufacturing PMI, the hard economic data from around the world is not expected to provide enough resistance against the rising tide of risk aversion in the markets”

- “The risk-off theme is expected to remain dominant, until the coronavirus outbreak can show material signs of stabilizing”(Updates with currency market open)

Finally, courtesy of Macrohive’s George Concalves, here is a twitter thread describing where the Fed finds itself and what its options are:

Many investors are expecting Fed (coordinated or not) to do something soon (perhaps before futures open). There has been a lot of debate that CB easing can’t resolve health issues, but they can help sentiment. Here’s what may happen next.

Backdrop1: Long gone is the façade the Fed will ignore sliding financial conditions (regardless of driver). Its not much, but the Fed has some flexibility on rate policy side but more importantly can come up w/some creative solutions in its use of the powers granted under 13 (3)

Backdrop2: One of the reasons why the Fed needs to be preemptive is because some of its crisis fighting abilities have been damped post GFC due to Federal Reserve Act section 13(3) revisions per DFA. That said, from what I understand they could still launch ABC facilities.

Backdrop3: In the early days of GFC the Fed resorted to tweaks versus all out easing measures or launching new facilities. In August 2007 it cut the discount rate and not the FF rate and in Jan-2008 did a 75 bp intra-meeting ease (followed by another 50bp at the meeting).

Old School Fed: I found this Min-Fed posting (see tinyurl.com/rgyeklr) as a good historical review of potential Fed crisis fighting usage of section 13(3), also see link at the end “Lender of more than last resort” for how the discount window evolved, more later…

Old Fed playbook1: In the ’02 Bernanke report on deflation (see tinyurl.com/qmyto8g) he provides a laundry list of what they can do to stimulate the economy/markets. We have pretty much done all of them except for buying foreign bonds. Meanwhile Fed can buy munis too.

Old Fed playbook2: Since September 2019 the Fed has been providing liquidity with TOMO repo operations and TRM bill purchases (ie notQE). At a minimum the Fed will be inclined to keep these programs for a while longer (and abort tapering repo) while introducing new tools.

New Fed playbook1: In my view there is a risk of an intra-mtg ease (as early as today vs allowing mkts to freefall). First off this is a public health concern, but COVID disruptions run the risk of hitting biz CF/working capital. The Fed can encourage discount window use.

New Fed playbook2: Given JPM & Quarles want to break the DW stigma (see tinyurl.com/qqpbkzx) Fed could announce it reduces the DW rate to 25bp or even 0 over FF (vs 50) for large banks, maybe further for smaller banks if funds are used to help industries hit by COVID

New Fed playbook3: 17 days is a long time to wait for levered investors, so expect FF rate to come down 50bps too (would make DW rate cut be 75-100bp). The Fed could gauge how these measure work as well as monitor COVID into 3/18 where it could always do more if needed.

DEFCON1: Its too early to forecast COVID’s eco-impact and if there is multiple waves. But Fed is on track to move to DEFCON1 in table (see tinyurl.com/sq65skd) if so they will end up with new ABCs, ZIRP (with tiering) eventual YCC, & credit easing (MBS, CP, & munis).

Tyler Durden

Sun, 03/01/2020 – 15:43

via ZeroHedge News https://ift.tt/2PzzYEo Tyler Durden