Fed Capitulates To Stock Vigilantes: Goldman Sees Two More Rate Cuts In Next Month

It’s damage control time for Jerome Powell: having cut 50bps on Tuesday, it’s first 50bps emergency, intermeeting rate cut since Oct 8, 2008, the peak of the financial crisis (which in turn followed another panicked, 75bps rate cut when Jerome Kerviel put on a couple of terrible trades and blew up SocGen), stocks jumped… for about 10 minutes and then crashed, leading to an outcome which BMO politely said was “not what Powell had in mind.”

A less polite observation is that Powell’s Fed – which for a few months appeared ready to undo the idiotic boom-bubble-bust policies of previous Fed chairs only to fold like a Made in Wuhan lawn chair after a little pressure from markets – finally shat the bed, and not only deployed a “bazooka” which turned out to be a sad water pistol, but the central bank now has about half the dry ammo it had this morning and stocks are tumbling.

And now, in just two short weeks the Committee will be faced with an even more difficult decision of either underwhelming investors’ expectations or quickly utilizing the limited rate-cutting potential afforded by the low outright yield environment.

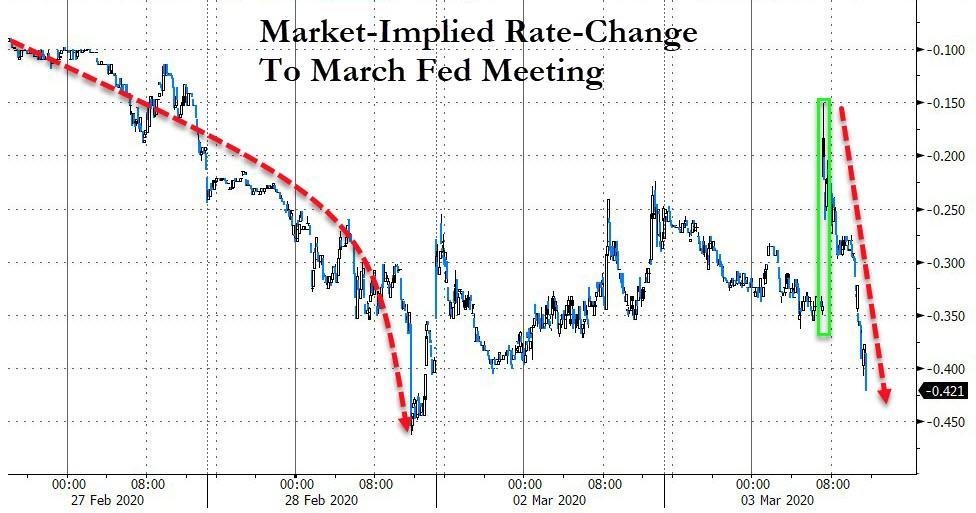

Sure enough, having once again capitulated to the stock vigilantes, the market has already spoken and it will keep tantruming until it gets another 40bps, or almost two full rate cuts, in the March meeting, resulting in a fed funds rate of just above 0 entering April.

Goldman agrees: commenting on today’s shocking Fed announcement and market reversal, the bank’s chief economist Jan Hatzius writes that Fed Chairman Jerome Powell stated that risks from the coronavirus outbreak had “changed materially” after he cut by 50bps. He also termed the current policy stance “appropriate,” he also said “we are prepared to use our tools and act appropriately.” And while the near-term policy implications were somewhat ambiguous, in Goldman’s view, “the press conference was consistent with further Fed easing in coming months. We retain our forecast of another 50bp but are now penciling in 25bp moves on March 18 and April 29 (versus April and June previously).”

The full Goldman note confirming that the Fed has now capitulated to the stock vigilantes:

1. At the press conference following the Fed’s intermeeting decision to cut the funds rate by 50bp, Chairman Powell stated that the risks from the coronavirus outbreak to the US outlook had “changed materially,” and that the virus would “weigh on economic activity here and abroad for some time.” With regard to future policy moves, his message was somewhat ambiguous. On the one hand, he said that “we do like our current policy stance…we think it’s appropriate to support our dual mandate goals.” On the other hand, he noted that the Fed was “prepared to use our tools and act appropriately,” echoing the official statement. In response to a question on whether rate cuts would be effective in response to a supply shock, Chair Powell argued that Fed action would “provide a meaningful boost to the economy” and would help avoid a tightening in financial conditions. Chair Powell stated that the Fed would do its part to “keep the US economy strong as we meet this challenge” and that it was “possible” that there would be more formal coordination from policymakers going forward.

2. The mixed signals in the statement and press conference left the timing of future rate cuts somewhat ambiguous. Historically, a promise by the Fed to “act as appropriate” in response to a growth shock is a very strong signal of imminent cuts, especially when inflation is low. But Powell also described the current policy stance as “appropriate,” and he said that future changes depend on “the flow of events” and “a range of things.” Uncertainty is high across several dimensions—the Fed’s reaction function, the number of US cases to be reported in coming weeks, the extent of the weakness in upcoming US and global data, and financial conditions. But all things considered, our baseline expectations are an additional 25bp cut at the March 17-18 meeting followed by a 25bp cut in April (previously, we had expected both of these cuts in Q2).

Needless to say, if Powell does miraculously grow a spine by March 18 and for once surprises the market by refusing to be pushed around by stock bulls demanding ever more from the Fed, then watch out below.

Tyler Durden

Tue, 03/03/2020 – 16:35

via ZeroHedge News https://ift.tt/3aoyTqX Tyler Durden