Gold Jumps, Dollar Dumps After ‘Emergency’ 50bps Fed Rate-Cut

Trump wins? … but what is The Fed so afraid of?

Shortly after the G-7 meeting promised to do whatever it takes, and the biggest demand for Fed repo liquidity since the program began…

A desperate Fed has once again met market expectations, The Fed has just announced an emergency 50bps rate-cut.

The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity.

In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent.

The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.

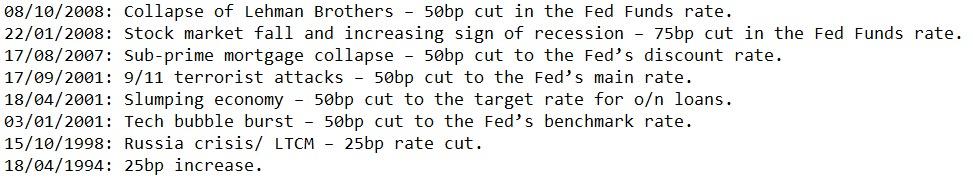

This is the largest rate-cut since the fall of 2008, and just the ninth emergency rate cut in history…

So you have to wonder, just how huge a deal is the virus’ impact on the global economy – despite consensus that this dip in economic activity will almost immediately v-shaped recover back to the new normal?

Stocks are spiking…

But, we note, that stocks are losing their initial gains…

Gold is jumping…

And the dollar is dumping…

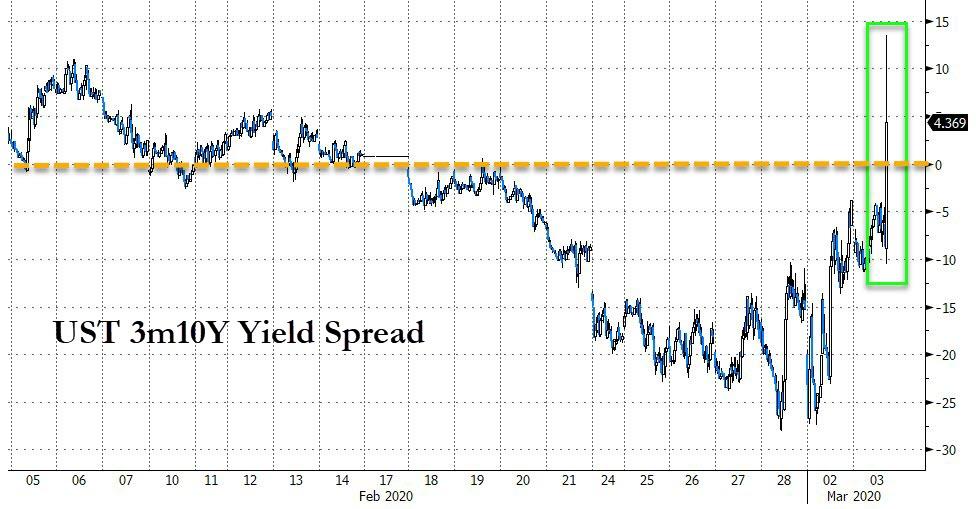

But hey, The Fed managed to un-invert the yield curve…

It seems the current Fed is ignoring the risks that former Dallas Fed head warned of last week…

“Does The Fed really want to have a put every time the market gets nervous? …Coming off all-time highs, does it make sense for The Fed to bail the markets out every single time… creating a trap?”

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, anbd even 2007-2009.. and have only seen a one-way street… of course they’re nervous.“

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?“

the market is dependent on Fed largesse… and we made it that way…

…but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

The market is now pricing in no more rate-cuts in March but a high probability of at least one rate-cut in April.

At 11amET, Powell will hold a press conference.

Tyler Durden

Tue, 03/03/2020 – 10:04

via ZeroHedge News https://ift.tt/2VMYwOl Tyler Durden