Not-So-Super Tuesday: Fed’s Shock-And-Awe Fails, Sparks Market Turmoil

People were already panicking… (empty water shelves at Costco)

And now the market and The Fed are too…

After Friday’s greatest Dow point loss ever was followed by yesterday’s greatest Dow point gain ever, the question is – after The Fed unleashed $100 billion of repo liquidity and 50bps of rate cuts today, but leaving stocks lower – will it work (whatever work means)?

Scott Minerd doesn’t think so.

“While I believe this rate cut is a necessary act, I doubt it is sufficient to bail out the market. Now is the moment of truth…

…We will now see how impotent monetary policy is at addressing this crisis.”

Last week, amid the collapse in markets, Minerd, who is Guggenheim’s CIO, said the outbreak is “possibly the worst thing” he’s seen in his career because of its potential global spread and the Fed’s limited tools to staunch potential economic fallouts.

“This has the potential to reel into something extremely serious,” Minerd told Bloomberg TV last week.

“It’s very hard to imagine a scenario where you can actually contain this thing.”

And no matter what The Fed delivers, it will never be enough as Minerd sees the 10Y Treasury yield hitting 25bps by the time this is over… and another 15% or so lower in stocks.

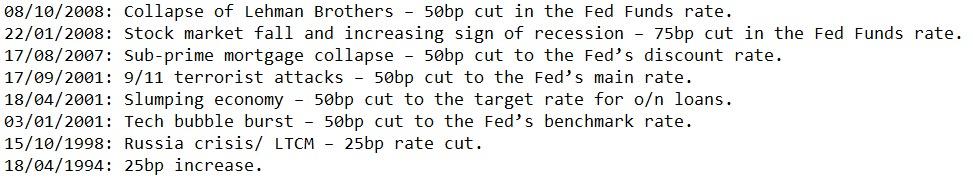

This is the largest rate-cut since the fall of 2008, and just the ninth emergency rate cut in history…

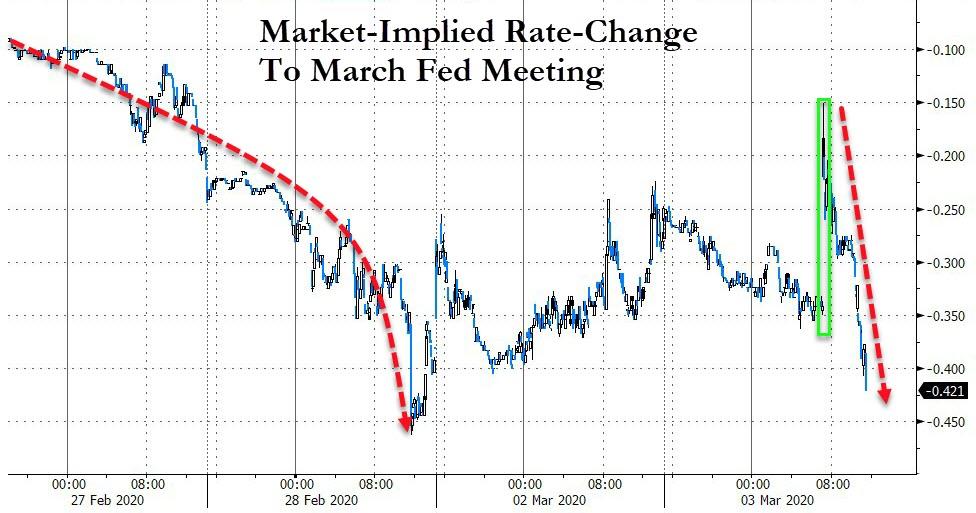

So, The Fed cut 50bps… but the market quickly priced in demands almost two more rate-cuts in March!!

Source: Bloomberg

But lost in much of the hype around the rate-cut was the fact that term and overnight repo liquidity exploded to its highest since the crisis began last September…

Source: Bloomberg

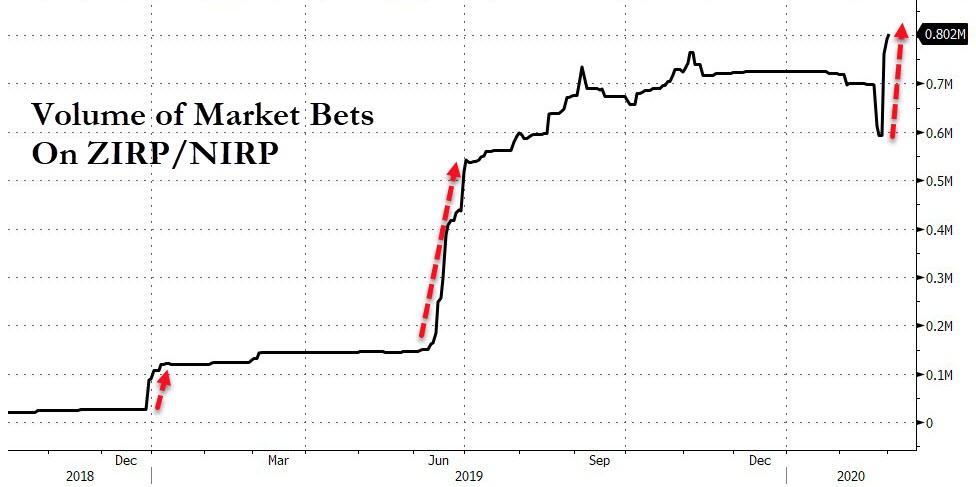

Bets on interest-rates going to zero, or negative, have exploded…

Source: Bloomberg

Believe it: MESTER: FED’S FRAMEWORK REVIEW INCLUDES STUDYING NEGATIVE RATES

And as rates plunged and that headline hit, bank stocks cratered…

Source: Bloomberg

Airline stocks also tumbled back to their lowest close since Oct 2016…

Source: Bloomberg

US markets were briefly exuberant after The Fed cut rates, then the questions began…

US markets also fell back into correction (sub-10%) territory today…

Futures show the real action on the day as buyers panicked into stock on the rate-cut but were devastatingly rejected…

Nasdaq closed below its 100DMA and S&P closed below its 200DMA…

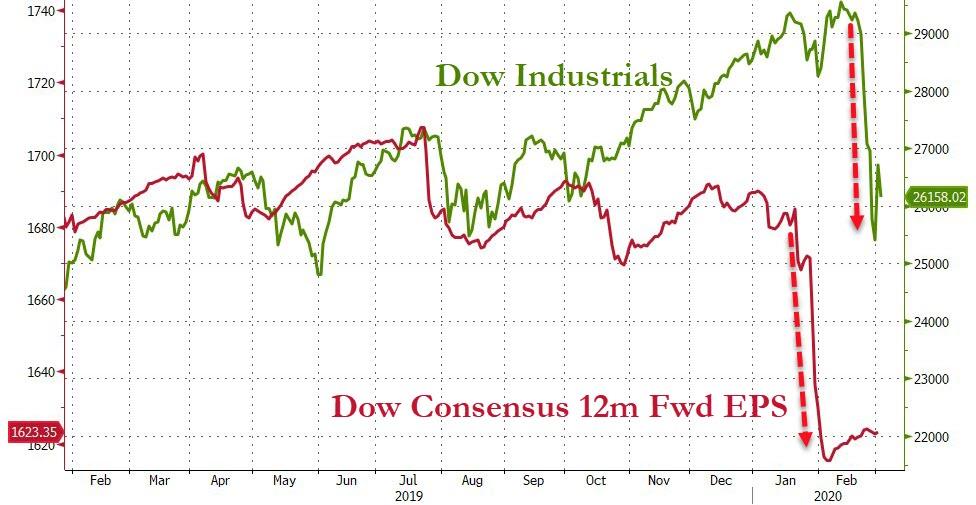

No one should be surprised by this drop… earnings had plunged before it…

Source: Bloomberg

VIX trading was insane today, flash-crashing below 25 when The Fed cut rates, only to explode back higher, topping 40 intraday, before fading back in the last hour…

Source: Bloomberg

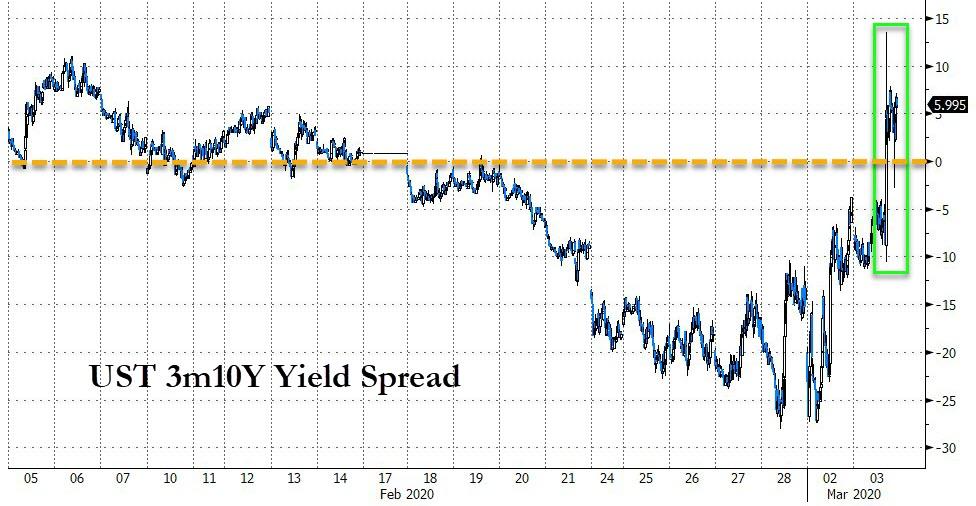

Stocks continue to catch down to bonds’ reality…

Source: Bloomberg

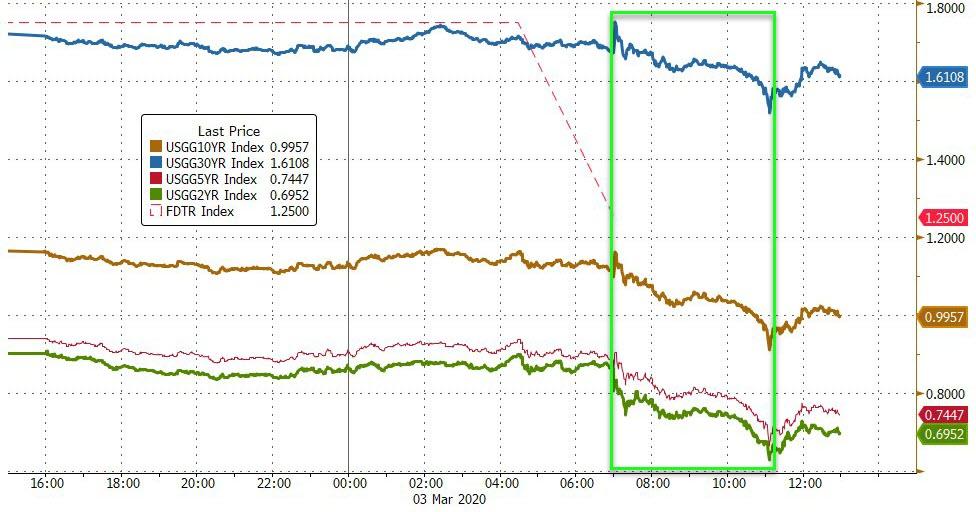

Treasury yields plunged today after The Fed rate-cut…

Source: Bloomberg

With yields at or near new record lows across the curve…

Source: Bloomberg

10Y plunged below the Maginot Line of 1.00% yield…

Source: Bloomberg

The yield curve steepened (as the short-end was utterly destroyed)

Source: Bloomberg

30Y TIPS yields crashed into negative territory for the first time ever…

Source: Bloomberg

The Dollar puked lower on the rate-cut, holding at 4-week lows…

Source: Bloomberg

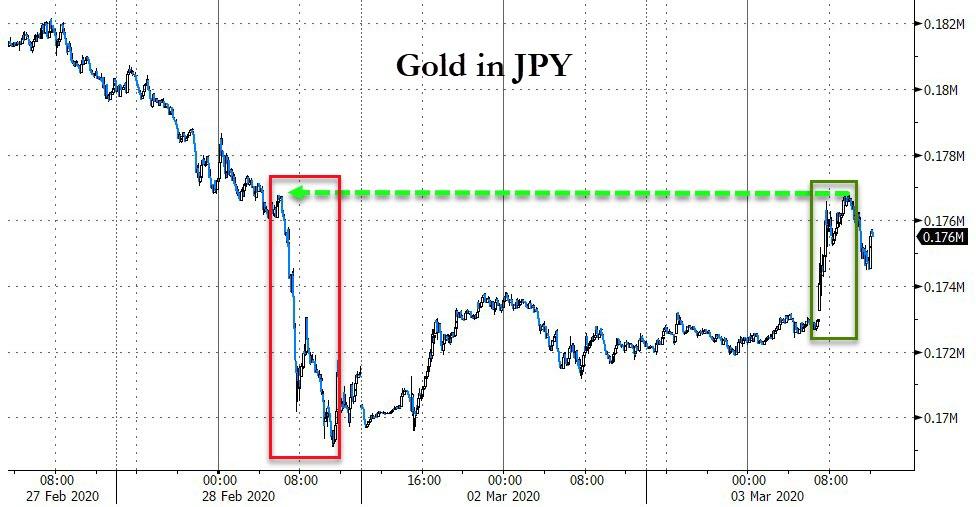

JPY weakened notably against gold today, erasing the forced selling from last week…

Source: Bloomberg

Cryptos rolled over today amid the market slump, with Bitcoin back below $9000…

Source: Bloomberg

Commodities initially all spiked on the rate-cut, then oil and copper plunged as PMs held gains…

Source: Bloomberg

Gold soared higher today after The Fed cut rates, erasing last week’s puke with futures tagging $1650 intraday…

WTI traded up to $48.50 intraday, but ended back below $47.50…

So, finally, we ask, did The Fed just swing from omnipotence to impotence?

The Fed cut rates and the market dropped.

Time for the Fed to go full Costanza and raise rates. pic.twitter.com/2tYfXbUWIY

— Ramp Capital (@RampCapitalLLC) March 3, 2020

It seems an emergency rate-cut of 50bps has done more to damage confidence that rebuild it… “what do they know?”

Did The Fed get an early glimpse of this week’s payrolls data?

We wonder what Powell and Trump are thinking?

As Rabo noted earlier, in order to decide what to do after The Fed cut, answer this first, key question:

what level of interest rates is required to incentivize you to risk the death of yourself and your family?

I am sure that there are policy wonks out there who believe they can correctly capture that precise equilibrium level on monetary policy. The point is that lower rates don’t help in this situation at all. If demand is destroyed by people bunkering down at home for weeks, and supply chains being disrupted, all lower borrowing costs can do is help tide businesses over if banks agree to extend loans and credit cards, etc. (as China is already now doing) – and all that does paint us further into the corner we are already in, because those rates won’t be able to rise again.

Of course, if we don’t see any major fiscal stimulus then it’s hard to imagine how one can remain too optimistic either.

It seems the current Fed is ignoring the risks that former Dallas Fed President Richard Fisher warned last week…

“Does The Fed really want to have a put every time the market gets nervous? …Coming off all-time highs, does it make sense for The Fed to bail the markets out every single time… creating a trap?”

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, anbd even 2007-2009.. and have only seen a one-way street… of course they’re nervous.“

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?“

And they will never learn, as we noted above, the market is now demanding more rate-cuts…

Because, as Fisher concluded ominously: “the market is dependent on Fed largesse… and we made it that way… but we have to consider, through a statement rather than an action, that we must wean the market off its dependency on a Fed put.”

And then there’s this… Biden and Bernie all tied up in the prediction markets ahead of tonight’s Primary…

Tyler Durden

Tue, 03/03/2020 – 16:00

via ZeroHedge News https://ift.tt/3cs3aa5 Tyler Durden