“In The Eye Of The Storm”: Futures Plunge On Surge In Virus Cases, California State Of Emergency

The rollercoaster market is back.

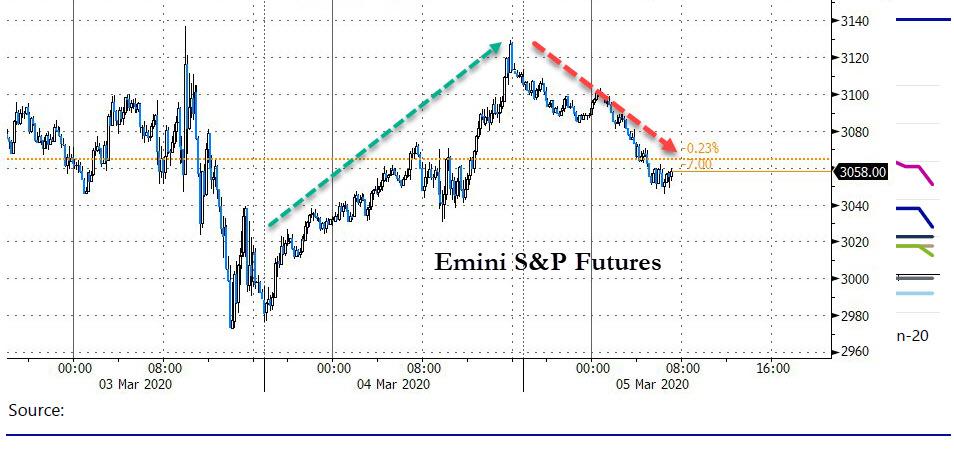

After yesterday’s torrid surge, which saw the Dow Jones soar by nearly 1,200 points for the second day in three, US equity futures tumbled alongside European stocks on Thursday as cases of the coronavirus surged in the US, California announced a state of emergency, Switzerland reported its first covid-19 death, and fears about the pandemic re-emerged front and center as traders once again realized that central banks are powerless to reverse the change in consumer behavior that is shutting down entire parts of the global economy on fears the pandemic will be here for a long time. Treasuries rallied with the yen and gold.

After initially trading higher, European bourses snapped a three-day winning streak with markets in London, Frankfurt, Paris and Milan dropping as much as 1.4% amid mounting evidence of the damage the coronavirus outbreak was inflicting. Meanwhile, in the US, S&P index futures pointed to more pain ahead as E-Minis fell nearly 2% after California declared a state of emergency as coronavirus cases increased.

Europe’s losses came after MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.7% in a fourth day of gains. The gains came after the Dow and S&P 500 surged more than 5% on Wednesday while the Nasdaq nearly matched their gains

“European stocks are now catching with the downward trend, dragged by a wave of profit warnings,” said TFS Derivatives strategist Stephane Ekolo. “U.S. futures are down due to fears the situation could worsen after California declared a state-wide emergency.”

Earlier in the session, Asian stocks blissfully gained for a fourth day, extending their longest rising streak since mid-January, following a 4.2% rebound in U.S. equities. All markets in the region traded in the green with Australia’s S&P/ASX 200 Index enjoying its biggest jump in almost two months, and Japan’s Topix up as much as 1.3%. Trading volume for MSCI Asia Pacific Index members was 20% above the monthly average for this time of the day. While coronavirus infections outside of China accelerated, the epidemic showed signs of easing in the Asian nation, with new cases slowing dramatically and recoveries gathering pace. Remarkably, the CSI 300 Index jumped 2.2% Thursday to its highest level in two years as China is now actively manipulating not just public opinion but also markets.

Conmenting on the volatile market jumps, DB’s Jim Reid writes that “in terms of the virus impact it feels like we’re in the eye of the storm at the moment. We’ve not yet had the number of cases to justify large lockdowns of significant parts of the Western World but given all the contingency plans outlined by the authorities and the constant climb of news cases, it feels like they are coming. Yesterday felt like the calmest day since Italy’s cases started to jump but this will be drawn out over many, many weeks and there will likely be some nasty surprises to come.”

Thursday’s slump follows Wednesday’s surge when US stocks found relief in Joe Biden’s performance in the campaign for the Democratic presidential nomination. Adding to the momentum was an approval by the U.S. House of Representatives of an $8.3 billion funding bill to combat the spread of the coronavirus. The emergency legislation followed a surprise rate cut by the U.S. Federal Reserve on Tuesday. Unfortunately none of this matters for the pandemic, which showed no signs of slowing, with deaths mounting globally.

Risk assets have whipsawed this week, with traders still on edge amid a rise in virus cases around the world and governments extending quarantines and travel restrictions. An industry association warned the outbreak could cost airlines as much as $113 billion in lost revenue. The S&P 500 has rebounded since the Federal Reserve pledged action on Friday, but it remains about 7.5% below last month’s all-time high.

“There is little doubt that the COVID-19 outbreak will slow global growth considerably this quarter, and we expect it to actually produce a rare non-recessionary contraction in GDP,” said JPMorgan which now expects a 50% chance of rates hitting 0% this year. JPM also noted that the bank’s all-industry PMI measure of activity for February slumped 6.1 points, the largest one-month drop on record, and at 46.1 was at its lowest since May 2009.

In response to the economic slowdown, the Fed and Bank of Canada both responded by cutting interest rates by 50 basis points. Markets in the euro zone are pricing in a 90% chance that the European Central Bank will cut its deposit rate, now minus 0.50%, by 10 basis points next week.

“We have to get past the threshold where COVID-19 shifts from panic to headline exhaustion and subsequent news on it becomes more and more of a fade,” Tom Porcelli, chief U.S. economist at RBC Capital Markets. “Then risk assets can move higher in earnest.”

Investors are struggling to find the correct balance between two factors, RaboBank strategists led by Richard McGuire wrote in a note. One is “the need to de-risk on the back of virus-related fundamental concerns,” and the other is “the growing appeal of risky assets in the wake of an unfolding coincidental, or perhaps co-ordinated, global policy response.”

In rates, 10Y Treasury yields fell below 1% again, trading last at 0.9536%, and just 5bps away from record lows hit earlier this week. Yields have fallen for 11 straight days, the longest slide in at least a generation.

In FX, the dollar index softened 0.2%, with the Bloomberg Dollar index sliding below 1,200 and the euro trading at $1.1170, heading back toward a two-month high of $1.1212 hit earlier in the week. The dollar hit a fresh five month low of 106.78 yen, up from a five-month low of 106.84.

In commodities, oil prices rose with OPEC agreeing to cut output by an extra 1.5 million barrels per day in the second quarter of 2020 to support prices, conditional on Russia joining in. Oil prices have fallen around a fifth since the start of the year. Brent crude futures stood at $51.57 a barrel; U.S. crude at $47.16. Gold steadied after jumping when the Fed cut rates. It was last at $1,638.97 per ounce.

Looking at the day ahead now, there are a number of data releases out from the US, including January’s factory orders, weekly initial jobless claims, the final reading for Q4’s nonfarm productivity and unit labour costs, as well as the final January reading for durable goods orders and nondefence capital goods orders excluding air. From central banks, we’ll hear from the BoE’s Governor Carney and chief economist Haldane, the Bank of Canada’s Governor Poloz and Dallas Fed President Kaplan. Kroger and Costco are among companies reporting

Market Snapshot

- S&P 500 futures down 1.6% to 3,064.50

- STOXX Europe 600 down 0.8% to 383.40

- MXAP up 1.3% to 159.92

- MXAPJ up 1.3% to 527.41

- Nikkei up 1.1% to 21,329.12

- Topix up 0.9% to 1,515.71

- Hang Seng Index up 2.1% to 26,767.87

- Shanghai Composite up 2% to 3,071.68

- Sensex up 0.3% to 38,534.38

- Australia S&P/ASX 200 up 1.1% to 6,395.74

- Kospi up 1.3% to 2,085.26

- German 10Y yield rose 1.5 bps to -0.623%

- Euro up 0.2% to $1.1158

- Italian 10Y yield rose 2.5 bps to 0.847%

- Spanish 10Y yield rose 1.8 bps to 0.194%

- Brent futures down 0.7% to $50.79/bbl

- Gold spot up 0.4% to $1,643.49

- U.S. Dollar Index down 0.2% to 97.15

Top Overnight News from Bloomberg

- California declared a state of emergency to give authorities greater leeway in combating the coronavirus. The declaration in the most populous U.S. state followed passage in the House of Representatives of a $7.8 billion spending package to fund measures to combat the outbreak

- Italy announced a nationwide closing of its schools until March 15 as it redoubles efforts to curb the worst virus outbreak in Europe

- Incoming Bank of England Governor Andrew Bailey said the central bank will work hand-in- hand with the Treasury to help the economy withstand the virus fallout

- Michael Bloomberg endorsed Joe Biden for the Democratic nomination as he ended his presidential campaign on Wednesday and pledged to continue working to defeat President Donald Trump. (Bloomberg is the founder and majority owner of Bloomberg LP, the parent company of Bloomberg News.)

- Oil firmed in Asia trade on Thursday after an emergency U.S. spending bill to combat coronavirus lifted optimism on the outlook for demand

- The coronavirus outbreak is re-firing enthusiasm for a debt market that many bond buyers had long since written off.

- The Bank of Japan is likely to consider the introduction of a new lending program to help companies affected by the outbreak of coronavirus this month, according to people familiar with the matter.

- Other Asian governments have stepped up their fiscal response to the virus.

- One of the world’s largest metals and mining giants has tumbled to record lows in the bond market, adding to a growing list of commodity companies that are selling off as the coronavirus epidemic hits demand for raw materials.

Asia-Pac indices rose across the board following the constructive pick up from Wall St where all major indices surged and the DJIA posted gains of almost 1200 points after Joe Biden’s Super Tuesday victory and with sentiment also underpinned by US data, as well as further response measures including the BoC’s 50bps rate cut and IMF’s USD 50bln aid package. ASX 200 (+1.1%) was underpinned by hopes of looming stimulus which Australian Finance Minister Cormann reiterated will be announced very soon and as healthcare tracked the outperformance of the sector stateside which was boosted after Biden overtook ’Medicare for All’ advocate Sanders as favourite in the Democrat nomination race, while TPG Telecom was the biggest gaining stock post-earnings and after the ACCC declared it will not appeal the decision to allow the Co.’s merger with Vodafone. Nikkei 225 (+1.1%) also benefitted from notable strength in pharmaceuticals including Takeda which is developing a coronavirus drug and completed the sale of certain OTC and non-core assets, although further upside in the broader market was capped by an indecisive currency. Elsewhere, Hang Seng (+2.1%) and Shanghai Comp. (+2.0%) conformed to the optimism and eventually outperformed despite early hesitation after the PBoC continued to hold off on liquidity operations and amid a slight increase in the mainland coronavirus cases, while reports also noted local companies and officials were falsely boosting metrics to achieve back-to-work targets. Finally, 10yr JGBs were choppy and initially slumped following the post-settlement declines in T-notes through 136.00 amid a return of corporate issuers to the market, although JGBs later recouped some of the losses following the break helped by the 30yr JGB auction which attracted higher prices before slipping back again to beneath 154.00.

Top Asian News

- Virus Drags Mining Giant Vedanta to Record Lows for Bonds

- China’s Xi Planned State Visit to Japan Delayed Over Coronavirus

- Vietnam May Loosen Trading Rule in UpCom to Boost Liquidity

Initial gains for European equities (Eurostoxx 50 -1.5%) turned out to be fleeting as sentiment remains vulnerable to the ongoing spread of coronavirus and questions surrounding the efficacy of monetary and fiscal responses. Unexpected rate reductions by the FOMC and BoC this were welcomed by the market, however, central bank action thus far has done little to assuage concerns over the supply-side impact from the spread of COIVD-19 with the UK’s Chief Medical Officer today warning that there is now community transmission in Britain and officials are now at the stage of trying to delay the virus’ spread rather than contain it. From a sector standpoint, performance is relatively mixed with energy, materials and consumer discretionary names the laggards, whilst consumer staples and health care names are faring slightly better than their peers. In terms of individual movers, Merck (+1.8%) sit at the top of the Stoxx 600 after earnings which saw the Co. forecast strong profit growth, Aviva (U/C) have also been supported, albeit fleetingly, post-earnings with the Co. posting record profits. To the downside, Capita (-23.9%) are trading with heavy losses as concerns continue to mount over the Co.’s debt levels, Continental (-10.9%) have also suffered post-earnings after posting a EUR 1.2bln loss and noting falling demand for cars, ITV (-10.7%) shares have been dealt a blow after positing soft earnings and revenues for FY19.

Top European News

- ProSieben to Buy Dating Firm Meet Group in Tough TV Market

- Star Banker Collardi’s Past Raises Tensions at Bank Pictet

- Germany’s Merck Predicts Reduced Impact From Coronavirus

- ITV Slides as Travel Firms Delay TV Advertising Due to Virus

In FX, it’s been a steady grind and measured move, but Usd/Jpy and Yen crosses are trending lower again amidst more worrying headlines concerning the coronavirus that have halted a recovery in risk appetite prompted by latest attempts to contain the epidemic and economic fallout. On that note, the BoJ is said to be looking at a new credit facility following the IMF, PBoC and others, while conventional policy stimulus via YCC tweaks and a standard rate cut are bound to be under consideration as well. Usd/Jpy has retreated through 107.00 and now testing Wednesday’s 106.85 overnight low and an October 2019 base close by, while Eur/Jpy is below 119.50 even though the single currency is also trying to extend gains vs the Dollar.

- NZD/GBP/CHF/EUR – All firmer against the Greenback, with the Kiwi making a more decisive break of 0.6300, though probably assisted by a degree of Aud/Nzd retracement after mixed Aussie trade data. Meanwhile, Cable has crossed more resistance levels on the way to and through the 1.2900 handle, like the 10 and 21 DMAs, as Eur/Gbp continues to pull back from another 200 DMA peak. However, 1.2950 and 0.8600 may be tough to breach without additional bullish momentum ahead of more BoE commentary and a speech from EU’s Barnier on the first round of trade talks with the UK at noon. Elsewhere, the Franc is firmer around the 0.9550 axis, but Eur/Chf more restrained either side of 1.0650 as the Euro stages another advance on 1.1200 amidst broad Buck weakness in G10 circles and the DXY losing impetus following yesterday’s upbeat US data/survey releases – index fading ahead of 97.500 and now only just holding above 97.000. Note, however, decent option expiry interest may hamper Eur/Usd between 1.1175-80 (1 bn).

- AUD/CAD – As noted above, Aud/Usd is lagging somewhat within a 0.6637-07 range in wake of trade data showing weaker than forecast exports and imports under the wider than expected surplus, while Usd/Cad remains above 1.3400 following the BoC’s 50 bp ease and ahead of Governor Poloz presenting the EPR later today.

- EM – The aforementioned deterioration in sentiment has derailed recoveries in regional currencies to the extent that the Rand has not been able to reap much reward from a modest improvement in SA business morale or a significantly narrower than anticipated current account deficit.

In commodities, the crude complex was modestly in negative territory for much of the session however recent source reports out of OPEC have bolstered WTI and Brent front month futures substantially, although this has since begun to pair back. The report noted that OPEC have agreed to a 1.5mln BPD cut, which would be above the 1.0-1.2mln sought by Saudi but in-line with some reports yesterday. However, and likely the reason for the pairing in price action, this OPEC agreement is subject to approval from Russia who so-far has not offered much indication of their view. Now perhaps more so than any other point in the week participants remains focused on Russia’s stance, but the likelihood of seeing an update to this today has perhaps been diminished by reports that Energy Minister Novak has returned to Russia; albeit, he will be returning for the OPEC+ meeting tomorrow. Elsewhere, spot gold has been grinding higher throughout the session after trading relatively range-bound overnight. The yellow metal is currently posting gains in proximity to USD 10/oz, but is still a way off recent multi-year highs at USD 1689.29/oz. Gold aside, base metals aren’t too changed on the day with copper seemingly remaining capped by the USD 2.60lb mark but ING believes that metals in general are beginning to show signs of support following this week’s policy action.

US Event Calendar

- 8:30am: Unit Labor Costs, est. 1.4%, prior 1.4%

- 8:30am: Nonfarm Productivity, est. 1.3%, prior 1.4%

- 8:30am: Initial Jobless Claims, est. 215,000, prior 219,000; Continuing Claims, est. 1.74m, prior 1.72m

- 10am: Factory Orders, est. -0.1%, prior 1.8%; Factory Orders Ex Trans, prior 0.6%;

- 10am: Durable Goods Orders, est. -0.2%, prior -0.2%; Durables Ex Transportation, prior 0.9%

- 10am: Cap Goods Ship Nondef Ex Air, prior 1.1%; Cap Goods Orders Nondef Ex Air, prior 1.1%

DB’s Jim Reid concludes the overnight wrap

It terms of the virus impact it feels like we’re in the eye of the storm at the moment. We’ve not yet had the number of cases to justify large lockdowns of significant parts of the Western World but given all the contingency plans outlined by the authorities and the constant climb of news cases, it feels like they are coming. Yesterday felt like the calmest day since Italy’s cases started to jump but this will be drawn out over many, many weeks and there will likely be some nasty surprises to come.

For now markets took a more positive view on the Fed’s emergency cuts from Tuesday, the US government’s funding package, and the Biden surge that we discussed yesterday which continued to draw some sighs of relief in the US market. Overall the S&P 500 closed +4.22% and is now +2.3% above where we were immediately before the 50bps cut and +7.95% above where we were when Powell’s Fed statement came out on Friday night. In fact we’re ‘only’ down -3.12% YTD now. A reminder from yesterday that after the last 7 emergency Fed cuts the median S&P 500 price move has been +2.8% (1 week later), -4.3% (6 months) and -9.2% (1 year). So there is previous form for an initial positive reaction before declines set in. Back to yesterday and defensives that perform well in low-rate environments like utilities continued to lead the US rally higher, but the other big outperformer on a sector basis was healthcare, which may be in response to Biden pulling ahead of Sanders in the nomination race. The VIX dropped another -4.8 points, but still remains over 30 as the market continues to see large daily moves. S&P 500 volumes were the lowest since the selloff began in earnest on February 21st though.

Markets in Asia have also pushed ahead this morning with the Nikkei (+0.71%), Hang Seng (+1.37%), Shanghai Comp (+1.40%) and Kospi (+0.98%) all up. Futures on the S&P 500 are down -0.73% however and yields on 10y USTs are down -4.7bps to 1.013%. This follows the state of California announcing a state of emergency to address the spread of coronavirus where there are currently 53 cases. Hollywood had a similar declaration – with Universal and MGM moving the upcoming James Bond film from April to November (delaying it by 007 months!!) on fears of poor theater turnout. This announcement is another data point as markets continue to get nervous messaging from corporates. Late in the US session last night, United Airlines published plans to reduce flights and impose a hiring freeze on Covid-19 worries while GE also warned on the impact of the virus

Even while it felt calm overall yesterday, big virus-headlines still percolated, especially in Europe. The Italian prime minister said Italy’s health service risks being overwhelmed by the coronavirus. This comes after reports that deaths in the country rose to 107 from 79 on Tuesday and the number of confirmed cases rose over 3,000. Italy announced it would be closing its schools and universities nationwide for the next two weeks in order to tackle the spread of the virus, following other nations with large outbreaks like Japan and China. Even the ECB announced that they were taking precautions, saying that conferences at the ECB would be postponed, with the exception of monetary policy press conferences. Furthermore, non-essential travel by ECB Executive Board and staff members would be restricted until 20 April. Here in the UK, the number of confirmed cases jumped by over 50% yesterday to 85.

Across the Atlantic, Canada’s Public Health Officer cited 33 confirmed cases of covid-19 – all related to travel. Elsewhere China car sales plummeted in February, with data from the China Passenger Car Association showing they fell 80% year-on-year. Overnight, Australia’s Treasury head Steven Kennedy said that “The economic impact of COVID-19 is likely to be deeper, wider and longer when compared to SARS,” while adding, “it will create more risk of a prolonged downturn and fiscal support will be needed to accelerate the recovery of the economy.” Australia’s Treasury and Reserve Bank both expect half a percentage point cut from GDP in Q1 due to the virus and the Australian government is expected to release a fiscal “boost” for the economy in coming days.

In other virus related news, a ship being held off the coast of San Francisco has 21 passengers and crew members which are showing symptoms of the virus. Elsewhere, Hong Kong confirmed first human to animal transmission of the virus as a pet dog of a coronavirus patient has been confirmed with a “low level” infection. In a sign that the virus is continuing to spread in Asia, 12 crew members and 51 passengers on Vietnam Airlines flight have been placed in quarantine over fears the carrier’s employees had been exposed earlier to a Japanese traveler with the novel coronavirus. Meanwhile, Facebook said overnight that an employee in Seattle has been diagnosed with the coronavirus, the first known infection within the company.

Back to markets where 10yr Treasury yields rose +5.2bps to finish at 1.052%, after hitting a midday low of 0.96% – it was the largest one day rise since early February. The yield curve continued to steepen, with the 2s10s curve up by +6.0bps to rise for an 8th consecutive session and is now steeper than any point since June of 2018. Records were also set elsewhere too, with 10yr Gilt yields also falling to a new all-time low, down by -2.0bps to 0.366%. Meanwhile in continental Europe, 10yr Bund yields fell a further -1.3bps yesterday to their lowest level since early September. Italy 10yrs edged higher by +2.5bps.

Even as the virus was spreading through the continent, European equities continued to rally. The STOXX600 gained +1.36% on the day, and is now up every day this week. Banks underperformed however (-0.42%), which came against the backdrop of continued falls in yields. Oil continued selling off, Brent down -1.41%, now down 8 of the last 9 sessions and down over 20% since the beginning of the year, as OPEC+’s Joint Ministerial Monitoring Committee ended with no agreement, with Russia still resisting deeper oil production cuts.

As discussed above and yesterday, Super Tuesday went massively in Biden’s favour and the results were therefore more market friendly. His candidacy was further aided yesterday by the fact that former NYC mayor Mike Bloomberg dropped out of the race, leaving Biden as the sole remaining contender from the more moderate wing of the party, with Bloomberg endorsing Biden as he announced his exit from the race. That said, there’s still a long way to go in this process, with a further 6 states voting next Tuesday, including Michigan – which is a large delegate state that Sanders won in 2016 and is hoping to win to slow Biden’s new found momentum. The week after there’s an even bigger day in terms of delegates, when 4 states including Florida (4th biggest delegate holder) will be holding their primaries. There is another debate right between those two Mini-Tuesdays that will be important for Biden to perform well at if he is indeed going to be the frontrunner. See the note out earlier this week from Karthik on my team for an outline of the process (link here).

The Bank of Canada became the latest to join the ranks of central banks easing policy, and is now the 3rd G20 central bank to cut rates over the last 2 days. The BoC cut rates by 50bps, following the Fed, and in their statement they said that they are “ready to adjust monetary policy further if required to support economic growth and keep inflation on target”, so implying that this is not necessarily the final move lower. Indeed, markets have fully priced in another rate cut by the June meeting so there’s a clear expectation that more will be needed.

Meanwhile here in the UK, incoming Bank of England Governor Andrew Bailey, who’ll be taking over the position on 16th March, said to the Treasury Select Committee that he’d spoken to the Chancellor of the Exchequer and said that “we must act in a coordinated fashion”. That said, sterling strengthened following Bailey’s remarks that more evidence was needed before deciding on policy action, ending the session up +0.48% against the US dollar. Currently markets are pricing in a near 100% chance of a rate cut at the BoE’s meeting later this month, which will be Bailey’s first at the helm.

In terms of data out yesterday, the services and composite PMIs from around the world were the highlight. Looking at the main readings, the final Euro Area composite PMI came in at 51.6, in line with the flash reading and at a 6-month high, while the services PMI was revised down to 52.6 (vs. flash 52.8). Note that the survey for the Euro Area was taken from 12-25th February however, so mostly before the surge in the number of European cases. All eyes will therefore be on the preliminary March PMIs towards the end of the month for the signs of how this has impacted the global economy. There was also positive data out from the US, where the ISM non-manufacturing index unexpectedly rose to 57.3 (vs. 54.8 expected), it’s highest level in a year. Furthermore, the new orders index rose to 63.1, the highest level since it matched that back in June 2018. Once again, the question will be to what extent this deteriorates as the effects of the coronavirus filter through to the economy.

To the day ahead now, and there are a number of data releases out from the US, including January’s factory orders, weekly initial jobless claims, the final reading for Q4’s nonfarm productivity and unit labour costs, as well as the final January reading for durable goods orders and nondefence capital goods orders excluding air. Meanwhile over in Europe there’s the German construction PMI for February. OPEC+ will be officially meeting tomorrow as well to continue discussing cuts. From central banks, we’ll hear from the BoE’s Governor Carney and chief economist Haldane, the Bank of Canada’s Governor Poloz and Dallas Fed President Kaplan.

Tyler Durden

Thu, 03/05/2020 – 07:58

via ZeroHedge News https://ift.tt/2TDYsxA Tyler Durden