Just How Bad Is Market Liquidity

Over the weekend, we warned that as investors hoped for a respite in vomit-inducing swings and soaring market volatility, such hopes would be dashed for one key reason: liquidity in S&P futures was all time low, noting that with “virtually no liquidity, extreme moves to the downside are now very likely which in turn creates a reflexive relationship with risk sentiment, as the lower the liquidity and greater the selloff, the higher volatility surges leading to even lower liquidity, even more selling and so on. In short: absent central bank intervention, it will be virtually impossible for any major player to arrest the market’s collapse.”

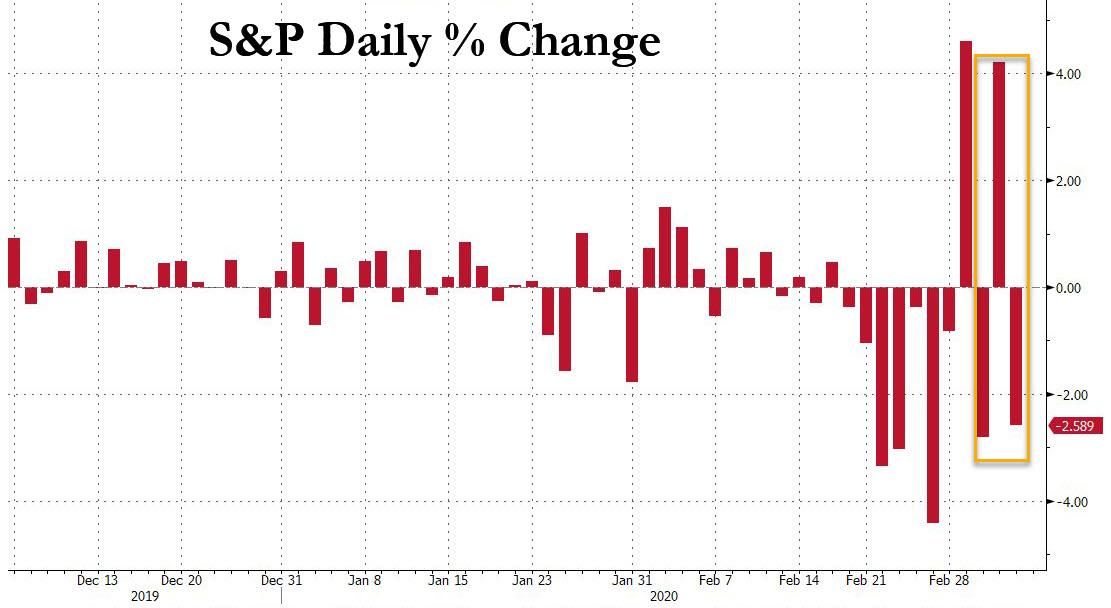

Of course, two days later a central bank did intervene, when the Fed announced an emergency, intermeeting 50bps rate cut. Ironically, in doing so, Powell only made things worse, as liquidity only shrank further resulting in market moves that are now straight out of a rollercoaster with the S&P moving more than 2% every since day since the Fed’s rate cut.

So with the rate cut failing to stabilize markets, and in fact doing the opposite as market depth has absolutely imploded, some – such as Morgan Stanley’s derivatives division – is asking this morning “just how bad is liquidity”

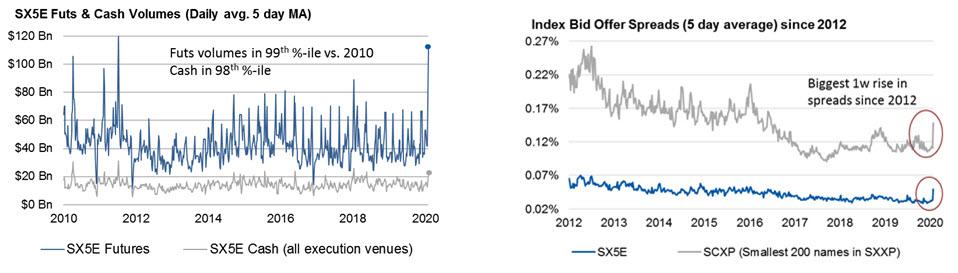

To be sure, looking at indicative European markets, Morgan Stanley notes that, at least optically, liquidity is extremely high – after all volumes are off the charts. However, as we have repeatedly noted, liquidity is not volume (it is how much of a market impact a certain sized order creates). In any case, here is what MS said:

- SX5E futures traded $110bn on average per day over the last week (peaking last Thursday @ $125bn, the 5th highest day since 2010). Left chart below.

- Largest 2 weeks of put options delta traded on record (since 2006) – 2x larger than previous peak.

- SX5E cash market daily volumes were on average $21bn over the last week (98th %-ile) and even SX5E dividend futures are seeing all-time record high volumes.

However, away from the obvious, all is not well and the cost of trading has risen sharply. Widening bid/offer spreads and increased impact of trading is related to a reluctance of market markers to offer or bid for meaningful sizes (less HFT participation is likely related). As a result, we now have a market that is very sensitive to natural supply/demand dynamics.

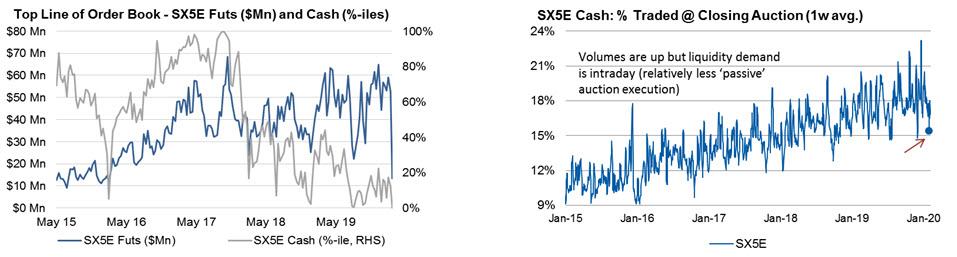

Coupled with increased spreads, another difficulty is the available size in order books. SX5E Futures have been most impacted with an average of ~500 contracts on the top line of the order book over the last week vs. a 6m average of 3,500 (left chart below). Aggregating across single names in the cash market, order books are the thinnest since at least 2015 with the top line now 40% thinner than the 6m average. So, while volumes are high, trading is not easy.

There has also been a sharp relative decrease in the use of the closing auction (right chart). High intraday volatility brings an increase in demand for market-hours liquidity and relatively less passive participation in auctions, all at a time when order books are shrinking!

Options are also seeing record high volumes with $155Bn of SX5E Put delta trading in the last week ($14Bn of gamma, $700MM of vega) and $60Bn of Call delta trading in the last week ($8bn of gamma, $250m of vega) – left chart.

The bid/offer spread in SX5E 2m ATM Put options is much higher vs. the last 6 months (right chart below). Critically, spreads are widening more at the time of day when demand for volumes is highest and the market WANTS to trade – particularly into the EU cash close (market makers may be slow to take overnight gap risk).

Finally, sector-wise, spreads widened most in some of the key Cyclical sectors and hit their 90th %-ile vs 2014 (despite spreads becoming a lot tighter since then). At the theme level, spreads have widened most in the Weak Balance Sheet basket as cash flow concerns are finally starting to drive volatility in the theme higher, and as cash flow fundamentals (now that cash flows are grinding to a halt due to collapsing supply chains) are set to return to market analysis with a bang.

Tyler Durden

Thu, 03/05/2020 – 14:50

via ZeroHedge News https://ift.tt/2VLD8J0 Tyler Durden