“We Don’t Know What’s Going On”: Wall Street Admits It Is Clueless

When the stock market was melting up virtually every day from the launch of QE4 until the end of January, Wall Street’s “expert” strategists always had a ready explanation “why”: solid earnings, strong fundamentals, traders climbing a wall of worry, a global economic rebound, inflation picking up, blah blah blah (just not the Fed, never the Fed as that would mean Wall Street professionals as a group are now worthless in a world where only the Fed matters if stocks go up or down). In short, there was always a reason to keep buying the dip, even when there was no dip to buy.

Then everything changed, and starting in late February, the meltup, which until that point even ignored the second guidance cut by AAPL in 13 months ended with a bang, and volatility exploded. Here too, the experts were ready to “explain” what’s gong on: traders are jittery, they are overreacting to the coronavirus, it’s all the algos’ fault, traders are tumbling down the wall of worry, oh and once Powell eases, everything will be back to normal.

Only, Powell did ease and suddenly the narrative broke down completely when the S&P suffered not one but two 3% drops after the emergency 50bps cut, sparking speculation that the Fed’s bazooka is now a water pistol and the US central bank has been rendered powerless to restore the rally in the face of a microscopic, viral nemesis, one most likely created in a Chinese P-4 bioweapons lab.

And so, suddenly the goalseeking narrative that was meant to “explain” not only what just happened but what will happen, broke down as every explanation failed. Bloomberg put it best:

Pessimism over Fed policy. Optimism over the government’s response. Pessimism over the government’s response. The Beige Book. Joe Biden.

The ink’s barely dry on one view, and the market goes careening the other way. It’s a futile, and infuriating, situation for investors and analysts. Forget about trying to predict where stocks will be in six months or a year. These guys can’t even figure out where they’ll be tomorrow. Everything depends on how the virus outbreak will play out. And nobody has a clue.

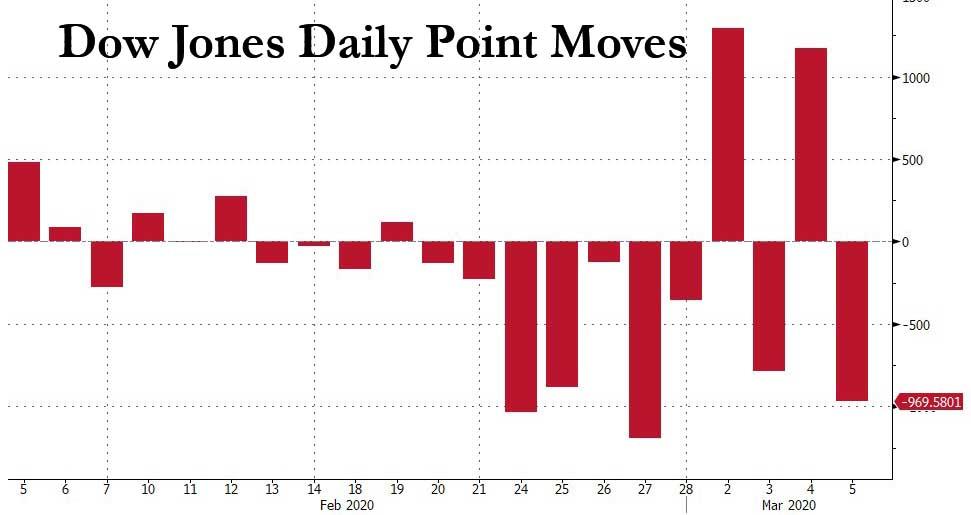

Too lazy to read the quote above? Then look at the chart below showing the market’s harrowing moves in just the past 10 days. It hardly needs an explanation, especially since one doesn’t exist for what is clearly a regime change in market sentiment, one which has resulted in four 1,000 point Dow Jones closing moves in the past ten days (today we were just 31 points away from a 5th)…

… and one where nobody really knows what’s going on any more. But don’t take our word for it.

“When you have a 4.5% up day in the market and a 2% down day – what does that mean?” Kathryn Kaminski of AlphaSimplex Group told Bloomberg. “It just means we don’t know what’s going on.”

That may be the first honest analyst assessment we have read in the past week – one which admits nobody has a clue. Indeed, anyone who has pretended to have an idea of what the market will do next, has been humiliated: as Bloomberg notes, the past ten days has seen a burst of historical turbulence, with swings that rank with those observed during the financial crisis. The VIX, has remained above 30 for six consecutive sessions, the longest streak since 2011, and is poised to close above its EM counterpart by the most on record, based on data going back to 2011.

Yet this is hardly the first time when markets have seen an explosion of volatility after a volumeless meltup – surely the old faithful maxim will work now as it did every time before. We are talking of course about “Buy the dip?“

Or maybe not: “This time, it’s a little harder to say whether that’s the right thing to do,” said Chris Zaccarelli, CIO at Independent Advisor Alliance. “Until you have better clarity on whether or not it could cause a recession or a dramatic slowdown, the likes of which the bond market is indicating, it may be a little premature.”

Some are actually doing the opposite, and selling the rip:

Cantor Fitzgerald says use any rally based on central bank actions to sell equities. JPMorgan Chase & Co. says the responses will succeed: time to wade in. Bloomberg Intelligence’s Gina Martin Adams points to a spike in high-yield spreads — bad for shares. Deutsche Bank Securities Inc. strategists see the sell-off continuing.

So with everyone clueless, perhaps the history books have some insight? As Bloomberg notes, citing Deutsche Bank analysts, in times when volatility increased relative to historical levels, it’s taken an average of six to seven weeks for it to subside, with the S&P taking another four to five months to recoup losses after that. A 30% drop from recent peaks, their most severe scenario, corresponds to an average recession sell-off.

Elsewhere, Citigroup said it’s unwise to do anything before data catches up with the virus, including earnings revisions. “We admit that we cannot fully capture what are fluid developments,” the group led by Tobias Levkovich wrote in a note.

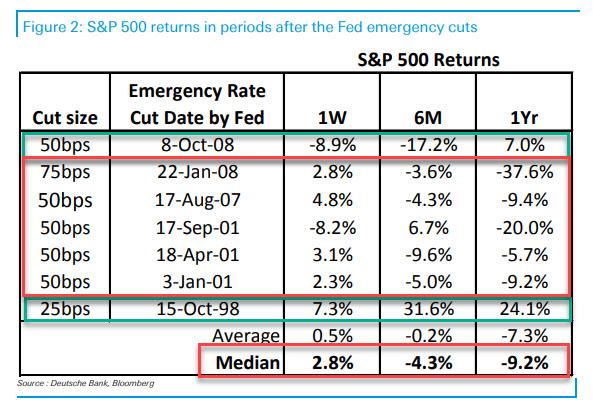

Perhaps it’s already too late, as suggested by the Fed’s emergency rate cut – something that has historically happened just ahead of recessions, and which as we showed last night, has resulted in a down market 1 year out on 5 out of 7 times after an emergency cut.

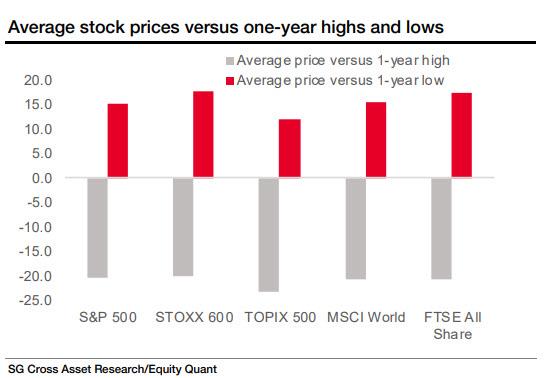

For some the recession is already here: on Monday SocGen’s Andrew Lapthrone showed that the average stock is already in a bear market, down 20% from its all time highs if still 15% above their one-year lows, .

Other companies will soon follow: a string of corporations have warned of hits to profits but few have said how big. Goldman Sachs and JPMorgan have cut their earnings forecasts in recent days. Cumberland Advisors, a money management firm with over $3 billion in assets, has taken down its projections three times, according to David Kotok, the firm’s chief investment officer.

“We aren’t getting guidance from companies because companies don’t know what to give,” Kotok told Bloomberg TV this week. “But we do know pain is coming on the earnings front.” The firm projects earnings of $160 for 2020, but may lower them again, he said. “We don’t know what the final numbers will be.”

That said, we do know know that virtually every firm with direct exposure to China expects a collapse in revenue as supply chains implode.

We also know that Wall Street’s traditional ability to come up with any ridiculous story to explain what has happened, and to predict what will happen, is now crushed: “It’s definitely volatile. Once things get to this point, it normally takes a few weeks for things to settle down,” Michael Shaoul, chief executive officer at Marketfield Asset Management LLC, told Bloomberg TV. “All we know now is that we don’t really understand what’s going to happen next. It’s probably 4, 6, 8 weeks before we’re going to have any useful information as to what the trajectory of the virus is or what the actual economic fallout looks like.”

In conclusion, we will note that this is the perfect environment for talented if unknown traders to emerge from the crowd of mediocrity and to impress with their returns. Unfortunately, few if any such cases have emerged, and we can only assume that that is due to more than one generation of trader having been so habituated to getting bailed out by the Fed every time the market drops, that virtually nobody has any clue what to do when the market finally does crash.

Tyler Durden

Thu, 03/05/2020 – 17:45

via ZeroHedge News https://ift.tt/32TJOX6 Tyler Durden