Carnage Crushes Credit, Crude, & The Yield Curve As Fed Admits “Credibility Eroding”

The global equity market cap collapsed by a record $9tn – or two-thirds of China’s GDP – in 9 days, while global; sovereign 10-year bond yields crashed below 1.00% for the first time ever…

Source: Bloomberg

Even the veteran-ist of veteran traders were shocked by this week’s moves…

“Panic moved up a few notches from already extremely high levels,” said one trader today,

“I thought last Friday was the blow off top and then a few times this week before today but now its beyond belief,” he said, noting the rally in 30-yr to all- time lows.

The flip from Extreme-est Greed to Extreme-est Fear was unprecedented…

Or put another way…

But the real shock was from Federal Reserve Bank of St. Louis President James Bullard, who admitted central banks are losing their credibility rapidly: “Many central banks have consistently missed their stated inflation targets to the low side for many years… Critically, the central bank has to be able to actually deliver the required.” Which means…

“Credibility of central banks, instead of improving over time based on the achievement of stated goals, seems to be eroding instead.”

That’s quite an admission but 100% correct and this week’s carnage after an emergency 50bps rate-cut did nothing to calm fears is a perfect example…

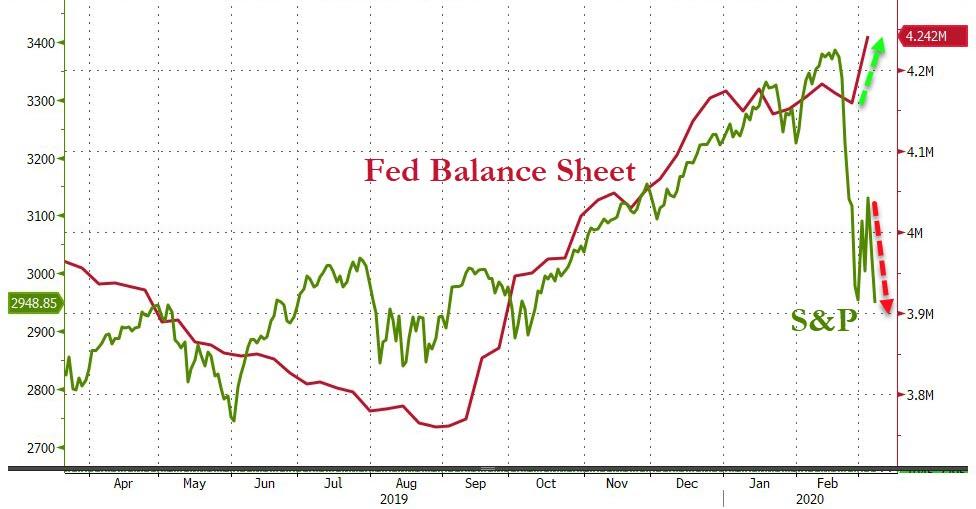

And despite a huge resurgence in the Fed’s balance sheet, stocks were not playing along at all…

Source: Bloomberg

Today was quite a day across every asset class. We gathered some of the most shocking market move headlines of the day for some perspective:

-

GLOBAL CONFIRMED CORONAVIRUS CASES SURPASS 100,000

-

EUROPE DEBT RISK GAUGE EXTENDS RISE TO HIGHEST SINCE JUNE 2016

-

GERMANY’S 10-YEAR BOND YIELD FALLS TO RECORD LOW

-

GERMANY’S 30-YEAR BOND YIELDS FALL TO ALL-TIME LOW

-

EUROPE SENIOR FINANCIAL DEBT-RISK JUMPS MOST SINCE 2018

-

JPMORGAN EMBIG DIVERSIFIED SOVEREIGN SPREAD RISES ABOVE 400 BPS

-

EMERGING-MARKET USD SOV.-BOND PREMIUM JUMPS MOST SINCE 2011

-

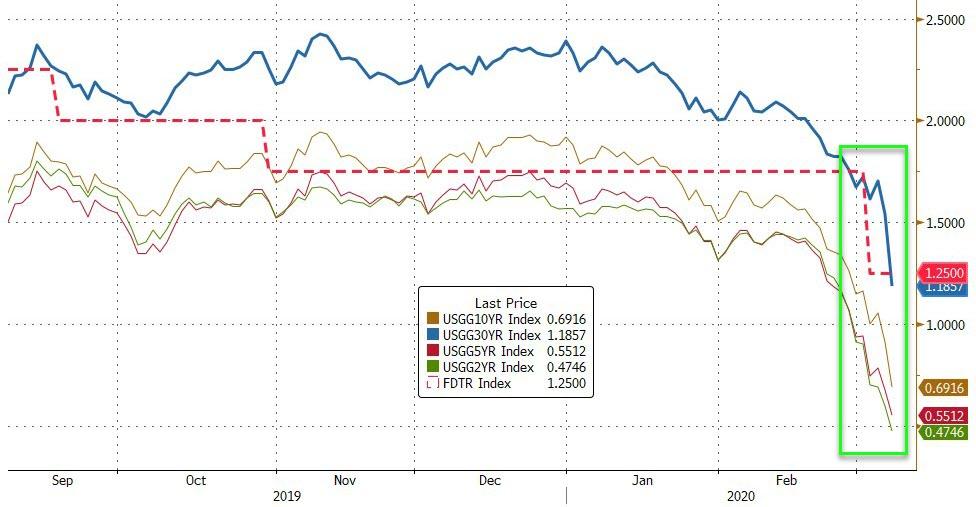

U.S. TREASURY 5-YEAR YIELD FALLS BELOW 0.50%

-

U.S. 30-YEAR YIELD FELL AS MUCH AS 30BP ON INTRADAY BASIS

-

U.S. 30-YEAR YIELD SET FOR BIGGEST ONE-DAY DROP SINCE 2009

-

U.S. CREDIT MARKET FEAR GAUGE SURGES MOST SINCE AT LEAST 2011

-

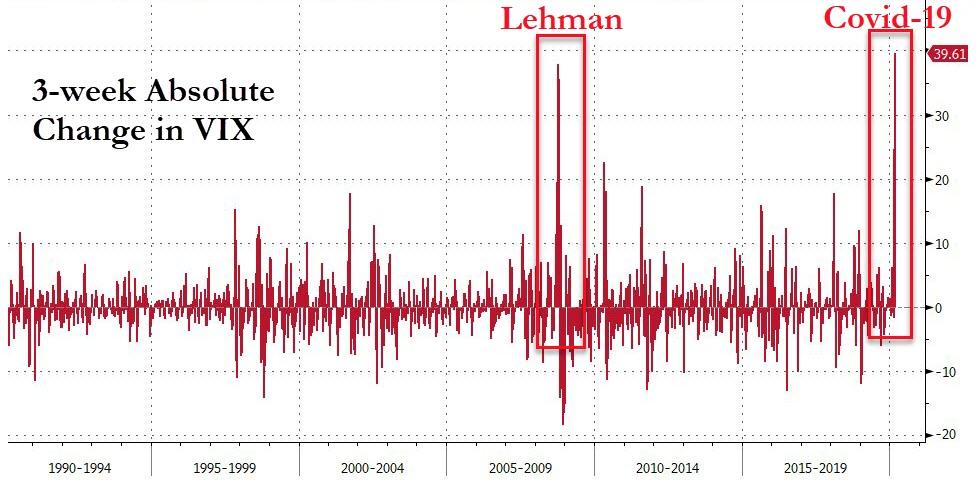

VIX’S 3-WEEK CHANGE IS BIGGEST EVER – BIGGER THAN LEHMAN

-

WTI CRUDE FUTURES DOWN 10.% – BIGGEST FALL SINCE 2014

For some context – the recent bond market collapse has never, ever happened before…

If you can tell from my tone, this troubles me, so I went back and looked into this, we have never had a 50% change in 10y yield levels in either direction over a 2-wk window. We have had larger rallies (yup in 4Q08) but nothing comes close to cutting rates in half this fast… https://t.co/tP2fJAdbvf pic.twitter.com/8308IzVmwW

— George Goncalves (@bondstrategist) March 6, 2020

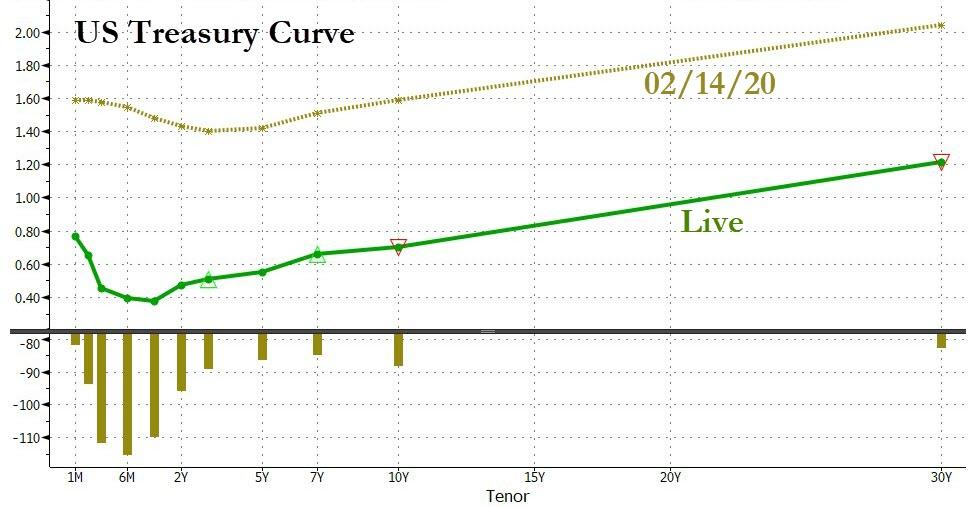

And as The Fed cut rates, the 30Y Yield chased it down, along with the rest of the curve…

Source: Bloomberg

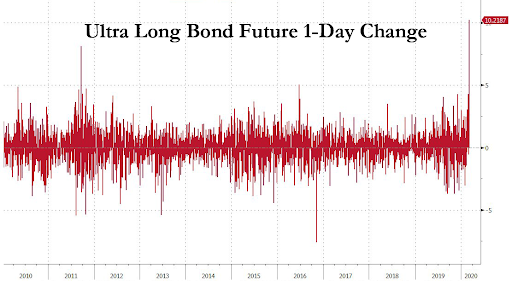

As Nomura’s Charlie McElligott details, panic moves in US Rates as Duration / Convexity goes “offer-less,” with 10Y yields hitting a fresh record low of 0.6932%, multiple “limit-UP” halts in UST Ultra bond futures and 30Y UST yields crashing down -22bps at the extremes (5s30s was flatter by -14bps at one point) in an investor climate that is fixated on “imminent global recession” via pandemic “lock-down”-NYT piece stating that over 2700 people have quarantined themselves in New York City, while new cases in S Korea frighteningly re-accelerate

This obviously has the look of a Rates “convexity-event” (forced hedging / buying at the highs from mortgage investors, insurance companies and those who are “short options”—i.e. all the Vol dealer desks selling low-strike receivers for the past few years, or the market makers short those 350k ED$ “Par Calls” for Jun expiry!)…

…but this is also a simple function of OIS markets now pricing-in a full ADDITIONAL 50bps rate cut on March 18th from the Fed already, as well as the obvious dynamic where “Rates are your everything hedge” from cross-asset investors (i.e. Equity L/S investors buying ED$ upside).

Source: Bloomberg

Today was also the biggest single-day jump in the Ultra Bond Future ever…which prompted fears of a major macro fund blowing up.

Source: Bloomberg

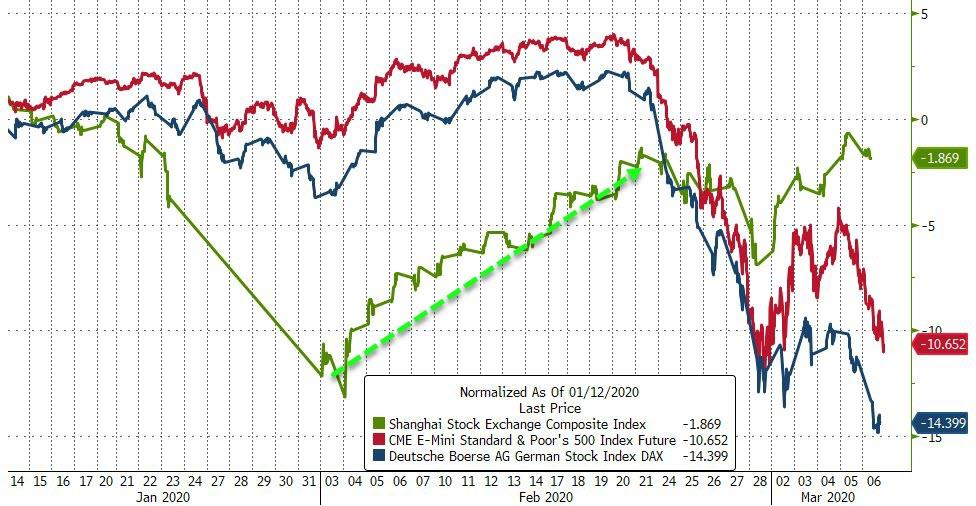

China is still massively outperforming US and Europe since the start of the Covid-19 crisis…

Source: Bloomberg

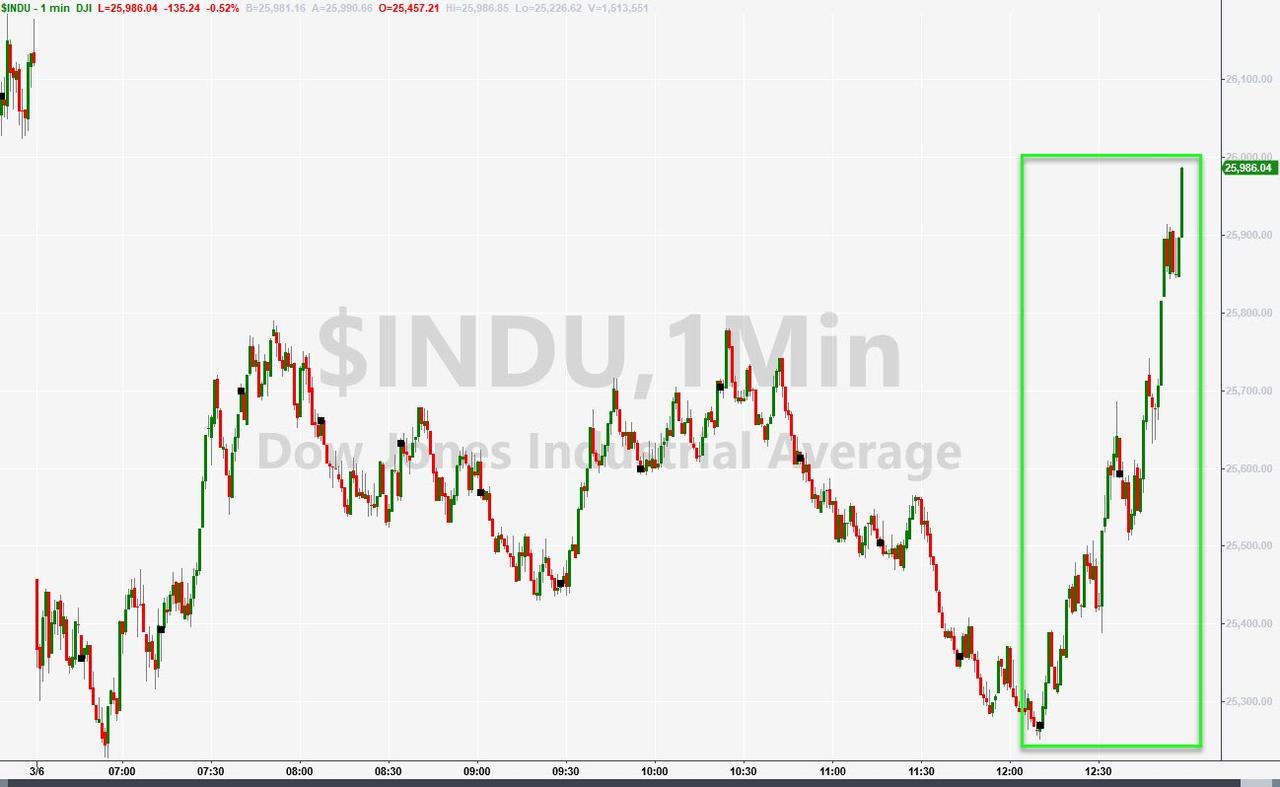

Today’s US equity market carnage sent all the majors into the red for the week, but the last 30 minutes saw the machines work ultra-hard to get the Dow, S&P, and Nasdaq green…

Was The PPT in the house again?

Somebody do something!

Another late-Friday panic-buy?

The Elon Musk Ramp? “The coronavirus panic is dumb”

So are we due for a bounce now?

Source: Bloomberg

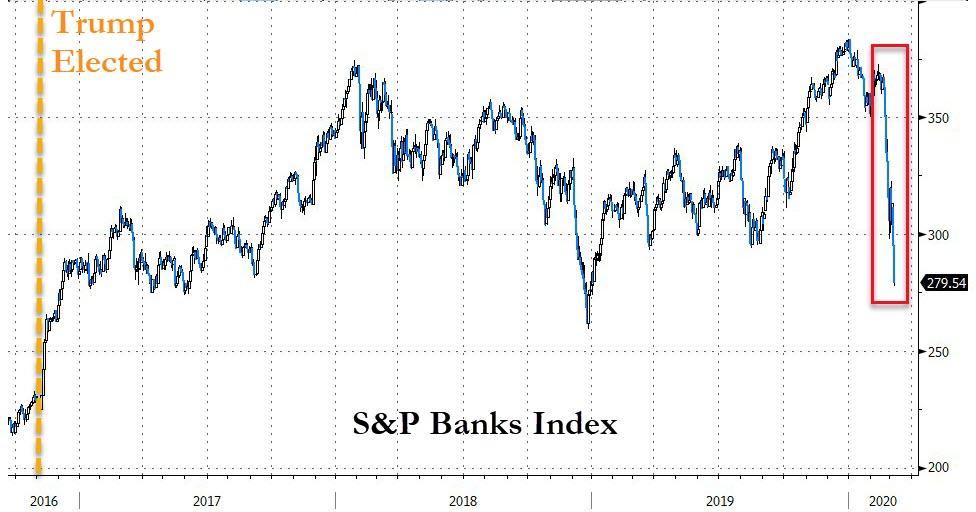

US Banks have now crashed over 27% from their early Jan highs…

Source: Bloomberg

The biggest US banks have been bloodbath’d…

Source: Bloomberg

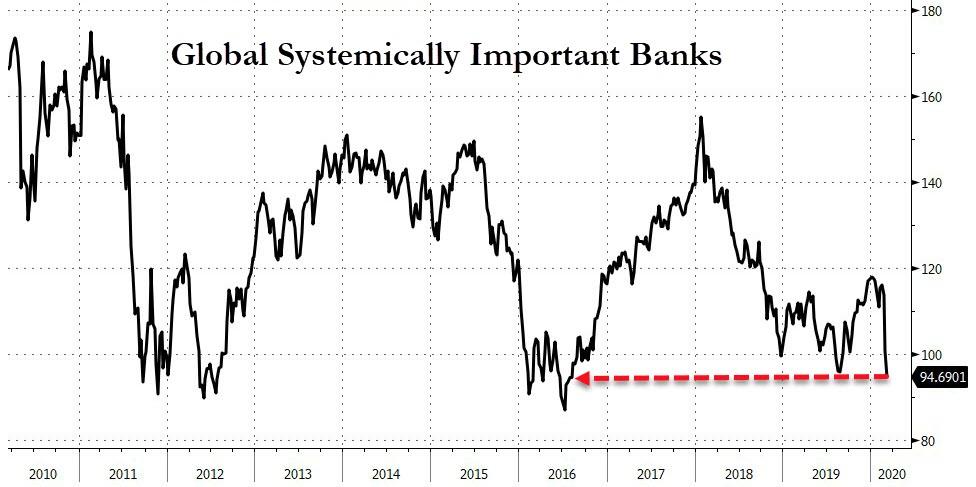

But, more worryingly, Global Systemically Important Banks stocks have crashed to their lowest since 2016…

Source: Bloomberg

While energy stocks were already getting clubbed like baby seals, the last two weeks have seen them collapse 22%…

Source: Bloomberg

MAGA Stocks have now lost over $750 billion in market cap (Note that the Q4 2018 collapse wiped just over $1 trillion)…

Source: Bloomberg

The week saw defensives dominate as cyclicals were hammered…

Source: Bloomberg

VIX topped 54 intraday for the first time since 2009…

This is the biggest 3-week surge in VIX… ever…

Source: Bloomberg

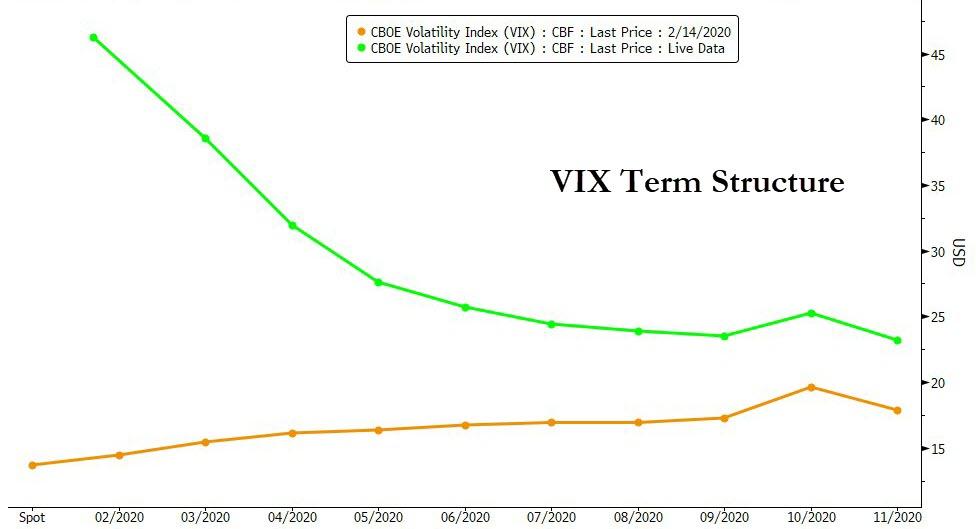

The VIX term structure is in massive backwardation…

Source: Bloomberg

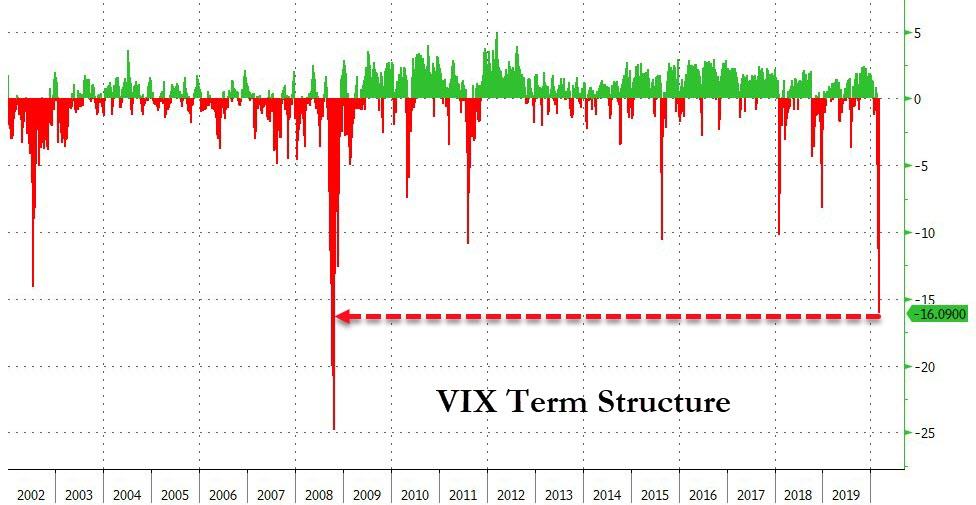

The VIX Term structure hasn’t been this inverted since Lehman…

Source: Bloomberg

Europe’s VIX exploded this week, closing at its highest since the 2011 crisis…

Source: Bloomberg

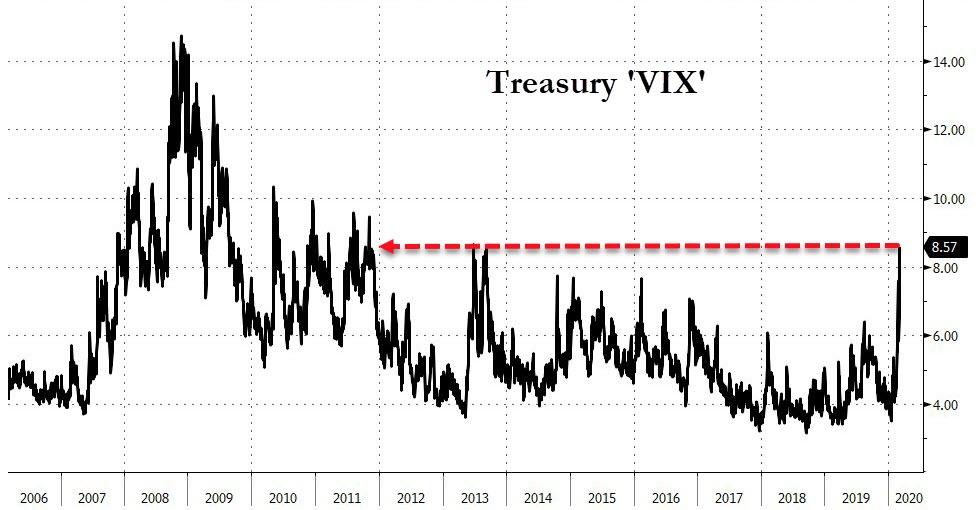

Treasury ‘VIX’ surged today to its highest since 2011…

Source: Bloomberg

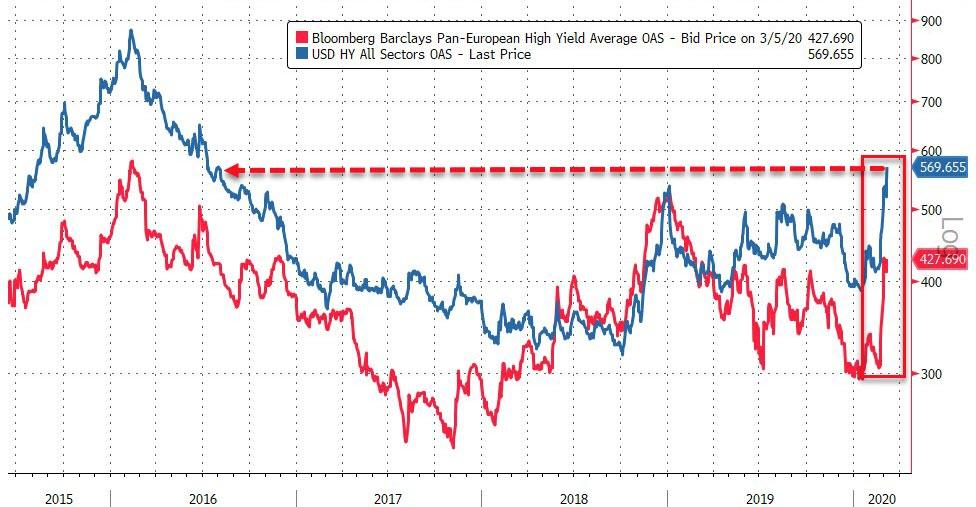

Credit markets were a bloodbath this week, with both HY and IG blowing out in US and EU…

Source: Bloomberg

And if you thought that credit’s biggest blowout ion a decade was notable, it’s nothing if it starts to catch up to its capital structure colleague on risk…

Source: Bloomberg

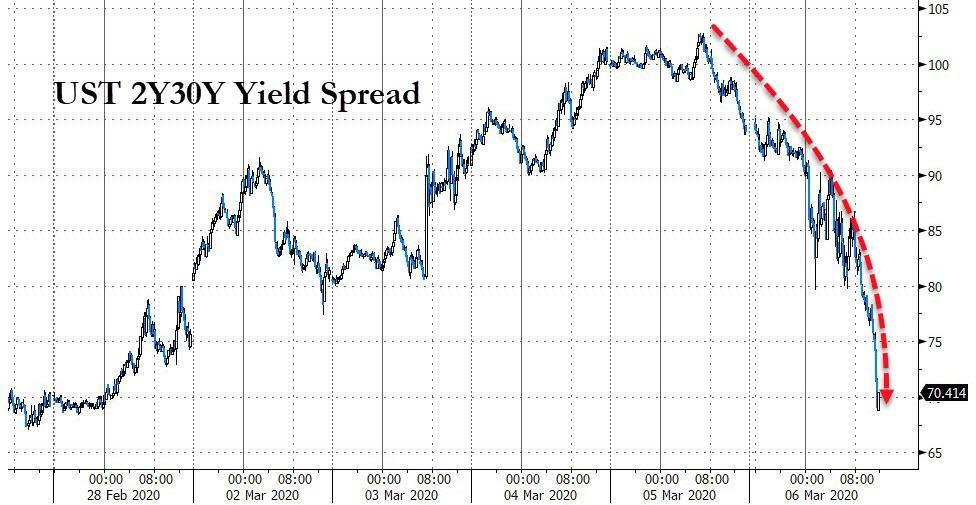

US Treasury yields collapse this week was nothing short of stunning with the entire curve down 40-50bps!!

Source: Bloomberg

10Y Yields crashed to a stunning 65bps overnight…

Source: Bloomberg

The 30Y Yield accelerated lower in the last hour, crashing below the Fed Funds Rate!

Source: Bloomberg

The yield curve flattened drastically,,,

Source: Bloomberg

Some perspective to where were just over a month ago…

Source: Bloomberg

The Dollar Index fell for the 2nd straight week (down 6 of the last 7 weeks)…

Source: Bloomberg

On a broad trade-weighted basis, the dollar has been gaining against the rest of its fist peers, but crashing relative to hard money…

Source: Bloomberg

Cryptos rallied on the week led by Bitcoin Cash…

Source: Bloomberg

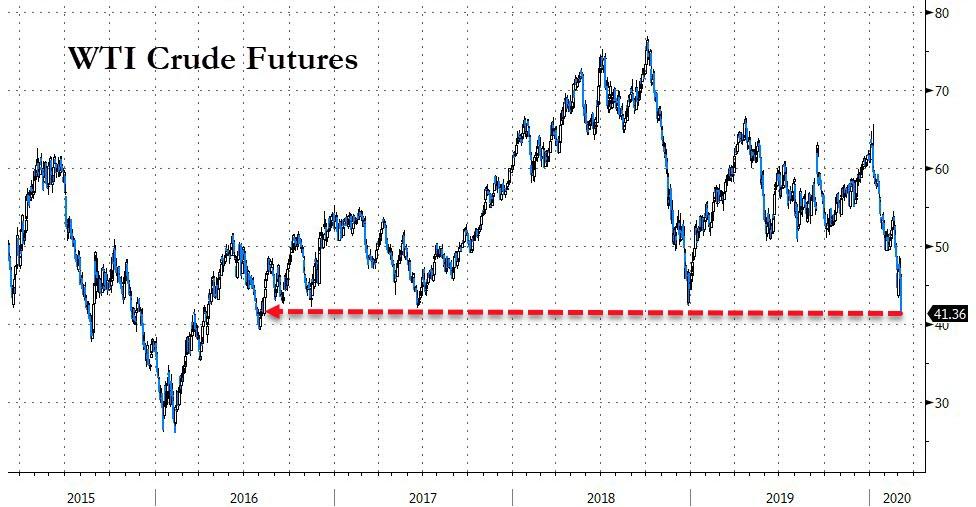

Crude was obviously the week’s biggest commodity loser , copper went nowhere as PMs were bid…

Source: Bloomberg

WTI crashed over 10% today after the collapse of OPEC+ talks, its biggest drop since 2014…

Source: Bloomberg

Brent was worse, with its biggest drop since Jan 2009…

Source: Bloomberg

Oil ‘VIX’ has exploded higher…

Source: Bloomberg

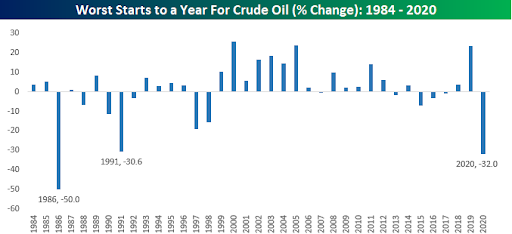

This is the worst start to a year for crude since 1986…

Spot Gold soared up to $1690 – the highest since Jan 2013

Source: Bloomberg

Finally, there’s this…

That’s quite a serious out of stock at Costco…. pic.twitter.com/6kh2q5b8ch

— Matthew Boyle (@bizboyle) March 5, 2020

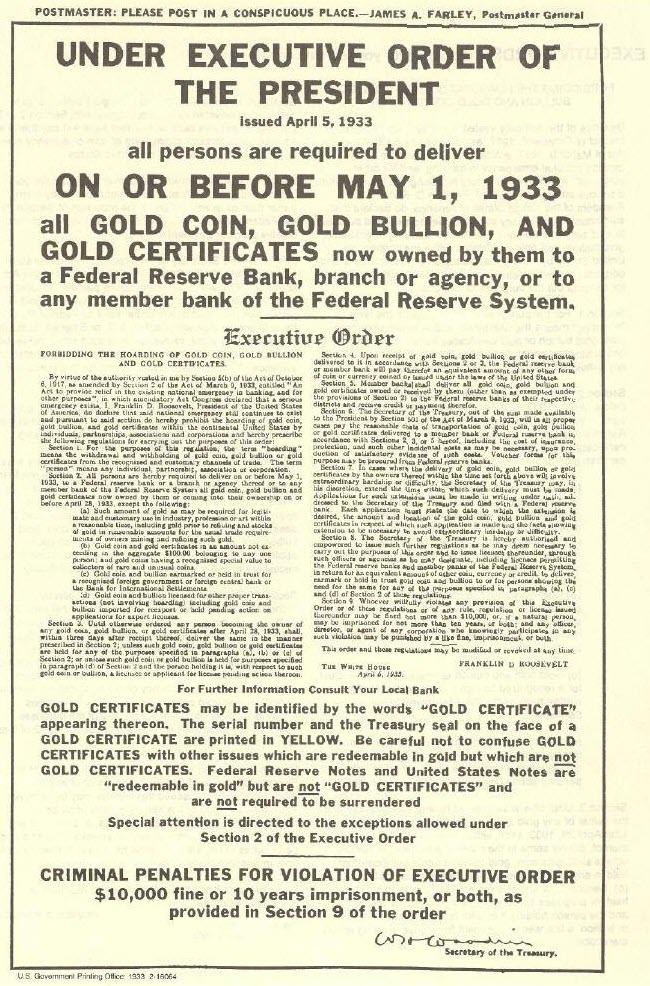

And here is the stunning punchline: out of the five historical instances of this week’s pattern of trading (leaving out the present case for obvious reasons), Nomura finds that the only instance that was followed by a sustained market rally was that of April 1933, when the US abandoned the gold standard in the midst of the Great Depression.

And while it would be next to impossible to confiscate gold, a massive dollar devaluation against the yellow metal may be just what the Fed is planning next (as Harley Bassman suggested in 2016)

As Sven Henrich tweeted into the close:

“A world without central banks in control is a scary world indeed. People actually have to actively think about their investments.”

Trade, or hoard, accordingly!

Tyler Durden

Fri, 03/06/2020 – 16:01

via ZeroHedge News https://ift.tt/2wzdqgn Tyler Durden