“Gold Is Going A Lot Higher” – DoubleLine’s Gundlach Warns Of “Seizure In The Corporate Bond Market”

“The bond market is rallying because The Fed has reacted the seizure in the corporate bond market – which is not getting enough attention.”

That was the sentence that sparked a chin hitting the table moment for anyone watching DoubleLine CEO’s Jeff Gundlach being interviewed on CNBC today. Until now, amid all this equity market carnage, various talking heads – who clearly are not ‘in’ the bond market – have confidently claimed ‘yeah, but it’s different this time, there’s loads of liquidity and credit markets are not showing any signs of pain’… Well that all changed today as the world was told the truth.

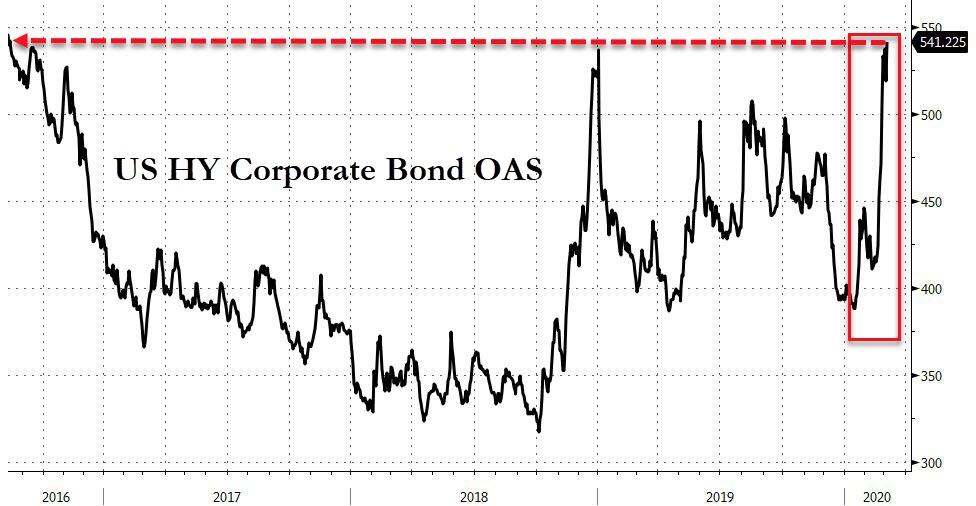

Credit spreads have exploded wider in recent days… “the junk bond market is widening out massively…”

Gundlach noted that Powell’s background in the private equity world – rather than academic economist land – has meant that his reaction function is driven by problems in the corporate bond market as “this will be problematic for the buyback aspect of the stock market.”

The Fed cut rates, he added, “in reaction to even the investment being shutdown for 7 business days.“

So the DoubleLine CEO said that Powell “cutting rates was justified” but didn’t like the way it was done as it signaled “panic.”

The reason for his disdain is clear:

“The Fed in their most recent press conference, took a victory lap, talking about how they had finally reached a stable place in policy and that they could be on hold for the foreseeable future, maybe even the entire world. That we are in a good place. That policy rates were appropriate. And I don’t know, I thought it was a little bit of hubris at this time.”

And reminds watchers that historically, “when The Fed has cut 50bps in an emergency intra-meeting such as this, they typically cut pretty quickly after once again.”

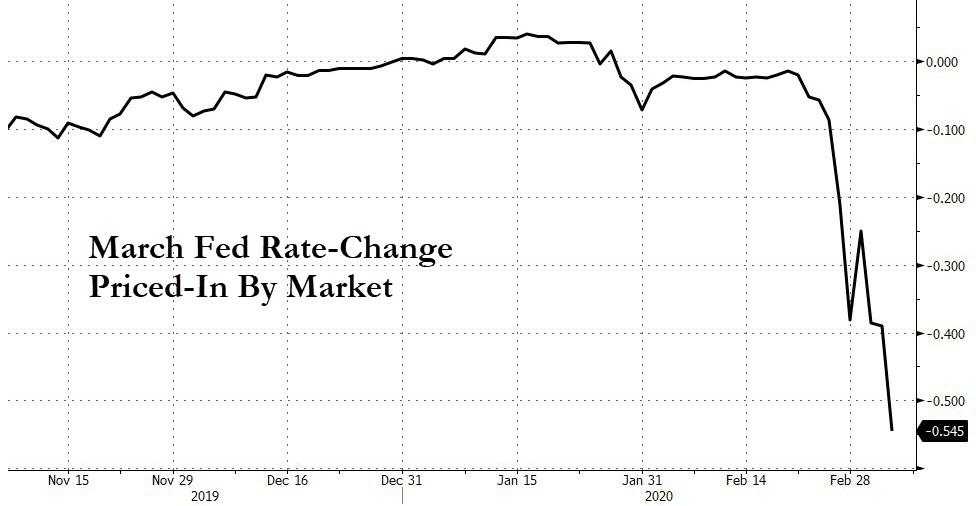

And sure enough the market is already pricing in another 50bps cut at the March meeting…

However, unlike Guggeheim’s Scott Minerd – who sees 10Y yields at 25bps – Gundlach believes “we are pretty near the low right now…maybe we get to 80 basis points on the ten year.”

Well we are at 85bps now…

However, while his view is that long-rates are starting to floor, he notes that “short rates are definitely going lower. There is absolutely no upward pressure on short rates.”

Gundlach agrees with Jim Bianco that short-rates are going back to zero, but stopped short of expectations for negative rates:

“I think Jay Powell understands that negative rates are fatal to global financial system. If we go to negative rates, there will be capital destruction en masse.”

But more easing is coming, as Gundlach reflects on those calling for v-shaped recoveries:

“I think it is foolhardy to think anything other than this [pandemic] is going to take a major hit to short-term economic growth.”

His perspective on the financial and societal impact of the Covid-19 pandemic is refreshingly honest on CNBC:

“…obviously, the airlines are in free fall for good reason. And small business activity is going to contract. Maybe grocery store sales will go up on a short-term spike. But all other kind of social activity is grinding to a standstill.”

Warning that “the two sectors that are just falling knives are financials and transports. And I don’t see anything that’s going the reverse that until we get through the other side this valley of this sort of travel shutdown.”

Finally, Gundlach ends on an even more ominous note:

“…the President and the physicians, on top of this coronavirus situation, and they are saying that they might have a vaccine in like a year, year and a half.

So, nobody knows what is happening here. And so, caution is appropriate.“

So no more buy the dip?

As former Dallas Fed President Richard Fisher noted, that means a generation of money-managers are about to losae their security blankets!

And that’s why Gundlach is long gold:

“I turned bullish on gold in the summer of 2018 on my Total Return webcast when it was at 1190. And it just seems to me, as I talked about my Just Markets webcast, which is up on DoubleLine.com on a replay, that the dollar is going to get weaker.

And the dollar getting weaker seems to be a policy. And the Fed cutting rates, slashing rates is clearly going to be dollar negative. And that means that gold is going to go higher.“

Watch the full interview below:

Tyler Durden

Thu, 03/05/2020 – 21:45

via ZeroHedge News https://ift.tt/3aA84jR Tyler Durden