CDS Pricing Breaks Amid “Huge Credit Moves”

The US stock market wasn’t the only one to suffer a historic meltdown overnight, when it hit and was locked limit-down in both futures (for several hours) and cash markets (for 15 minutes) on Monday: the credit market suffered a similar breakdown, with IHS Markit briefly suspending CDS marks amid a “huge move wider in credit spreads” according to IFR.

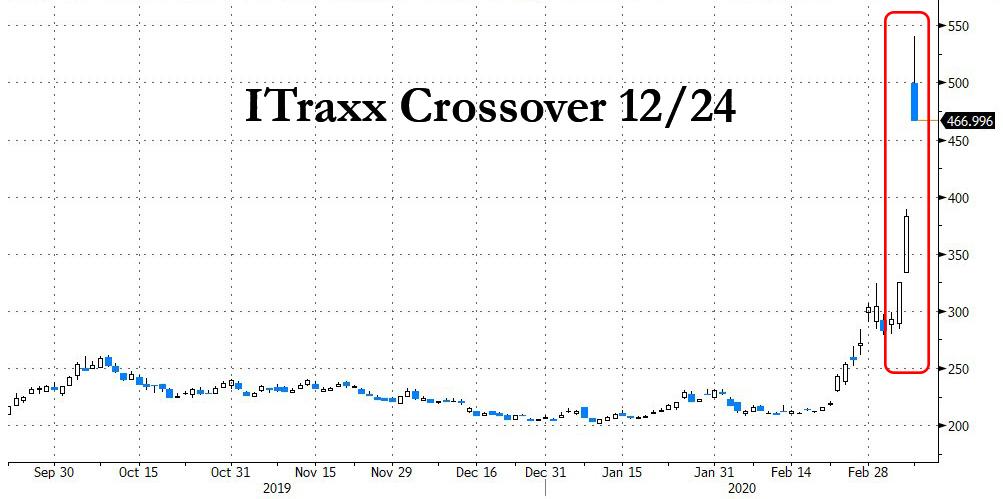

It all started when Markit’s European CDS index, the iTraxx Crossover – which tracks the 75 most liquid sub-investment grade entities – soared almost 160bps on Monday to a session high of 550bps, its highest level since 2013 and on track for its sharpest one-day gain on record, according to Refinitiv data.

The iTraxx Crossover index has now more than doubled in less than three weeks from just 219bp on Feb. 21, causing irreparable losses to anyone who was short. IHS Markit is the central source for data in the CDS market, collating and aggregating pricing information from trading desks for single-name and index CDS.

The record blow out came amid plunging oil prices on concerns over an escalating price war between Saudi Arabia and Russia, which hammered European energy names, adding fuel to the prolonged sell-off in credit markets over the past two weeks.

As IFR points out, “the massive move wider in credit spreads and enormous volatility in CDS prices led IHS Markit’s system to mark a lot of the pricing data it received from banks that trade these credit derivatives with a low confidence score“, effectively saying it was not sure if the market reflected price discovery or was,well, broken. Indeed, as an IFR source said, because of the volatility of prices “the system didn’t trust the data it received.”

In an email sent out by IHS Markit earlier in the day, the London-based information provider said that “IHS Markit is experiencing technical difficulties with the Intraday and Sameday services for CDS Single Name and Credit Indices as of 9 March 2020. Our technical and infrastructure teams are working to resolve the issue and will have an update in the next 2 hours.”

As IFR’s Christopher Whittall points out, “it is a highly unusual occurrence for it to report a temporary outage and underlines the extraordinary volatility in financial markets at present”, and yet that’s precisely the reality that traders had to grapple with today, not only in credit but across equity markets, which were locked up much of the time, and when they weren’t, there simply wasn’t any liquidity at indicated prices. Traders also confirmed – long after the fact – something we warned about last weekend, lamenting that liquidity has vaporized in recent sessions amid the prolonged selloff in credit and equity markets.

As we showed earlier on Monday, US high-yield debt markets have emerged as particularly vulnerable to a large drop in oil prices as many of the issuers in that market are energy companies.

“The weekend oil market developments could barely have come at a worse time for the US HY market,” Deutsche Bank credit strategists wrote in a note to clients. “Already starved of liquidity following the sell-off over the last two weeks, a near 20% plunge for oil overnight is likely to result in carnage in the market today.”

They were right.

Tyler Durden

Mon, 03/09/2020 – 12:45

via ZeroHedge News https://ift.tt/3cHGcfm Tyler Durden