Panic Purgatory: Oil Crashes To $27; S&P Futures Locked Limit Down, Treasuries Soar Limit Up Amid Historic Liquidation

The Sunday futures fiasco started off on the back foot, with virtually every risk asset that is not nailed down puking with a force unseen since the financial crisis. It has only gotten worse since.

While futures initially tumbled as much as 4.7% in the first minutes of trading, they have not only failed to find any BTFD support, but have been locked at the -5% limit down for nearly two hours with a brief interlude in which they rebounded modestly only to find another wave of buyers. As a reminder, even as thousands of offers build up, they can’t cross due to the limit down state of the Emini.

Amid this unprecedented crash in equities, 10Y Treasury futures have soared, and also for the first time in over a decade, were locked limit up for about an hour, at 139-29+, prompting a brief trading interruption…

… which however failed to do much, with the entire US Treasury curve – including the 30Y – trading not only below the effective fed funds rate, but also below 1.00% for the first time ever…

… as a sudden, furious flash crash just before 10pm ET in both the Australian dollar…

… and the USDJPY…

… most likely the result of a macro fund being margined out and liquidating carry positions, unleashed another bout of risk-off liquidation across asset classes.

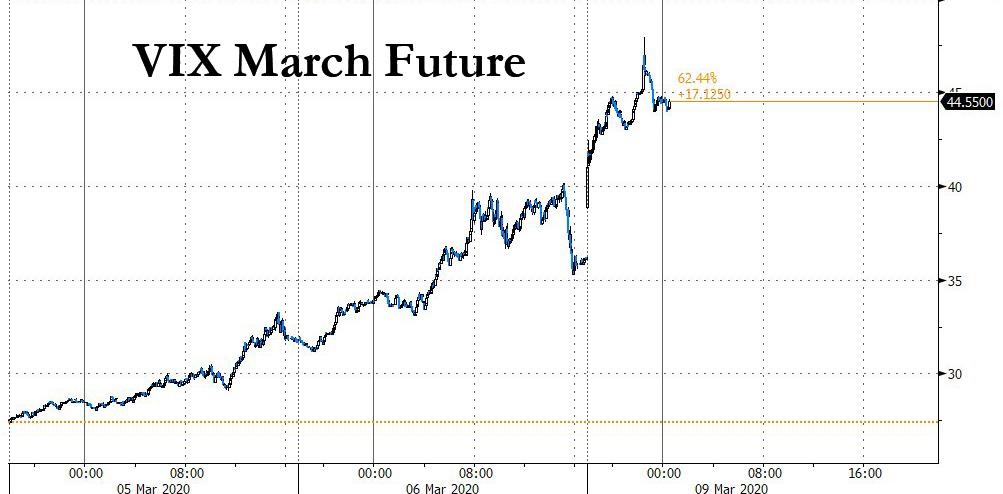

And so, with traders unable to either sell equity futures or buy Treasurys, they still can rush into the VIX, which is a long way away from its 70%+ limit up, a number which may be reached but would virtually assure another great depression.

The night’s big irony is that unable to sell anything else, funds – facing historic margin calls on Monday – are selling what they can… such as gold, which after hitting $1700 earlier in the session has tumbled 0.7% as more investors liquidate the safe asset to shore up liquidity ahead of a Monday that nobody will every forget… and in which many, most certainly anyone who was long oil, will lose their jobs.

Meanwhile, the asset that started the evening’s avalanche, crude, continues to crater with West Texas now trading with a $27-handle, down more than $15 (!) from Friday’s close.

Commenting on the unprecedented crash in oil, Pickering Energy’s Dan Pickering put the crash in perspective: “From OPEC share announcement in 2014 it took 14-15 months for oil to break $30 (Feb 2016) This time it took less than 1 trading day. Breathtaking! Energy industry, welcome back to Hell.”

As I type, front month $WTI is trading ~$28/bbl. From OPEC share announcement in 2014 it took 14-15 months for oil to break $30 (Feb 2016) This time it took less than 1 trading day. Breathtaking! Energy industry, welcome back to Hell. #ValueOverVolume

— Dan Pickering (@pickeringenergy) March 9, 2020

He is right, and nowhere more so than junk bonds: once markets open tomorrow (assuming they are not indefinitely halted), keep a close eye on HYG, which consists more than 10% of energy junk bonds, and is set to plunge by the most on record.

And speaking of the plunge in crude (and “value” energy stocks), tomorrow we may also see the VIXtermination-like vaporization of 3x levered oil and E&P ETFs such as UWT and GUSH, for which the 30% drop in oil will be a liquidation event catalyst.

VelocityShares 3x Long Crude Oil ETN ($UWT) currently has $500mil in assets… https://t.co/gxwGx9tcph pic.twitter.com/nKdEJs45Oy

— Nate Geraci (@NateGeraci) March 8, 2020

Curiously, not even a hail mary attempt by Bloomberg, which shortly before midnight blasted that “the Trump administration is drafting measures to blunt the economic fallout from coronavirus and help slow its spread in the U.S., including a temporary expansion of paid sick leave and possible help for companies facing disruption from the outbreak” had absolutely any impact on stocks.

Why? Because not only will any fiscal stimulus less than $2-$3 trillion be roundly ignored by the market, but because at this moment there are only two question on every trader’s mind: at what time on Monday morning will the Fed announce a 50-100bps emergency rate cut – the second in under a week – and, more importantly, will it include the official resumption of QE, and potentially the launch of helicopter money i.e., MMT.

Anything less than this would be a disappointment.

And yet, even if the Fed vows to buy not only stocks but also oil, at this point what it is really buying is just time: time for those who still own financial assets to sell as much as they can before the Fed loses all control, having already lost credibility, culminating in the biggest crash in history.. and a market that is indefinitely halted.

Finally, for all those Millennials who are shocked by this evening’s selloff, we leave the final word to the Stalingrad & Poorski twitter account, who put it best: “This is not crazy. What was crazy was the reckless monetary policies of central banks that led to this.”

Love people calling these moves we are seeing right now ‘crazy’. This is not crazy. What was crazy was the reckless monetary policies of central banks that led to this.

— Stalingrad & Poorski (@Stalingrad_Poor) March 9, 2020

Then again, as we have so often said, as long as those reckless policies pushed stocks – and the “wealth effect” higher – nobody cared. They will, however, care this time.

Tyler Durden

Mon, 03/09/2020 – 00:43

via ZeroHedge News https://ift.tt/2PZHBnL Tyler Durden