Goldman: VIX Options Signal “Normalization Is Increasingly Distant”

Following yesterday’s carnage (the only prior 7% one-day SPX drops since 1940 had been in Oct. 1987 and Sep.-Dec. 2008), the overnight exuberance, and resumed misery today, US equity market volatility has exploded higher.

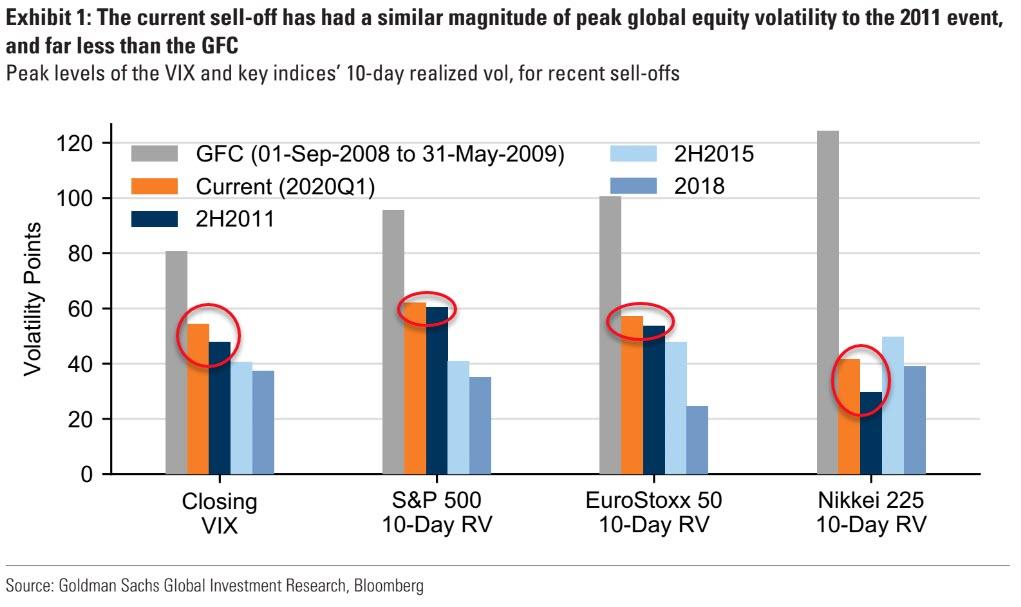

While VIX closed above 50 for the first time since the GFC, Goldman notes that most metrics of S&P volatility are closer to 2011’s highs than GFC highs.

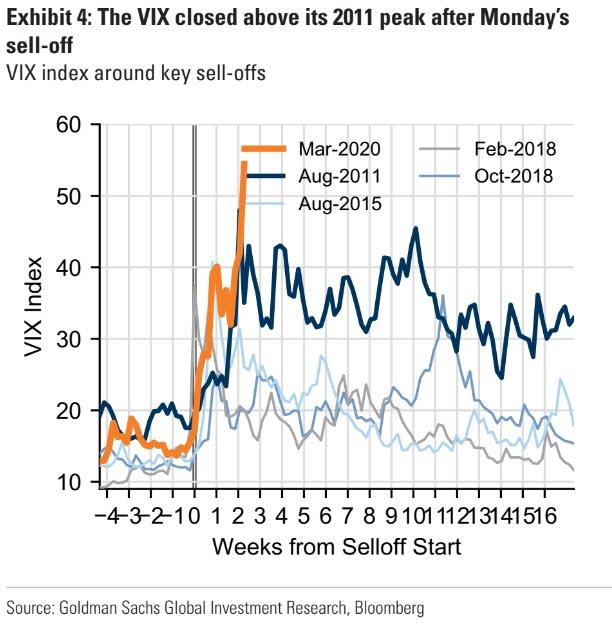

So the question Goldman asks is – are the markets following the 2011 path.

To date, the 2020 SPX sell-off has been of a similar magnitude and velocity to the 2011 event that followed the US debt downgrade, and saw volatility of a larger magnitude than any recent event.

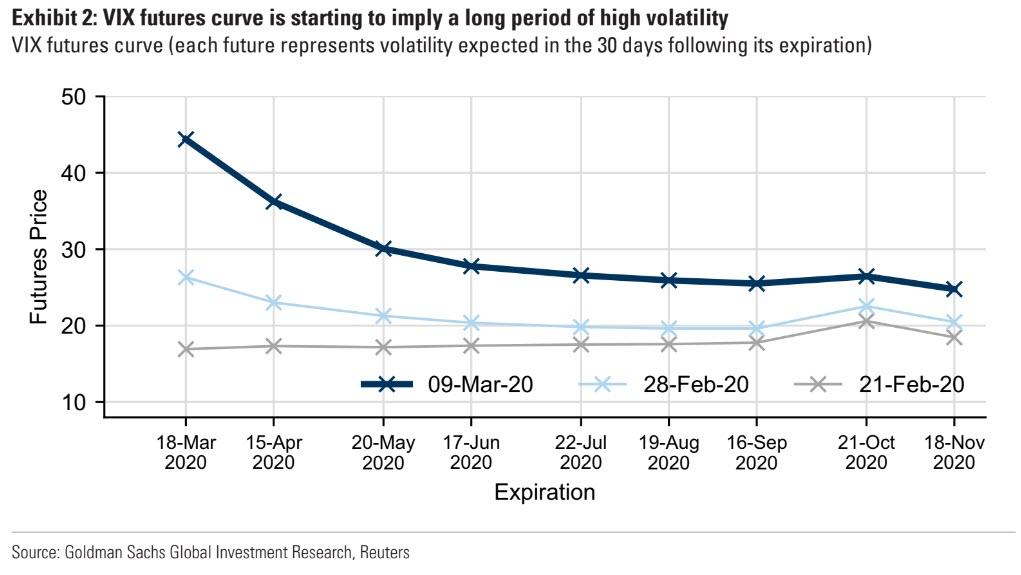

In 2011, the VIX remained in the 30’s and 40’s for most of three months, and the SPX re-tested its initial lows three times over the following three months.

Data on the impact of the coronavirus will be the key driver of normalization in the current environment. Even with the 7.6% move on Monday, the SPX has had realized volatility (11-day realized vol: 60%) that has been similar to 2011’s peak and well below GFC highs.

VIX > 50 means expensive hedges, 2.5% daily SPX moves. The most direct takeaway from a 50+ VIX level is that options are expensive: a 1-month, 95% put option now costs 4.0% of spot, ten times what the same structure cost three weeks ago. For investors willing to commit to buying equities at a lower spot price, many near-term zero-premium 1×2 put spreads can set up breakeven levels close to 2018 lows. The VIX currently implies 2.7% expected daily SPX moves over the coming month; for comparison, the SPX has had moves exceeding +1- 2.7% on fewer than 3% of trading days over the past decade.

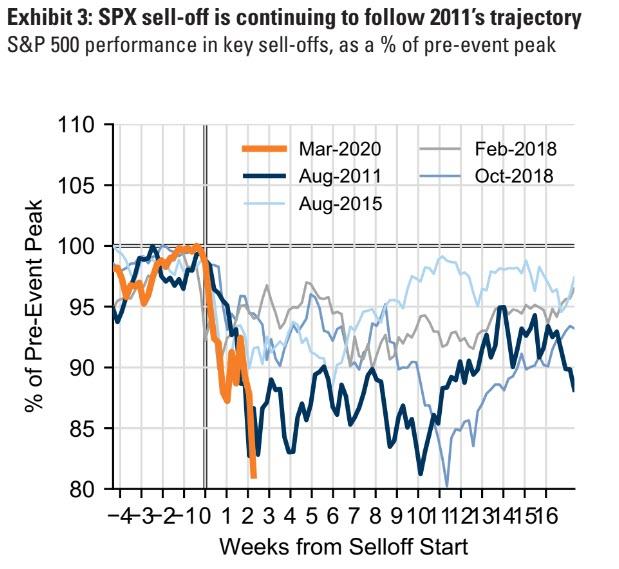

But, noted Goldman, markets view normalization as increasingly distant.

As the magnitude of the market moves grows, trades that position for a reversal of the majority of the past few weeks’ moves are becoming increasingly leveraged, despite very high volatility.

This is particularly relevant in VIX markets after a strong reaction of VIX futures to SPX moves in recent days.

As of late yesterday, May 50-strike calls cost twice as much as May 20-strike puts, even though the VIX has closed above 50 once (yesterday in the last decade) vs. over 2000 daily closes below 20. Similarly, VIX option markets are pricing a 20% probability of the VIX being below 25 on 15-Apr, and a 55% chance it’s below 25 on 22-Jul, even though the VIX has been under 25 on 95% of trading days over the past five years. VIX put spreads can express the view that these odds are too high (relevant if one views virus fears as likely to recede).

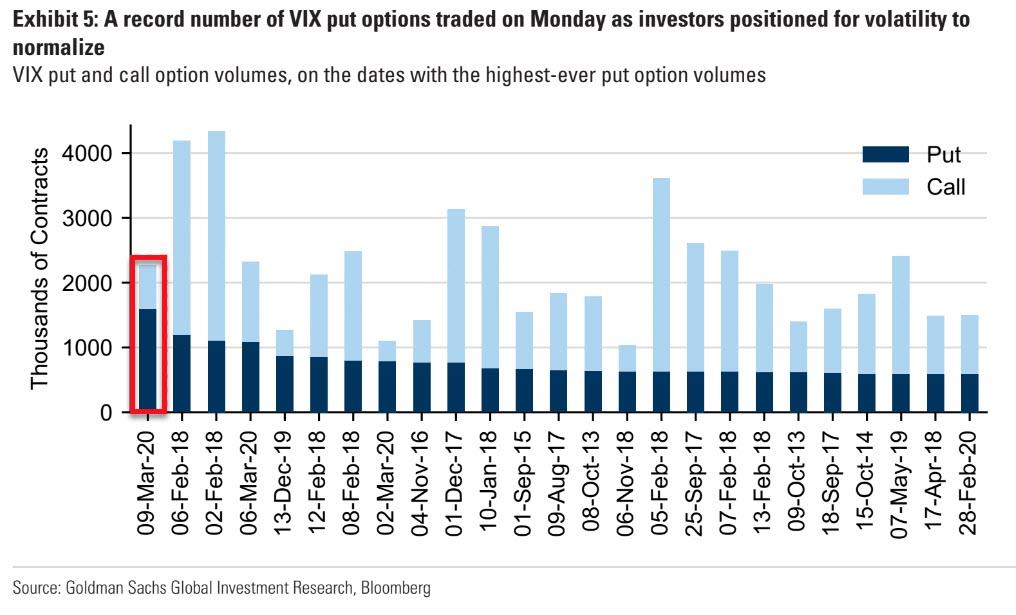

Markets have started to notice: Monday had the highest VIX put option volume ever, with relatively little call option volume.

In other words, traders are taking advantage of the relatively cheap put pricing to position for a reversion in VIX and return to normalization that – for now – is not priced in anytime soon.

Tyler Durden

Tue, 03/10/2020 – 14:05

via ZeroHedge News https://ift.tt/3cP17Nt Tyler Durden