Nomura: Today Has The Feel Of A Standard “Bear-Market Rally”

One day after Nomura’s Charlie McElligott deconstructed the various flow and technical drivers behind Monday’s unprecedented VaR shock-cascading plunge in the US stock market, on Tuesday the quant writes that yesterday’s “peak calamity” moment, where shock price gaps triggered “negative-convexity”/“short-gamma”-like trading across VIX, Equities, Rates and Crude, is been meaningfully reversed, with S&P futures briefly surging “limit up” earlier after screaming +4.7% to 2879.

The Pavlovian response that tiggered this move is hardly a secret: whether one uses Michael Hartnett’s favorite phrase whereby “markets stop panicking when policymakers start panicking”, or simply points to the market hope that a “major” fiscal stimulus is about to be unveiled by Trump (even though we now know it probably won’t), as McElligott puts it, “the worse this market-shock gets (thus negatively impacting US financial conditions, particularly at risk of self-fulfilling a corporate credit crunch), the larger the more asymmetric the policy response will likely be; as such, fiscal stimulus measures are beginning to take shape globally, as governments respond to COVID-19.”

Which brings up the question whether either fiscal, or monetary, or a joint stimulus response can do anything to fix a problem that is health/epidemiological in nature. This is how Rabobank’s Michael Every put it:

US President Trump, who is truly worried about those Dow baseball caps, doubly so as the prediction markets concurrently see his odds of retaining the presidency decline, has floated “very substantial measures” via an economic stimulus package: one that includes a payroll-tax cut, to either save or spend on toilet roll; support for hourly wage earners that will allow people to take paid time off if they get sick (presuming they have insurance to cover medical bills); as well as some kind of fiscal support for small businesses, who are about to see demand evaporate anyway.

This is all welcome but is just a plaster on a deep wound unless we see some serious efforts to concurrently fight the virus, not the bear market – and as the “Chug! Chug! Chug!” dynamic at the US sporting event yesterday underline, this is still not being seen on the ground.

Which brings us to the bigger point: was yesterday’s panicked selling the bottom, and is today the start of a new rally? McElligott’s answer won’t please the bulls:“Today has the feel of a standard “bear-market rally”…

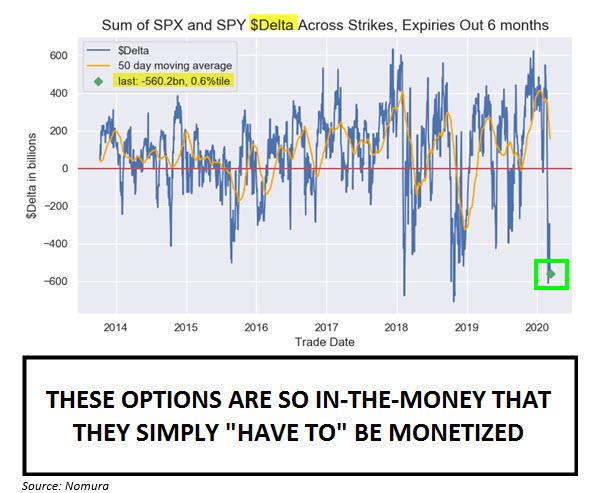

… where selling is increasingly exhausted (see “tgt vol” fund example below), monetization of dynamic hedging in futures shorts turns into a rather violent “squeeze”; as stated repeatedly here, the enormous “Short Delta” via SPX / SPY options (-$560B, 0.6 %Ile since ’13) will continue to act as a “core” catalyst for these raging UP trades (despite still-horrible sentiment and outlook from clients) as these options “have to” be monetized when they’re this in-the-money, especially as they’re expensive to roll.”

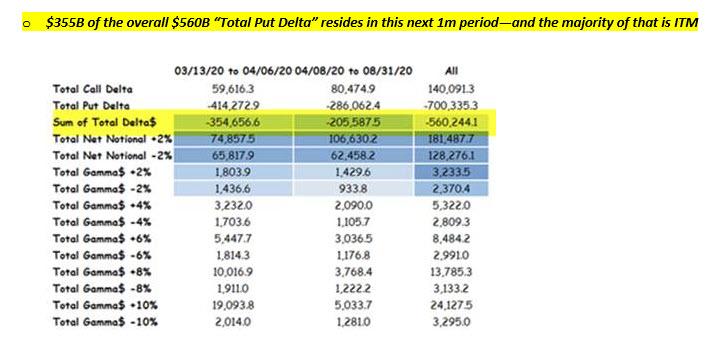

Here the biggest factor for reflexive, “technical” buying is the massive notional ($355BN) of put delta that is currently deep in the money over the next month…

… rising to a gargantuan $560BN over the next six months.

Another point made by Charlie is that yesterday we saw equity futures and ETF volumes (ex-XLE in light of the absurd Energy move) shrink relative to single-name flows for the first time in this down-trade, which to him “indicates that there was a local high in de-grossing flows of underlying L/S book exposures, as funds went into risk-management “VaR-down” mode, something we discussed extensively yesterday.

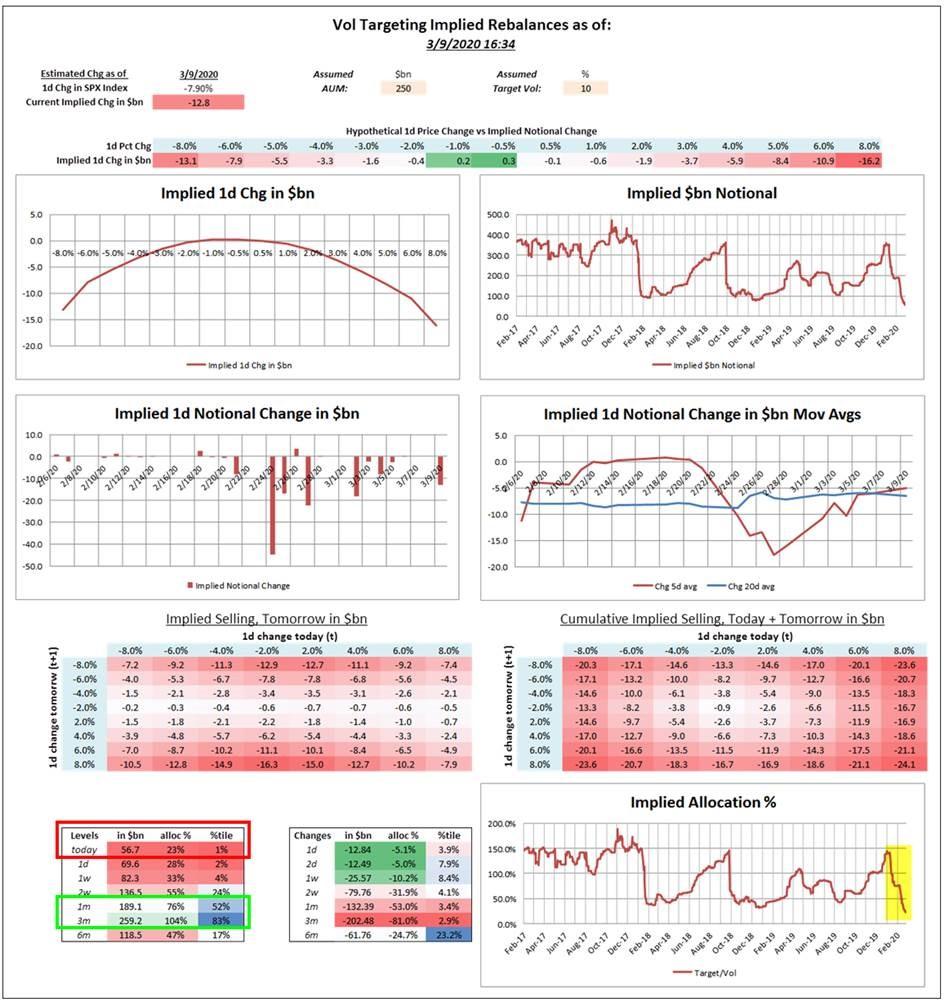

Another example of this increasing “exhaustion” of sell flows, is that Nomura’s “Target Vol” fund implied rebalancing model estimates that the $130B of Equities selling over the past 1 month has shrunk to just $56.7BN, or 23% allocation left, which is a 1st %ile since 2010: “this simply tells us that there is increasingly little left to sell and the greater risk is incremental reallocation to BUY in the coming weeks.“

Yet whether this is merely a bear-market rally, or just seller exhaustion, the key for a “sticky” bounce according to McElligott will be the ability for Vol to reset lower, “but which, for now, remains a challenge most likely until after the March 20th expiration, when the majority of the two prolific legacy hedges in the market we have discussed for months on account of their impact on term-structure (the mega S&P put-wing trades from 2500-2700 strikes and the high-profile VIX call wing lottery tickets) are largely set to expire, and should help release this massive tension in the market that keeps S&P trading so “crash-y.”

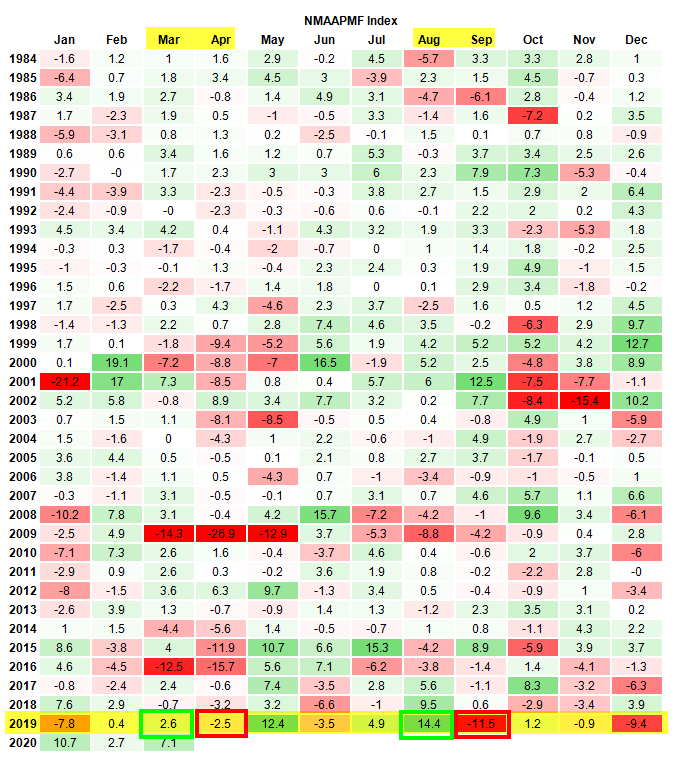

There is another risk: as Charlie writes, “if we see an extension of the UST/Rates selloff on Risk-Asset relief and increased FISCAL stimulus (coming after front-loaded monetary policy “easing”), it is in scope of aligning dangerously with the April U.S. Equities “Peak Momentum Unwind” seasonal month (since 1984).”

This dynamic risks looking like the dual Mar/Apr and Aug/Sep “rally then shock reversal” trades last year in US factors, whereas “Price Momentum” saw enormous performance in Mar and Aug on the back of the factor being a “pure” expression of the “Everything Duration” trade, rallying tremendously with USTs / Rates—but in the month after each Bond rally “overshoot” (largely on account of the “Negative Convexity” events in March ’19 due to Dealer Vol Desks and the August ’19 kind being a function of the Mortgage / ALM / Bank Portfolio hedging / forced buying of Duration), we then saw crashing “Momentum Unwinds” in US Equities

In conclusion, if volatility indeed resets lower after the March expiry, and if TSYs/Rates also re-price lower thereafter into April’s “Peak Momentum Unwind” monthly seasonal, “we can then see a forced re-risking from Vol Target / Risk Control strategies via potentially massive releveraging and in-turn creating a powerful “UP-trade” in Equities…April has the makings for something special from the “Reversal” side…”

Tyler Durden

Tue, 03/10/2020 – 10:32

via ZeroHedge News https://ift.tt/2vdssrW Tyler Durden