Oil, Stocks Rip Higher After Trump Promises “Very Dramatic” Actions To Support The Economy

After almost the biggest single-day drop since Black Monday, it is hardly surprising that markets are bouncing back a little and all it took was the promise of ‘very very substantial’ relief to hard-working Americans hurt by the impact of the virus.

During the daily virus update press conference, President Donald Trump said his administration will discuss a possible payroll tax cut with the U.S. Senate, saying they would seek “very very substantial relief” for the economy that has been roiled by the outbreak of coronavirus.

Trump, speaking at a White House news conference, added his administration plans to speak with lawmakers on Tuesday, seeking the aid to help hourly wage earners “so they don’t get penalized for something that’s not their fault.”

The president also said he that he plans to announce “very dramatic” actions to support the economy at a press conference on Tuesday.

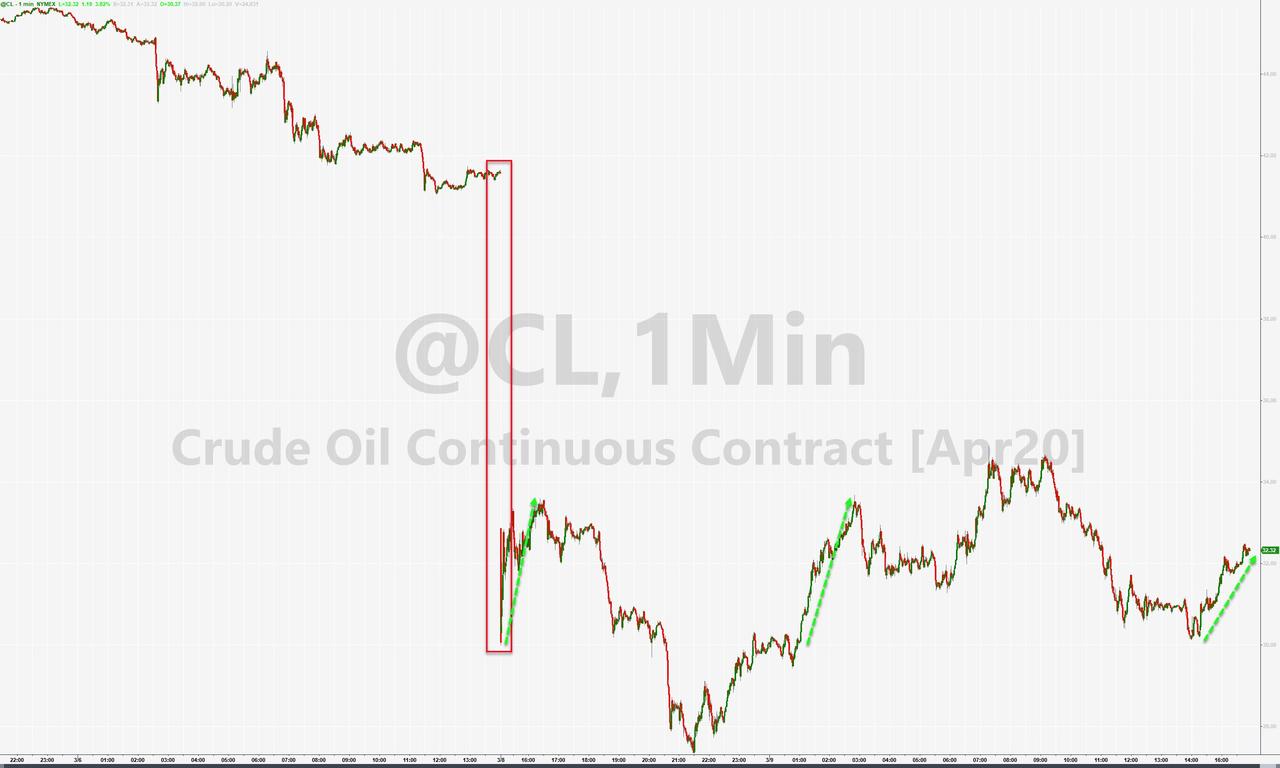

And just like that WTI is up 4%…

And Dow futures are up over 400 points…

We wouldn’t hold our breath however, as we noted previously, the idea that Democrat-controlled Congress would ‘help’ is beyond a joke and in fact it could corner the President. If he comes asking for a payrolls tax-cut “for the people,” Democrats can easily respond “sure, just unwind the corporate tax cuts to pay for it and it’s a done deal.”

But of course that will crush the stock market – which is the only thing really matters – and so Trump will refuse and Dems can play the “see, he doesn’t work for the ‘little people’ card.”

Meanwhile, Daily Caller reporter Chuck Ross asked an excelent question:

“Confused why, from an expectations management standpoint, the White House isn’t letting public know that there will be a spike in COVID cases as testing ramps up.”

We can only imagine what that sudden jump will do markets.

Additionally, it appears Mnuchin ‘made the call’ again…

As CNBC’s Wilfred ZFrost reports that I can confirm that the White House meeting with bank CEO’s will be on Wednesday at 3p ET. The nation’s biggest 7 banks have all been invited – maybe more too. I know at least 2 will send their CEO – I imagine all (other than JPM) will do so. Some industry bodies like ABA invited.

Tyler Durden

Mon, 03/09/2020 – 20:06

via ZeroHedge News https://ift.tt/2IvLa0U Tyler Durden