Trader: “Markets Want Proof, Not Promises” Of ‘Substantial’ Policy Relief

Authored by Richard Breslow via Bloomberg,

It is certainly safe to say it has been a day of low-conviction trading. Which certainly hasn’t meant small ranges. No wonder the CME is raising the margin requirements on some of its products. The day has a certain feeling of randomness. Which is odd, because it has become clearly directional.

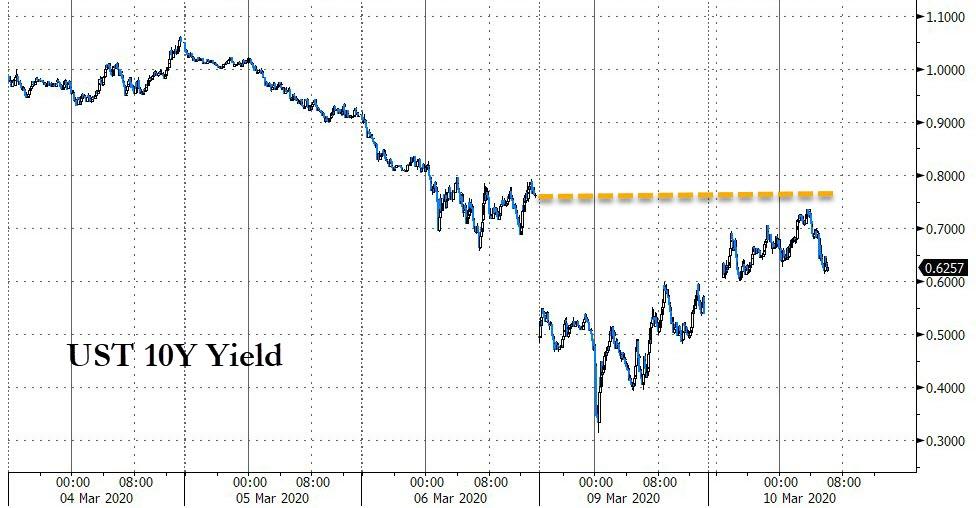

Equities are up big. Crude is leaping. Bond yields have been moving up. And doing it with gusto. Ten-year Treasury yields opened higher, and then went another 10 basis points. Yet, as cash trading got underway in European government bonds, Treasuries found themselves exactly in the middle of the day’s range, waiting for additional instructions. It seems that when each center opens, traders just aren’t sure what the next group of investors is going to do with things. Or much of anything else, for that matter.

It would be nice to say that today will meaningfully reverse yesterday’s “overreaction.” And, by definition, it has partially done so, if you go by asset prices alone. But it’s still too early to declare victory. And that’s the case, not only from a technical point of view, but because the market, and citizenry for that matter, are now firmly in the “show me and I’ll believe it” camp. That’s both the good news and the bad news. It finally seems to be getting a response.

Japanese equities opened well down from the previous close only to jump higher on comments by Prime Minister Shinzo Abe that his government would be working closely with the BOJ to strengthen the economy. People want to hear fiscal, not monetary, to get sustainably excited. Markets had the expected reaction. The yen weakened almost 2 1/2 big figures. And subsequently gave one of them back. The market now seems unsure what it wants to do from here. It isn’t that it wasn’t welcome news. Frayed nerves were soothed according to one observer. But nothing is going to lastingly change until they come up with the goods.

Forward guidance and promises are only going so far these days.

The BOJ has said all the right things, but has limited room. And what they are likely to try again at their next policy meeting hasn’t exactly kick-started things. The government, itself, isn’t quick to act. The talk overnight was for a stimulus package in April or May. The world isn’t in the mood to consider patience a virtue. And, unilateral currency intervention is unlikely to accomplish much, but should USD/JPY approach 100, expect a lot of talk about it. Which will be fodder for market rumors and jumpy price action. As an aside, the Europeans have little interest in the euro taking off, either.

In the U.S., hopes for fiscal stimulus has been a game changer after Monday’s slide. It did wonders for European markets, as well. We can debate all we want about the best ways to deliver it. A legitimate debate. But too picky for traders. At least for the moment. The powers that be can go micro or macro. Targeted or broad brush. The market, at this point, just wants proof that they are capable of action. Stay tuned. It sounds good, now we’ll see how the politics work.

If you want to get a sense of how desperate the market is to see proactive governments taking action, watch Italy. The news there is terrible. Lock-downs have spread to the entire country. Although, compliance is a bit of an issue. Their country is probably in recession. But the announcement of a possible increase in the already proposed stimulus package got a very favorable reaction.

I’m cherry-picking, but it is the only bond market on my launchpad that is green on the day.

Yesterday, one expert after another warned of recessions and market meltdowns. Serious economists and CIOs talking scary stuff. I seriously doubt that if we brought them back today, they will have changed their analysis. And not out of stubbornness. They, too, need to be convinced. There is a lot at stake. Traders will do what they have to and that is probably going to mean chasing risk assets higher. One day on, the next off. But, at the risk of offending, even a healthy bounce in the S&P 500 doesn’t mean all is yet well with the world. Make them show you.

Tyler Durden

Tue, 03/10/2020 – 09:21

via ZeroHedge News https://ift.tt/3aK0eUQ Tyler Durden