Earnings Expectations Are Starting To Plunge: Here Are The Most-Impacted Sectors

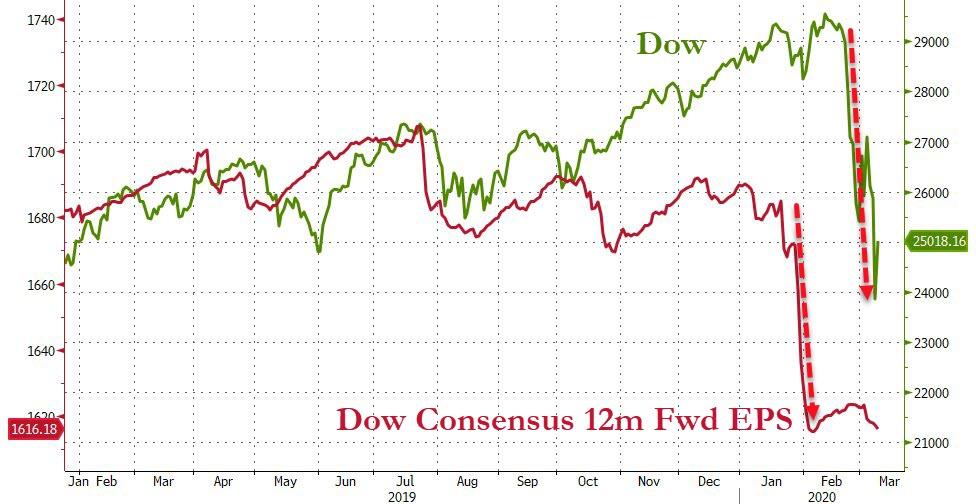

While investors are shocked, shocked I tell you, at the plunge in US stocks, they shouldn’t be. Earnings expectations were already plunging long before the actual indices woke up to the new reality…

Source: Bloomberg

And of course, this has crushed the P/E of the market – providing the asset-gatherers and commission-rakers with a new talking point for why you should buy: “stocks are ‘cheap’ again.” There’s just one problem, as can be seen at the far right of this chart – although prices fell, crushing the P/E ratio; now that earnings are starting to be marked down, the P/E ratio is starting to accelerate higher once again…

Source: Bloomberg

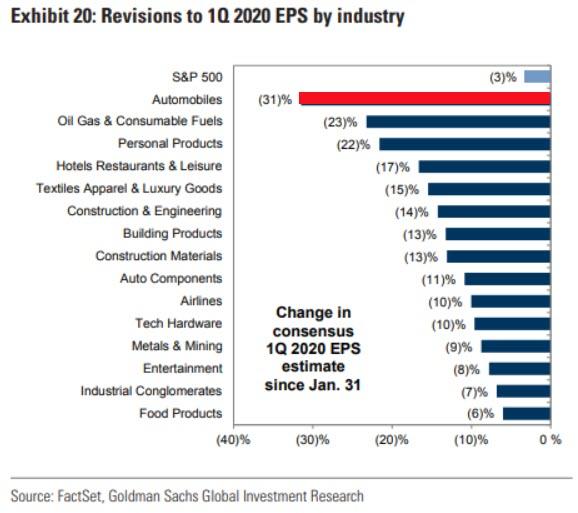

And, unsurprisingly, it is Autos and energy-related companies that are slashing earnings expectations at the fastest rate.

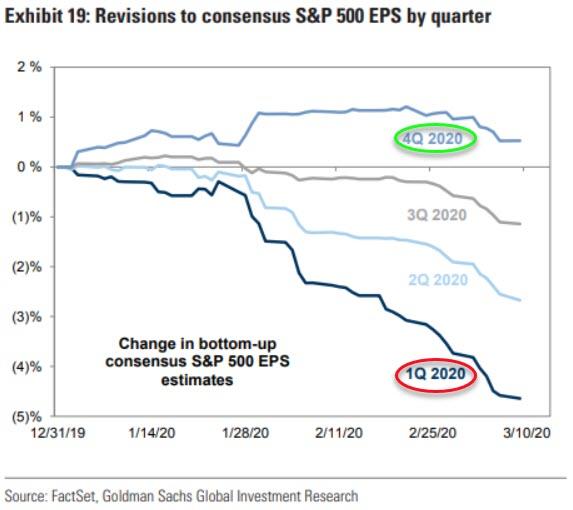

As Goldman notes, the market continues to believe in the v-shaped (or maybe a slight u-shaped) recovery with earnings growth expected to resume in Q4 2020…

We wouldn’t hold our breath.

Tyler Durden

Wed, 03/11/2020 – 15:18

via ZeroHedge News https://ift.tt/2TVcIlO Tyler Durden