Liquidity Getting Worse By The Day: Fed Injects Record $132 Billion With Overnight Repo

Mot much new to report this morning regarding the daily Fed’ repo operations that we didn’t already cover extensively yesterday in “Funding Freeze Getting Worse: Dealers Demand Record $216BN In Liquidity From Fed Repo“, except to note that while we wait for tomorrow’s upsized term repo operation, today’s overnight repo, which as a reminder was recently upsized from $100BN to $150BN…

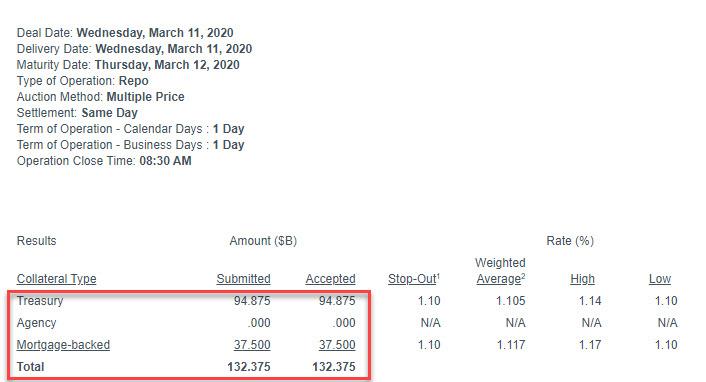

… saw the highest amount of both bids and accepted securities since the central bank resumed the offerings in September as the liquidity crisis is clearly getting worse by the day. Specifically, dealers submitted $132.375BN of bids at 1.10% vs a maximum of $150b, which was not only up from Tuesday’s total bids of $124BN, but also the highest in overnight repo history!

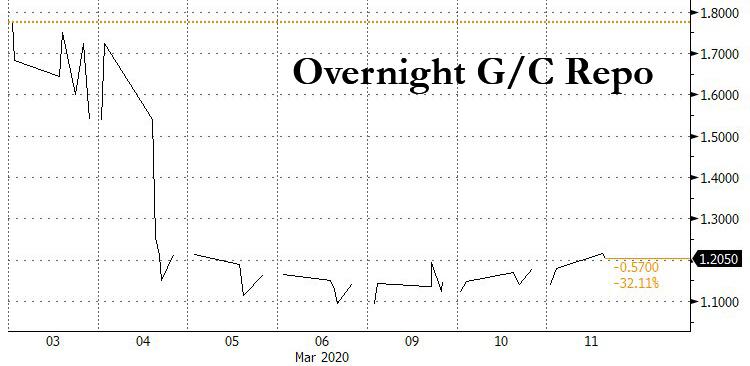

The growing funding panic also meant that general collateral has continued to rise, and after dropping to 1.10%, in line with last week’s Fed emergency rate cut, overnight GC has pushed higher, and last traded at 1.23%/1.18% as dealers are once again scrambling for liquidity anywhere they can.

As this latest data merely confirms that the liquidity crisis is getting worse, we have nothing new to add to our conclusion from yesterday so we will just repost it here:

As we pointed out last week, this continuing liquidity crunch is not only bizarre, but increasingly concerning, as it means that not only did the rate cut not unlock additional funding, it actually made the problem worse, and now banks and dealers are telegraphing that they need not only more repo buffer but likely an expansion of QE… which will come soon enough, once the Fed funds hits 0% in a few days and is forced to restart bond buying to prevent the next crash.

Will that be enough to stabilize the market? We don’t know, but in light of the imminent corona-recession, on Tuesday Credit Suisse’s Zoltan Pozsar repo guru published a lengthy piece whose conclusion – at least on the liquidity front – is that the Fed should “combine rate cuts with open liquidity lines that include a pledge to use the swap lines, an uncapped repo facility and QE if necessary.“

Tyler Durden

Wed, 03/11/2020 – 09:50

via ZeroHedge News https://ift.tt/2TZvjgf Tyler Durden