Stocks Puke Into Bear Market As US Financial Conditions Crash Most ‘Since Lehman’

Today the stench of a desperate liquidity scramble as The Dollar rallied while Stocks, Bonds, Bitcoin, Crude, and Gold were all dumped.

The Dow and S&P crash into a bear market…erasing most of the Trump rally…

This is the fastest drawdown from a peak into bear market in history, and worst start to a year since 2009…

Source: Bloomberg

US Financial Conditions are tightening massively…

Source: Bloomberg

Crashing at the fastest pace since Lehman… (NOTE – the sudden drop is reminiscent of the first moments of crisis in August 2007)

Source: Bloomberg

With a massive dollar shortage evident…

Source: Bloomberg

Forcing The Fed to puke liquidity into the markets…

Source: Bloomberg

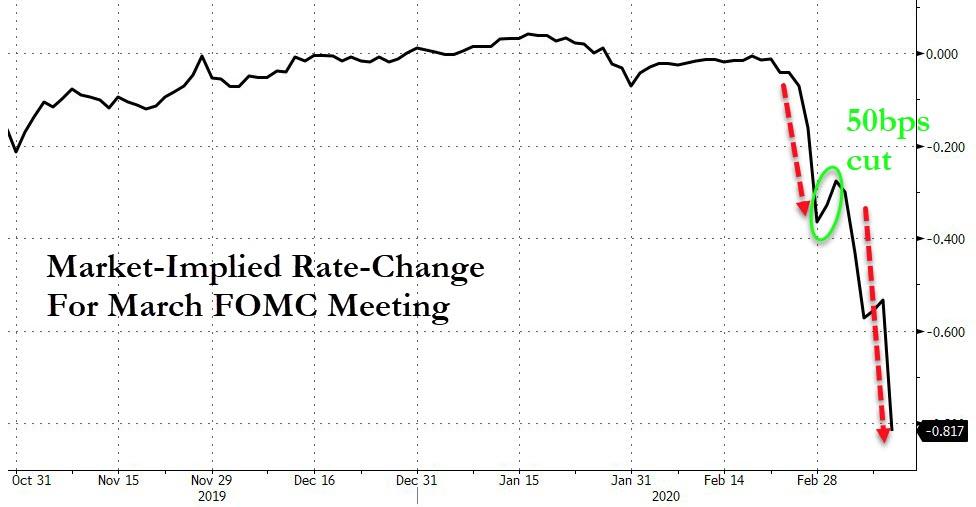

Which is perhaps why the market is now demanding 82bps of rate-cuts next week by The Fed…

Source: Bloomberg

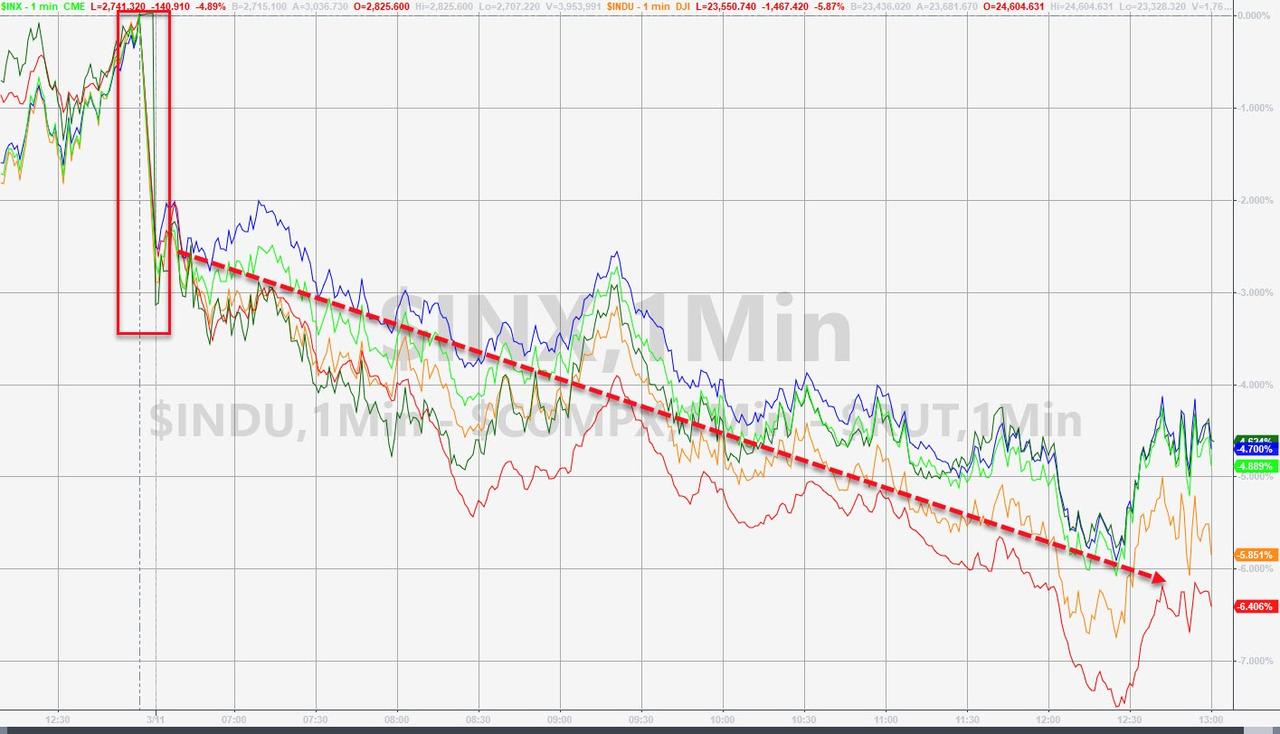

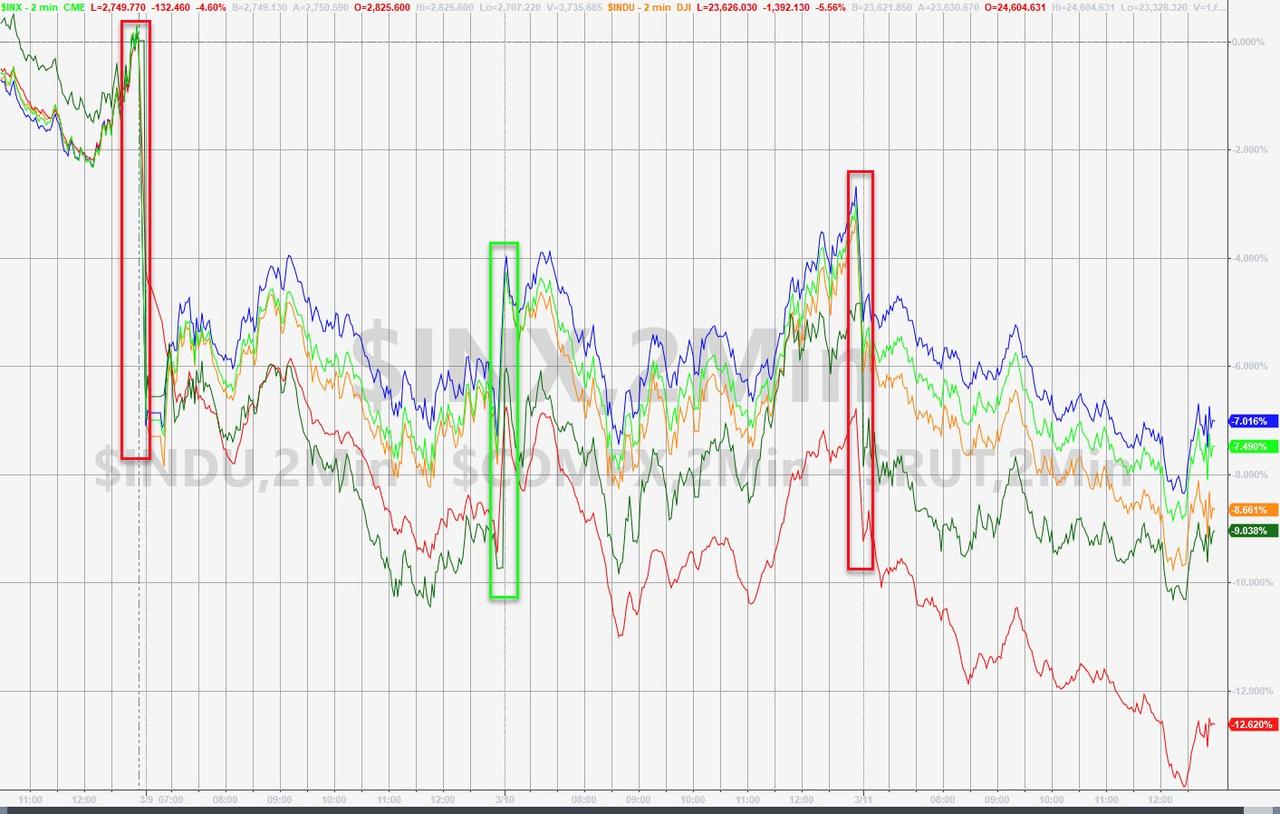

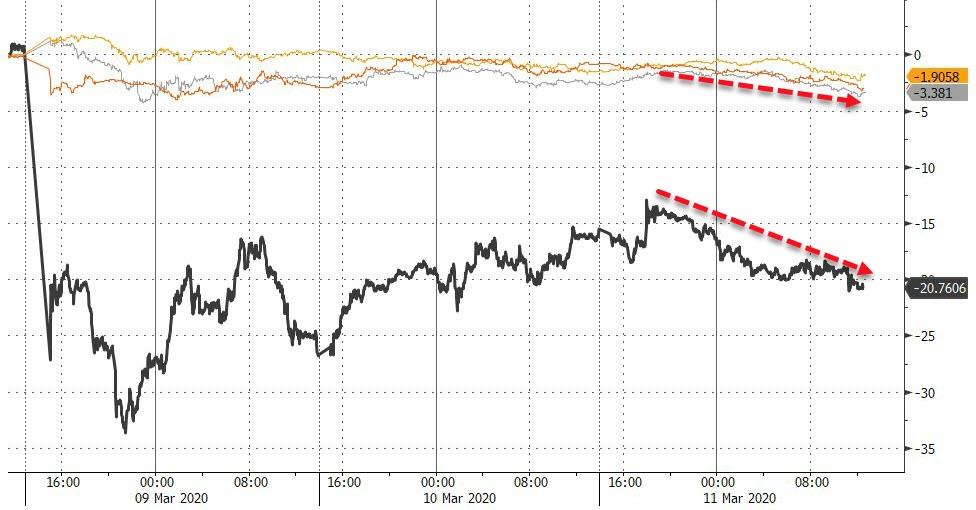

Today was a bloodbath in US equities with Small Caps and The Dow hammered hardest…

Dow Futures show the week’s carnage best – just make sure to check the scale, these are simply massive swings…

And on the week, Small Caps are down almost 13%…

The Dow was the biggest underperformer because Boeing stock crashed today, but it was the CDS that is more worrying…

Source: Bloomberg

Virus-related travel and leisure sectors were hammered…

Source: Bloomberg

Bank stocks were clubbed like a baby seal today, now down a stunning 10-16% on the week alone!

Source: Bloomberg

VIX surged back above 50 today…

As Bloomberg details, the historic oil-market collapse that’s dragging down shares of the biggest Western explorers is swelling yields on investor payouts. The elite cohort of large international drillers known as the supermajors – Exxon Mobil Corp., Royal Dutch Shell Plc, Chevron Corp., Total SA and BP Plc – now are churning out bloated yields that dwarf those paid by the broader S&P 500 Index.

Source: Bloomberg

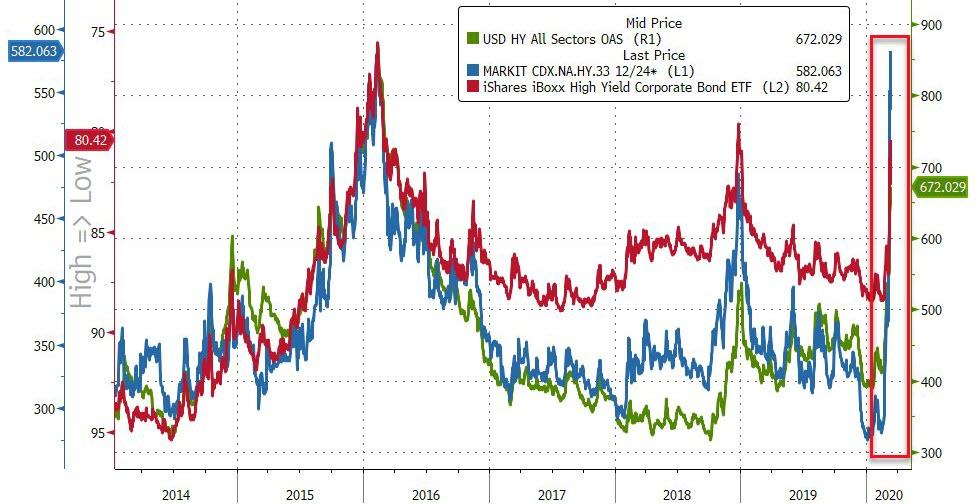

Credit markets are collapsing with HY spreads smashing wider…

Source: Bloomberg

And IG spreads are exploding in the US…

Source: Bloomberg

Treasuries were very mixed today with the short-end rallying (2Y -5bps) and long-end selling off (30Y +5bps)…

Source: Bloomberg

10Y Yields pushed back above the pre-weekend plunge levels…

Source: Bloomberg

The Dollar rallied today as everything as was sold – suggesting a massive scramble for liquidity…

Source: Bloomberg

Rather notably, Developed Market FX is now trading with a higher vol than Emerging Market FX…

Source: Bloomberg

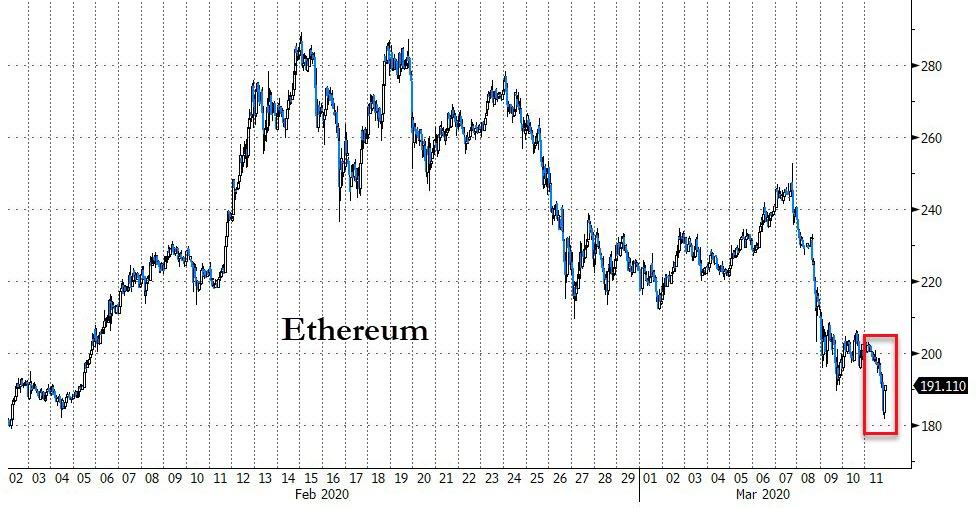

Cryptos continued to slide lower, with Ethereum hammered today…

Source: Bloomberg

Bitcoin was battered back below $8000…

Source: Bloomberg

Ethereum plunged back below $200…

Source: Bloomberg

Commodities were all lower today…

Source: Bloomberg

WTI’s hopeful rally ended today with prices back to a $32 handle…

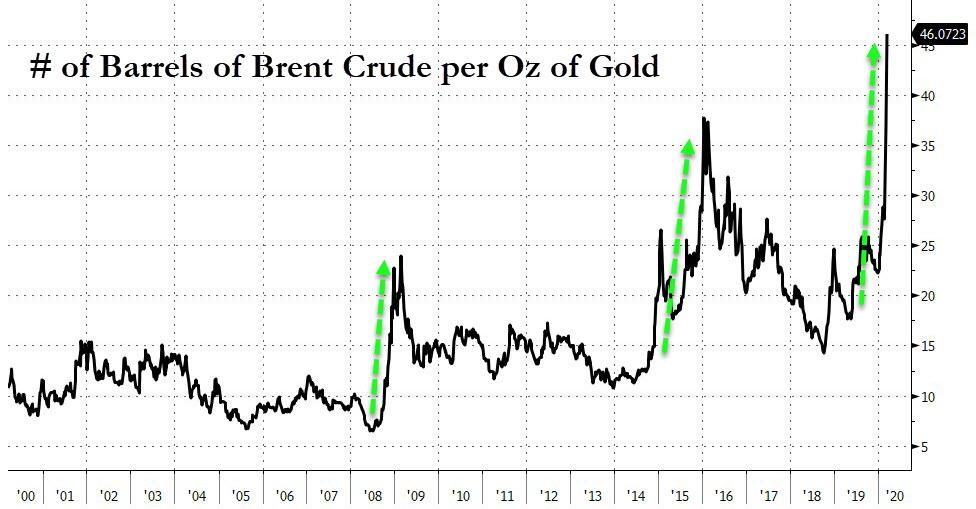

Gold was sold today too alongside bonds, bitcoin, and stocks…

And for a sense of just how much oil has crashed, the number of barrels that an ounce of gold can buy is exploding…

Source: Bloomberg

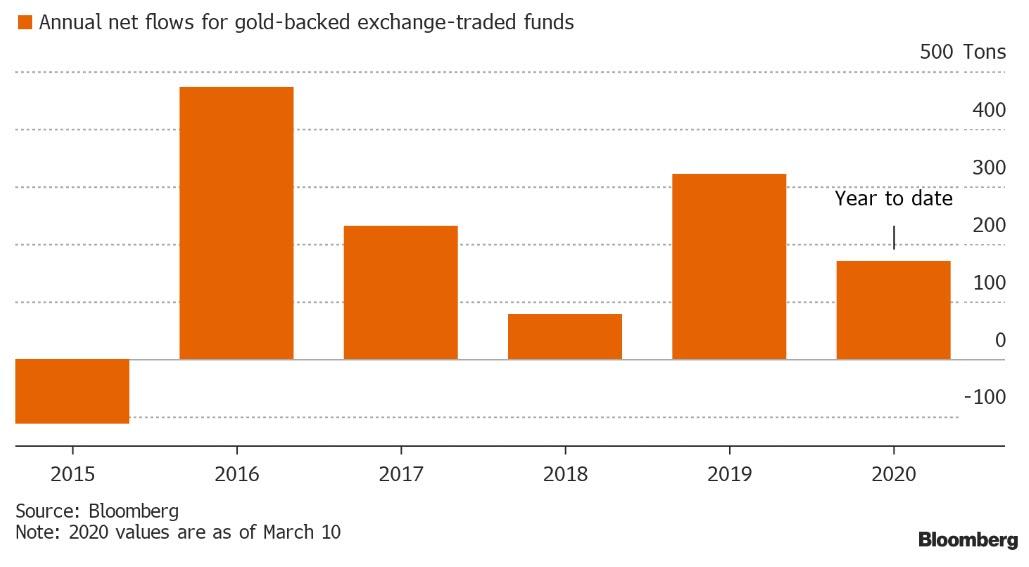

Finally, Bloomberg notes that investors are piling into gold day-after-day as concerns escalate about the impact of the coronavirus, markets gyrate, and rate-cut expectations jump. Holdings in bullion-backed exchange-traded funds expanded 55 tons in the three days to Tuesday, with increases seen both on days when S&P 500 Indexsank, as well as posting gains. The tally stands at a fresh record, and year-to-date inflows already total more than half of the 323.4 tons added in 2019.

Source: Bloomberg

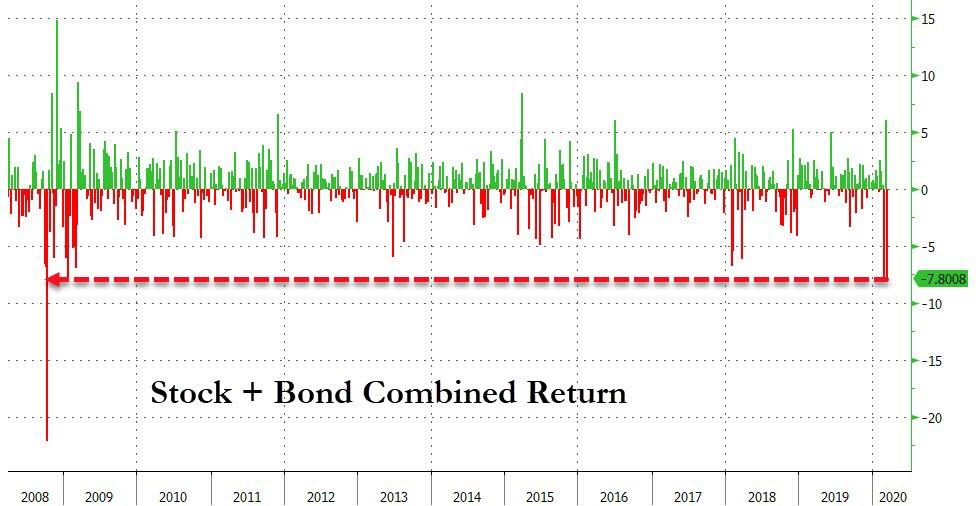

This week is the worst for a stock/bond portfolio since Lehman…

Source: Bloomberg

And investors have swung from “Extreme Greed” to “Extreme Fear” at the fastest pace on record…

Tyler Durden

Wed, 03/11/2020 – 16:01

via ZeroHedge News https://ift.tt/3cMw7hr Tyler Durden