WTI Extends Losses After Huge Crude Build Indicate Significant Virus Impact

Oil’s modest rebound from its biggest crash in decades on Saudi-Russia price war escalations has faded notably overnight as OPEC now sees a whopping 94% drop in 2020 global oil demand growth in response to the economic impact of the coronavirus even as global oil supply is set to explode.

Prices are not plunging yet, but in order for prices to move even lower and stay there, “we need to see storage tanks being filled at a greater level than we originally thought following the coronavirus outbreak,” said Edward Marshall, commodities trader at Global Risk Management.

So all eyes are on this morning’s official inventory data as today’s report is likely to give the first view into the effects of the virus and how crude export weakness ripples through the markets (though keep in mind this does not include the effect of the very recent price war plunge in prices).

API

-

Crude +6.407mm (+1.9mm exp)

-

Cushing +364k

-

Gasoline -3.091mm (-2.1mm exp)

-

Distillates -4.679mm (-1.8mm exp)

DOE

-

Crude +7.664mm (+1.9mm exp, whisper +3.25m) – biggest build since Oct 2019

-

Cushing +704k

-

Gasoline -5.049mm (-2.1mm exp) – biggest draw since Apr 2019

-

Distillates -6.404mm (-1.8mm exp) – biggest draw since 2004

API reported bigger than expected builds for crude and draws for products and the official DOE data shoiwed it was even more extreme with crude inventories jumping most since Oct 2019, and massive product draws…

Source: Bloomberg

Overall crude stockpiles are back at their highest since July 2019…

Source: Bloomberg

US Crude production dipped extremely modestly last week from record highs…

Source: Bloomberg

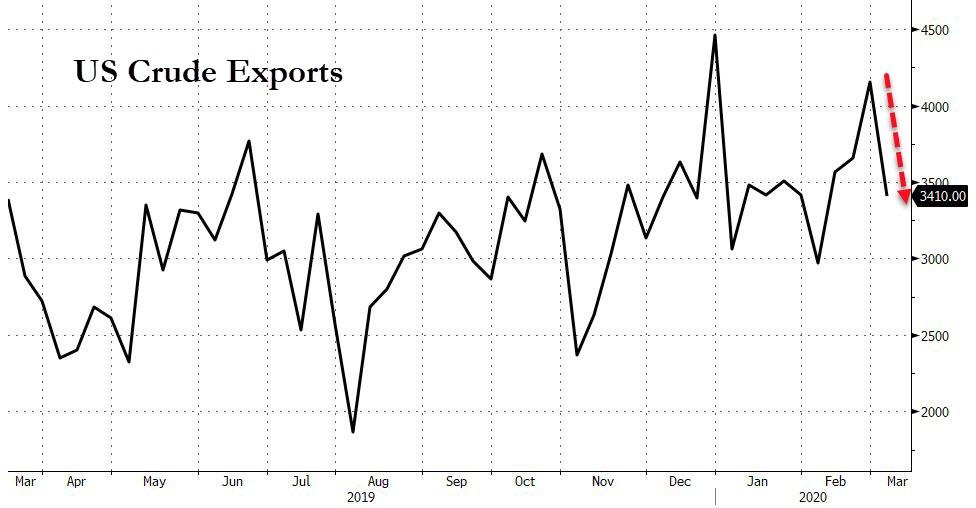

The effect from the coronavirus may be starting to kick in for crude sellers overseas. Crude exports fell by nearly 20% this week, the lowest in about a month.

Source: Bloomberg

WTI was trading around $33.50 ahead of the print and is accelerating losses after the major crude build…

Meanwhile, the spread between WTI and Brent is collapsing…

As Bloomberg notes, should this continue, WTI will soon fetch a premium to Brent as shale output has come under threat from the latest price route, although U.S. government is considering a bailout for the industry. Crude exports are under pressure from the coronavirus, even as U.S. sellers optimize on sales to unaffected areas.

Tyler Durden

Wed, 03/11/2020 – 10:39

via ZeroHedge News https://ift.tt/2ICOE1B Tyler Durden