BofA’s Shocking Warning: The Treasury Market Is No Longer Functioning Normally

In a stunning report published this morning by BofA’s Marc Cabana, the rates strategist warns that the US Treasury market is no longer functioning properly, and will “likely requires a rapid & large near-term policy response from the US Treasury or Federal Reserve” to get back to normal.

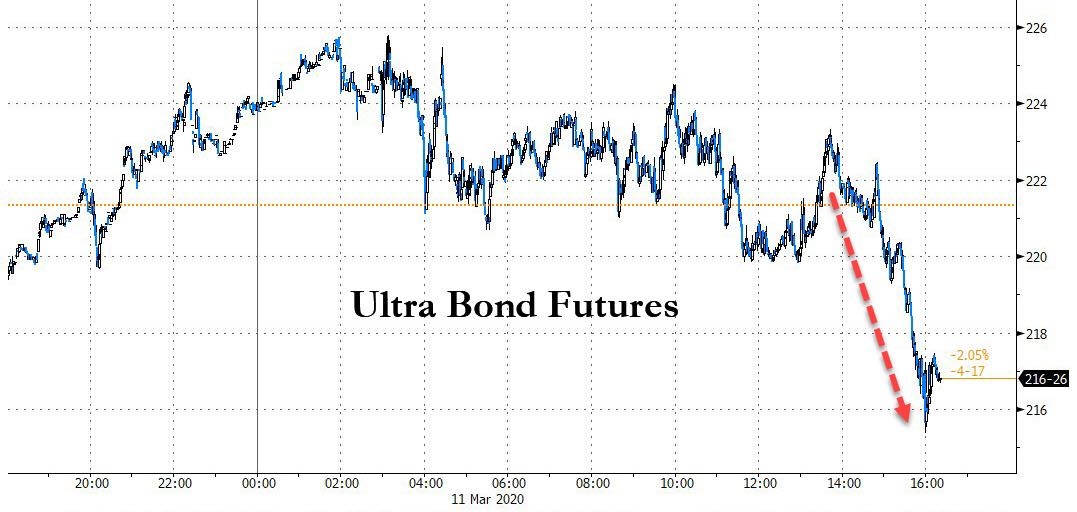

Prompting BoA’s stunning admission that the world’s most liquid market appears broken, was the unexpected plunge in Treasury futures which we discussed yesterday…

… with Cabana perplex by the 11bps surge in 30Y bond yield even as the S&P declined 5%: “In a risk off environment it would be expected to see UST yields decline; yields appear to have been overwhelmed by liquidity concerns yesterday.“

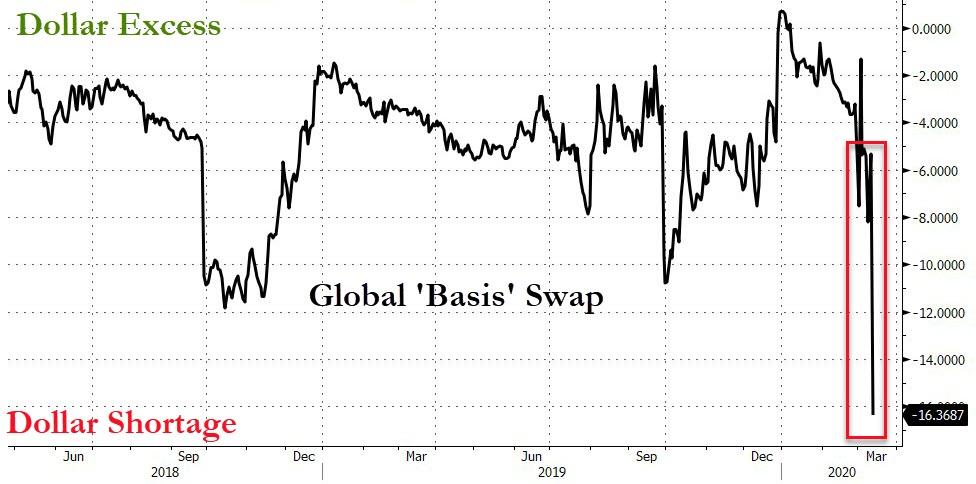

Of course, it’s not just yesterday’s late day puke: as we noted earlier, the funding market itself is starting to freeze up, with the FRA/OIS, i.e., bank dollar funding stress indicator, exploding to the highest since the financial crisis…

… and global FX basis swap cratering amid a sudden shortage in dollars.

All of this ties back to the increasingly imbalanced Treasury market, which itself is starting to break.

As a result, BofA believes that only two things could help restore functioning to the bond market:

- Fed re-starting UST QE

- US Treasury conducting buyback operations.

For what it’s worth, Cabana favors the latter. In the below excerpt from his full note, he explains what is going on, and what has to be done to make sure the world’s most important market does not freeze.

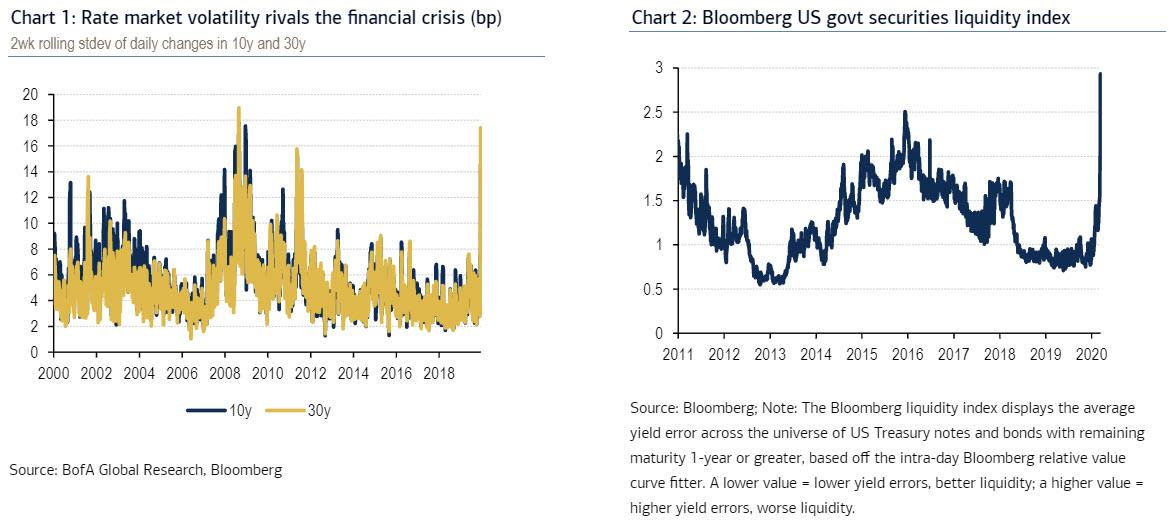

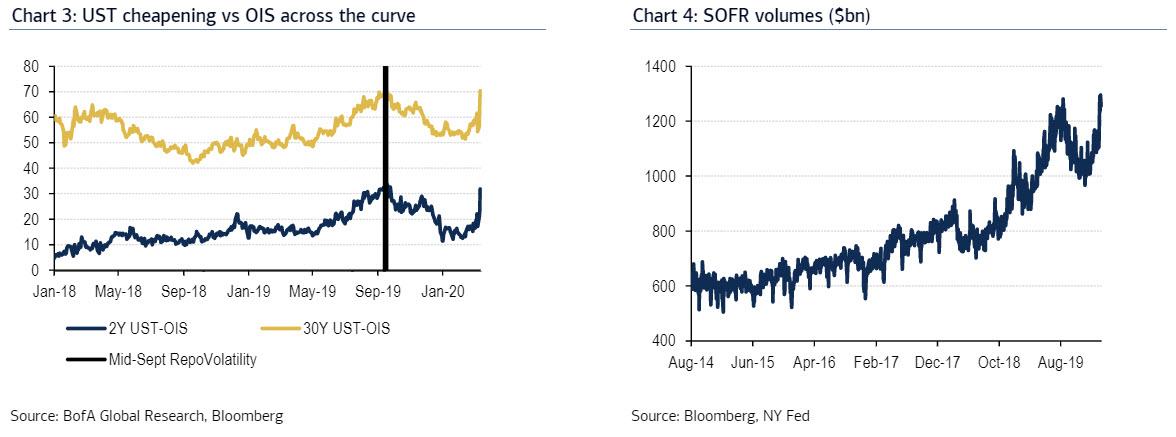

What happened? – The US Treasury market has been very volatile due to macro uncertainty. Realized volatility in the Treasury market is at the highest levels since EU breakup concerns in ’11 & the financial crisis in ’08 (Chart 1). This has caused dealers to widen their bid-offer spreads and limited their ability to transfer risk. These dynamics have materially worsened market functioning (Chart 2), and led to a large cheapening of USTs vs OIS across the curve (Chart 3).

Why should you care? -Sustained illiquidity in the US Treasury market threatens the ability for certain actors to retain their UST positions and could result in large scale position liquidation. The investor community most at risk is leveraged UST investors. These investors typically invest in US Treasury securities and hedge their interest rate exposure with Treasury futures; this is a profitable strategy since UST securities trade “cheap” to futures due to the associated balance sheet cost of holding the UST security vs the futures hedge. This activity supports elevated UST debt issuance by providing a significant source of demand while keeping on & off the run USTs at relatively tight spreads.

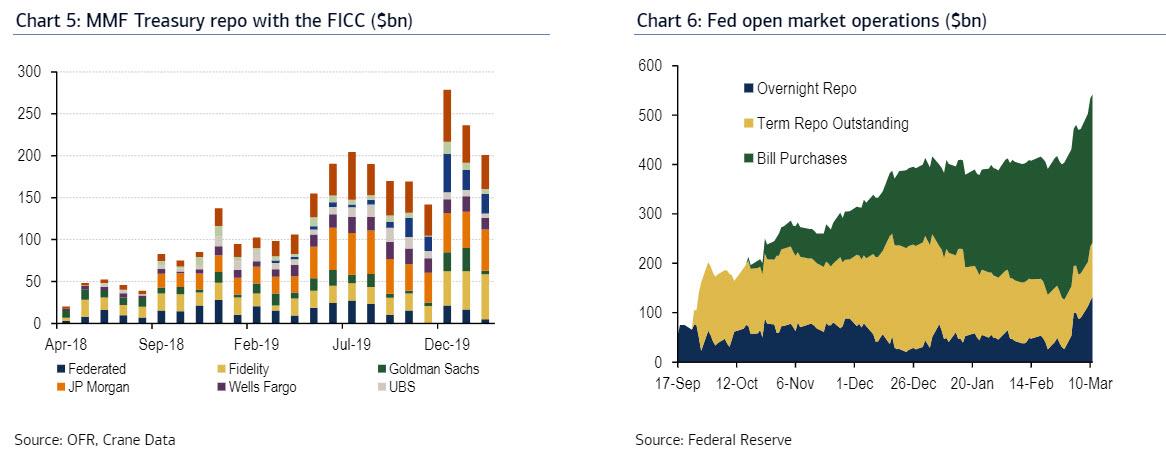

The size of the leveraged UST community is difficult to estimate but the extent of its growth can be seen via growth of the US Treasury repo market. The overnight Treasury repo market has doubled in size since 2016 (Chart 4, Chart 5). The US Treasury repo market is essentially comprised of real money investors lending cash to dealers who then pass this cash along to leveraged investors. The growth of the US Treasury repo market can then be a proxy for the growth of leverage in the UST market.

The risk in the current environment is that sustained illiquidity of the UST market and cheapening of USTs vs OIS could cause leveraged UST investors to reduce their Treasury positions on a large scale. This would essentially result in a Treasury “supply shock” as these funds reduce their positions & force dealers to sell those positions in a very illiquid market. Significant position reduction from one large leveraged UST investor would likely lead to a cascading effect whereby US Treasury yields rise sharply and force liquidations from other similar investors. This would worsen conditions for dealers to intermediate risk in the US Treasury market, exacerbate the rise in US Treasury yields, and further cheapen Treasuries vs OIS or swaps.

Where are the other investors? – Other real money investors should theoretically use Treasury market illiquidity as a buying opportunity. However, real money investors appear hesitant to re-engage in the market due to the elevated illiquidity and fear that conditions could get worse. These real money investors don’t want to “catch the falling knife” especially if there are large scale and disorderly UST position unwinds. They likely believe there may be better buying opportunities in the near future.

What is the bigger picture? – The US Treasury market is the bedrock for all other financial markets; it is the world’s risk free rate and allows the US government to fund itself. If the US Treasury market experiences large scale illiquidity it will be difficult for other markets to price effectively and could lead to large scale position liquidations elsewhere, ex. agency MBS, credit, equities. It would also increase the cost and reduce the ability for the US government to fund itself. This would make it increasingly difficult to provide much needed fiscal help to combat the COVID-19 public health emergency.

What is the policy response? – The Fed today extended the tenor of its repo operations from overnight & 2 week tenors out to 1 month (Chart 6). The first 1-month repo operation is $50 bn in size, slated for Thursday morning, and priced at 1-month fed funds OIS + 5 bps. This repo operation will help provide certainty over dealer funding costs that can be passed along to the leveraged UST community and should assist in stabilizing funding costs. The action shows that the Fed is sensitive to underlying market conditions and working to improve market functioning. However, it may not be enough.

We are concerned that the size of this repo operation may not be large enough to stabilize the cheapening in UST securities and materially improve Treasury market liquidity. We believe it may take a more forceful action from the US Treasury or Federal Reserve to act as a “circuit breaker” in these illiquid Treasury markets. Specifically, we think there is a case for official sector policy action to support market functioning. Two options for consideration include: (1) the Fed re-starting UST quantitative easing (2) the US Treasury conducting “buyback” operations. We favor the latter option.

How does a Treasury buyback work? – In a buyback operation the US Treasury redeems USTs outstanding. This is the same process by which any other private issuer could choose to extinguish outstanding debt or equity. In a Treasury buyback the US Treasury Department would instruct the New York Fed (NY Fed = US Treasury fiscal agent) to buy USTs from primary dealers and pay for these purchases by drawing down its cash balance. To offset the cash balance decline, the US Treasury could increase its debt outstanding at other tenors. The US Treasury engaged in buyback operations from 2000-2002 as a means to manage debt stemming from a budget surplus & strong tax receipts; the US Treasury has done a number of small value buyback operation tests since the fall of 2014 but not done any large scale buyback operations recently.

We expect that the US Treasury would target its buyback operations at tenors across the US Treasury curve and finance these operations by increasing short-term bill issuance. The Treasury has the benefit of the Fed currently conducting 1-month repo operations which should limit the extent of upward pressure on short-dated bills.

The buybacks across the curve would represent a strong real money investor that could aid dealer risk transfers and improve two-way market making activity. We are not sure how large such a buyback program would need to be but we might imagine it could take $50-$100 bn to stabilize market conditions and result in more orderly market making. The Treasury would likely signal that these buyback operations are being done to promote market functioning and will remain open ended until more orderly market conditions prevail.

Why not just do Fed UST QE? – The mechanics of Fed UST QE & Treasury buybacks are very similar but their intentions are fundamentally different. Fed UST QE is designed for monetary policy purposes; the intention of QE is to lower overall borrowing costs, reinforce forward guidance for low interest rates, and have a “portfolio balance impact” by removing duration risk from the private market (Table 1). The Fed likely does not believe it should expand its balance sheet and engage in QE to support market functioning. The Fed likely believes this resides more in the remit of the US Treasury Department.

What about moral hazard? – Such an official sector policy response raises important questions about moral hazard regarding UST leverage and US fiscal deficits; however, these moral hazard risks likely pale in comparison to the acute risks stemming from illiquid Treasury market functioning and the challenges it poses for US government financing of the COVID-19 public health response. A Treasury buyback or Fed UST QE program designed to support market functioning will almost certainly raise questions from Congress. The necessity of these actions will likely increase scrutiny around the extent to which certain investors have been able to deploy leverage and the sustainability of US government deficits. These are important and serious questions to address; however, the more pressing issue is likely to re-establish US Treasury market functioning and provide the US government with an ability to raise cash for the current public health emergency.

Market implications? – Any such Treasury buyback or Fed UST QE response would result in a material richening of UST vs OIS & widening of swap spreads across the curve. Market participants are likely reluctant to take such positions at present due to liquidity concerns. However, the acute illiquidity in the US Treasury market is likely to increasingly drive an official sector policy response. Time is of the essence.

Tyler Durden

Thu, 03/12/2020 – 10:11

via ZeroHedge News https://ift.tt/38L4qSO Tyler Durden