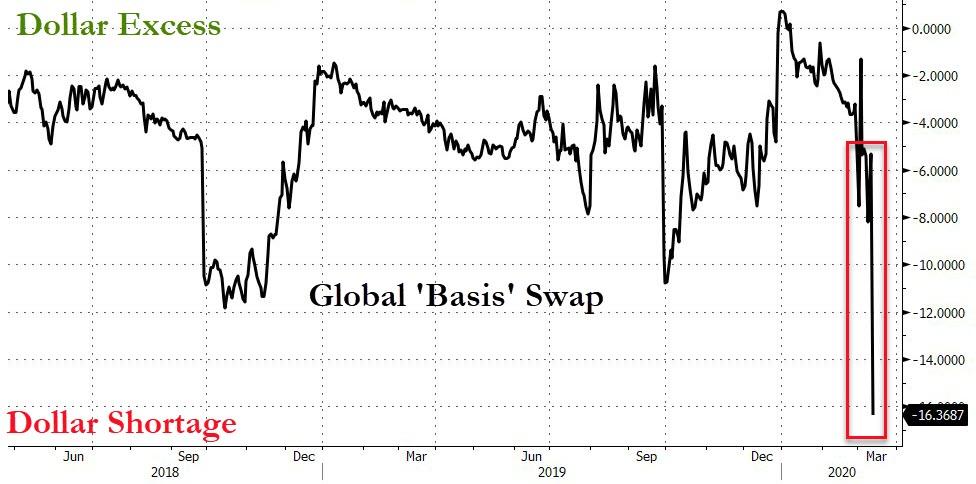

Funding Markets Are Freezing: Global Dollar Shortage Hits Alarming Levels

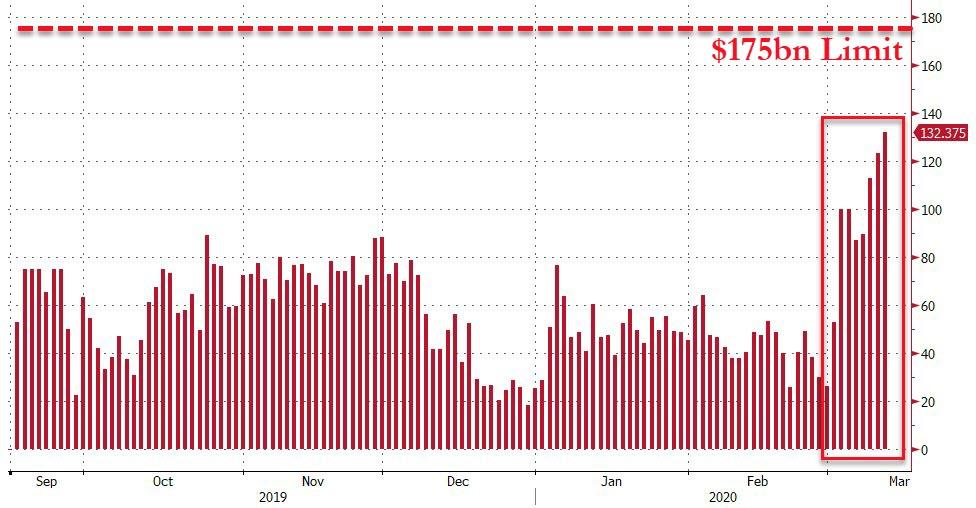

The surging demand for repo liquidity – and massively expanded bailout facility size by the New York Fed – suggests there is a major global scramble for USD funding, and today’s price action in the archaic money markets exposes it has now reached extremely alarming levels.

Surging cross-currency basis swaps (measuring how much investors are willing to pay to swap their currencies for dollars for 3m) signal something has snapped…

And it appears to be centered on Japan (though EUR and UK are also seeing huge demand for USDs)

Additionally, the FRA/OIS spread is screaming liquidity crisis…

Which helps explain why The Fed just upped its daily repo limit to $175 billion (yes billion)…

But as evidenced in today’s worsening situation in liquidity markets, it is not helping.

This is all exacerbating the massive tightening in US financial conditions…

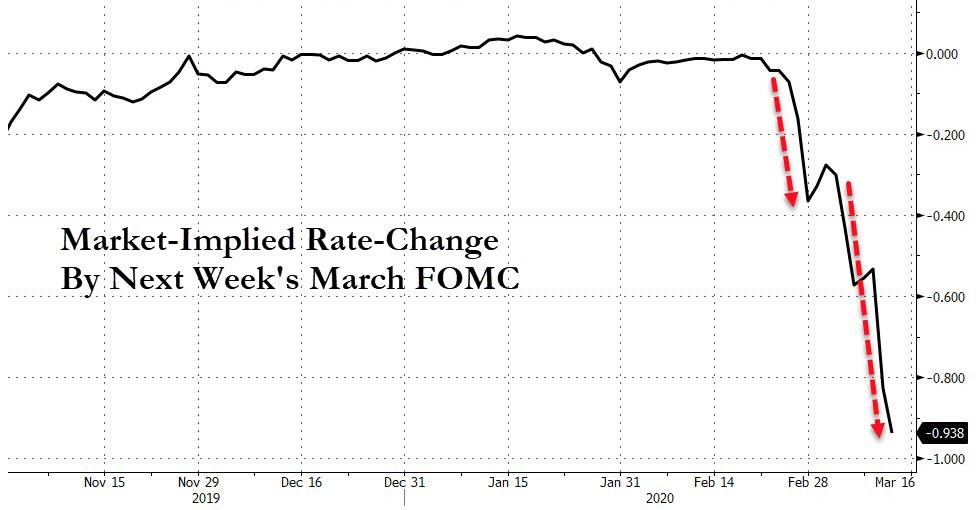

Which has sparked demand from the market for almost a 100bps rate-cut next week (or before) when The Fed meets…

Summing up, Bloomberg’s Cameron Crise notes that in fixed-income relative value – historically a very profitable, highly leveraged strategy – relationships have frayed to the point of incredulity, indicating high levels of distress.

One consequence of this basis swap repricing is that USD-denominated treasuries are suddenly more expensive to hedged foreign buyers to the tune of roughly one rate hike. Which, all else equal, would mean that there is now that much less demand by international buyers for TSY paper on the long end. Could this shift in supply-demand mechanics impact the yield on long-dated paper? Which is what we have seen in recent days as bonds have not rallied as much as one would expect given the carnage in stocks.

Tyler Durden

Thu, 03/12/2020 – 08:46

via ZeroHedge News https://ift.tt/2vl7fMQ Tyler Durden