Pandemicdemonium: S&P Futures Limit Down, Europe Plunges To 2016 Lows, World Stocks Enter Bear Market

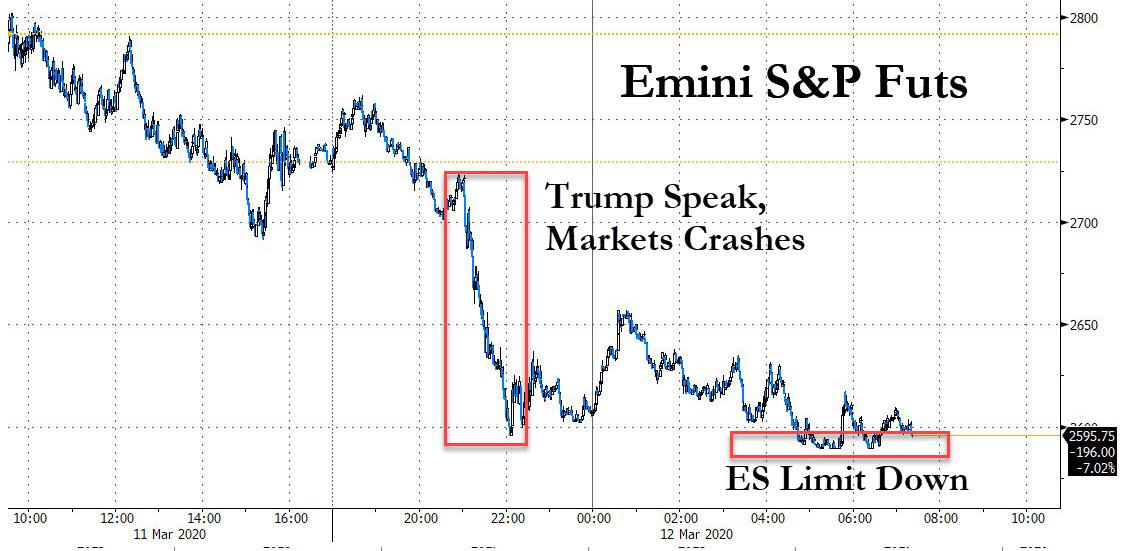

At 9pm on Wednesday evening, president Trump took the emergency step of addressing the nation to describe how the US will defend itself from the spreading pandemic and to calm America’s fears over the coronavirus. It did not work out as expected, because moments after Trump announced a 30-day travel ban for European flights to the US, global stocks plunged into a bear market, oil crashed, airline stocks and treasury yields plunged, and US equity futures eventually tumbled limit down.

With the pandemic wreaking havoc on the daily life of millions, investors were disappointed by the lack of broad measures in Trump’s plan to fight the pathogen, prompting traders to bet on further aggressive easing by the Federal Reserve.

“He (Trump) did not announce any new concrete measures such as a large-scale payroll tax cut to buffer the economy against the impending coronavirus slowdown,” said Jeffrey Halley, senior market analyst at OANDA. “That has probably disappointed markets more than anything.”

As a result, S&P 500 futures once again hit their lower trading limit a day after the Dow Jones Industrial Average formally entered a bear market, ending the longest bull-run in history for American shares.

“Market moves suggest monetary stimulus has reached its limits,” said Lucas Bouwhuis, a portfolio manager at Achmea Investment. “Most of the stimulus needs to come from the fiscal side and we are just not seeing enough of that yet.” Meanwhile, signs that companies in the hardest-hit industries were drawing down credit lines to battle the effects of the virus on their businesses added to anxiety.

“The market will need much more to get its confidence back,” said Mohit Kumar, managing director at Jefferies International Ltd. “The economic slowdown is because consumers won’t spend as they don’t go out or travel — you can’t make them spend by giving cheaper money. What you need is fiscal stimulus — helping SMEs and helping banks.“

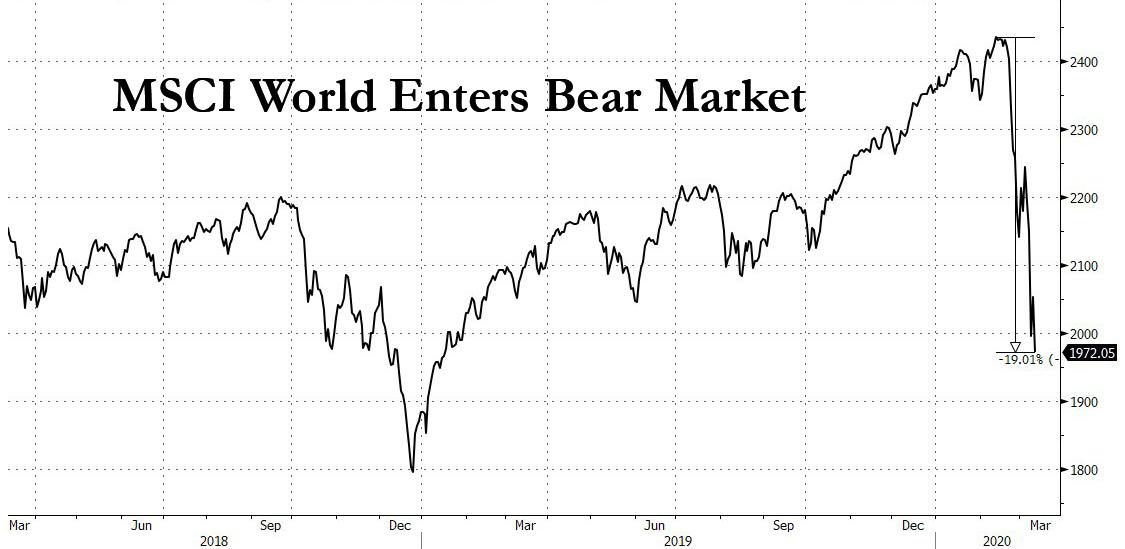

It wasn’t just the US: the MSCI All-Country World Index extended losses to trade more than 20% below last month’s peak, down nearly 2% on the day and putting it in bear market territory.

European shares cratered to their lowest since 2016 in one of the most epic drops in history, with the benchmark STOXX 600 index falling 5% in early deals and most industry sectors plunged more than 5%.

European travel and leisure stocks shed 8.6% on news of the airtravel ban, hitting their lowest since 2013!

Earlier in the session, Japan’s Nikkei crumbled 4.4% to a trough last seen almost three years ago while MSCI’s broadest index of Asia-Pacific shares outside Japan fell 4.7% led by energy and materials as investors sold anything that isn’t nailed down. Japanese stocks plunged even after another liquidity pledge from the country’s central bank.

All markets in the region were down, with Thailand’s SET dropping 11% and Australia’s S&P/ASX 200 falling 7.4%. The Topix declined 4.1%, with IBJ and Jeans Mate falling the most. The Shanghai Composite Index retreated 1.5%, with KraussMaffei and Nanjing Canatal posting the biggest slides. Australian shares plunged 7.4% to the lowest level in more than three years while Seoul’s Kospi fell 4.8% to 4-1/2-year lows with massive selling prompting a brief trade halt. Thai shares sank 8.8% to 8-year lows.

The catalyst for this pan-demic-denomium? Trump’s speech which was supposed to calm nerves, in which the president announced the US will suspend all travel from Europe, except from Britain for 30 days starting on Friday. However, Trump said trade will not be affected by the restrictions. He also announced some other steps, including instructing the Treasury Department to defer tax payments for entities hit by the virus.

“The travel ban from Europe has definitely taken everyone by surprise,” said Khoon Goh, head of Asia Research at ANZ in Singapore. “Already we know the economic impact is significant, and with this additional measure on top it’s just going to multiply the impact across businesses. This is something that markets had not factored in … it’s a huge near-term economic cost.”

Investors also rushed to safe-haven assets from bonds to gold to the yen and the Swiss franc.

Treasury yields resumed their retreat after yesterday’s freak selloff, sliding by almost 20 basis points to lead a rally in the safest government debt. Oil extended losses by more than 5%.

The 10-year U.S. Treasuries yield fell to 0.6704%, though it is still above a record low of 0.318% touched on Monday. The two-year yield fell to 0.4314%, but stood well above Monday’s low of 0.251%.

In the money market, traders further raised expectations of another U.S. rate cut, even after the Fed’s emergency cut last week. Fed fund rate futures are now pricing in a large possibility of a 1.0 percentage point cut, rather than 0.75, at a policy review on March 17-18, meaning in a few days the US will be back at ZIRP.

The highly infectious coronavirus which shut down most of China for much of February is spreading rapidly in Europe and increasingly in the United States, disrupting many corners of life from education to sports, entertainment and dining. Investors worry how much of an effect policies can have in turning around the global economy given the restrictions on daily life, travel and business.

A case in point was Britain, where the FTSE stock index hit near four-year lows on Wednesday as investors doubted whether the $39 billion spending plan and the Bank of England’s 0.5 percentage point rate cut announced on Wednesday would be enough to counter the shock from the outbreak. The index fell even further on Thursday, down 6.25%. The British pound last stood at $1.2792, down 0.16% on the day.

In rates, the dollar slid against the safe-haven yen and the Swiss franc. The U.S. currency fell 0.8% to 103.63 yen and lost 0.14% to 0.9366 franc. The euro traded at $1.1265, down 0.04% ahead of the European Central Bank’s policy meeting later in the day. The ECB is all but certain to unveil new stimulus measures, including new, ultra-cheap loans for banks to pass onto small and medium-sized firms.

In commodities, oil prices were hit by an intensifying price war between Saudi Arabia and Russia, on top of fears of a sharp slowdown in the global economy. The United Arab Emirates followed Saudi Arabia in promising to raise oil output to a record high in April. U.S. West Texas Intermediate (WTI) crude shed 4.94% to $31.35 per barrel. Copper, seen as a gauge of global economic health because of its wide industrial use, fell to over three-year lows.

Expected data include producer prices and jobless claims. Adobe, Broadcom, Gap, and Oracle are among companies reporting earnings

Market Snapshot

- S&P 500 futures down 5% to 2,593.25

- MXAP down 4% to 142.12

- MXAPJ down 4.6% to 463.87

- Nikkei down 4.4% to 18,559.63

- Topix down 4.1% to 1,327.88

- Hang Seng Index down 3.7% to 24,309.07

- Shanghai Composite down 1.5% to 2,923.49

- Sensex down 6.5% to 33,375.67

- Australia S&P/ASX 200 down 7.4% to 5,304.63

- Kospi down 3.9% to 1,834.33

- STOXX Europe 600 down 5.7% to 314.30

- German 10Y yield fell 2.3 bps to -0.765%

- Euro down 0.07% to $1.1262

- Italian 10Y yield fell 15.1 bps to 1.007%

- Spanish 10Y yield unchanged at 0.262%

- Brent futures down 5.8% to $33.72/bbl

- Gold spot up 0.5% to $1,642.72

- U.S. Dollar Index little changed at 96.52

Top Overnight News

- A pandemic-driven global recession is becoming more likely by the day as the flow of goods, services and people face ever- increasing restrictions

- Christine Lagarde will bid to prevent the coronavirus outbreak from sparking a repeat of the 2008 financial turmoil when the European Central Bank finally unveils its monetary response to protect the region’s economy. The president effectively — and exceptionally — pre-committed action this week

- A dash for cash from corporate treasurers may be about to put additional strain on global funding markets. As uncertainty grows over the ultimate economic impact of the coronavirus outbreak, companies are rushing to borrow to bolster their cash reserves

- If the oil face-off between Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman turns on who has a stiffer fiscal backbone, it’s the ruble that could help carry Russia to the finish line

- Bank of Japan Governor Haruhiko Kuroda said he discussed recent market volatility with Prime Minister Shinzo Abe at a meeting following further sharp falls in stocks and gains in the yen ahead of a central bank policy meeting next week

Asian equity markets traded with hefty losses again after another bloodbath on Wall St where the DJIA slipped by almost 1500 points and into bear market territory due to the ongoing fallout from the coronavirus which the World Health Organization labelled as a global pandemic, while the sell-off extended overnight in which Dow futures fell below the 23k level with losses of as much as 1200 points and Nasdaq futures hit limit down after US President Trump’s primetime address was met with disappointment. President Trump announced to suspend all travel from the EU to the US for 30 days which does not apply to the UK and he unveiled several relief measures including support for small businesses, the deferral of some tax payments and called on Congress for immediate payroll tax relief, although these failed to appease markets and the travel restrictions subsequently dragged EURO STOXX 50 futures lower by as much as 8%. ASX 200 (-7.4%) and Nikkei 225 (-4.4%) slumped with energy and commodity-related stocks front running the broad losses in Australia which saw the index post its worst decline since 2008 despite the government announcement of measures valued at AUD 17.6bln in response to the outbreak, while the Japanese benchmark collapsed on the weight of the JPY inflows and languished firmly below the 19k level where the BoJ flagged it would incur losses on ETF holdings. Hang Seng (-3.7%) and Shanghai Comp. (-1.5%) conformed to the negative tone amid the global rout and after weaker than expected Chinese lending data, but with losses in the mainland at a lesser extent as China’s coronavirus updates continued to show a moderation in additional cases. Finally, 10yr JGBs were pressured at the open and briefly fell below 154.00 on initial spill over selling from USTs, although Japanese bond prices then briefly reversed some of the losses as the sell-off in stocks worsened, before selling resumed once again in the aftermath of the 20yr JGB auction which showed weaker results across all metrics.

Top Asian News

- Record Spike in Fear Has This Hedge Fund Go Long on India Stocks

- Thailand Stock Benchmark Plunges 10%, Triggers Trading Halt

- Hermes, Prada Raised at Bernstein as Virus Goes Global

- Hong Kong Next Up in World’s Growing List of Stock Bear Markets

Another detrimental session for the equity space as the impact of the virus outbreak further materialises across the globe and with US measures to tackle the pandemic seemingly deemed unsatisfactory by markets. APAC stocks suffered hefty losses overnight, with the Aussie index ending the session over 7.5% lower, whilst Japan’s Nikkei gave up the key 19k handle and some more. Meanwhile, the sentiment reverberated in US and EU equity futures with the former trickling lower to trade at/near their respective 5% limit downs (Full details of levels available on the headline feed), futures across the pond fare no better. In terms of cash markets, European stocks show broad-based losses to the tune of 5.5-7.0% [Eurostoxx 50 -5.5%] with losses of similar magnitude reflected across sectors, although defensive fare slightly better than the cyclicals. Zooming into the sectors, EU Travel & Leisure underperforms its peers after US President Trump announced a 30-day travel ban to Europe. As such, the likes of Norwegian Air Shuttle (-21%), Lufthansa (-9.9%), Air-France (-11.0%), easyJet (-5.4%) all under pressure alongside cruise names. Financial names meanwhile bear the brunt of the low-yield environment; Barclays (-8.9%), Deutsche Bank (-8.3%), Commerzbank (-8.8%), BNP Paribas (-7.0%), UBS (-6.2%). In terms of individual movers, Nestle (-3.7%) failed to gain impetus from source reports that it is progressing with the sale of its China unit Yinlu Foods for ~USD 1bln. AstraZeneca (-4.0%) underperforms vs. the sector after its Phase III trial for Cediranib did not meet its primary endpoint.

Top European News

- Finablr Taking Urgent Steps on Liquidity as NMC Fallout Spreads

- Orange Is Said to Invite Initial Bids for French Fiber Project

- European Airline and Travel Stocks Plunge to Lowest Since 2013

- Verbund in Exclusive Talks to Buy OMV’s 51% of Gas Connect

In FX, although the Dollar is on a somewhat mixed footing against major counterparts and the US Treasury curve has flipped back into bull-steepening mode, the DXY has bounced firmly from overnight lows and back above 96.500 to breach Fib resistance at 96.695 by virtue of heftier gains vs high beta, activity, risk and even yield rivals, not to mention even more pronounced appreciation relative to floundering EM currencies. On that note, even the recently resilient YUAN is succumbing to the latest bout of safe-haven positioning irrespective of latest reports that nCoV has peaked and the epicentre of the coronavirus outbreak is returning to normal, as Usd/Cnh crosses the psychological 7.0000 mark again.

- AUD/NZD – The Aussie has pulled back further towards 0.6400 and through 1.0300 in Kiwi cross terms amidst renewed risk-off trade, and hardly getting any relief from a substantial fiscal injection overnight, while its Antipodean peer has fallen in sympathy from 0.6300+ to sub-0.6250 territory awaiting the RBNZ for more independent impetus and more immediately NZ manufacturing PMI tonight.

- NOK/SEK/GBP/EUR – Also on the backfoot, with Eur/Nok soaring beyond 11.0000 to another new ATH circa 11.1675 amidst a deeper retracement in crude prices and calls for the Norges Bank to cut the benchmark depo rate by 50 bp next week. Eur/Sek lagging on less dovish Riksbank vibes and mixed Swedish inflation data, while Sterling is back down near early March lows (Cable around 1.2750 and Eur/Gbp 0.8800+) in wake of yesterday’s emergency BoE ease and UK budget excesses. However, the Euro has unwound more post-Fed rate cut strength vs the Greenback in the run up to the ECB amidst high uncertainty over the likely policy adjustments given elevated anticipation for something big like last September’s multi-faceted salvo (check out the Newsquawk Research Suite for a full preview of the March policy meeting that comes with updated Staff forecasts). Eur/Usd has lost grip of 1.1300 and 1.1250 to probe technical support between 1.1239-13 that spans a Fib retracement level.

- JPY/CAD/CHF – Relative G10 outperformers or at least displaying a degree of resistance to the Buck’s ongoing revival, as the Yen holds above 104.00, albeit off best levels following yet more talk about imminent or impending BoJ stimulus to supplement Japanese Government measures. Meanwhile, the Loonie is trying to contain losses within a 1.3821-3752 band against the backdrop of renewed pressure on oil and the Franc is firm, though contingent on the SNB’s reaction to what unfolds in Frankfurt via the ECB.

- EM – As noted above, broad and hefty losses for regional currencies due to well documented negative factors, but with the Rouble and Mexican Peso particularly weak due to crude correlations

In commodities, further downside in WTI and Brent front-month futures as the complex continues its OPEC and virus-induced sell-off with the overall narrative around the market largely unchanged, although additional bearish factors include WHO labelling the outbreak as a pandemic and US President Trump announcing a 30-day travel ban to Europe. The contracts are under further pressure from bearish comments from the Russian Deputy Energy Minister who suggested that deeper oil cuts would be ineffective and challenging – alluding to a reaffirmation in stance as Saudi attempts to force Moscow’s hand to agree to further reductions. That said, Energy Ministry Novak stated that the OPEC+ JTC on March 18th will be conducted by video conference – which was signalled earlier but the notion suggests that Russia is willing to cooperate with the other oil producers despite the soured relations with Saudi Arabia. However, the Russian Energy Minister is set to meet with Russian oil companies today to discuss the OPEC situation, with expectations skewed to no-change in their stance regarding cuts. WTI Apr’20 and Brent May’20 hold onto losses of ~5% at the time of writing as the former briefly breached USD 31/bbl to the downside in APAC trade whilst the latter found an overnight base sub-33.50/bbl. Conversely, the risk-off sentiment has kept an underlying bid in spot gold which resides just south of the USD 1650/oz level. As a reminder, desks note that gold prices could be less supported amid a stock-market selloff as traders and investors will need to close positions to account for decaying margins. Elsewhere, copper prices continue to suffer amid the broad risk-off sentiment with prices firmly back under the USD 2.5/lb mark.

US Event Calendar

- 8:30am: PPI Final Demand MoM, est. -0.1%, prior 0.5%; Final Demand YoY, est. 1.8%, prior 2.1%

- 8:30am: PPI Ex Food and Energy MoM, est. 0.1%, prior 0.5%; PPI Ex Food and Energy YoY, est. 1.7%, prior 1.7%

- 8:30am: PPI Ex Food, Energy, Trade MoM, est. 0.1%, prior 0.4%; PPI Ex Food, Energy, Trade YoY, est. 1.5%, prior 1.5%

- 8:30am: Initial Jobless Claims, est. 220,000, prior 216,000; Continuing Claims, est. 1.73m, prior 1.73m

- 9:45am: Bloomberg Consumer Comfort, prior 63

- 12pm: Household Change in Net Worth, prior $573.6b

DB’s Jim Reid concludes the overnight wrap

We wake up to another wild rise in Asia (S&P futures down another -3% plus) after an extraordinary intervention from the US President. Mr. Trump announced in an Oval Office address to the nation that all travel from Europe to the US would be suspended for the next 30 days. Interestingly this does not cover the UK. This means avoiding all but essential travel to the region. In his speech he actually said that this will “not only apply to the tremendous amount of trade and cargo but various other things”. The White House had to clarify after that this would only apply to people and not goods. Mr Trump also clarified this in a tweet but this has left markets rattled.

The President said that the government would extend tax-holidays to certain individuals and businesses, as well as looking to provide emergency funds to small businesses in the form of low interest loans with $50bn ear marked. The president also asked Congress to look at sick-leave for hourly workers and reiterated that he is seeking cuts to payroll taxes but didn’t specify the amount. There will likely be more details to come and political negotiations will have to take place on some measures. Elsewhere, the Washington Post has reported overnight that Mr. Trump had asked Mnuchin at a meeting on Monday to speak with the Fed Chair Powell and urge him to take greater steps to stop the stock market falling. The report further added that Mr. Trump also complained that Powell should never have been appointed and that the Fed chair is damaging his presidency and the nation.

Overnight, the House Democrats have also introduced their coronavirus legislation that would provide emergency paid sick leave, enhanced unemployment benefits and free coronavirus testing. Bloomberg is reporting that speaker Nancy Pelosi plans to have the chamber vote on the bill today. Elsewhere, Derivatives exchange CME Group said that it will close its famed trading pits in Chicago at the end of Friday, a precaution to prevent a large gathering that may contribute to the virus’s spread.

A quick look at Asia shows that the risk off is continuing with aggressive momentum as the Nasdaq and Dow futures have both hit their daily limit down while the S&P 500 futures are down -3.17% as President Trump’s confusing address fell short of fiscal stimulus details that the market was expecting. Asian equity bourses are also trading in a sea of red with the Nikkei (-3.79%), Hang Seng (-3.56%), Shanghai Comp (-1.33%) and Kospi (-3.57%) all down. As for fx, the Japanese yen is up +0.59% and the Swiss franc is up +0.37%. Amidst continued volatility 10y USTs yields are back down -6.1bps to 0.811% and crude oil prices are down c. -5% this morning while gold is trading flat.

In other virus related news, Australia announced a AUD 17.6bn ($11.4bn) fiscal stimulus package geared towards the second quarter. Elsewhere the NBA said overnight that it is suspending the remainder of the basketball season after a player tested positive for the virus. Arguably the highest profile person to catch the virus has been announced with actor Tom Hanks announcing that he and his wife have contracted it.

Meanwhile Italy is further locking down the country and running only essential services. All shops outside of groceries and pharmacies will close until March 25th. Bars and Restaurants will also shut. It wouldn’t be a surprise to see other places in Europe migrate towards this over the next couple of weeks. In some ways this feels worse than the GFC. At least life and the economy went on as normal for the vast majority then. This crisis is literally forcing many activities to grind to a total halt. Everyone is being impacted.

Ahead of today’s very key ECB meeting, the daily monster swings in markets are becoming almost second nature at the moment with yesterday’s -4.89% close for the S&P 500 the 9th move of at least 3% either up or down in the last 13 sessions. A remarkable statistic. It’s also the fourth down day in the last five sessions which has seen the S&P shed $3.3tn in market cap. Since the peak last month the index has now shed $6.1tn in total which is roughly $1trl more than the GDP of Japan, which is 3rd in the world. The index briefly fell into “bear market” territory before rallying slightly into the end of the day. The sell-off got a mid US session kicker with the WHO finally declaring the outbreak a pandemic but it was already down well over -3% by then.

One of the most fascinating things about this virus is whether the response from authorities are proportionate to the risks. It’s also fascinating to see the extreme commentary. Indeed Mrs Merkel yesterday said in a press conference with the country’s Health Minister that 60-70% of the German population could catch covid-19 at some point unless measures were found and taken to slow the spread of the disease. It wasn’t clear if that was meant to be a multi-year forecast but to put it in prospective 0.006% of the Chinese population has so far tested positive for the virus and new cases over the last few days have been down to a 20 to 40 people per day range, or a growth rate close to 0.05% at the high end. At that daily rate it would take around 52 years to infect 70% of the population of China. Similarly, the attending physician of the U.S. Congress & Supreme Court briefed Senate Staff in a closed-door meeting that he expects anywhere from 70 up to 150 million people in the U.S. to contract coronavirus (according to CNBC), which is 20-45% of the entire country. Now clearly China (and South Korea who have also managed to control the rise in new cases this week), have been very strict at locking down the main sources of the spread and there still could be a second wave but that is still a huge bid-offer between 0.006% and 70% of the population.

Back to yesterday and the NASDAQ (-4.70%) and DOW (-5.86%) – which officially fell into a bear market at the end of the session – also had days to forget while Europe, which actually opened with strong gains, finished in the red across the board. The STOXX 600 in particular closing -0.74% with a -3.24% drop from the highs. Meanwhile the VIX closed above 50 again at 53.9. HY credit also struggled with cash HY spreads +23bps wider in the US and energy spreads +91bps wider. CDX HY finished +57bps wider and CDX IG +10.7bps.

Treasury yields traded in more big ranges. Indeed 10y yields traded in a 16bp range most of the session before breaking just higher to finish at 0.870%. 30y year yields also rallied 11bps. Fiscal headlines rattled the market with Treasury Secretary Mnuchin announcing support for smaller and medium-sized businesses and also certain sectors like the travel industry, impacted by the coronavirus. Mnuchin also said that the administration sees no need for intervention in the markets. Elsewhere Italian debt rallied 15.1bps as expectations built ahead of today’s ECB meeting.

Talking of which, in light of everything in recent weeks, today ranks up there in terms of one of the more hotly anticipated ECB meetings. Our economists revised their expectations this week and expect the following; (1) a new targeted liquidity facility (e.g. a short-term LTRO aiming to boost SME lending in affected regions); (2) a 10bp deposit rate cut; (3) a policy to supplement general liquidity conditions. The latter is the bigger question mark in terms of how the ECB achieves this. Our colleagues note that a TLTRO-based policy may be easier but as a passive means of expanding the balance sheet may be less effective. Private asset purchases might be more effective, but their costs bring limits. Low yields mean sovereign purchases are not obviously needed, but would inject market confidence if seen as policy coordination.

For the market its fiscally-equivalent policy that will likely have the greatest impact. The concern is that all the announcements we’ve seen globally this week appear to have underwhelmed so the market’s bar is high. Speaking of which, here in the UK there was no shortage of hype suggesting that the UK budget could see one of the biggest injections of stimulus in decades. However in the end it underwhelmed even if the media painted as a high spending budget. Chancellor Sunak announced that the UK would be staying within the fiscal rules with another review to come in the autumn. Our UK economists made the point that the market was expecting borrowing this year of £67bn which equates to 3% of GDP however in the end the OBR announced PSNB of 2.4%.

Of course this came after the BoE announced a 50bp rate cut just after we went to press yesterday which now seems an age ago. This has taken the bank rate down to 0.25%. The countercyclical capital buffer was also cut 100bps to 0% and a new term funding scheme for SMEs was announced. The market was pricing in a fair amount of easing from the BoE (not quite 50bps) but the timing was a bit of a surprise even if the Fed raised the risk of this happening sooner. Carney said in a conference call a couple hours after the decision that the “BoE will take all necessary steps to help the UK” and that there is “additional room in all policy instruments if needed”. Bailey added that the BoE sees 125bps of further easing available when other tools are included which when you consider the level of rates implies mostly through fiscal, further liquidity injections and asset purchases.

In the UK’s defence this was the most coordinated monetary and fiscal response so far in the main economies and more could easily come if the desire was there. It just wasn’t as much on the fiscal side as markets expected.

In terms of the day ahead, the ECB will be front and centre clearly with the macro data still mostly backward looking pre coronavirus. For completeness we get January industrial production for the Euro Area and February PPI in the US. One data point potentially worth keeping a closer eye on though is jobless claims which will cover the week ending March 7th.

Tyler Durden

Thu, 03/12/2020 – 08:00

via ZeroHedge News https://ift.tt/3aQ6vhS Tyler Durden