Is South Korea About To Unleash A Neutron Bomb Across Global Stock Markets

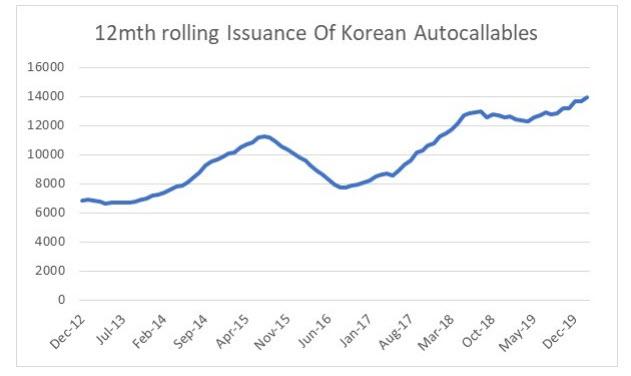

Last June, when stocks were merrily grinding higher without a care in the world, and certainly oblivious of the crash that was about to slam global markets half a year later, we explained why South Korea’s massive autocallable issuance could be “ground zero” of the next vol catastrophe.

In retrospect it wasn’t: the proverbial “black swan” of the next crisis turned out to be a Chinese black bat, but that doesn’t mean that the world is now safe from what could be a potential volatility tsunami, triggered in South Korea and which sends global markets far lower than where they are now.

But before we go any further, put your hand up if you know what an autocallable is, and since there are barely any hands in the air, let’s back up.

As the “world’s most bearish hedge fund manager”, Horseman Global’s Russell Clark explained in January 2019, autocallables, which are fundmentally structured products that are extremely popular with South Korean traders, are best thought of as a service. A bank will offer to sell insurance on the stock market on your behalf, so that you can generate an income from the premiums received. So rather than buying an autocallable, it’s better to think of an investor as posting collateral for a bank to sell puts on their behalf. Typically, the bank will tell the investor what sort of yield they can generate, for a certain level of insurance. For example, a 5% return as long as the S&P 500 does not fall to 2000, from roughly 2900 today.

Typically, when markets fall, the price of insurance rises, and the bank does not need to sell that much insurance to meet a 5% yield target for an investor. Conversely, when markets rise, insurance prices fall, and banks would need to sell more insurance to meet the target yield. Hence, in normal markets, the risk to clients is balanced. More insurance is sold when market rise as insurance prices are low, and less insurance is sold when market fall as insurance prices rise.

However, when there are times when this process goes haywire: i) either when a negative gamma feedback loop emerges, similar to what happened in February 2018 with the VIX complex in the US that liquidated 3x levered inverse vol ETNs, or ii) when the market drop is so precipitous that there is a step function lower in the value of the collateral, and local banks flood clients with margin calls, which in turn prompt a forced liquidation of more risk assets, triggering a feedback loop cascade where selling begets more selling, and not just of South Korean assets, but global, as most of the risk assets collateralizing the autocallables universe are not domestic to South Korea.

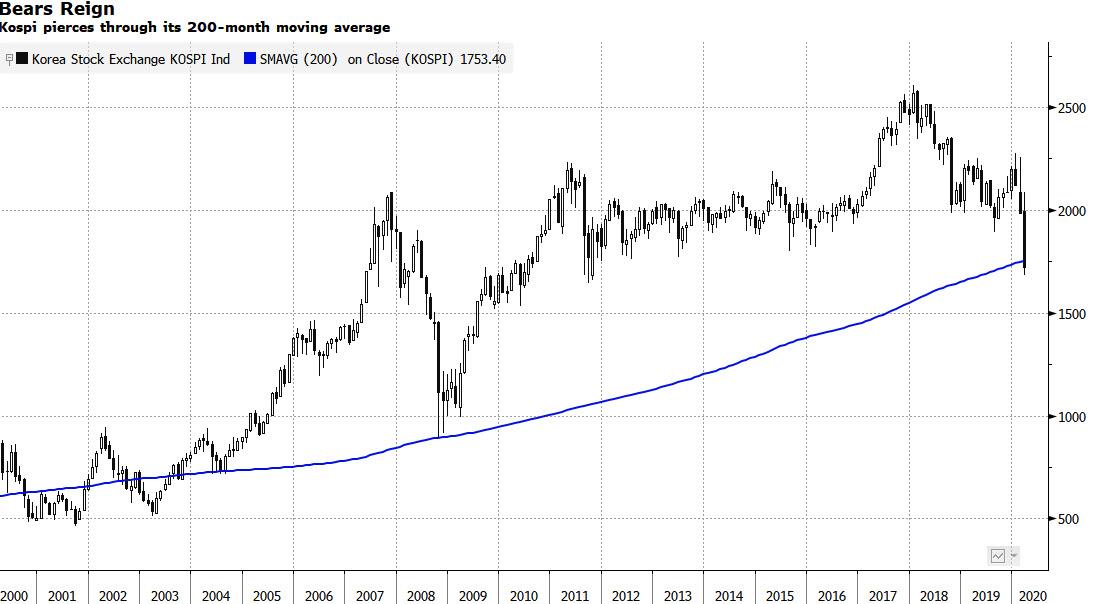

We are now deep in scenario II, because shortly after the US suffered its biggest drop since Black Monday 1987, South Korea’s Kospi entered a bear market Friday, while the Kosdaq was halted limit down after tumbling 8%. Furthermore, the Kospi broke below its 200-month average near 1,750 – that’, according to Bloomberg, is a marker that served as a support level during the global financial crisis.

The drop was so big that the Bank of Korea reportedly was discussing the need for a special meeting, and would consider “appropriate steps” to stabilize markets, including open-market operations if needed, while closely monitoring bond markets, according to a Bloomberg update.

However, if Horseman is right, the pain may just be getting started for both retail and institution linvestors facing massive margin calls. Worse, if the long awaited autocallable liquidation cascade is finally triggered, the shockwave that is unleashed in Seoul could rattles global stock markets, resulting in another – potentially even more dire – selling avalanche.

In a note published today, Horseman’s resurgent CIO, Russell Clarke, also known as the world’s biggest bear whose fund returned a whopping 20% during February’s rout warns that “the continued issuance from Korea suggests that autocallables have not yet been knocked in, and in fact investors are taking advantage of higher volatility to get higher yields.”

However, there is a limit to everything, and today violent liquidation in South Korea may be just the trigger.

Below we lay out the latest thoughts and observations from Clark, who waited patiently for years to be proven right on his doomsday predictions, and which are now being validated courtesy of the biggest weekly crash in global stocks since the financial crisis.

* * *

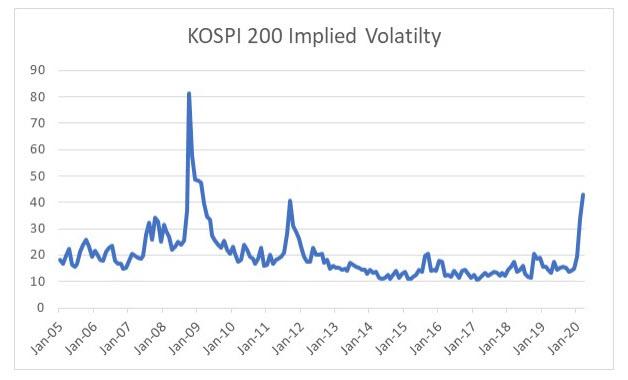

Korea and the KOSPI 200 are the spiritual home of autocallables. Historically, the KOSPI 200 was a highly volatile market but the long bull market in semiconductors, combined with rampant volatility selling, caused market volatility in the KOSPI 200 to collapse. Even the collapse in memory prices had little effect on KOSPI 200 volatility in 2019. However, the KOSPI volatility has recently broken out to levels not seen since 2011. (Price as at 10.00 GMT – 12 March 2020)

Despite the breakout in volatility there has been no reduction in the issuance of autocallables. In 2015, HSCEI based autocallables were knocked in causing issuance to collapse. The continued issuance from Korea suggests that autocallables have not yet been knocked in, and in fact investors are taking advantage of higher volatility to get higher yields.

Meanwhile, the KOSPI 200 is still above levels that have held since 2011. It is likely the most KOSPI 200 strike prices are set somewhere below the 230 price that has held since 2011.

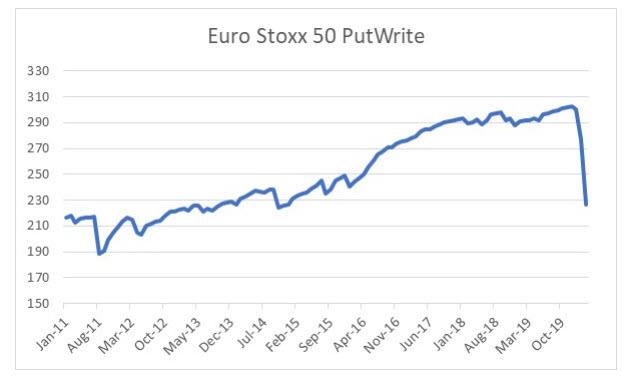

Autocallables issued in Korea will often include Euro Stoxx 50 in a “worst-of structures” market. A good proxy for the performance of this strategy is the Euro Stoxx 50 PutWrite Strategy. This has recently deteriorated sharply.

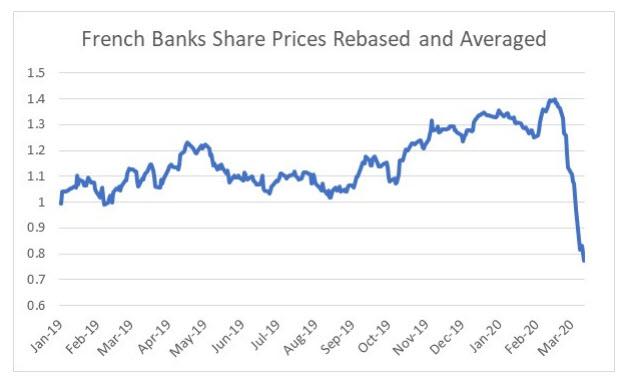

The spike in volatility has coincided with a steep decline in the share prices of French banks that structure many of the autocallable products.

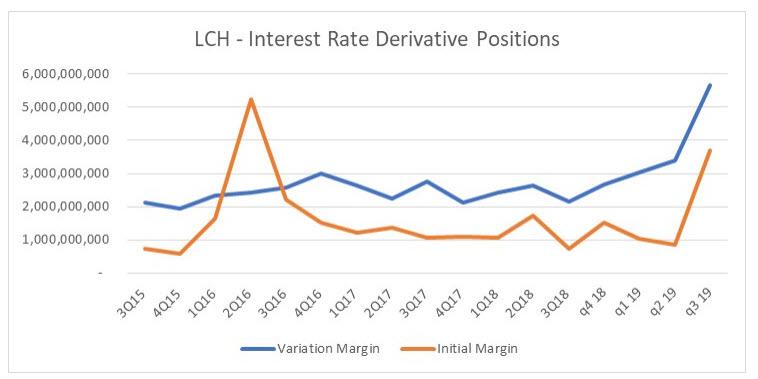

If autocallables are triggered, then implied volatility should move even higher from current levels. For clearinghouses, the high level of both implied and realised volatility should lead to increased in margins. As a reminder, LCH as per its Q3 2019 disclosures was still running at initial margins at very low levels to variation margins, although both rose significantly. During the strains of Brexit initial margin rose to be multiples of variation margin.

One more timely way to monitor margins is to look at initial margins for large index futures. With rising volatility, margins have been increasing even as the S&P falls. To normalise over time we divide the amount of margin for trading the future by contract value. Cost of trading has recently risen to 6.4%, the highest level since 2011.

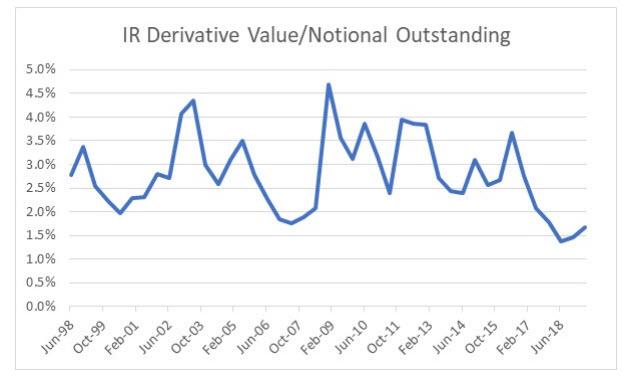

For OTC options, we can use BIS data to get an idea of initial margins. Taking the gross value of margins and dividing it by outstanding notional we can see that values were at a level seen before the global financial crisis and the dot com bubble.

Clark’s ominous conclusion: “Market volatility has risen significantly, but margin and collateral in the system still looks too low. Should autocallables break barriers in the KOSPI 200 or the Euro Stoxx 50, then the structurers will turn into volatility buyers, not sellers. Higher volatility leading to margin calls look likely, which could drive the market lower.“

For much more on autocallables, please read “As Autocallable Issuance Explodes, Is This “Ground Zero” Of The Next Vol Catastrophe“

Tyler Durden

Thu, 03/12/2020 – 21:24

via ZeroHedge News https://ift.tt/3cSH012 Tyler Durden